CoinW研究院

关键要点

全球加密货币总市值为4.46万亿美元,较上周3.96万亿美元,本周内加密货币总市值上升12.6%。截止至10月6日,美国比特币现货ETF累计总净流入约600亿美元,本周净流入32.4亿美元;美国以太坊现货ETF累计总净流入约144.2亿美元,本周净流入13亿美元。

稳定币总市值为2,987亿美元,其中USDT市值为1,763亿美元,占稳定币总市值的59%;其次是USDC 市值为753亿美元,占稳定币总市值的24.6%;DAI市值为53.6亿美元,占稳定币总市值的1.79%。

据DeFiLlama的数据,本周DeFi总TVL为$1,691亿,较上周1,555亿,上升约8.74%。按公链进行划分,其中TVL最高的三条公链分别是Ethereum,占比67.75%;Solana链,占比9.09%;Bitcoin,占比6.47%。

本周多条公链交易与生态数据整体回升。除Ethereum日成交量下降18.5%外,其余链均上涨,其中Sui(+87.56%)与Aptos(+58.46%)增幅最显著。交易费用方面,Solana涨幅高达105%,Aptos与Sui分别上涨39%与8.79%。日活跃地址方面,Ethereum(+15.29%)和Solana(+7.14%)表现突出,BNB与Aptos则下滑约18.5%。TVL整体上行,Sui增幅最大(+22.79%),Solana、BNB与Aptos分别上涨14.23%、13.39%与11.89%。

新项目关注:Stable 是由 Bitfinex 与 Tether 联合推出的 Layer1 区块链,其特色在于将 USDT 设为原生 gas 代币,使点对点 USDT 转账免手续费。Limitless 是一个建立在 Base 链上的去中心化预测市场平台,主打分钟/小时级/日级短期价格预测。StandX 是一个去中心化永续合约交易平台(Perps DEX),推出了可自动生息的稳定币 DUSD,用户通过 USDT/USDC 铸造后即可获得收益,并可用作合约保证金。

目录

一.市场概览

1.加密货币总市值/比特币市值占比

2.恐慌指数

3.ETF流入流出数据

4.ETH/BTC和ETH/USD兑换比例

5.Decentralized Finance (DeFi)

