Written by: Eric, Foresight News

The Solana DEX Meteora, which plans to officially launch its token MET on the 23rd of this month, announced its tokenomics during the National Day holiday and has named the initiative "Phoenix Rebirth."

According to the MET tokenomics, 20% is allocated to Mercurial stakeholders; 15% is distributed to Meteora users through an LP incentive program; 2% is allocated to off-chain contributors, those who contribute to the development of Meteora; 3% is allocated to the Launchpad and Launchpool ecosystem; 3% is allocated to the Jupiter staking incentive program; 3% is allocated to centralized exchanges, market makers, etc.; and 2% is allocated to M3M3 stakeholders. Additionally, 18% of MET will be allocated to the team, and 34% of MET will be reserved for Meteora, both of which will be unlocked linearly over 6 years.

In total, 48% of the tokens will be distributed and directly unlocked at TGE, but MET will not be distributed in the usual airdrop format for users. Instead, 10% of the tokens will be distributed to users in the form of liquidity positions. According to Meteora, this mechanism allows the project team to avoid providing additional tokens for initial liquidity, while users can also earn fee income.

What many people do not know is that Meteora's development journey has been tumultuous, and it is not an exaggeration to say it has undergone a "Phoenix Rebirth." To understand the story behind it and what Mercurial and M3M3 are in the token distribution plan, we need to start from the beginning.

From "Princeling" to "Prisoner"

Meteora's predecessor, Mercurial Finance, was established in 2021, positioning itself as a stablecoin asset management protocol within the Solana ecosystem. Notably, another protocol developed by the founding team of Mercurial is Jupiter, which is currently the absolute leader in the Solana DEX space. One of the co-founders, Ben Zhow, has a background in product design and has worked at design consulting firms IDEO and AKQA, focusing on user experience and product development. He later co-founded social applications Friended and WishWell. Another anonymous founder goes by the pseudonym meow, who has served as an advisor for several DeFi/wallet projects such as Instadapp, Fluid, Kyber, and Blockfolio, and is also an early contributor to the decentralized domain protocol Handshake.

The core of Mercurial is to establish a platform focused on providing low slippage for on-chain stablecoin trading and high returns for liquidity providers (LPs). In terms of reducing slippage, Mercurial does not require LPs to configure token pairs in a 1:1 ratio when providing liquidity, allowing for flexible configuration options that enable LPs to achieve arbitrage by adding unilateral liquidity after large trades, thus reducing subsequent trading slippage. Additionally, Mercurial utilizes special price curves to concentrate liquidity within the desired range. If a user's trade exceeds the trading rate range, they will receive less liquidity support.

To enhance returns, Mercurial employs a dynamic fee mechanism. Simply put, when trading is active, Mercurial raises transaction fees to reduce LPs' impermanent loss; when trading is quiet, Mercurial lowers transaction fees to stimulate trading. On the other hand, Mercurial will deploy assets within the pool to external protocols, such as lending, to further increase LP returns, once approved by the DAO.

In the booming DeFi market of 2021, protocols like Mercurial that aimed to become the Curve of Solana were highly sought after. It received early investments from Alameda Research, the Solana Ecosystem Fund, OKEx (now OKX), and Huobi, and conducted an IEO on FTX. At that time, FTX founder Sam Bankman-Fried personally endorsed the project, stating, "The team's strong technical, research, and operational capabilities demonstrate Solana's appeal. We look forward to working with them to enhance the liquidity and usability of the Solana platform."

In early August 2021, at the peak of Mercurial, its TVL accounted for nearly 10% of Solana's total TVL. Even by the end of 2021, when Solana's TVL was nearing $10 billion, Mercurial's TVL still accounted for over 2%. While it may not be considered a pillar of strength, it was certainly one of the important DeFi infrastructures on Solana.

The subsequent story is well-known; the Solana ecosystem faced a comprehensive downturn during the bear market of 2022, plummeting to a freezing point with the collapse of FTX. Mercurial, due to its close ties with FTX, suffered significant damage, with its TVL drastically reduced and remaining low. By October 2023, its TVL had fallen below $10 million, less than 5% of its peak. Similar stories have occurred with many DeFi projects that have since disappeared, but Mercurial's story did not end there.

