撰文:J1N,Techub News

没想到平平无奇的 2025年 10月11日又成了载入史册的一天。

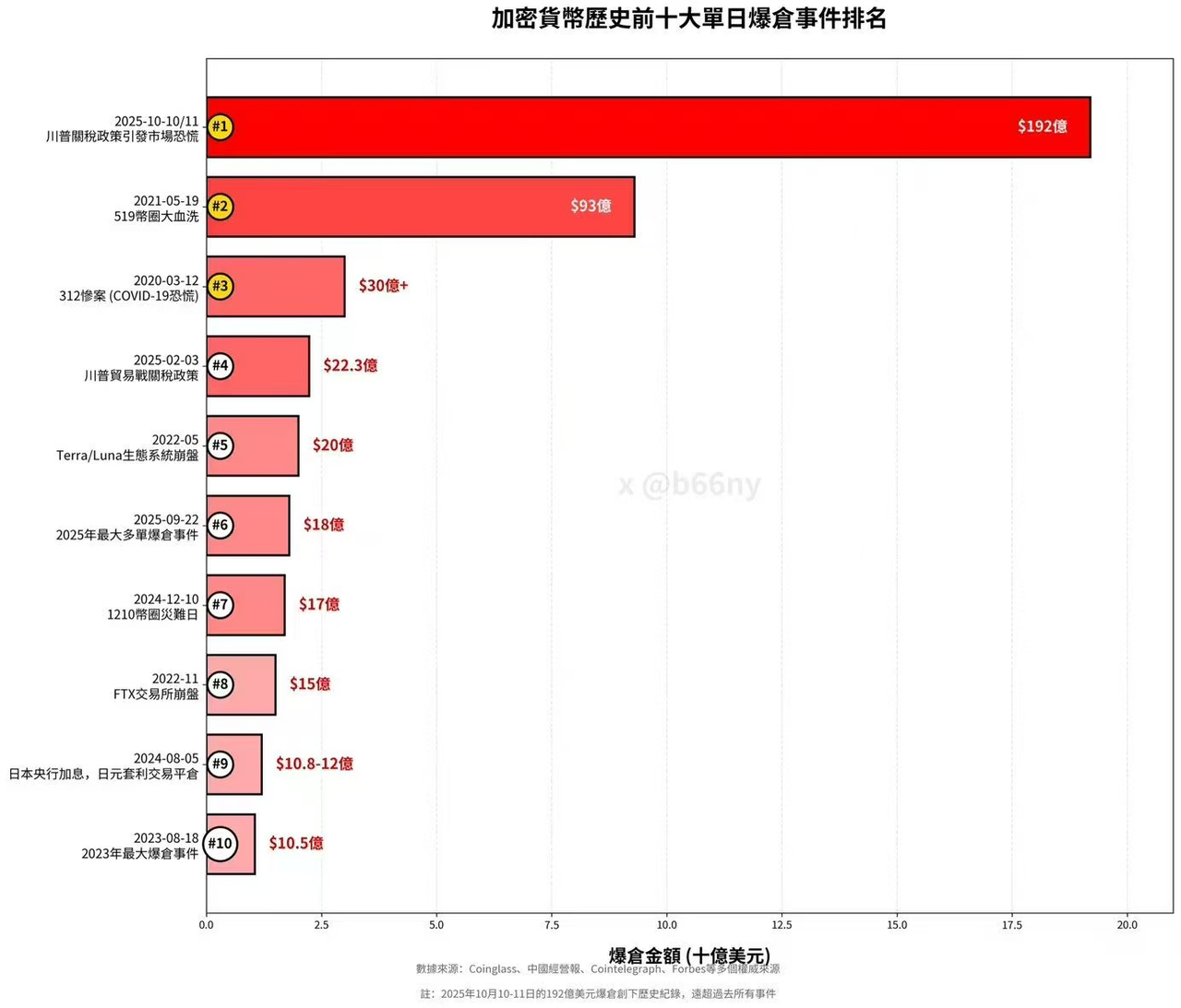

加密货币市场经历了一场前所未有的「黑色星期五」,短短 24 小时内,全网爆仓金额飙升至 191 亿美元以上,刷新历史之最,数百万投资者一夜之间血本无归。比特币从 119,000 美元高位暴跌,以太坊崩盘 23%,山寨币更是尸横遍野。

