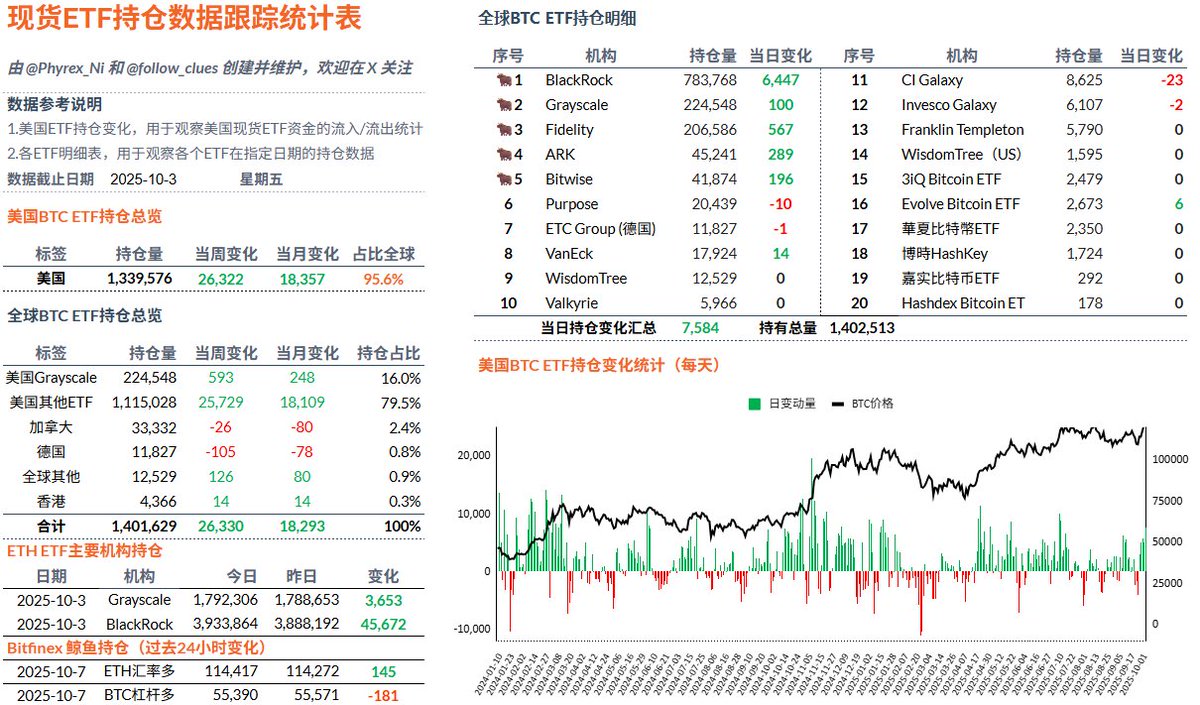

Not bad, indeed not bad. I think everyone has guessed it; the price increase of $BTC on Friday inevitably brought a lot of buying power. It is indeed the case. The net inflow of the spot ETF on Friday was the largest single-day net inflow since July 11, with over 80% of the inflow coming from BlackRock. This is very similar to the first few days of last week, where BTC rose, and only BlackRock's investors bought in large quantities, while other investors, including those from Fidelity, had very limited purchases.

The data for Bitcoin in week 90 also looks good, with a net inflow of over 26,000 BTC in one week, while in week 89, this figure was a net outflow of over 8,000 BTC. Next, we will see how long this FOMO sentiment lasts, with the main reason likely being the increased expectations for interest rate cuts triggered by the standstill.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。