Transforming to Focus on DEX, Gaining Fame through TRUMP

On December 27, 2022, Mercurial published an article on Medium announcing the Meteora plan, which included launching Dynamic Vaults and AMM on the Meteora platform, introducing a new token to replace the original MER, completing a brand overhaul, and transitioning to Meteora.org.

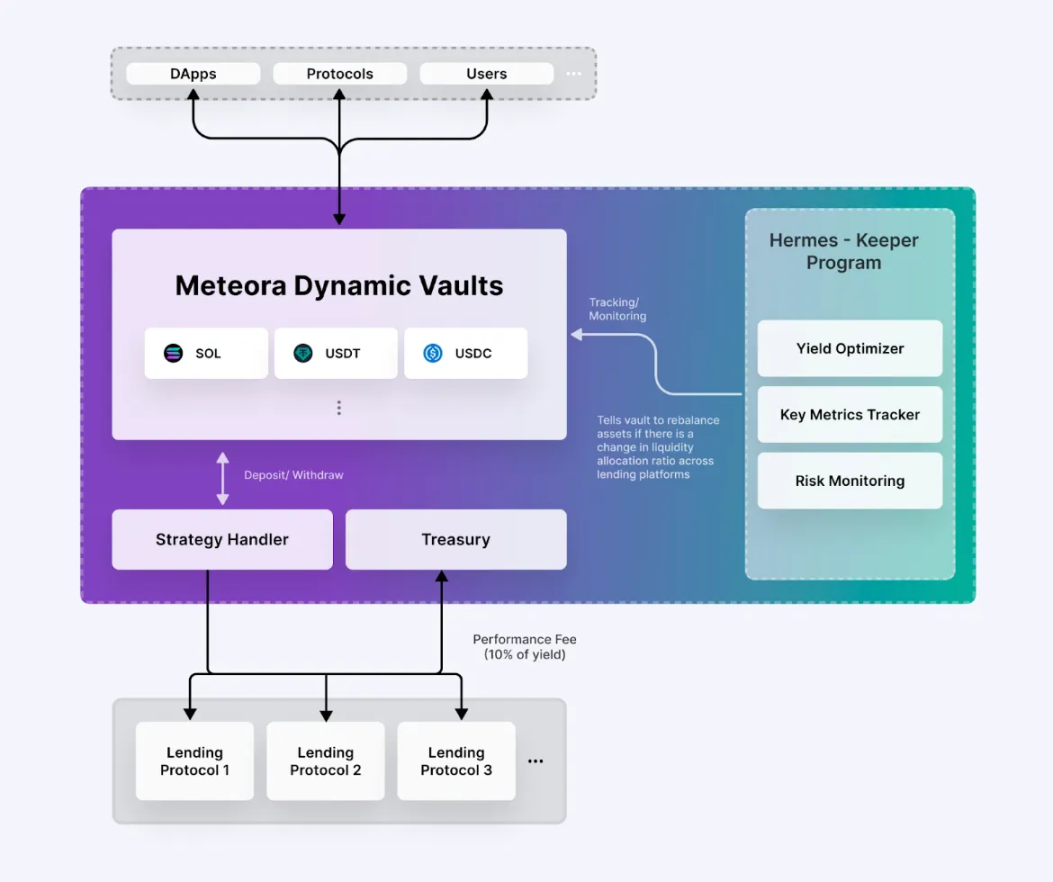

At that time, Mercurial focused on Dynamic Vaults, hoping to establish Meteora as a yield layer on Solana. The team's vision was to create a new platform composed of Dynamic Vaults, AMM pools, and guardians, with guardians responsible for monitoring and rebalancing the vault assets of different lending protocols every few minutes to provide LPs with the highest returns.

In February 2023, the new platform Meteora was officially launched, but as mentioned earlier, the low point of TVL occurred in October of the same year. Meteora did not emerge from the shadows simply by "changing its name." After muddling through for 10 months, a turning point appeared at the end of 2023.

In early December of that year, Meteora announced that it would begin implementing a liquidity incentive program on January 1, 2024, allocating 10% of the new tokens to users providing liquidity. The incentive targets not only included stablecoin liquidity pools but also began to encompass non-stablecoin asset liquidity pools. It was precisely at this moment that Meteora shifted its strategic focus to DEX, and its TVL surged from less than $20 million in December to over $50 million.