是特朗普的一条推文引发这一切?还是早已布好的清盘局

特朗普一条推文,瞬间引爆全球恐慌

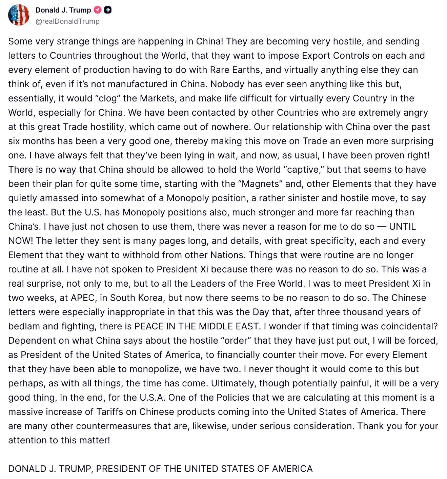

一切要从 10 月 10 日说起,特朗普在其社交平台威胁要为中国增加关税,并在 11 日 5 点扬言要加 100% 关税。原话大致是:

从 11 月 1 日起,美国将对所有来自中国的进口商品加征 100% 的额外关税。中美关系已经恶化到无需面对面会晤的地步,我们将用金融和贸易手段进行全面反击。中国在稀土上的垄断地位让我们别无选择,这是为了保护美国的核心利益。

推文一出,直接引发了美股「一泻千里」,紧接着加密的连环下跌。

2025 年的中美摩擦,早已从科技封锁蔓延到供应链重构,美国一直在加码施压。但「100% 关税」这一刀太狠,远超以往的 25% 或 10%,几乎等于让所有中国出口商品成本翻倍。

想想那些电子零件、原材料、日用消费品全线涨价已成定局。全球供应链本就「吹弹可破」,这次再遭重击,不仅是中美两国的事,欧洲、亚洲的市场也被卷入漩涡。

纳斯达克指数暴跌 3.56%,创下4月以来单日最大跌幅;美元指数下滑 0.57%;原油暴跌 4%,铜价同步跳水。传统市场一乱,风险资产就成了第一批「祭品」,加密货币首当其冲。

