原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

一觉醒来,相信怀疑自己眼花了的不只我一个。

Coinglass 数据显示,过去 24 小时全网爆仓总金额为 191.33 亿美元,爆仓人数多达 1,618,240 人。OKX 行情显示,BTC 一度跌至 101500 美元;ETH 一度跌至 3373 美元;SOL 一度跌至 144 美元左右。更多现货价格惨状,详见《惊魂暴跌夜:单日爆仓史上最高191亿美元,财富疯狂流动》。

尽管目前各大主流币价格均有不同程度的修复,但这仍然是一场属于空军的财富盛宴。而在这波极端行情下赚的盆满钵满的最大赢家,无疑是疑似内幕交易员的某 BTC OG 及开出 9 位数空单的加密巨鲸。Odaily 星球日报将于本文对内幕巨鲸相关操作及可能身份作简要分析。

加密巨鲸最高开出 10 位数空单,一天内狂揽 2 亿美元

或许谁也没想到,BTC 价格新高后会迎来如此巨幅的回调,除了部分内幕消息者和部分眼光老辣的加密巨鲸。

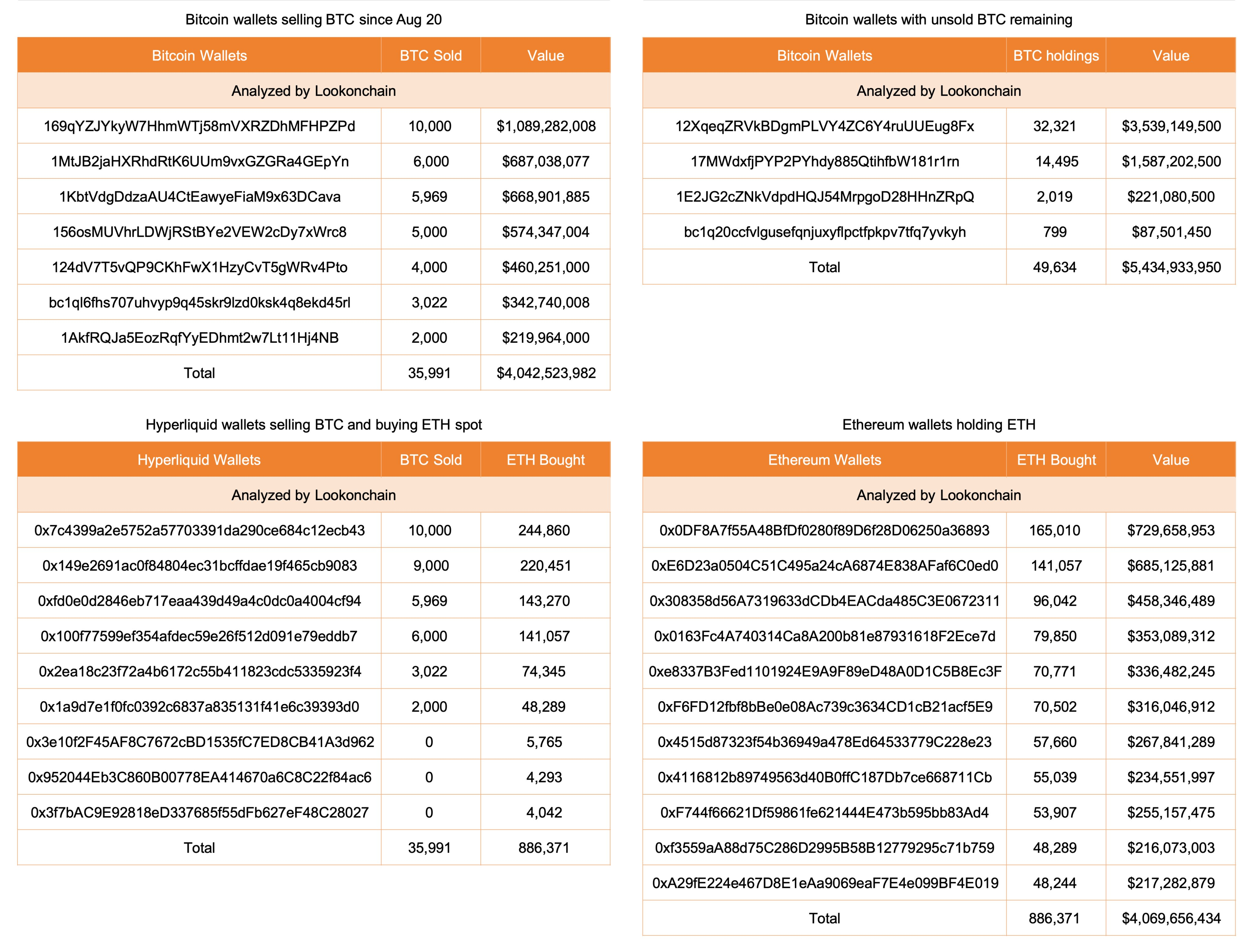

比特币 OG 巨鲸提前3天开出巨额空单,操作记录一览

某浮盈超 7000 万美元的 BTC OG 巨鲸最早的交易操作可以追溯至 8 月 20 日:据 LookonChain 监测,自 8 月 20 日,该交易员/机构就在 Hyperliquid 出售了近 3.6 万枚 BTC 并买入超 88.6 万枚 ETH,彼时 ETH/BTC 汇率为 0.0406;在其其余 4 个钱包中,仍持有超 4.9 万枚 BTC,价值 54.3 亿美元。

