撰文:FinTax

1. 引言

泽西岛拥有独立于英国的税收制度体系,长期以来以「低税负、制度清晰、结构简洁」著称,是全球最具吸引力的离岸金融中心之一。该岛税制在坚持本地治理的基础上,兼顾国际合规标准,为传统金融服务、财富管理机构和新兴加密经济提供了灵活而稳定的税务环境。

与其他国家不同,泽西岛对加密资产的制度回应并不激进创新,而是表现出一种谨慎、分层、以兼容性为导向的路径选择。税收上,它延续了对资本利得免税、公司低税负的传统设计,但在行为认定上保留了「商业性」与「目的性」的判断弹性;监管上,它通过扩展既有法律边界,将虚拟资产纳入反洗钱、交易信息披露、许可证制度等常规框架,而非另起一套加密法典。

2. 泽西岛加密税收制度

2.1 泽西岛税收体系

泽西岛是英国皇家属地,具有高度自治权,拥有独立的税收与金融监管制度。其税制以简单、稳定、低税负著称,致力于为全球投资者和高净值个人提供具有吸引力的税务环境。主要税种和税率如下:

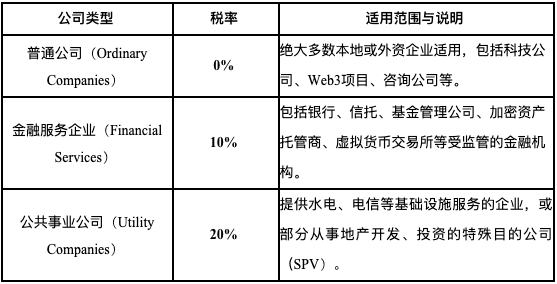

①公司税:泽西岛采用「0-10-20」的分类税率架构,即标准企业所得税税率为0%,金融服务公司适用10%,公共事业公司适用20%。

②个人所得税:统一税率为20%,无递进结构,并设有基本免税额(在17000英镑上下,每年略有调整),无资本利得税、遗产税、赠与税。

③商品与服务税(GST):在2008年起引入商品与服务税,统一税率为5%,与增值税相似但范围更窄,主要适用于本地商品与服务交易,对于金融服务、出口性服务等则通常免税处理。

这一税收制度设计不仅服务于传统金融,也为加密资产相关业务提供了政策空间,也成为该岛吸引Web3企业注册和运营的关键因素之一。

2.2 泽西岛加密税收政策

2.2.1 对于加密资产的定性

从整体监管口径来看,泽西岛将加密资产视为一种「资产」,而非法定货币,也不将其一律认定为证券或金融产品。这意味着,在法律和税务层面,加密资产既不享有法偿地位,也不自动被纳入金融工具监管范畴,而是依据具体使用场景进行功能性认定:

泽西岛监管机构以JFSC(Jersey Financial Services Commission)定义为依据,将加密资产认定为「可以交易或传输、可用于支付或投资的数字价值表示」,但不将其视为法定货币。若加密资产用于投资、持有增值,则被视为一种类似「个人财产」的投资资产,适用于与普通财产类似的税收规则。

依据JFSC 2018 年ICO Guidance Note,若代币具有参与发行人利润、资产索偿、赎回承诺、管理权或收益预期等特征,将被认定为证券,如具备集体投资安排特征,则当作「集体投资计划(collective investment scheme)」处理,需根据其权益结构进行个案评估。若从事挖矿或链上服务获得加密资产,则相关收入可能被视为「商业收入」或「受偿服务」的对价,需纳入所得税或公司税范围。

泽西岛监管机构对加密资产的监管和征税强调风险导向和用途分类原则,并不对所有虚拟资产一刀切纳入监管范畴,而是将加密资产的交易、持有、流通、服务等行为分别归类,决定是否适用现行金融法规或反洗钱义务。