来源:东方财富

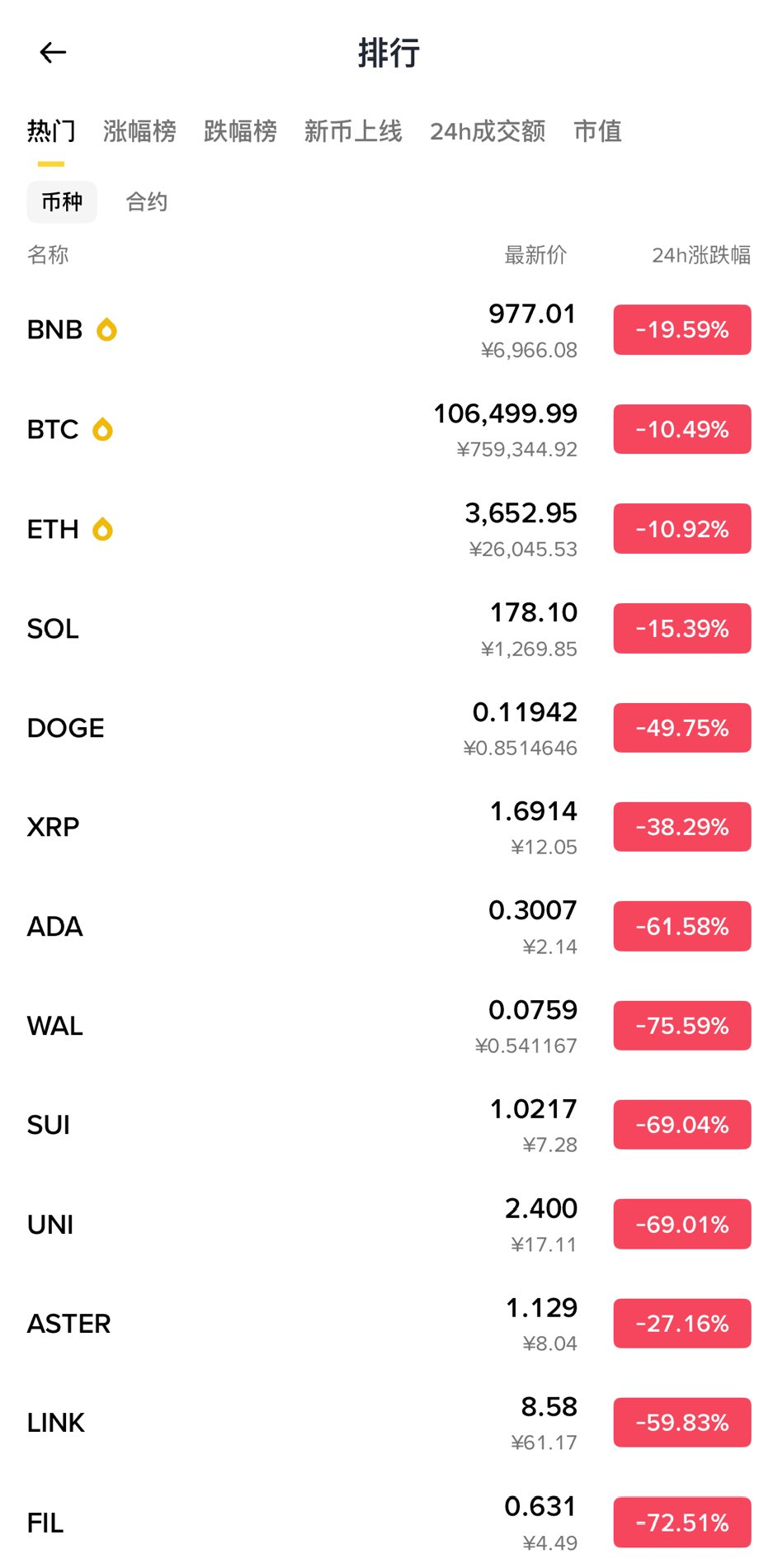

推文发出不久,比特币开始自由落体,从 119,000 美元高位几小时内砸破 102,000 美元,单日跌幅超过 14%。 以太坊更惨,直接崩了 24%;SOL 闪崩 25%,BNB 下跌 33%,XRP、DOGE、SHIB 等主流山寨币平均跌幅在 60%~80%。一些流动性差的小币种甚至几分钟内暴跌 90% 以上。这次的清算力度,哪怕只开 1 倍杠杆也被爆仓。

特朗普「推文治国」早已不是新鲜事,但放在 2025 年,这一击的杀伤力格外致命。加密市场如今与传统金融深度联动,美股一跌,币圈自然跟着崩。更关键的是,这次关税直指中国的稀土垄断。稀土可是芯片、电池等高科技产业的命脉,间接冲击了区块链矿业和硬件生态。

推文病毒式在全球扩散,机构与散户疯狂抛售,形成恶性循环。恐慌,就这样在几小时内全面失控。

24 小时爆仓 191 亿,刷新历史纪录

整个事件过去 24 小时,全网爆仓金额不断攀升,创下了币圈历史之最。这次不光规模大,还特别集中,只要加杠杆的几乎全军覆没。据 Coinglass 显示,24 小时全网爆仓升至 191.41 亿美元,再次刷新历史记录,全球共有 1,621,284 人被爆仓,其中多单爆仓 166.86 亿美元,空单爆仓 24.55 亿美元,最大单笔爆仓单发生在 Hyperliquid 平台的 ETH-USDT 合约交易对,价值 2.03 亿美元。币种方面,比特币爆仓 53.17 亿美元,以太坊爆仓 43.78 亿美元,SOL 爆仓 19.95 亿美元,HYPE 爆仓 8.88 亿美元,XRP 爆仓 6.99 亿美元。