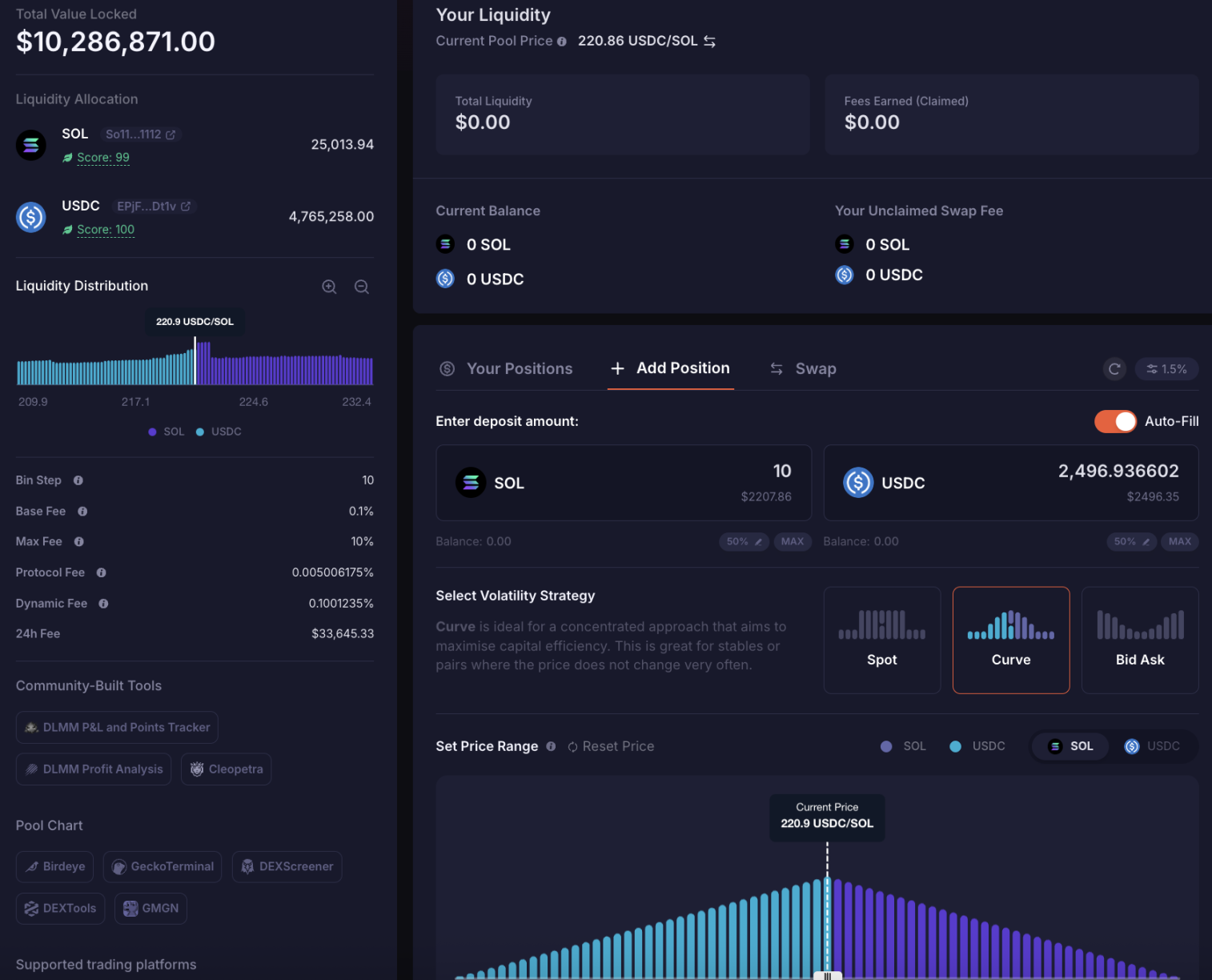

Alongside the incentive program, a new AMM model called DLMM (Dynamic Liquidity Market Maker), inspired by Trader Joe, was introduced. In simple terms, liquidity in the new AMM model is not continuous but divided into individual "Bins." Each Bin represents a fixed price, and the price of the asset traded through Meteora remains unchanged and at 0 slippage until the liquidity in that Bin is exhausted.

