Master Discusses Hot Topics:

It has been a few days since the last update, so let's talk about the recent macro market. Don't be fooled by how timid the market seems right now; this wave is still a standard deleveraging. But to say that tapering has stopped and that they are preparing to expand the balance sheet, that's a clear signal of easing!

Yet, when I look at the market, a bunch of people are still wailing about crashes and doom. I really want to ask, how many years have you been in the crypto space? Wasn't the 312 before the big bull run in 2021 also a brutal hit before an epic rally?

Old Powell has publicly stated that tapering has stopped; this is the most dovish stance he can take. Do you expect him to cut rates by 300 points overnight and expand the balance sheet by 10 trillion? Wake up; finance isn't a cheat code; it's all about rhythm.

That's how the market moves; the road must be paved step by step, and meals must be eaten bite by bite. If you don't make a plan now, when the news of balance sheet expansion is confirmed and funds really flow into the market, the smart money will have already started dumping. By then, if you rush in, you'll just be the last runner in the leeks relay race.

Today is the 15th, a good date to note. The 7 to 10 days before next week's FOMC is the time to speculate on expectations. From the 18th to the 21st, media, data, and news will come in waves to push sentiment. By then, FOMO will definitely kick in; whoever can position themselves first will be the first to act.

As for the massive liquidation on October 11, it was a historic bloodbath in the crypto space. In the past, bulls could still pull things back, but this time is different. Retail investors have been completely wiped out, and even institutions are severely injured; market liquidity has nearly collapsed.

Back to the market, last night's movement looked like a rebound, but it actually resembles a second bottom test. Powell's speech, Old Powell's most dovish stance, a certain fund throwing 300 million into QE, and insider positions being closed. All the elements for a rebound are there, yet it only rose a little.

This indicates that the main players don't believe in this setup; liquidity is too poor, and the funds are too lazy to move. In such times, trying to rebound only leads to being harvested. I am more optimistic about a downward trend; at least we need to wash out that batch of bottom positions at 109.6K.

The current range is very clear, oscillating between 116K and 109.6K in the short term. It would be reasonable to raid liquidity from 116K to 118K and then drop back down; breaking directly below 109.6K down to 107K is also reasonable. The direction isn't the key; the crucial part is that the operators want to make you completely disoriented.

As for Ethereum, after a pullback, I think it needs to rally once more. Breaking through 4255 to reach 4390, then a spike to 4420 before turning back, this rhythm is quite standard. A short-term low buy is also feasible; you can buy below 4080, with a left-side support at 4050 and a right-side breakout at 4150. The market may be weak, but you must not lose low-position chips; building positions during the recovery phase is a hard rule.

Master Looks at Trends:

