The largest liquidation storm to date saw $19 billion in leveraged bets "cleared in one go" last Friday night, with the vast majority of trading volume coming from just three centralized exchanges. This exposes a persistent hidden danger: the industry is still too centralized, with power and risk highly concentrated in the hands of a few giants. This is not just a numerical liquidation; it is a severe questioning of the core principles of the crypto industry. This is also the golden moment for DEXs, as Hyperliquid boldly claims to be "The House of All Finance," and this positioning is indeed their construction direction. Grvt has also publicly proposed its long-term vision—to "become the highest-yielding exchange," occupying a strategically significant niche in the perpetual contract DEX space, which is currently an area that no other platform is focusing on.

DEX Overview

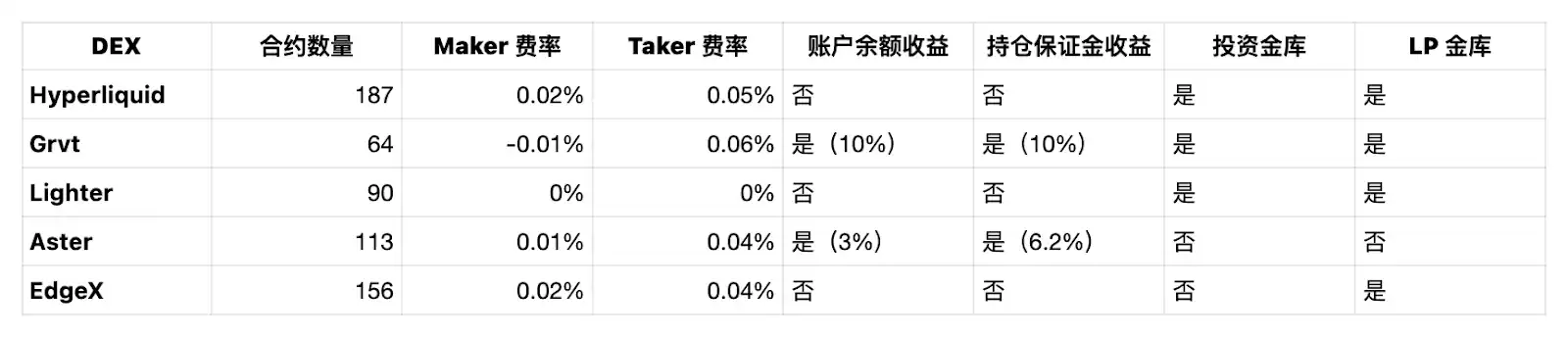

As of October 15, 2025, here is a comparison of the basic fee rates and related yield functions of several major perpetual contract DEXs:

Currently, Hyperliquid has the most perpetual contract trading pairs, while Grvt has the fewest contracts.

However, in terms of Maker fees (i.e., limit order fees), Grvt actually outperforms its competitors. It even charges a negative fee rate on Maker trading volume—meaning traders not only receive airdrop rewards when placing limit orders but also earn actual USDT returns.

In contrast, although Grvt's Taker fee (market order) is the highest, this part is more valuable during points farming, as it directly affects future Grvt airdrop rewards.

In terms of Yield on Balance, Grvt and Aster stand out the most:

- Grvt offers a 10% annual percentage yield (APY) on users' USDT trading accounts, with returns paid in USDT;

- Aster provides a 3% annual percentage yield on users' USDF balances, with returns paid in USDF.

In terms of Yield on Margin, Grvt and Aster also lead:

- Grvt allows users to enjoy a 10% APY whether their USDT is idle in the account or used as margin;

- Aster additionally rewards 3.2% APY when users use USDF as margin, accumulating to a total of 6.2% APY.

Regarding Investment Vaults, except for Aster and EdgeX, all other platforms allow users to invest in the exchange's internal vaults to earn potential returns outside of trading. Besides Aster, other platforms generally come equipped with LP (liquidity provider) vaults.

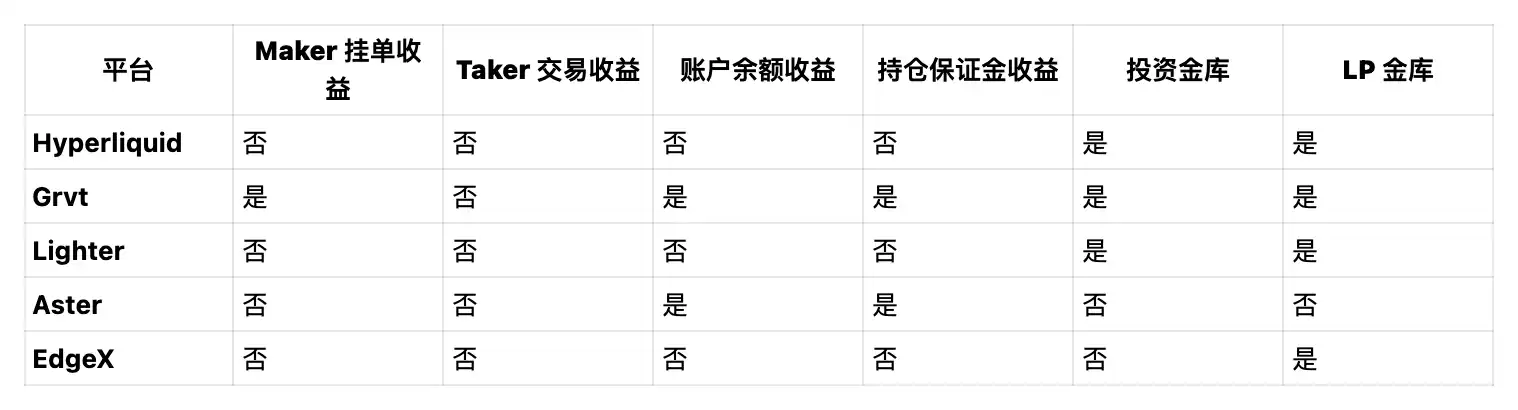

How to Earn Yields on These DEXs (Aside from Trading and Airdrops)?

From the table above, it can be seen that Grvt is currently the only platform in the perpetual contract DEX space that offers multiple yield paths, not limited to trading or points farming.

Although Aster also stands out with its unique account balance and margin yield mechanisms, it still falls short of its competitors in the most common investment vaults and LP vaults.

Conclusion

With the ability to earn negative fee rate rewards on limit orders and the highest annual yields on both account and margin, Grvt is gradually realizing its vision of being "the highest-yielding trading platform." As competition in the perpetual contract DEX space intensifies, we may witness more innovative product forms and yield structures in the future. The future of decentralized perpetual contracts is becoming increasingly promising.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。