6.链上数据

7. 稳定币市值与增发情况

二.本周热钱动向

1.本周涨幅前五的VC币和Meme币

2.新项目洞察

三.行业新动态

1.本周行业大事件

2.下周即将发生的大事件

3.上周重要投融资

四.参考链接

一.市场概览

1.加密货币总市值/比特币市值占比

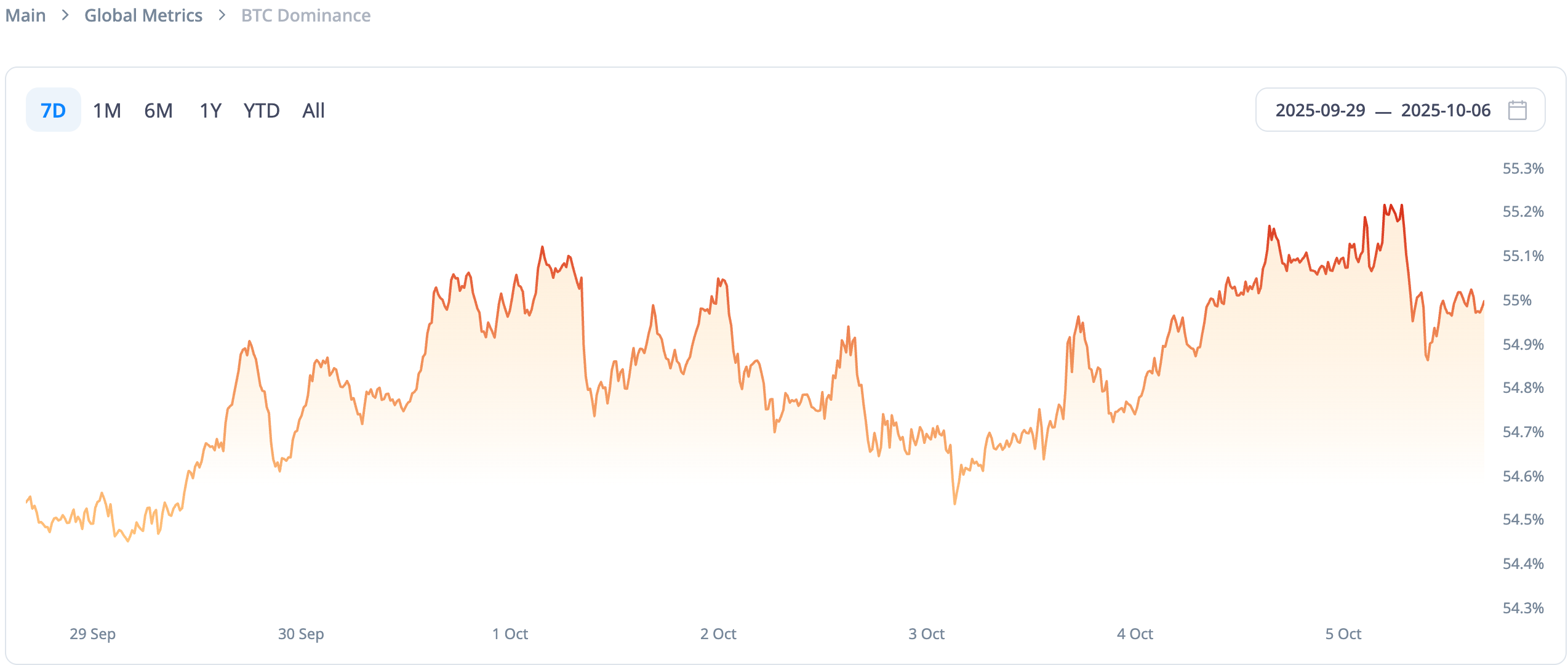

全球加密货币总市值为4.46万亿美元,较上周3.96万亿美元,本周内加密货币总市值上升12.6%。

数据来源:cryptorank

数据截止至2025年10月5日

截止至10月6日,比特币的市值为2.45万亿美元,占加密货币总市值的54.9%。与此同时,稳定币的市值为2,987亿美元,占加密货币总市值的6.69%。

数据来源:coingeck

数据截止至2025年10月5日

2.恐慌指数

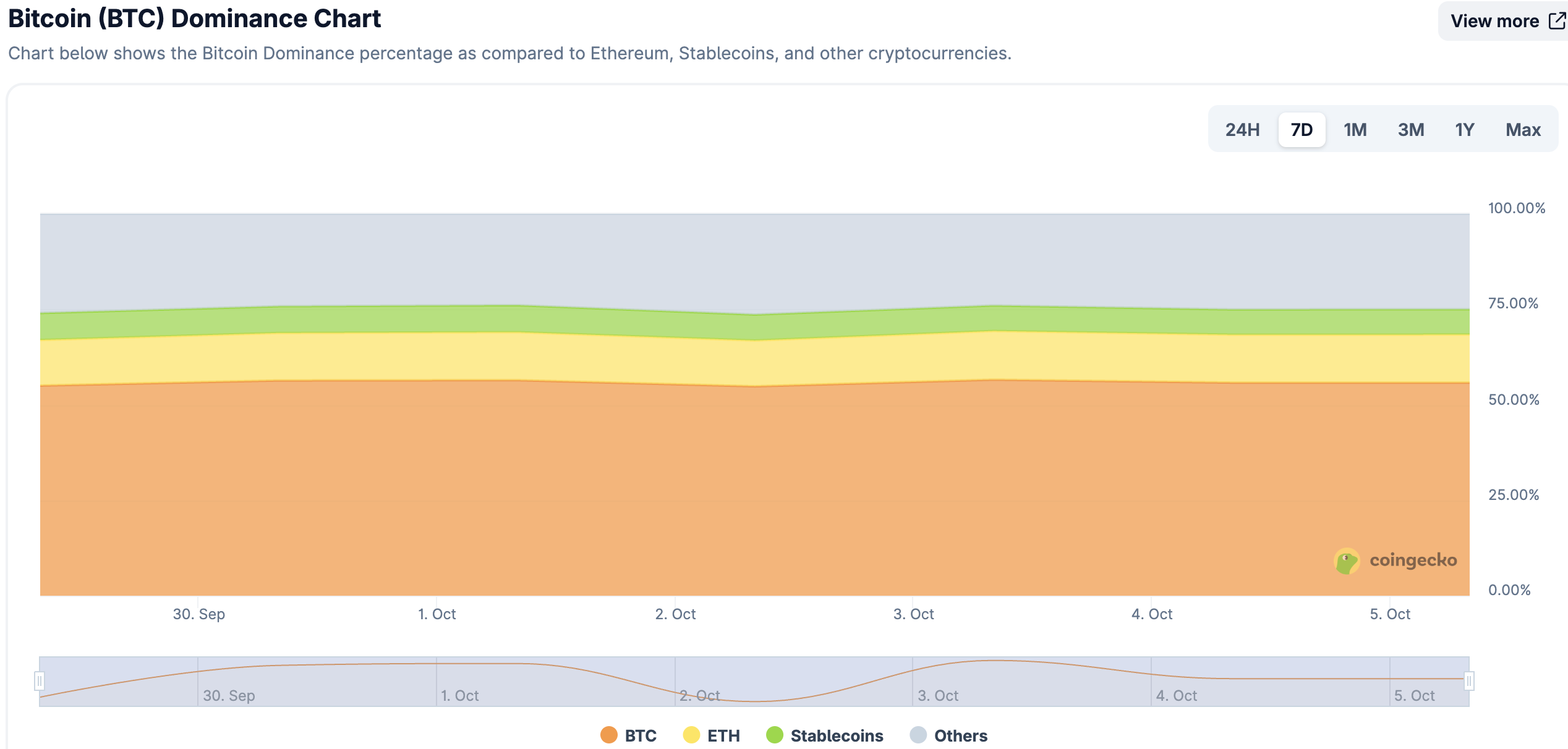