For example, suppose the current price of SOL is $200, and there are two SOL/USDC liquidity Bins on Meteora, priced at $200 USDC and $201 USDC, respectively. If at some point the market price of SOL rises from $200 to $201, but there are still 10 SOL remaining in the liquidity at the $200 USDC price that have not been traded, then the execution price for buying up to 10 SOL through Meteora remains $200 USDC. Only when the total purchase exceeds 10 SOL will the liquidity move to the $201 USDC price Bin.

For users, there are three ways to add liquidity: Spot, Curve, and Bid Ask. Both Spot and Curve distribute added liquidity "evenly," but the former is a linear average, while the latter is a curve average. The Bid Ask mode allows for the addition of unilateral liquidity, such as adding only SOL or USDC liquidity in the SOL/USDC pool.

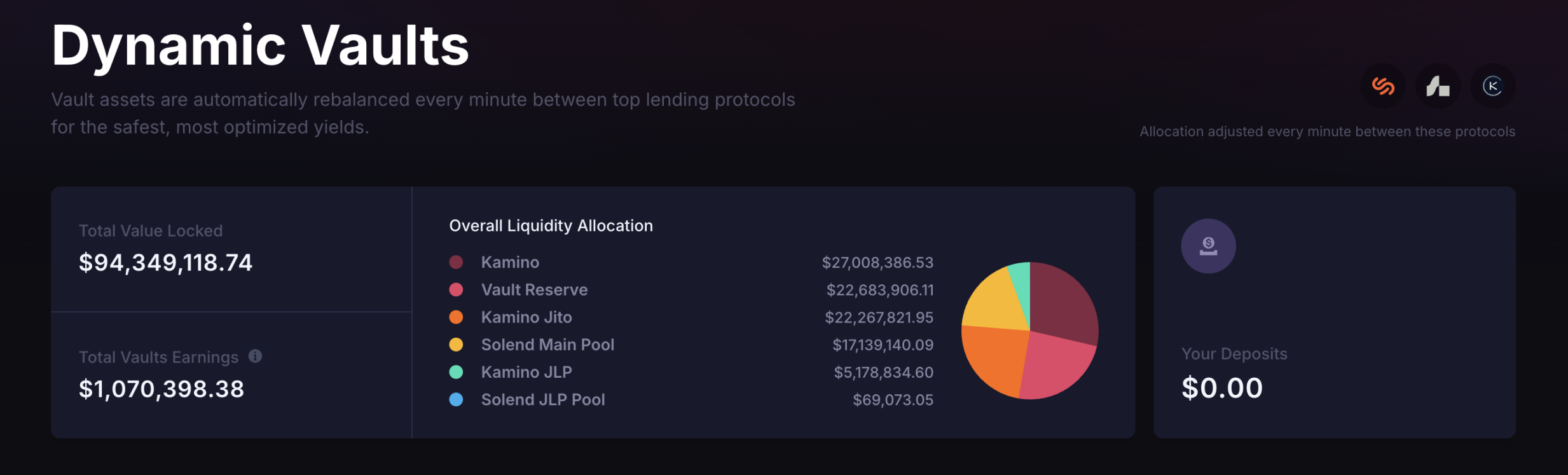

Although a new mechanism was introduced, Meteora did not abandon its original AMM+ yield aggregator product but instead renamed it DAMM v1 and retained it within the protocol. That Vault, which had only a few million dollars during its low point, had already surpassed $90 million in TVL at the time of writing. Subsequently, Meteora launched DAMM v2, independent of v1, characterized by a highly customizable AMM mechanism that provides various tools for newly launched token projects, such as native liquidity mining and unilateral liquidity, for early value discovery. Meteora has also become a choice for many new projects to establish initial liquidity, which is the business referred to by the 3% token allocation for the Launchpad and Launchpool ecosystem.

With this series of measures, while it cannot be said to have turned the tide, it has stabilized the situation. Meteora began to carve out its niche in the competition among Solana DEXs. Although its TVL fluctuated between $200 million and $300 million, trading volume and its share of total DEX trading volume on Solana gradually increased. A year after the transformation, the emergence of the TRUMP token further propelled Meteora's development forward.