2.2.2 加密资产相关税收政策

尽管泽西岛尚未出台专门的加密资产税法,但其税务机关Revenue Jersey已通过解释性文件与实践判例,将加密资产纳入现有税收框架下进行分类处理。整体上,泽西岛对加密资产的税收制度采取用途导向、属性判定、风险适配的基本原则。不同纳税主体和活动场景将适用差异化的税务规则,以下为主要情形:

(1)个人持有与交易

对于自然人来说,若其持有加密资产仅用于长期投资或偶尔买卖,所得增值通常被视为资本利得,在泽西岛无需缴税。但若交易频繁、具有商业性质,如使用杠杆或持续提供流动性,则相关收益将被视为经营所得,需按 20%的个人所得税申报。其中泽西岛对「交易行为」的认定参考英国税务海关总署 HMRC「Badges of Trade」原则(BIM 20205)。此外,质押收益、空投、节点奖励等非资本性收入,也通常被认定为应税收入,需要据实纳税。

(2)企业持有与运营

公司若从事与加密资产相关的业务,例如交易所运营、数字钱包托管、挖矿、代币发行、DeFi协议开发等,其经营所得应视为应税商业收入。根据泽西岛的「0-10-20」企业税制分类:一般技术类或平台类企业可能适用0%公司税率;若涉及金融服务性质(如加密资产托管、交易撮合、理财产品发行等),可能适用10%税率;若被认定为公共事业性或地产投资公司,适用20%税率。

(3)挖矿行为

对于加密资产挖矿行为,泽西岛并未专门立法禁止或豁免征税。官方在Cryptocurrency Tax Treatment文件中指出,若挖矿活动为「偶发性或非商业性」,则不构成应税活动;但若挖矿具有持续性、盈利性与组织性,其产出加密资产即构成应税收入,应按市场价格计入当期所得并纳税。

(4)加密支付与GST问题

尽管泽西岛实施5%的商品与服务税(GST),但税务机关明确表示,加密资产本身作为支付手段的「交换行为」并不构成应税交易。换言之,当用户用比特币或以太币购买商品、兑换法币或其他虚拟货币时,该行为本身不产生GST义务。但如果商家接受加密支付且提供应税商品或服务,其商品本身仍需按规定缴纳GST。此时加密资产仅被视为支付媒介,和使用现金、信用卡没有实质差异。

3. 泽西岛加密监管框架的搭建与完善

泽西岛的加密资产监管框架由泽西岛金融服务委员会(Jersey Financial Services Commission, JFSC)主导构建。JFSC负责泽西岛金融服务业的监督、监管和发展,其中包括对虚拟资产的监管,其职责主要包括:

①制定监管政策和指南:JFSC会发布指导说明和其他文件,明确泽西岛虚拟资产的监管方式,包括发布虚拟货币交易所的指南和许可证。

②注册与许可:在泽西岛运营虚拟资产领域的企业必须向JFSC注册并获得所有必要的执照或许可。

③监管与执法:JFSC负责监管受监管实体,确保其遵守泽西岛反洗钱/反恐怖融资法律以及其他监管要求。同时JFSC 也有权对违反这些要求的实体企业采取执法行动。

④制定合规与监督标准:JFSC为虚拟资产行业设定合规与审查标准。例如,企业必须配备具有相应技能和经验的人员,包括指定的反洗钱报告官(MLRO)和副报告官(Deputy MLRO),以及负责合规和内部监督的关键岗位人员。JFSC还监督虚拟资产服务提供商是否遵守「行程规则」(Travel Rule)和国际加密资产税务申报标准。

⑤国际合作:JFSC 与其他监管机构及国际组织开展合作、交换信息,推动全球虚拟资产监管的协同与一致性。

泽西岛并未制定针对加密资产的专门法典,而是在原有金融监管体系和反洗钱制度基础上,通过增设定义、扩展适用范围和实施注册制等方式,逐步将虚拟资产及其服务提供商纳入监管轨道。以下是目前与加密资产相关的核心法律与监管文件:

