撰文:Thejaswini M A

编译:Block unicorn

前言

桑迪普·奈尔瓦尔(Sandeep Nailwal)的父亲常常几天不回家。

等他回来的时候,每月 80 美元的工资就没了,挥霍在酒精和赌博债务上。

这家人住在德里亚穆纳河沿岸的定居点,当地人轻蔑地称该地区为「Jamna-Paar」,大致意思是「河对岸」。但这并不是一种赞美。

小时候的桑迪普总是站在教室外面,因为父母没交学费,进不去教室。他十岁那年,弟弟遭遇了一场严重的事故,他的童年就此结束。父亲的毒瘾意味着必须有人站出来。这个人就是桑迪普。

如今,奈尔瓦尔运营着 Polygon,一家每天处理数百万交易的区块链基础设施公司,与摩根大通、Stripe 和迪士尼等公司合作。从德里贫民窟到打造被财富 500 强企业使用的技术,这段旅程仅用了三十年。

但这条路并非一帆风顺,早年经历的伤痕影响了他所做的每一个决定。

桑迪普·奈尔瓦尔(Sandeep Nailwal)于 1987 年出生在喜马拉雅山脚下的拉姆纳加尔(Ramnagar),一个没有电的农村村庄。他的父母结婚时都是文盲,在他四岁时,他们搬到了德里,寻找村里没有的机会。

结果,他们发现的却是贫民窟。

亚穆纳河东岸的定居点拥挤、肮脏、且暴力频发。非法枪支和刀具是解决纠纷的首选工具。他的家人挤进他们能负担的任何住所,随着情况的变化而不断搬家。

他的父母不懂教育。他们不知道孩子三四岁就可以上学。桑迪普直到五岁才开始上学,仅仅是因为没人告诉他父母。这么晚才开始上学意味着他总是班里年纪最大的孩子,比班里的孩子大两岁,这时刻提醒着他落后了。

贫困带来的创伤不仅仅是没饭吃或衣衫褴褛的羞耻。它还包括看着父亲输光学费,而你站在教室外面的羞耻感。它还包括看着母亲一边努力维持一家人的温饱,一边与酗酒的丈夫斗争。

是在幼小的年纪就明白,没有人会来拯救你。

六年级的创业者

桑迪普应对贫困的方式是工作。六年级时,他开始辅导低年级学生,每月赚 300 卢比。他还找到了一位开文具店的朋友,开始以成本价收购钢笔,然后加价卖给同学。

虽然金额不大,但他学到的教训却很重要:你可以创造价值,获取其中的一部分,并用这些钱来改变你的处境。

他梦想着考入印度理工学院(IIT),这所享有盛誉的工程学院为有志向的学生提供了摆脱贫困的途径。但印度理工学院需要昂贵的辅导费用,才能与上百万申请者竞争 5000 个名额。他的家庭负担不起。

于是,奈尔瓦尔进入了二流的玛哈拉贾·阿格拉森技术学院,靠学生贷款支付学费。有时,他不得不用贷款还清父亲的赌债,而不是买教材或电脑。

学习计算机科学的决定源于在印度电视上看到马克·扎克伯格。当时,Facebook 正在全球范围内热销,年轻的桑迪普心想:「我想创建自己的 Facebook。」

他现在承认自己当时很天真。但天真与绝望的结合,却造就了一种特殊的决心。

获得工程学位后,奈尔瓦尔在孟买国家工业工程学院攻读 MBA 学位。在那里,他遇到了哈尔希塔·辛格,后来成为他的妻子。毕业后,他在德勤担任顾问,很快就偿还了自己的学生贷款和父亲的债务。

奈尔瓦尔在多家公司担任过职务:在计算机科学公司做软件开发者,在德勤做顾问,在 Welspun 集团的电子商务部门担任首席技术官。他工作出色,得到晋升,收入可观。

但他始终无法摆脱创业的冲动。

在印度文化中,结婚前买房是种压力。没有房产的男人没有前途。奈尔瓦尔深感这种压力。他有份好工作,可以贷款买房,可以安定下来。

哈希塔对他说了一句话,改变了一切:「你这样永远不会快乐。我不在乎自己的房子,我们可以租房住。」

2016 年初,纳伊尔瓦尔辞去了工作。他借了 1.5 万美元(这笔钱他原本计划将来用来办婚礼),创办了 Scope Weaver,一个提供专业服务的在线平台。他的想法是规范印度碎片化的服务业,打造一个类似阿里巴巴的平台,但服务对象是印度服务提供商,而不是中国制造商。

公司经营得还不错,也产生了一些收入。但奈尔瓦尔意识到自己正在成为瓶颈。客户想要的是一张脸,出问题时有人可以负责。他正在变成一个普通的服务提供商,只不过现在他得付员工的工资。

这门生意无法规模化。一年后,他开始寻找下一个机会。

800 美元的比特币赌注

奈尔瓦尔第一次听说比特币是在 2010 年。一位朋友建议一起挖矿,但奈尔瓦尔没有笔记本电脑,话题就此打住。

2013 年,他在攻读 MBA 时再次接触到比特币。他尝试设置一个矿机,但他的笔记本性能太差。他试着了解比特币,读了两段后看到「没有任何背书」,便认为这是个骗局,选择了放弃。