没错,191.41 亿美元!这在币圈历史上绝对是灭顶之灾,比之前的黑天鹅事件都要猛。多头仓位占了大头(166.86 亿),说明牛市氛围下,大家都在追涨杀跌,结果黑天鹅一来,全线崩盘,全球 1,621,284 人仓位瞬间化为乌有。

最大单笔爆仓发生在 Hyperliquid 平台,这个平台一直以高杠杆永续合约出名,这次成了重灾区。那笔 2.03 亿美元的 ETH-USDT 合约爆仓,从侧面反映了杠杆的可怕。Hyperliquid 的 HLP 在这次事件中盈利暴增,从 8000 万美元直窜到 1.2 亿美元,这就证明了清算规模有多庞大。

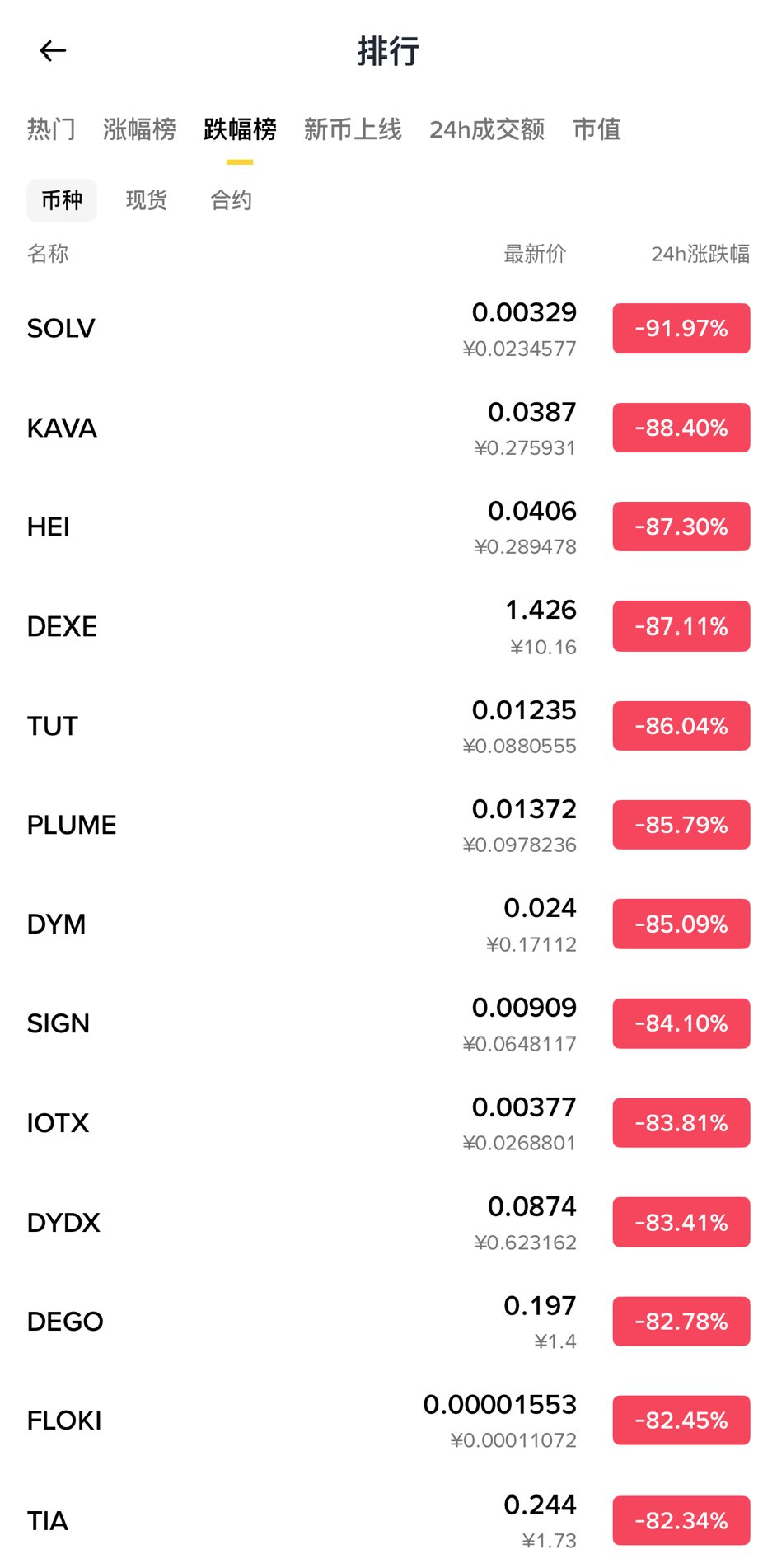

为什么 Hyperliquid 这么惨?因为它支持 USDe 这样的合成稳定币作为保证金,而 USDe 在崩盘中脱锚了。USDe 是 Ethena Labs 的产品,市值 140 亿美元,本来靠 Delta 中性对冲来维持稳定,持有以太坊现货,同时做空等值的永续合约。但特朗普推文引发以太暴跌 24%,资金费率转为负值,协议从赚钱一方变成赔钱一方,抵押品价值缩水。一家大机构在币安用 USDe 做跨保证金,直接爆仓抛售,导致 USDe 价格一度跌到 0.6 美元。连锁反应下,借贷协议的循环贷仓位全线清算,形成死亡螺旋。

在美股收盘前(凌晨 4 点)很多人用 3 倍、5 倍甚至更高的杠杆追多,都以为差不多了、跌完了,结果 5 点左右又来了当头一棒直接懵逼,一夜之间清零。Hyperliquid 上,有些用户短短 15 分钟损失上百万美元。整个过程就像多米诺骨牌:稳定币脱锚,保证金缩水,自动清算,抛售加剧,更多脱锚,CEX 宕机无法操作。