①《金融服务法》(Financial Services (Jersey) Law 1998)

该法是泽西岛最基础的金融监管法律,规定任何在泽西岛提供特定金融服务的企业必须向 JFSC 注册或申请牌照。JFSC 于2016年明确指出,虚拟货币交易所属于该法的监管范畴,因此须作为「货币服务业务(Money Service Business)」进行注册。

②《犯罪收益法》(Proceeds of Crime (Jersey) Law 1999)

这是泽西岛的反洗钱与反恐融资核心法律,适用于包括加密企业在内的所有高风险行业。该法要求从事虚拟资产业务的企业必须履行以下义务:客户尽职调查(CDD)、交易记录留存,以及向泽西岛金融犯罪情报单位(JFCU)报告可疑交易。

③《虚拟货币交易所监管规定》(Virtual Currency Exchange Regulations)

JFSC于2016年发布专门针对虚拟货币交易所的监管规定,要求其严格执行 AML/CFT 措施,建立健全的内部控制与治理结构。这些规定将加密交易平台纳入实质监管体系。

⑤《首次代币发行(ICO)监管指引》(Initial Coin Offerings Guidance Note)

JFSC 于2017年发布该指引,明确 ICO 在泽西岛的监管适用范围。该文件强调 ICO 将按个案评估,依据所发行代币的性质决定是否适用现有金融服务监管法律,若代币具备证券属性或构成集体投资工具,将需取得牌照并接受监管。

⑥《资金转移附带信息条例》(Information Accompanying Transfers of Funds (Jersey) Regulations 2017,2023年修订)

该条例用于落实 FATF 的「Travel Rule」,要求所有 VASP 在虚拟资产转账中收集并交换发送人/接收人的识别信息,是泽西岛加强跨境加密交易透明度的重要举措。

⑦《OECD 加密资产税收报告框架(CARF)规定》(Crypto-Asset Reporting Framework Regulations, 2024–2025)

泽西岛于2024年加入CARF协议,2025年实施本地法规,要求所有加密资产服务商履行客户税务信息的收集与报告义务,并与其他司法辖区实现自动信息交换。

在泽西岛,虚拟资产相关的税收与监管安排以《金融服务法》和《犯罪收益法》为基础,通过场景化细化规定和国际合作条款逐步完善。《金融服务法》确立了加密交易所等新兴业务纳入「货币服务业务」管理的许可要求,而《犯罪收益法》则作为所有虚拟资产活动的反洗钱和反恐融资底线,覆盖客户尽职调查、交易记录和可疑活动报告等义务。《首次代币发行指引》在此基础上对代币发行活动作出功能性分类,明确不同发行模式应否纳入证券或集体投资的现有监管框架。《资金转移附带信息条例》和CARF规定进一步加强了跨境资金流动和税务信息透明度,确保泽西岛在保有灵活税制优势的同时,与国际合规要求保持一致。

4. 总结与展望

泽西岛凭借其简洁灵活的税收制度和渐进式监管策略,正逐步构建起兼具吸引力与合规性的加密资产制度环境。税收制度方面,泽西岛依旧维持其传统优势——无资本利得税、企业低税负,这为加密产业提供了有利的落地条件。但可以看到,泽西岛并未鼓励投机套利式的结构设计,而是通过「商业性活动」的税务界定,明确边界,留下监管判断空间,这种模糊边界恰是其灵活性的来源。

未来,泽西岛将不可避免地受到国际规则收紧的影响,尤其是 OECD 的 CARF 框架和 FATF 对 VASP 透明度要求的落地,会逐步压缩其政策缓冲带。泽西岛面临的真正挑战,或许不在于如何「吸引更多加密企业」,而是如何在保持制度自治的同时,建立起一种可信赖、但不过度牺牲灵活性的监管形象。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。