加密货币恐慌指数为75,显示为贪婪。

数据来源:coinglass

数据截止至2025年10月5日

3.ETF流入流出数据

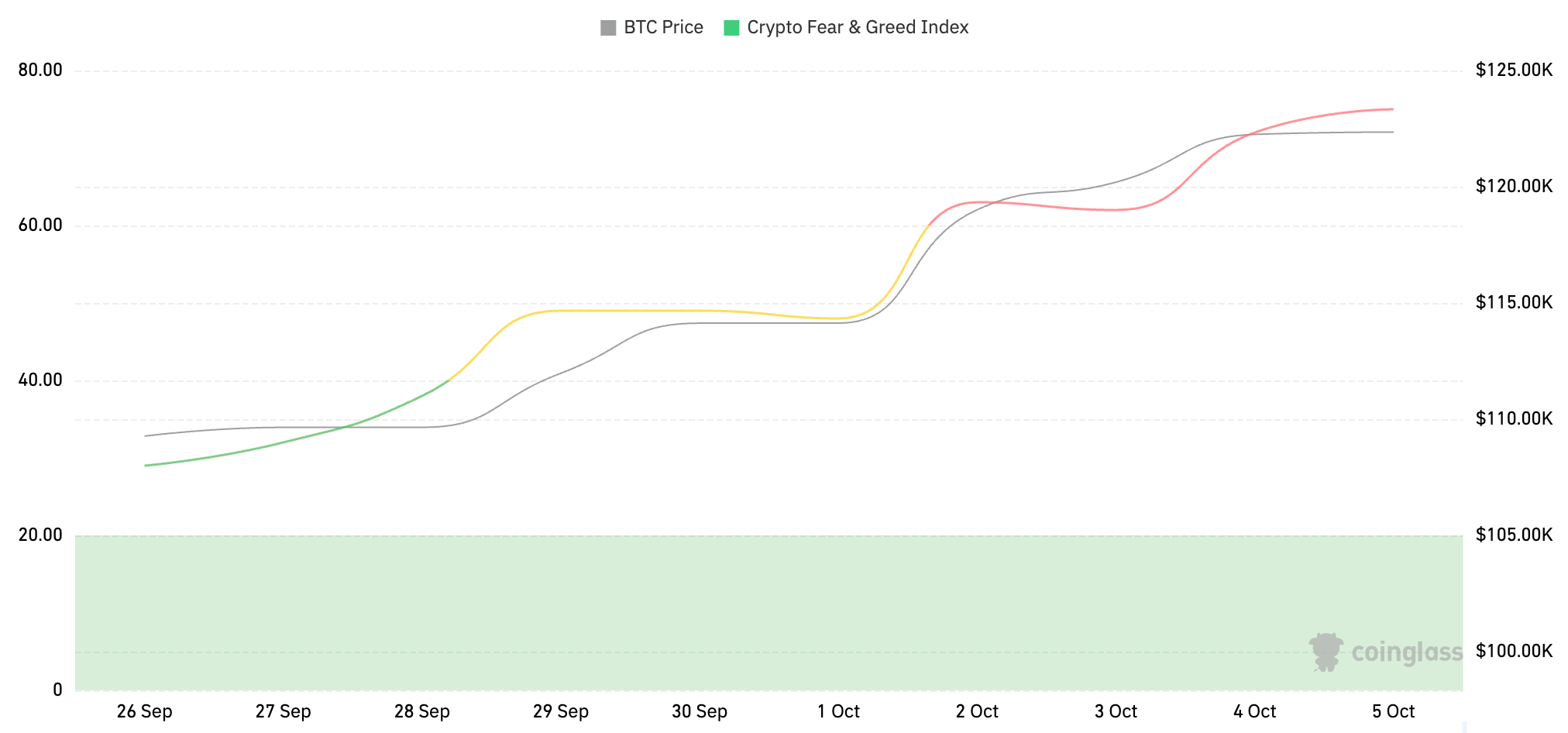

截止至10月6日,美国比特币现货ETF累计总净流入约600亿美元,本周净流入32.4亿美元;美国以太坊现货ETF累计总净流入约144.2亿美元,本周净流入13亿美元。

数据来源:sosovalue

数据截止至2025年10月5日

4.ETH/BTC和ETH/USD兑换比例

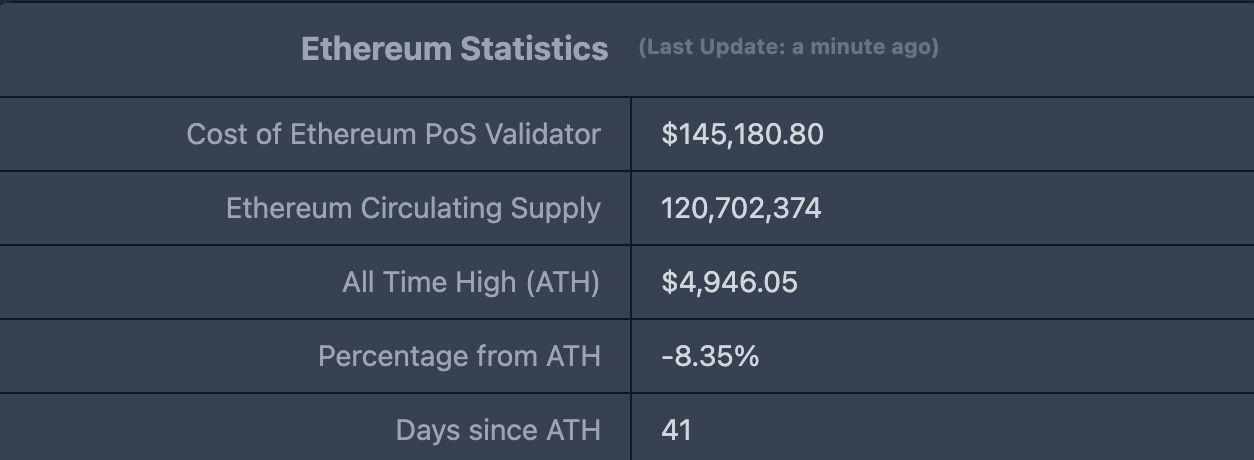

ETHUSD :现价$4,537.29,历史最高价$4,946.05,距最高价跌幅约8.35%

ETHBTC :目前为0.036865,历史最高为0.1238

数据来源:ratiogang

数据截止至2025年10月5日

5.Decentralized Finance (DeFi)