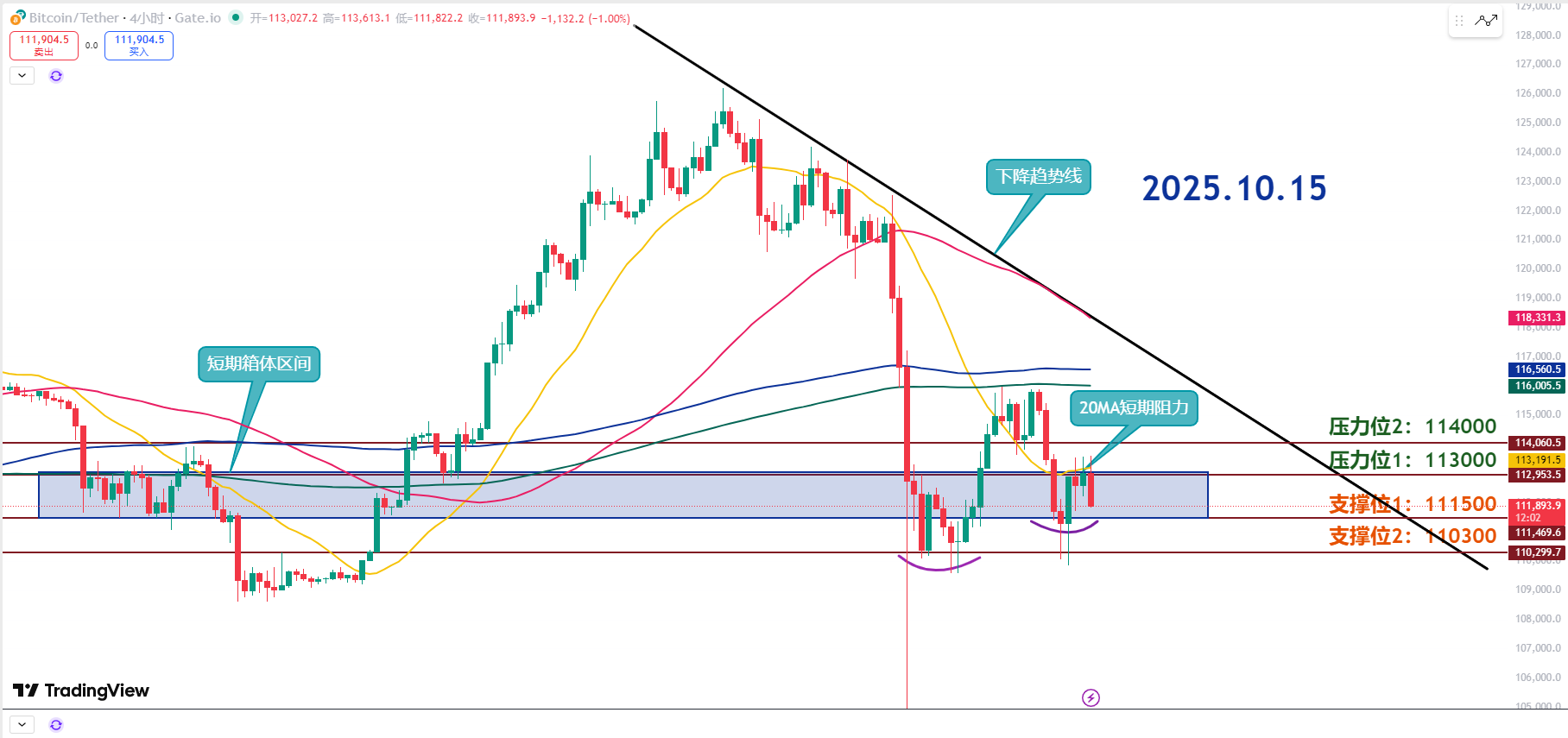

Resistance Level Reference:

Second Resistance Level: 114000

First Resistance Level: 113000

Support Level Reference:

First Support Level: 111500

Second Support Level: 110300

Bitcoin has not been able to pull off a decent rebound after the drop and is still hovering at the lower edge of the old range, far from stabilizing. The 110.3K to 111.5K area is a key support zone; if it can't hold, it will fall further.

Currently, 111.2K is the short-term low. As long as it holds above 111.5K, the short-term structure can barely maintain a higher low, which serves as a basis for a rebound. However, if this area is broken down, be cautious of the initiation of an N-shaped downward structure.

From a technical perspective, the price is being tightly pressed by the 20MA. If the rebound can't even surpass the average line, it indicates that the bears haven't let go. Only with an effective breakout and stabilization above can there be a chance to retest the descending trend line.

Above, 113K is a psychological resistance level and also the upper edge of the previous range. In such a position, don't think about chasing long; if you want to play it safe, wait for it to break through, then confirm support on a pullback before entering.

The area between 110.3K and 111.5K is the key zone for the main players to accumulate positions. Short-term traders can gradually buy in here, but be sure to use light positions and enter and exit quickly.

The first resistance is at 113K; if the trading volume doesn't pick up, failing to break through means it's a short-term top. Don't be blindly optimistic; a breakout before is just a rebound, not a reversal.

The second resistance is at 114K; if it can hold 113K and push up, there will be a chance to touch 114K. But it's still early; the focus is still on whether the lower support can be held.

The first support at 111.5K; as long as it doesn't break below 111.2K, there is still hope for short-term recovery. If it can stabilize in this area, there is a chance for a short-term rebound.

The second support at 110.3K; if 111.2K is broken again, it will easily lead to disappointment selling pressure, and selling pressure will spike, with a short-term plunge possible at any time. This position is crucial for the day.

10.15 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 110300-110600 range; Target: 111500-113000

Short Entry Reference: Sell in batches in the 113300-114000 range; Target: 111500-110300

If you truly want to learn something from a blogger, you need to keep following them, not just make hasty conclusions after a few market observations. This market is filled with performative players; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the top and bottom," but in reality, it's all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don't be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official public account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author! Please be cautious in discerning authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。