一觉醒来,哀嚎遍野

一条条爆仓数据不断提示,币圈社区彻底炸锅了。推特、Reddit、Telegram、Discord,到处是哭天喊地的声音。很多人一觉醒来,账户余额呈 90° 直下。有人感慨:「特朗普一推文,全网都跪了。昨晚还梦见大饼破 12 万,今天醒来连 10 万都不一定能守不住」。 还有人自嘲:「稳定币?稳定个屁!USDe 从 1 刀变 0.6 刀,我的养老钱全没了。」

牛市氛围太热了,大家都忘了风险,高收益的诱惑太大。USDe 的循环贷策略,听着高大上,年化 40%-50%,但本质上是杠杆赌博。从众心理严重,看到别人赚了就跟风,黑天鹅一来,全军覆没。机构也惨,可能是传统金融公司跨界玩加密,用 USDe 做保证金。结果流动性枯竭,小币种合约直接双杀。社区里不乏阴谋论:有人说川普家族提前开好了空单,配合关税战收割;也有人觉得是一场庄家联手早已布好的清算局一次收割。

「循环贷」的多米诺骨牌是怎么倒下的?

表面上看是特朗普推文,实际上是币圈的杠杆隐患。以 USDe 为代表的循环贷策略终于引爆了。就像一场精心设下的赌局,高收益背后藏着致命陷阱。

USDe 是 Ethena Labs 的合成美元,市值 140 亿,在稳定币里排第三。它承诺年化 12%-15% 的回报,远超 USDT 那种低息。怎么赚的?靠 Delta 中性对冲:持有以太坊现货,同时做空等值的永续合约,赚取资金费率。在牛市里,费率是正的,协议就能赚钱,分给用户。很多人不满足于此,就搞循环贷:把 USDe 抵押借出 USDT,再存回 USDe 赚息,反复操作,能把本金放大四倍,年化直奔 40%-50%。听着低风险高回报,吸引了数百亿资金涌入,存款池很快就满了。