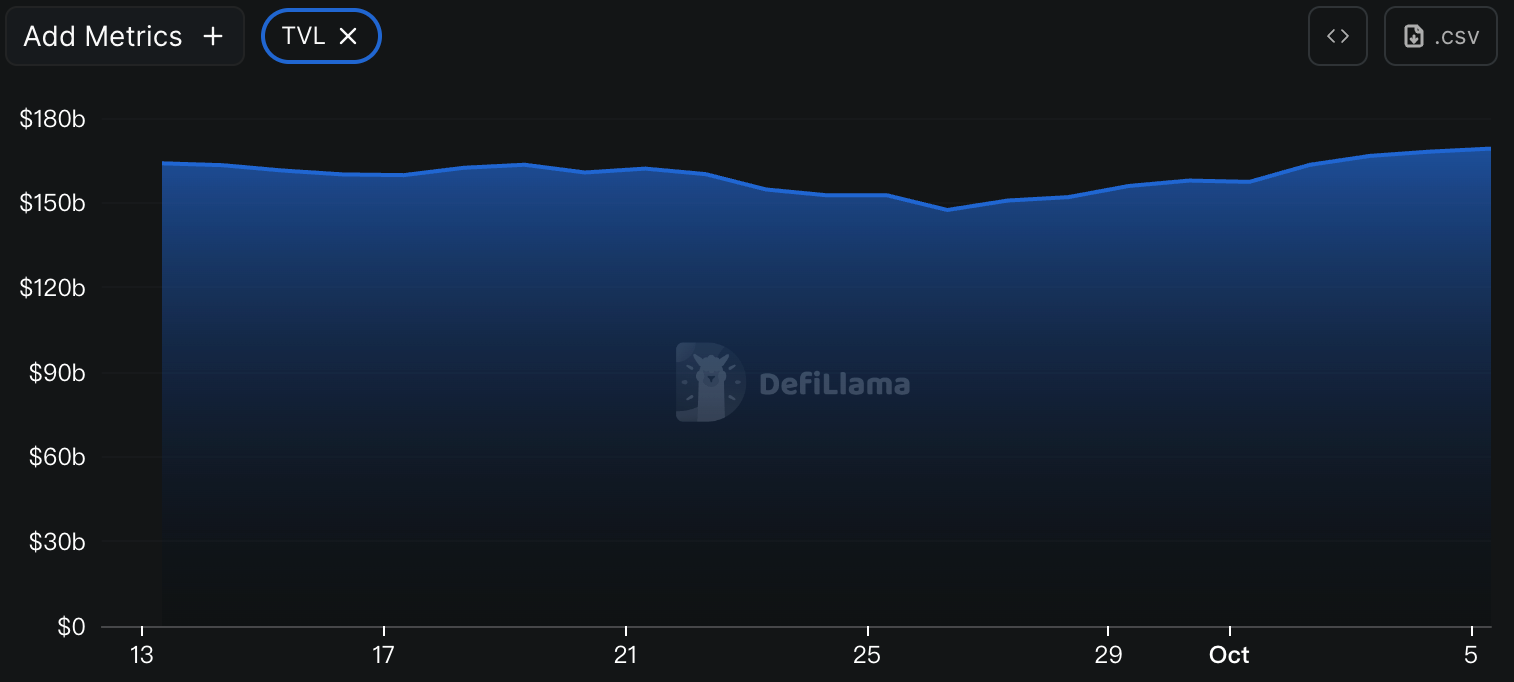

据DeFiLlama的数据,本周DeFi总TVL为$1,691亿,较上周1,555亿,上升约8.74%。

数据来源:defillama

数据截止至2025年10月5日

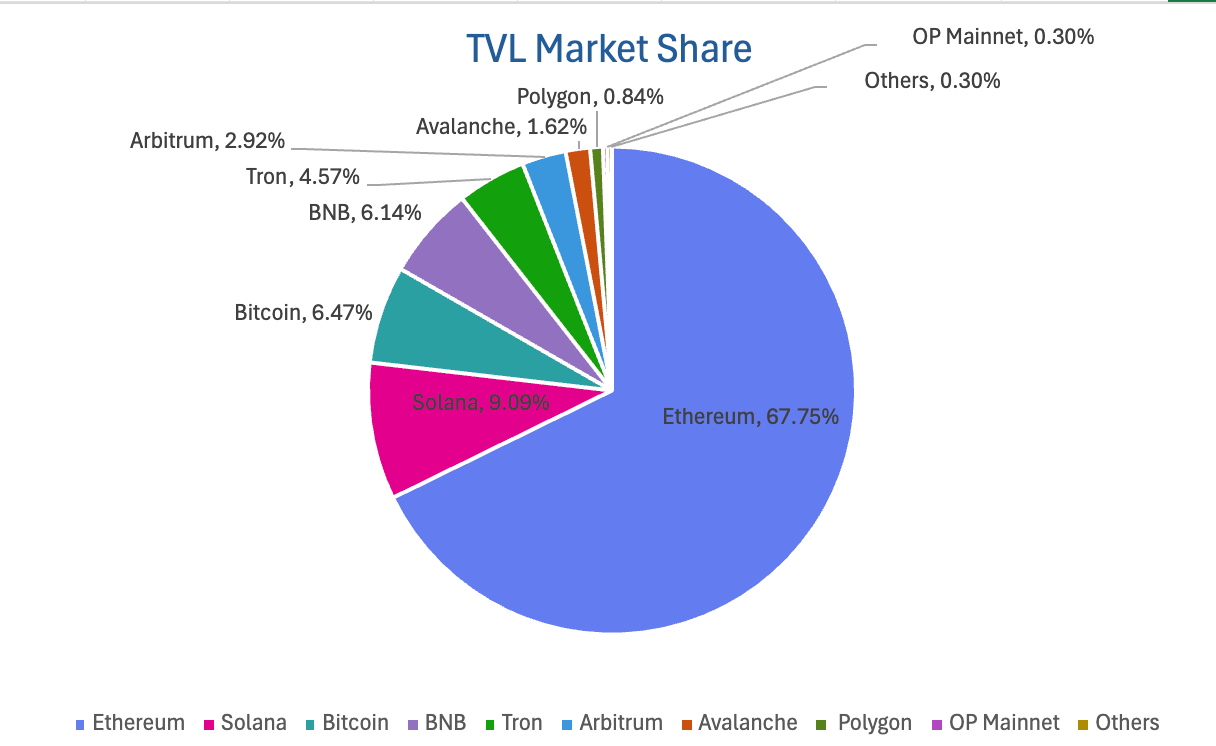

按公链进行划分,其中TVL最高的三条公链分别是Ethereum链,占比67.75%;Solana链,占比9.09%;Bitcoin,占比6.47%。

数据来源:CoinW研究院,defillama

数据截止至2025年10月5日

6.链上数据

Layer 1相关数据

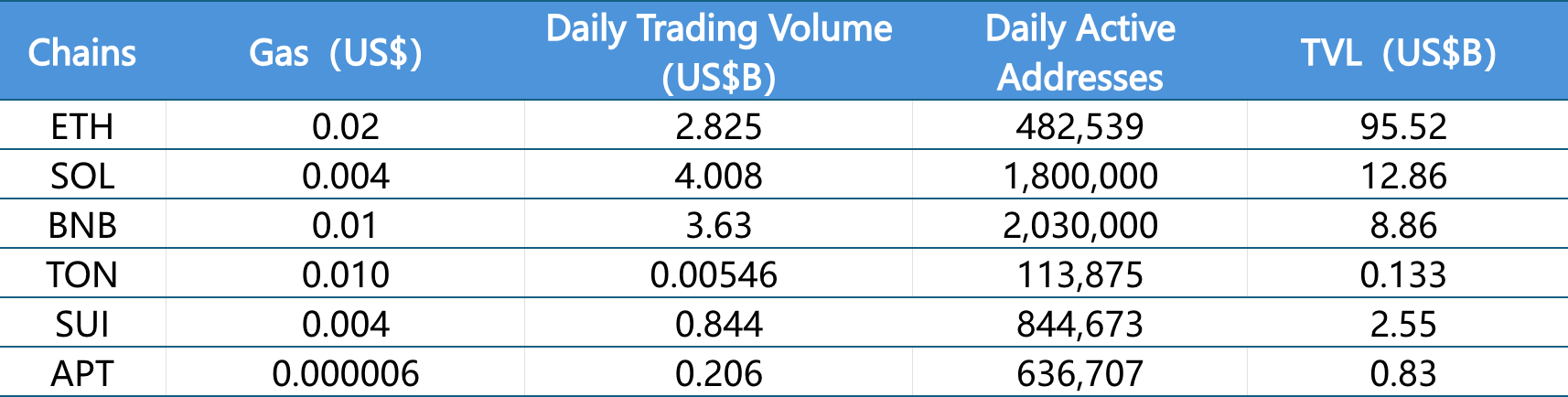

主要从日交易量、日活跃地址、交易费用分析目前主要Layer1含ETH、SOL、BNB、TON、SUI以及APTOS的相关数据。

数据来源:CoinW研究院,defillama,Nansen

数据截止至2025年10月5日

日成交量与交易费用:日成交量和交易费用是衡量公链活跃度和用户体验的核心指标。日成交量方面,本周仅Ethereum下降18.5%,其余链均上涨,分别是Solana(48.4%)、Ton(+36.5%)、BNB(+26.4%)、Sui(+87.56%)和Aptos(+58.46%)。在交易费用方面,本周Ethereum、BNB链和Ton链较上周持平;Solana上浮105%;Aptos和Sui分别上调39%和8.79%。

日活跃地址与TVL:日活跃地址反应了公链的生态参与度和用户粘性,TVL反应了用户对平台的信任程度。日活跃地址方面,本周Ethereum(+15.29%)、Solana(+7.14%)和Ton(+0.24%)有上升,其余链均下降。其中BNB和Aptos均下降18.5%左右,Sui下降10%。TVL 方面,本周Sui链上涨最对,为22.79%,其次为Solana、BNB和Aptos,分别上涨14.23%、13.39%和11.89%,Ton轻微上涨2.31%。