10 月 8 日,该巨鲸再次 卖出 3000 枚 BTC,价值 3.63 亿美元。目前 3 个相关地址中,2 个地址已清仓;还有一个地址持有

地址列表:

bc1pxeg2c8yy5gklex2z8qvmxlwgvf7kzhx07a68xek52kfl0s9dc20qjydsuu(已清仓);

0x757f88e931ef4d57c23b306c5a6792fc0d16edb2(Hyperliquid 地址,已清仓);

0x4f9A37Bc2A4a2861682c0e9BE1F9417Df03CC27C(持有 4.26 亿美元 USDC)。

10 月 10 日,该巨鲸开始了自己的“内幕式做空表演”——

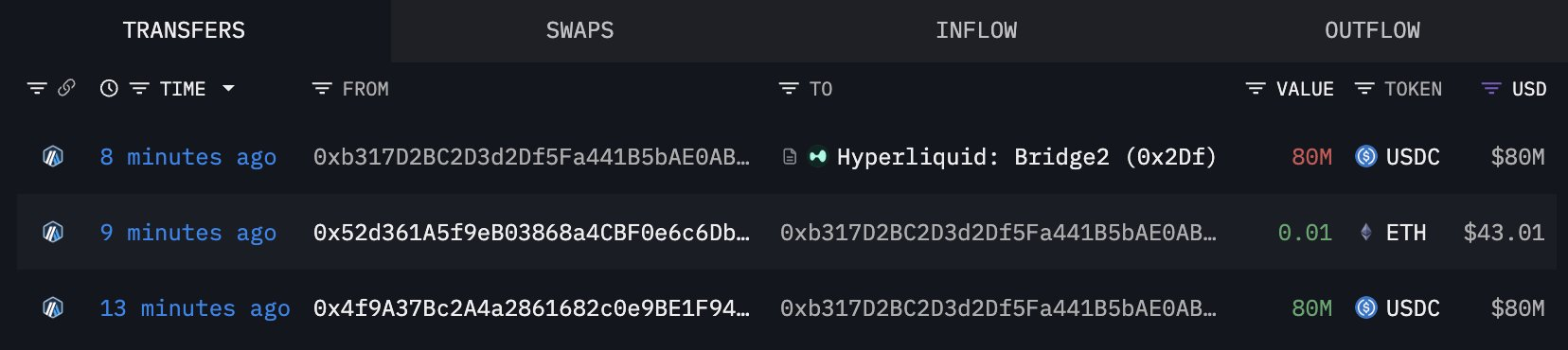

其先是向 Hyperliquid 存入 8000 万美元,开设了 3477 枚 BTC 的 6 倍空单;此外,还向币安存入了 5000 万美元的 USDC。地址:0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae;

随后,其再次加仓空单,将 BTC 做空仓位增至 3600 枚。

昨天下午,其将做空目标瞄准 ETH,向 Hyperliquid 存入 3000 万美元开设了 76,242 枚 ETH 的 12 倍空单。链上地址 见此处,目前该地址已清仓。

10 日晚间,该巨鲸 做空仓位不断增加,一度增至 11 亿美元左右,其中 BTC 空单仓位价值 7.52 亿美元;ETH 空单仓位价值 3.53 亿美元。

而随着昨日晚间特朗普再次发起关税战,市场应声下跌时,该巨鲸做空仓位也扭亏为盈,一度 盈利超 2700 万美元;

今日最新消息,Hypurrsan 数据 显示,此前做空 BTC 和 ETH 的巨鲸将 6000 万美元 USDC 提回 Arbitrum,过去 24 小时盈利 7233 万美元。

极端行情下,Hyperliquid再成赢家,HLP单日利润超4000万美元

此外,据链上分析师 @mlmabc 分析,该巨鲸在 Hyperliquid 上的单日盈利约 1.9 亿~2 亿美元;另外一边,身处极端行情下,Hyperliquid 借此也分了一杯羹: HLP 单日利润高达 4000 万美元;年利率飙升至 190%;总体资本回报达 10-12%。

内幕巨鲸的隐藏身份:或与 Trend Research 有关?

至于该巨鲸的幕后身份,目前来看尚无定论。

但据 Lookonchain 分析,高调换仓以太坊的比特币 OG 或与易理华旗下 Trend Research 存在关联。证据是钱包 0x52d3 此前向此比特币 OG 地址发送了 0.1 枚 ETH 作为 gas 费用,随后又向 Trend Research 的币安存款地址存入了 131 万枚 USDC。

Odaily星球日报也将持续跟进市场动态及该加密巨鲸/机构的更多消息。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。