With last week's sudden stop, I reminded everyone to stay calm. However, in the past two days of rebound, the price has not reached the key levels, so we believe it's time to change our thinking. Our tentative short positions have also been exited with a trailing stop.

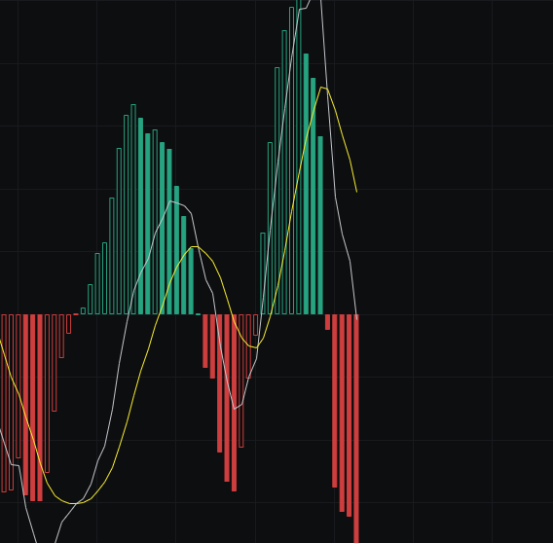

From the MACD perspective, the energy bars continue to press down, and the fast line has touched the zero axis. If the market is strong, a rebound will occur here; if there is no rebound, then it will continue to decline.

From the CCI perspective, two consecutive days of increase have not allowed the CCI to rise above the zero axis. The bulls have failed to reach the key level at this moment, which extinguishes hope, and the market will be dominated by the bears.

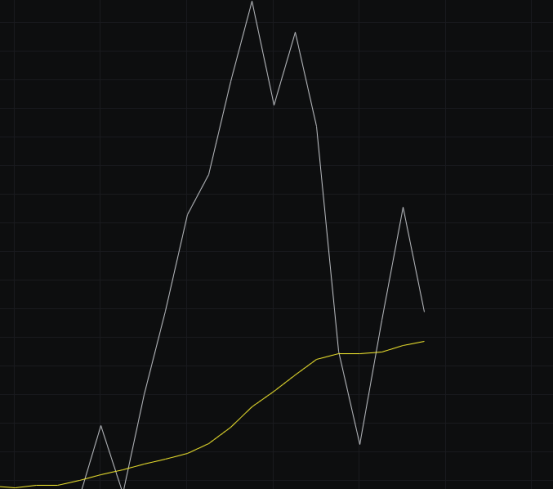

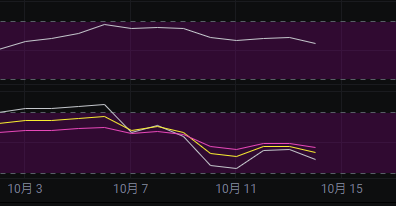

From the OBV perspective, the highs are moving down. Although the rise in the past two days allowed the fast line to surpass the slow line, today's decline has caused the fast line to drop quickly. The only positive is that the slow line is still slightly rising, but continuous bearish candles are needed to flatten the slow line.

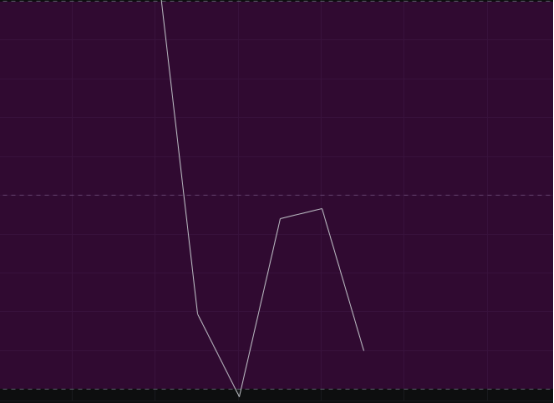

From the KDJ perspective, the KDJ has fallen from above and is currently around 50, showing no signs of stopping the decline, so we continue to expect a drop.

From the MFI and RSI perspectives, the MFI has reached the neutral zone and is turning down, while the RSI has entered the weak zone. Overall, the indicators lean towards bearish.

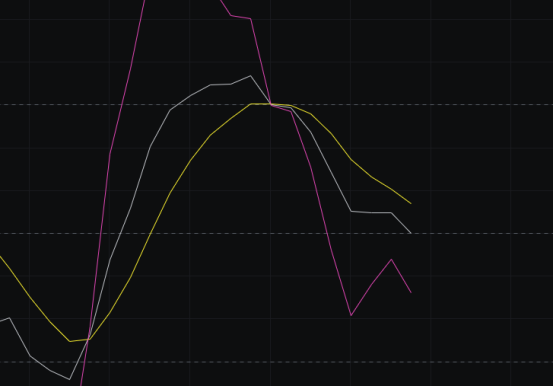

From the moving averages perspective, although it stood above 120 yesterday, it fell below today, which cannot be considered a complete breakout. Several moving averages are tending to flatten, indicating that the market needs to choose a direction again.

From the Bollinger Bands perspective, the upper band is tending to flatten, while the lower band is opening up with the current bearish candle. The upper and lower bands are not in sync, defining this as a wide range fluctuation. If the price fluctuates near the middle band and fails to stand above it, it will continue to drop back towards the lower band for a re-evaluation.

In summary: Despite two days of increases, the coin price has not reached the key levels, and the indicators are leaning towards the bears, so we are starting to look bearish. The first target for the bears is not to surpass 114,000, the second target is not to surpass 112,000, and the third target is for the price to reach around 109,000. Resistance is seen at 114,000-116,000, and support is at 109,000-107,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。