Layer 2相关数据

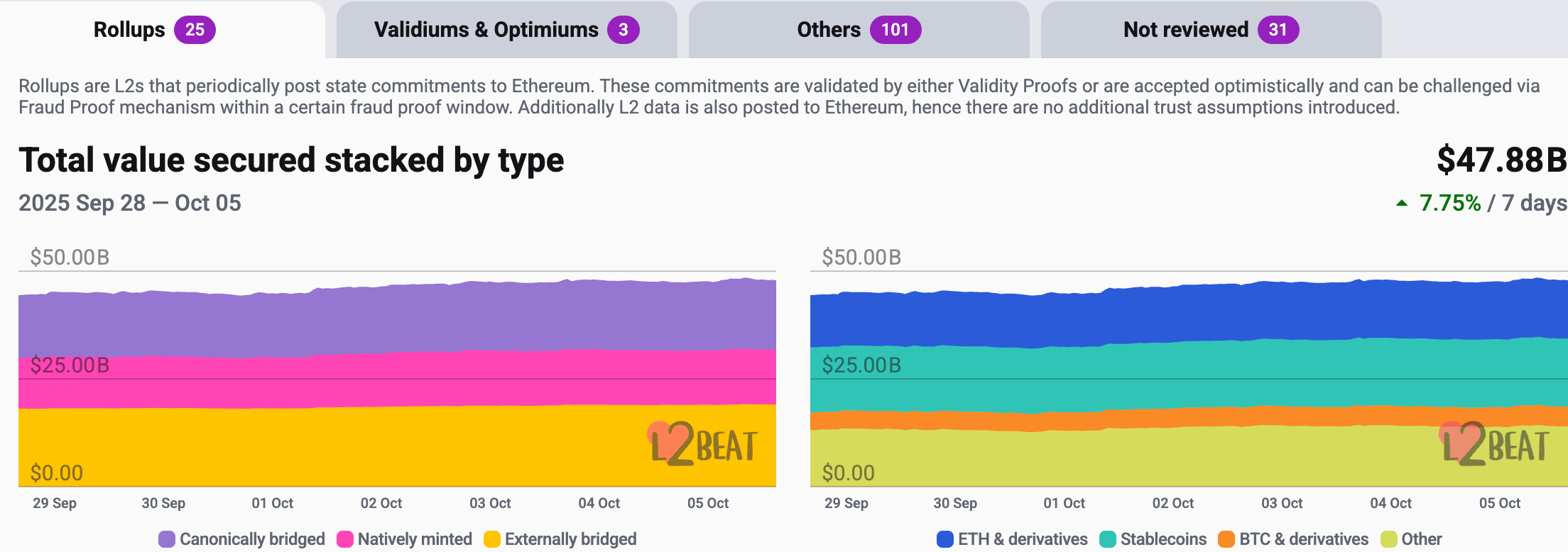

据L2Beat数据显示,以太坊 Layer 2总TVL为478.8亿美元,本周较上周($452.3亿)整体涨幅为5.8%。

数据来源:L2Beat

数据截止至2025年10月5日

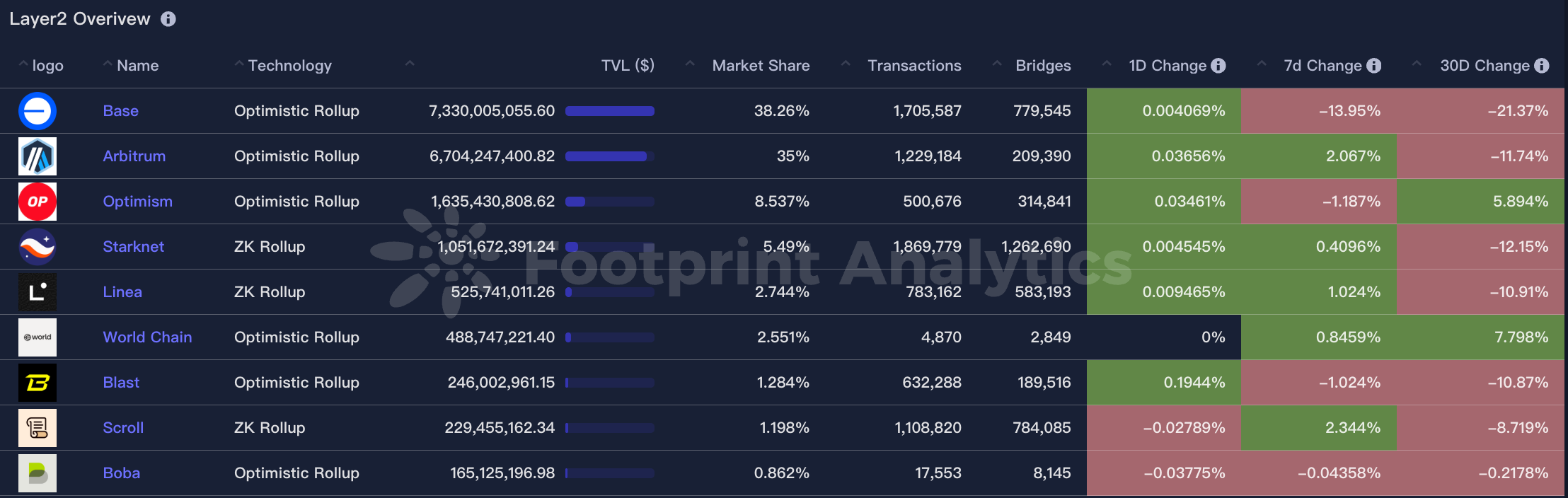

Base和 Arbitrum 分别以38.26% 和 35% 的市场份额占据前排,Base链过去一周市场份额略有下降,Arbitrum有所上升。

数据来源:footprint

数据截止至2025年10月5日

7. 稳定币市值与增发情况

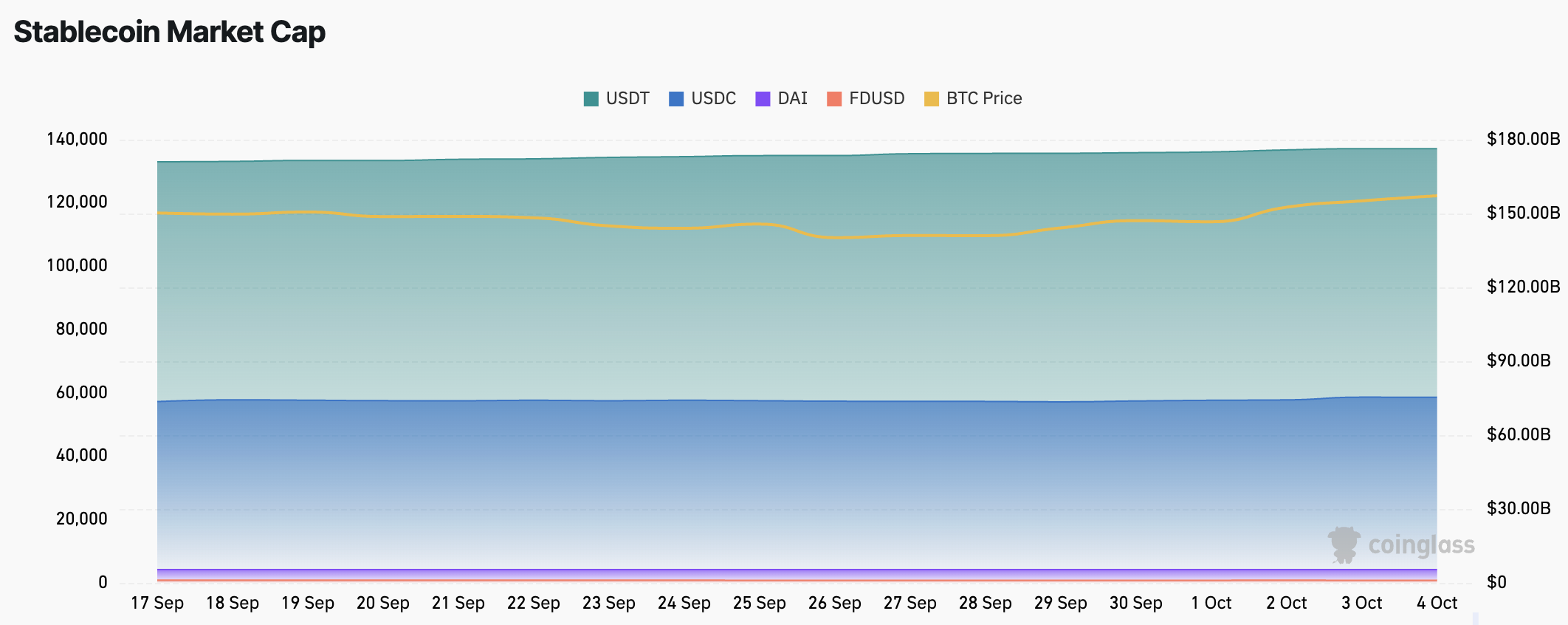

据Coinglass数据,稳定币总市值为2,987亿美元,其中USDT市值为1,763亿美元,占稳定币总市值的59%;其次是USDC市值为753亿美元,占稳定币总市值的24.6%;DAI市值为53.6亿美元,占稳定币总市值的1.79%。