但特朗普推文打破了这个平衡。以太坊暴跌 16%,费率转为负值,协议从赚钱变成赔钱,抵押品价值缩水。USDe 脱锚,价格腰斩到 0.6 美元。循环贷雪上加霜:「智能合约检测到抵押率不足,就自动抛售 USDe 来还债,进一步压低价格,触发更多清算,形成死亡螺旋」价格跌了,就清算抛售,价格再跌。

做市商用 USDe 做合约保证金,即使是 1 倍杠杆,缩水后也相当于被动加杠杆。流动性一枯竭,价差拉大,小币种闪崩 80%-90%。Hyperliquid 的 HLP 金库暴赚 40%,证明爆仓规模有多恐怖。加密投资人 Dovey 推测,币安上那家大机构爆仓就是起点:跨保证金操作,清算引发抛售潮。

当所有人都在追逐高收益时,风险往往最大。这次,杠杆加稳定币的组合拳,把局部危机放大成系统性崩溃。为什么明知有坑,还有那么多人前赴后继?因为人性贪婪,总以为自己是那个例外。

从 312 到 519,再到 FTX 的影子

币圈的崩盘从来不是新鲜事儿,这次 1011 事件,让人不禁回想过去几次黑天鹅事件。

2020 年的 312、2022 年的 519,还有 FTX 崩盘,每次都像历史在重演,但教训好像总被抛到脑后。

2020 年 3 月 12 日,新冠疫情在全球爆发,传统市场崩盘,加密跟着遭殃。比特币从 8000 美元一夜砸到 3800 美元,跌幅超 50%;以太坊从 200 美元跌到 90 美元;山寨币平均腰斩。24 小时爆仓数十亿美元,创下当时纪录。全球恐慌抛售,流动性枯竭。从低点起步,比特币大约 3 个月回到 8000 美元,然后 1 年多时间冲到 2021 年的峰值 6 万多美元。

2022 年 5 月 19 日,Luna/UST 暴雷,那是算法稳定币的噩梦。UST 承诺 20% 年化,吸引数百亿资金,但脱锚后 Luna 从 119 美元跌到 0.0001 美元,600 亿美元市值蒸发。爆仓数百亿,Terra 生态崩塌,波及 DeFi 和 NFT。比特币从 3 万美元低点,用了半年多回暖,然后 1 年时间到 2023 牛市启动。以太坊从 2000 美元跌到 800 美元,缓慢爬升。

2022 年 11 月的 FTX 崩盘,交易所巨头 FTX 破产,创始人 SBF 被捕。SBF 挪用用户资金炒币、加杠杆操作导致崩盘。爆仓数百亿,波及 SOL 生态(Alameda 关联),市场市值蒸发数千亿。但是币圈处于熊市,该事件也导致了熊市加深,半年后才企稳,2023 牛市启动。

这次 1011 事件,像是混合版:USDe 脱锚类似 Luna 的死亡螺旋;杠杆清算像 312 和 519;机构爆仓有 FTX 的影子。但不变的核心还是高收益做诱饵,极端情况下机制脆弱,从单一危机波及全市场。不同的是,USDe 有抵押,没彻底归零;发生在监管更严的时代。历史告诉我们,杠杆如同吸毒,让你享受同时也在自我毁灭。

活下来,永远比赚钱更重要

1011 大崩盘,不止是价格狂泻,更是整个生态的重塑。同时暴露了稳定币的脆弱性。高收益的 USDe,本质上是风险对冲,循环贷叠加杠杆成了赌局。监管呢?2025 年 SEC 管得更严,但黑天鹅还是防不住。长远来看,这次事件会推动稳定币审计加强,杠杆上限收紧。

从全球视角看,关税战升级,中美博弈会推高矿业成本,但也可能加速去中心化,矿场往中东或拉美转移。

这一夜对于对于币圈大多数人来说,是人生的至暗时刻。甚至有些本着对币圈乐观的行业观察者,感受到了一丝绝望气息。贪婪、侥幸、从众,这些是人性弱点,总在牛市里放大。币圈如人生,活下来,永远比赚钱更重要。致敬巴菲特的那句「只有当潮水退去时,你才知道谁在裸泳」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。