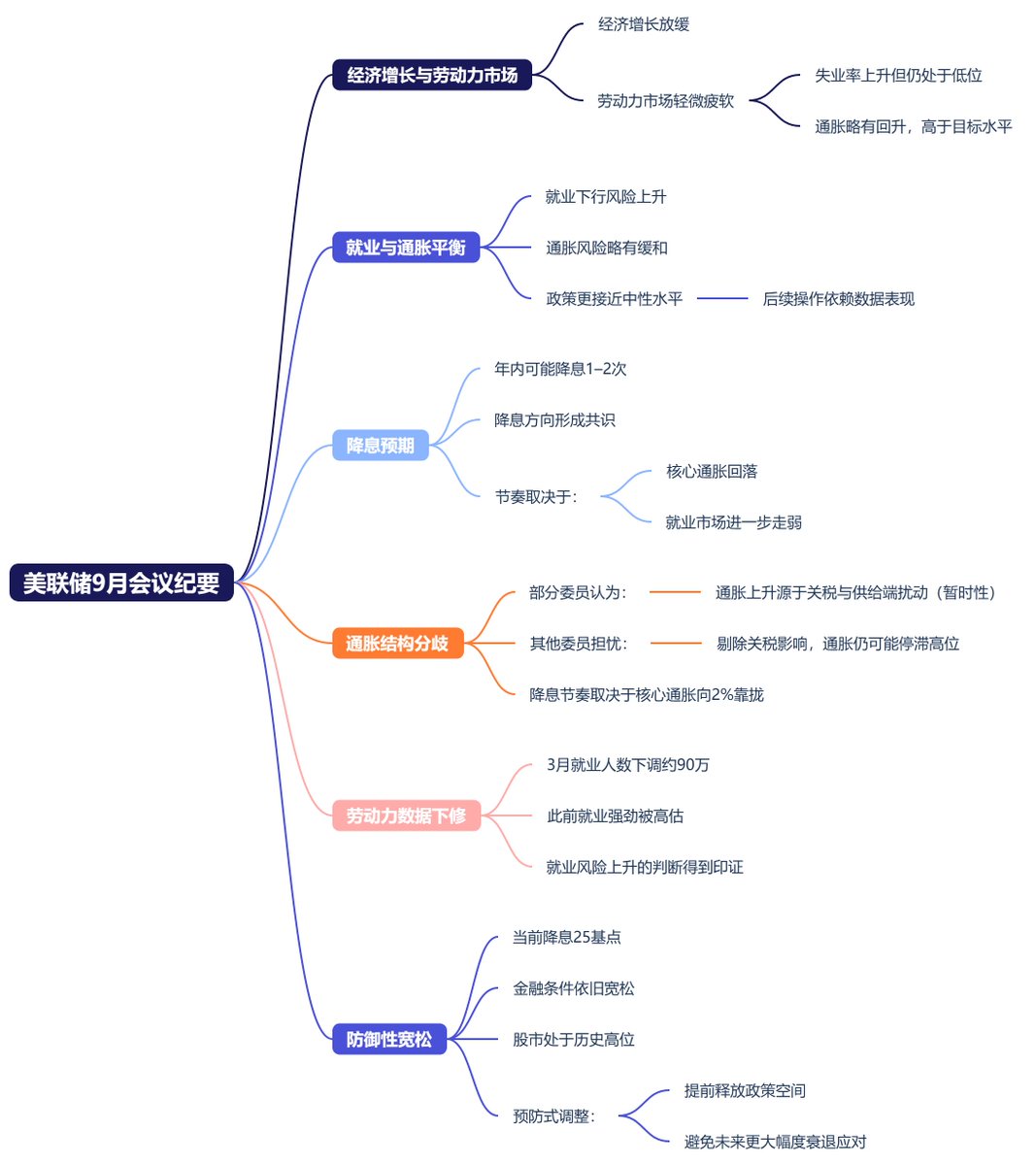

I just read the Federal Reserve's September meeting minutes, which did not contain much new information, and the overall tone was consistent with the post-meeting statement. The key points are as follows:

- Economic growth is slowing, and there are slight signs of weakness in the labor market.

The unemployment rate has risen but remains low, inflation has slightly rebounded and is still above target levels, indicating that the economy is entering a phase of moderate deceleration.

- The Federal Reserve emphasizes the balance between employment and inflation.

Downside risks to employment have increased, while inflation risks have eased slightly. Most committee members believe that current policy is closer to a neutral level, and future actions will rely more on data performance.

- Almost all committee members believe that there may still be 1-2 rate cuts within the year.

There is a consensus on the direction of rate cuts, but the pace will still depend on whether core inflation can continue to decline and whether the labor market weakens further.

- There are differing views among committee members regarding the structure of inflation.

Some believe that the rise in inflation is mainly due to tariffs and supply-side disruptions, which are temporary factors, while others are concerned that even excluding the impact of tariffs, inflation remains stagnant at high levels. This means that the future pace of rate cuts will still depend on whether core inflation can stabilize and approach 2%.

- The downward revision of labor data strengthens the case for easing.

The employment numbers for March were revised down by about 900,000, indicating that the previous strength in employment was overestimated. This also confirms the judgment of rising employment risks.

- Current rate cuts are more defensive in nature.

Despite a 25 basis point cut, financial conditions remain loose, and the stock market is at historical highs, indicating that the market is not in panic. The tone of the minutes is more like a preventive adjustment, aimed at releasing policy space in advance to avoid larger-scale responses to future recessions.

Overall, it is confirmed that the Federal Reserve has entered a phase of defensive easing. In simple terms, the current rate cuts are still defensive, which is favorable for the market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。