数据来源:CoinW研究院,Coinglass

数据截止至2025年10月5日

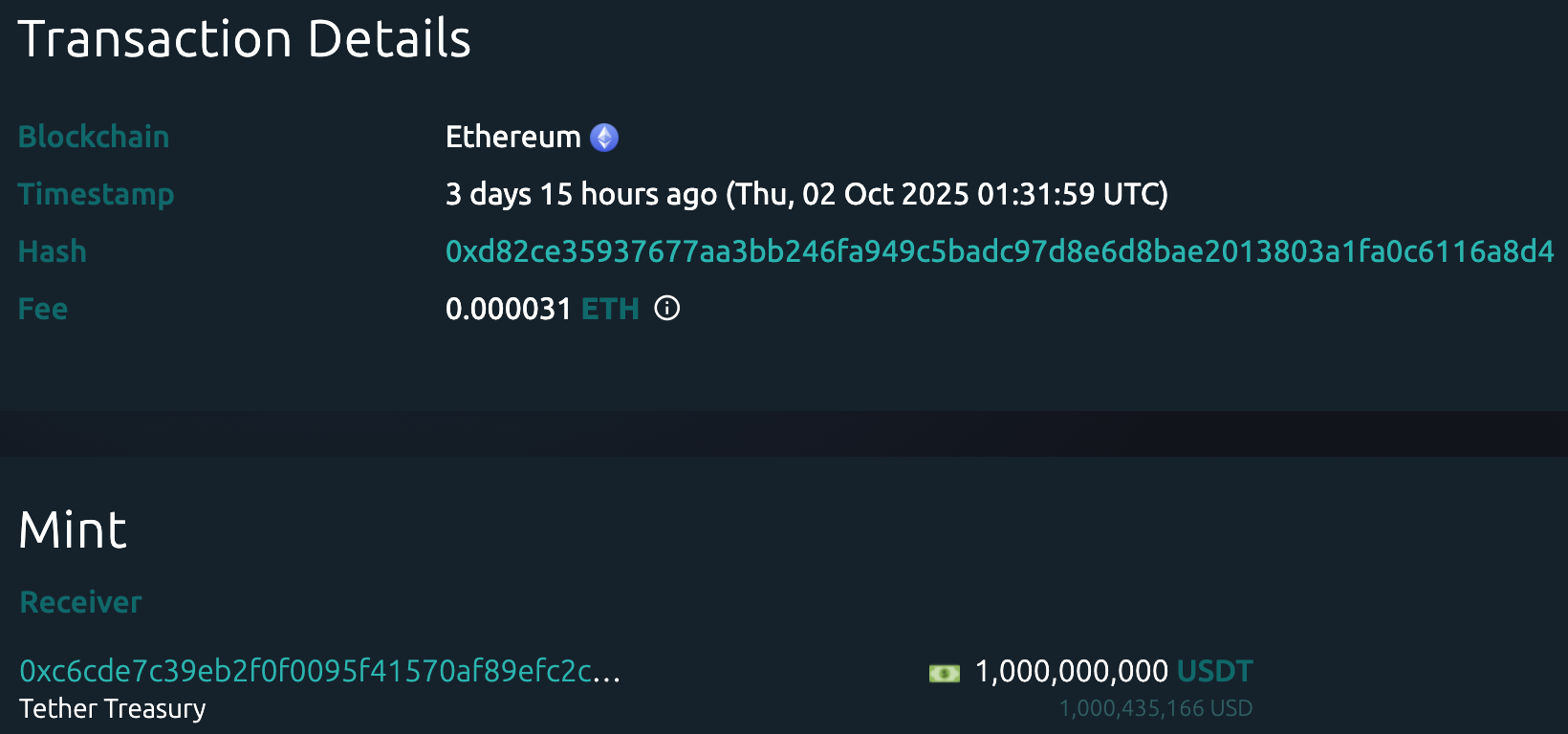

据Whale Alert数据显示,本周USDC Treasury总计增发40.4亿枚USDC,Tether Treasury本周总计增发20亿枚USDT。本周稳定币增发总量为60.4亿枚,较上周稳定币增发总量( 57.8亿枚)增加4.49%。

数据来源:Whale Alert

数据截止至2025年10月5日

二.本周热钱动向

1.本周涨幅前五的VC币和Meme币

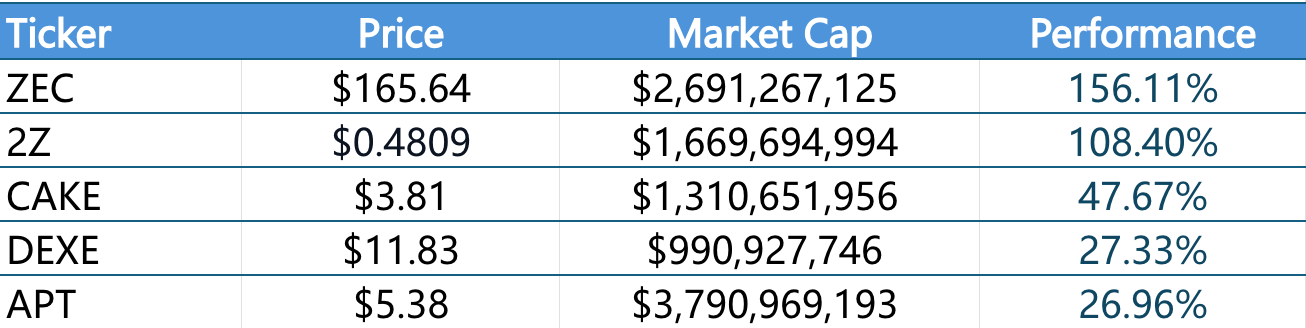

过去一周内涨幅前五的VC币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年10月5日

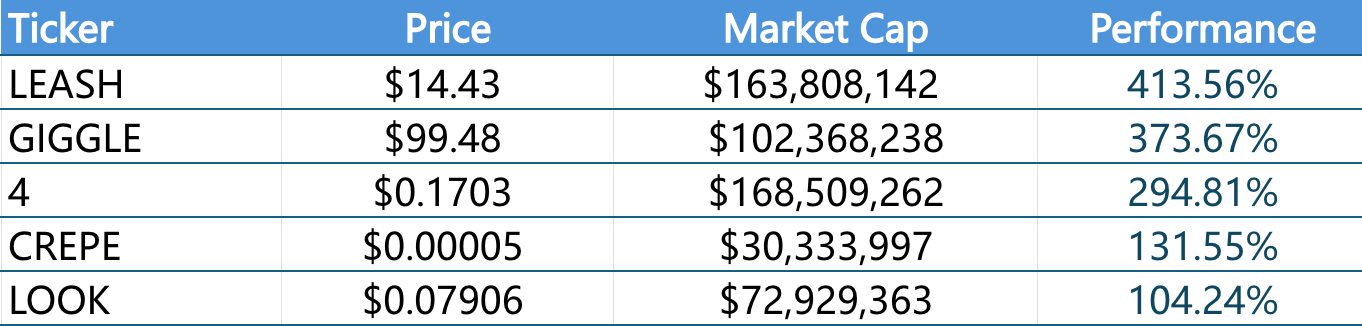

过去一周内涨幅前五的Meme币

数据来源:CoinW研究院,coinmarketcap

数据截止至2025年10月5日

2.新项目洞察

Stable 是由 Bitfinex 与 Tether 联合推出的 Layer 1 区块链,其特色在于将 USDT 设为原生 gas 代币,使点对点 USDT 转账免手续费。该链还支持在稳定币之上直接运行智能合约、为应用提供“免 gas”用户体验、本地法币通道集成、以及通过 USDT0 实现无桥接的跨链转移。它还设计了优先执行通道和合规架构,旨在为机构级稳定币使用场景(如支付、跨境结算、国库管理等)提供可预测、稳定的基础设施。