At that time, the TRUMP team chose Jupiter, Meteora, and Moonshot as partners. On the evening of January 17 and the morning of January 18, the TRUMP token issuance team established the initial liquidity for TRUMP on Meteora, leading to several days of festivities. According to DefiLlama data, on the 18th, the trading volume on Meteora reached $7.6 billion in a single day, while the total trading volume on Solana's DEX that day was $37.945 billion, with Meteora accounting for 20% of the total trading volume thanks to TRUMP. By the 20th, Meteora's TVL had reached $1.688 billion, accounting for 14.7% of Solana's TVL that day, while just three days prior, this figure was less than $470 million.

As a result of this event, Meteora gained significant fame. As two projects founded by the same team, Jupiter continued to hold its position as the leading aggregator on Solana, widening its moat, while Meteora gained the ability to compete with Raydium and Orca. Coupled with the tens of millions of dollars in fees earned from TRUMP, Meteora and Jupiter achieved both fame and fortune.

Market Manipulation Scandal Erupts, Co-Founder Resigns in Shame

The financial effects brought by TRUMP inexplicably sparked a wave of "celebrity meme token fever," including tokens like MELANIA, issued in the name of Trump's wife, and LIBRA, promoted by Argentine President Milei on Twitter. However, unlike the wealth effect brought by TRUMP, these tokens experienced a brief surge followed by a continuous decline, resulting in significant losses for many investors. Particularly after LIBRA's collapse, Milei vehemently denied that LIBRA was a token he participated in issuing, claiming he merely forwarded related information. This brought to light the true creators of LIBRA, Hayden Davis and Kelsier Ventures, of which he is the CEO.

