虽然很多小伙伴认为今天的作业好写,涨就完了,但我还是觉得今天作业不好写,主要是因为凌晨一点的时候美股出现的下跌,下跌的时间是美国白宫发言人的讲话,主要的内容还是停摆,虽然市场预测了停摆的时间可能会很长,市场预测了停摆可能会带来美联储降息的预期,但市场也担心停摆的时间过长对于市场的负面影响。

当然,我的推测未必是对的,等周一或者周二就应该大概知道了,因为最新的信息表明参议院休会至周一美东时间下午3点也就是北京时间周二的凌晨3点,几乎就是美股闭盘的时候,新一周的停摆是否会对市场造成负面影响,我估计应该会有说法了。毕竟2018年到2019年也是川普时期的停摆,在35天内对美国造成了110亿美元的损失。

明天就是周末了,我的第一反应是问题不会很大,但如果真的出现下跌明显的情况我会将剩余 20% 的合约仓位平掉,现货继续保持不动,大方向上我仍然觉得还没有到主要博弈的时候,但短期主要是看市场对于停摆的反应会不会升级。

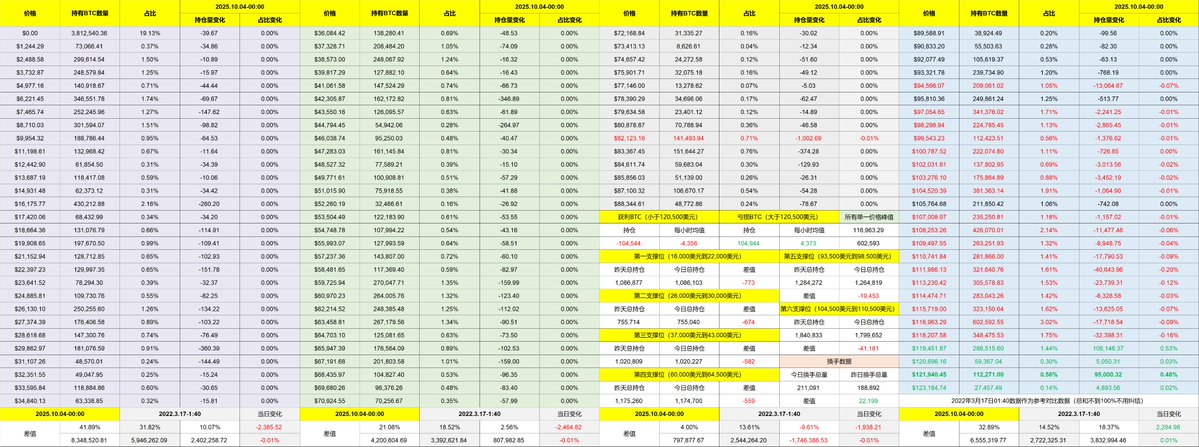

回到 Bitcoin 的数据来看,换手率还是继续增加,虽然还是短期投资者为主,但是换手率这么上升的话,不知道购买力能不能完全接的住,今天的换手率已经是近期最高的一次了,能明显感觉到随着距离新高的临近短期投资者的恐高情绪开始出现了。

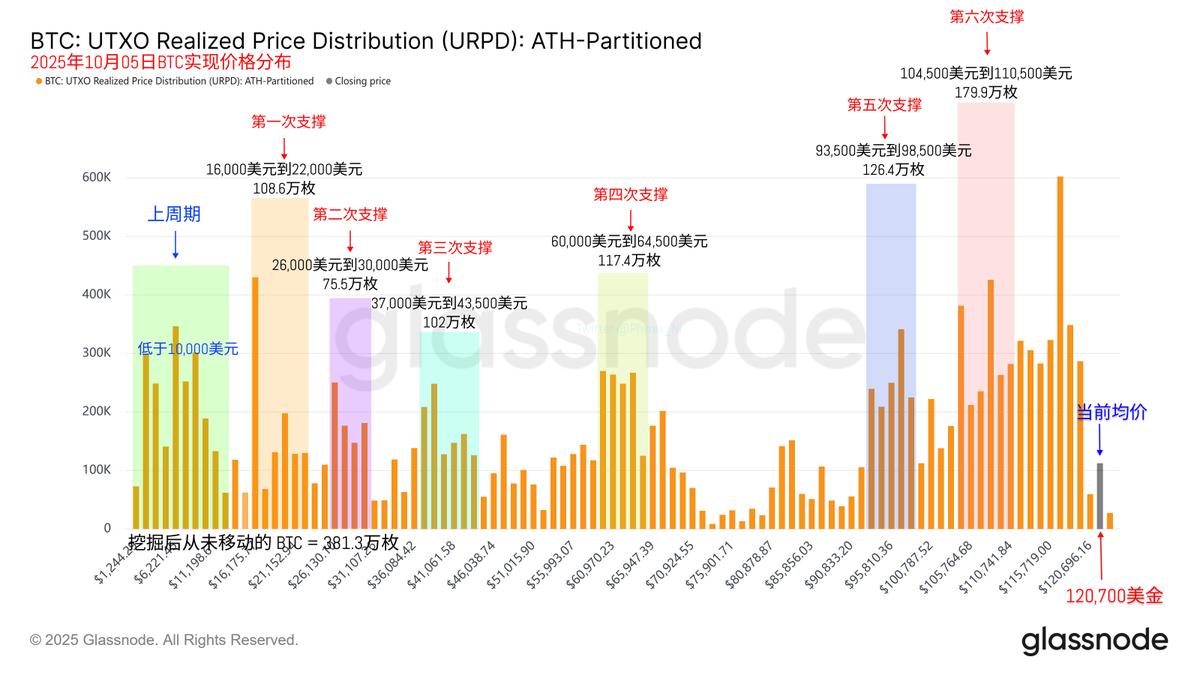

而且从 URPD 的数据来看,120,000 美元之前还算是分布均匀,稳定性也还可以,但当 $BTC 超过 120,000 美元以后,筹码出现了断崖式的分层,也代表了投资者对于高于 120,000 美元的价格还是有些犹豫的。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。