Limitless 是一个建立在 Base 链上的去中心化预测市场平台,主打分钟 / 小时级 / 日级短期价格预测。它已完成两轮融资,总融资额达约 700 万美元,包括最近一轮 400 万美元的战略融资,并推出 Points Farming 计划让用户通过交易、提供流动性、邀请等方式积累积分用于未来空投 / 代币释放。

StandX 是一个去中心化永续合约交易平台(Perps DEX),推出了可自动生息的稳定币 DUSD,用户通过 USDT/USDC 铸造后即可获得收益,并可用作合约保证金。项目已获得 Solana 基金会支持,TVL 突破 5,000 万美元,显示出较强的早期增长势头。

三.行业新动态

1.本周行业大事件

2025年9月29日,Falcon Finance(FF)完成代币生成事件(TGE)并开展多项空投与激励活动,包括向早期持币用户分发代币、推出小额空投以及设立 Launchpool 奖励池,用户可通过质押代币参与,以促进生态系统增长和提升社区活跃度 。

2025 年 9 月 29 日,Anoma 宣布其第一季度 XAN 代币空投查询功能正式上线,符合条件的用户可通过官网进行申领,申领截止时间为 10 月 5 日 09:00 UTC。此外,Anoma 还宣布第二季度空投活动即将上线,规模将更大,主要奖励在代币生成事件(TGE)后持续贡献和支持社区的成员,包括 Discord 成员、NFT 持有者和应用测试者等。

2025 年 9 月 30 日,zkVerify 正式上线主网,并启动 VFY 代币第一阶段空投申领。符合条件的 ProofPoints 贡献者可在主网上线后开始领取代币。VFY 代币总供应量为 10 亿枚,其中 37% 在上线时解锁。代币主要用于支付交易费用、质押、治理和验证者奖励等。

2025 年 9 月 30 日,OpenEden(EDEN)启动代币生成事件(TGE)和空投活动,其中 TGE 于 14:00 UTC 在以太坊和 BNB 智能链上线,首发流通量为 1.8387 亿枚,占总供应量的 18.39%;空投池规模为 1,500 万枚(占总供应量 1.5%),快照时间为 9 月 23 日 00:00 至 9 月 25 日 23:59 UTC,申领从 9 月 30 日 10:30 UTC 开始,用户可通过官方渠道查询并领取。

2.下周即将发生的大事件

Yield Basis(YB)是由 Curve 创始人 Michael Egorov 推出的去中心化金融(DeFi)协议。该项目预计将在 2025 年第四季度举行代币生成事件(TGE),项目已于 2025 年 9 月 29 日至 10 月 5 日 在 Legion 平台进行 优先认购(Merit-Based Presale),并于 2025 年 10 月 1 日至 10 月 2 日 在 Kraken Launch 平台进行 公开发售(FCFS),每枚代币价格为 0.20 美元。TGE 后,所有代币将立即解锁,无锁仓期。

Lern360.ai(LERN)计划于 2025 年 10 月 9 日至 11 日开启 IDO,目标募资规模约 55 万美元,将公开发售约 125 万枚 LERN 代币,占总供应量的不到 0.3%。项目代币总量为 10 亿枚,TGE 时释放 40%,其余部分将按月线性解锁 6 个月完成,旨在推动其 AI 与教育结合的区块链应用生态发展。

FacilPay(FACIL)是一家专注于简化数字支付与结算的 Web3 项目,代币总供应量为 5 亿枚,计划于 2025 年 10 月 15 日至 17 日开启 IDO,目标募资 40 万美元,公开发售 1,600 万枚 FACIL,占总量的 3.2%。代币分配机制为 TGE 时释放 20%,剩余部分将在 5 个月内线性解锁,以推动其去中心化支付生态的发展。

3.上周重要投融资

Flying Tulip 完成 2 亿美元种子轮融资,估值达 10 亿美元,融资采用 SAFT(未来代币简单协议)结构。资方包括 Brevan Howard Digital、CoinFund、DWF Labs、FalconX、Hypersphere、Lemniscap、Nascent、Republic Digital、Selini、Susquehanna Crypto 等知名机构,融资资金将用于平台建设、生态扩展及 FT 代币流动性保障。Flying Tulip 是由 Andre Cronje 创立的全栈 DeFi 平台,整合现货交易、永续合约、借贷、稳定币、期权和保险等功能,旨在打造一站式链上金融生态。(2025年9月29日)

比特币抵押借贷平台 Lava 宣布完成 1750万美元A轮扩展融资,投资方包括卡塔尔投资局的 Peter Jurdjevic 及 Visa、Block 前高管,继此前由 Founders Fund 和 Khosla Ventures 领投的 A 轮后再次获投。该平台专注于构建基于比特币的去中心化金融工具,通过链上可验证的抵押与自动化流程,降低托管、发放、还款及抵押管理等风险。(2025年10月1日)

Aptos生态应用 KGeN(Kratos Gaming Network) 宣布完成 1350万美元战略融资,投资方包括 Jump Crypto、Accel 和 Prosus Ventures,累计融资额达 4350万美元。KGeN 由 Kratos Studios 于2022年创立,致力于通过其多链游戏数据网络和 P.O.G.(Proof of Gamer)引擎,将新兴市场的游戏社区带入Web3。(2025年9月30日)

四.参考链接

Flyingtulip: https://flyingtulip.com/

Stable: https://www.stable.xyz/

StandX: https://standx.com/

Limitless: https://limitless.exchange/

KGeN: https://kgen.io/

Lava: https://www.lava.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。