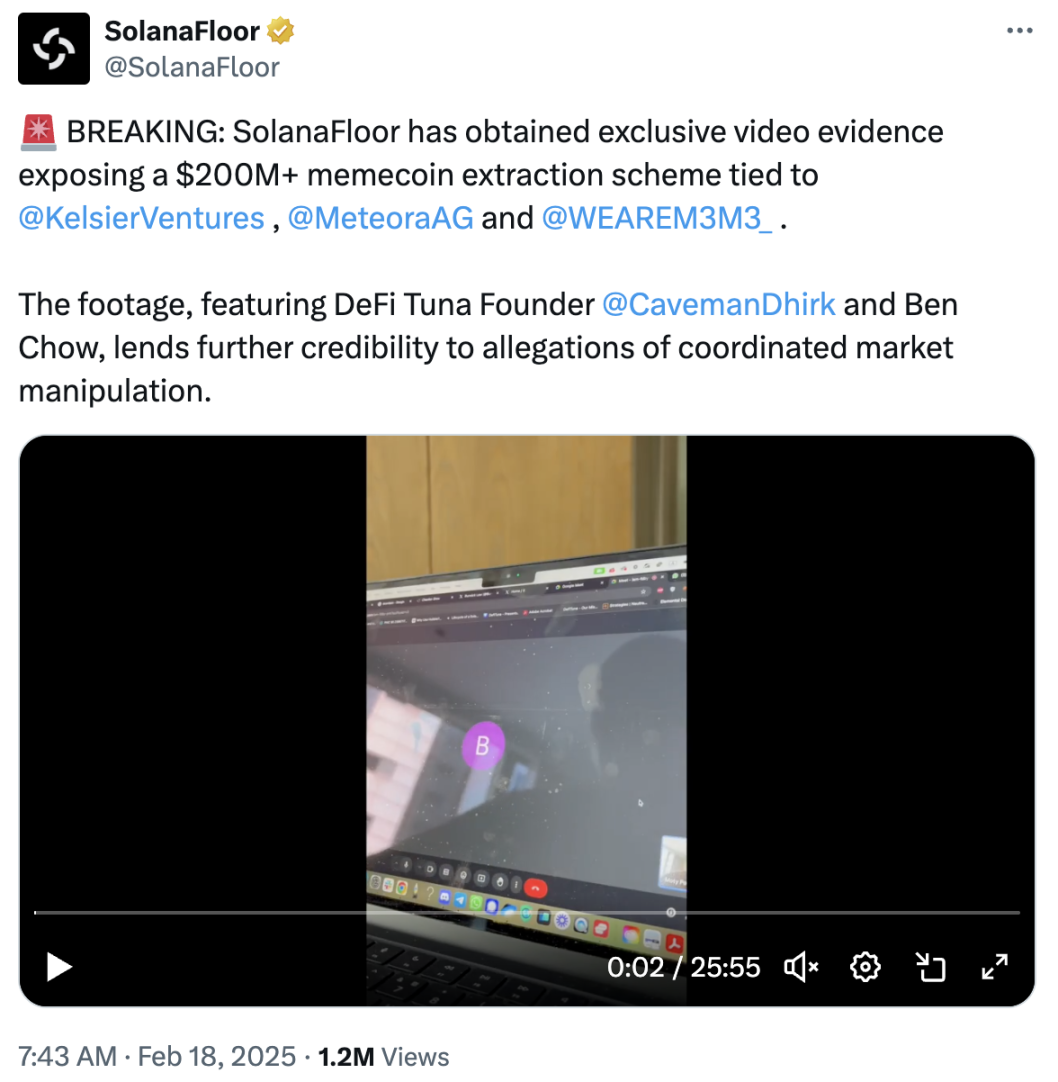

Following this, Moty, the founder of DefiTuna, revealed that Meteora and Kelsier Ventures were the masterminds behind it all, and the tokens involved were far more than just MELANIA and LIBRA. Kelsier manipulated the prices of meme tokens launched through the meme token launchpad M3M3 (which Meteora claims is a community-launched platform) to profit, including the later MELANIA and LIBRA, with Kelsier's total profits reaching as high as $200 million.

Meteora co-founder Ben was the first to step forward to clarify that his relationship with Kelsier Ventures was merely to inquire whether Kelsier would be willing to issue tokens on the platform to help with testing when M3M3 launched. Ben stated that Kelsier Ventures "seemed trustworthy" during this collaboration, which is why he recommended them to the MELANIA team. In the launches of both MELANIA and LIBRA, Meteora and he personally only provided technical support and did not manipulate prices.

However, just a day after Ben's clarification, Moty released a video that essentially "substantiated" the fact that Meteora colluded with Kelsier Ventures to manipulate the prices of a large number of meme tokens, leading to Ben resigning under pressure. Another co-founder of Meteora, meow, also posted on X expressing belief that the Meteora team and Ben did not engage in insider trading or market manipulation, stating that they would hire the law firm Fenwick & West to investigate the matter and provide a report. However, the market did not buy this statement, primarily because this law firm was previously the general counsel for FTX and was sued for allegedly assisting FTX in fraud.

In his clarification statement, Ben also mentioned that Kelsier Ventures had independently launched the M3M3 token during testing on the M3M3 platform, but later Meteora redesigned the tokenomics and provided funding to the so-called community to continue operating M3M3. However, at that time, the M3M3 token also experienced a brief surge followed by a continuous decline. In April, Burwick Law and Hoppin Grinsell LPP assisted the investors who suffered losses in filing a class action lawsuit against Meteora and its founders, accusing them of causing investors to incur a total loss of $69 million through the manipulation of the issuance and price of the M3M3 token.

Burwick Law had already accused Meteora and Kelsier Ventures in March of participating in the issuance of LIBRA, leading to significant losses for investors, and filed a lawsuit. Currently, there has been no further information regarding these two lawsuits.

Many believe that the issuance of TRUMP sounded the death knell for meme tokens on Solana, but in reality, it was these scandals related to Meteora that truly calmed the market and made investors hesitant. Even now, trading of meme tokens on Solana cannot be considered quiet, but it has certainly diminished compared to the fervent days.

The MET Token Arrives Nearly Two Years Late

The first mention of issuing a new token dates back to December 2023 when Mercurial first announced its plan to rebrand as Meteora. Over the nearly two years, Meteora has repeatedly stated that the token would be launched soon, but there was no follow-up. This "difficult birth" of the project token has finally found a resolution.

However, such a "difficult birth" is somewhat understandable. On one hand, Meteora focused more on "growing stronger" during its early transformation, and a hasty token issuance could be counterproductive; on the other hand, Meteora needed to consider various groups, including early holders of the Mercurial token, participants in early liquidity incentives, a large number of new users after the launch of the TRUMP token, and users who suffered significant losses from holding M3M3. For each group, how to distribute and how much to distribute are questions worth careful consideration.

Now it seems that Meteora has found a solution regarding the token issue, but the controversies surrounding the project still exist. Issuing the token may just be the beginning of a new journey for the team.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。