2016 年,比特币再次进入他的视野。奈尔瓦尔在意识到 Scope Weaver 无法成为他设想的企业后,开始探索「深度科技」的机会。他考虑过人工智能,但发现数学超出了他的能力范围。

然后,他真正读了比特币的白皮书。

「哦,这太重要了,」他想,「这是人类的下一场革命。」

无论是信念还是鲁莽,这取决于你的观点,奈尔瓦尔拿出他为婚礼借的1.5 万美元,并将其全部投入比特币,每枚比特币的价格为 800 美元。

他坦言:「我当时的 FOMO(害怕错过)情绪非常强烈,即使晚一年,我也会在 2 万美元时做出同样的事,而且会把所有的钱都赔光。」

但他没有亏。比特币价格上涨。更重要的是,奈尔瓦尔发现了以太坊及其可编程智能合约。这是一个无需中心化控制就能运行应用的新计算平台。

他彻底着迷了。

2017 年,奈尔瓦尔通过在线以太坊社区认识了詹蒂·卡纳尼。卡纳尼提出解决以太坊的扩容问题。当时,以太坊网络正因自身的成功而陷入网络拥堵。加密猫(CryptoKitties)导致交易费用飙升 600%。

卡纳尼和奈尔瓦尔与联合创始人安努拉格·阿尔琼和米哈伊洛·比耶利奇,于 2018 年初开始开发 Matic Network。他们筹集了 3 万美元的种子资金,计划先打造一个可运行的产品,再通过 ICO 融资。

这种原则性方法差点让他们失败。等到他们有了可用的测试网,加密市场已经崩盘。没人愿意投资,尤其是印度项目。当时有两个印度加密项目被曝是骗局。

「没人相信印度创始人能开发出协议,」奈尔瓦尔回忆道。

团队在头两年仅靠 16.5 万美元维持运营。创始人每月只拿几千美元的薪水。有好几次,他们的资金只够支撑三个月。奈尔瓦尔记得自己曾向其他加密货币创始人乞求 5 万美元,只为再坚持一个季度。

2018 年,在他结婚前夕,他的人生跌入谷底。一家中国基金承诺投资 50 万美元。婚礼前两天,比特币从 6000 美元跌至 3000 美元。这家中国基金打来电话说:「我们本来打算投资 100 个比特币。现在它贬值了一半,所以我们不投资了。」更糟糕的是,Matic 的资金全部是比特币。价值同样腰斩。

他的婚礼照常举行。朋友们也为他庆祝。但奈尔瓦尔知道,三个月后他们可能就没公司了。

2019 年初,币安批准 Matic 通过其 Launchpad 项目融资 560 万美元。尽职调查耗时八个月。这笔融资也给了 Matic 喘息的机会。但最终批准仍未实现。团队参加了无数次黑客马拉松,挨个拜访开发者,讲解他们的技术。

起初增长缓慢,但在 2021 年,由于以太坊的高昂手续费导致网络几乎无法进行小额交易,增长开始加速。开发者们纷纷迁移到 Matic。

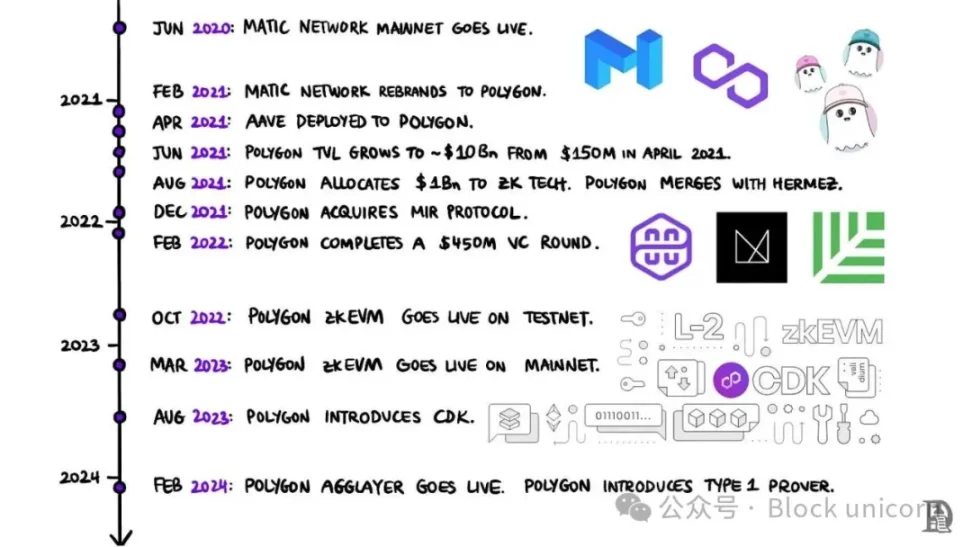

它最初以 Matic Network 的名称推出,是一个以侧链形式运行的单链扩容解决方案,并结合了 Plasma 和权益证明 (PoS) 机制。2021 年,Matic Network 进行了重大品牌重塑,更名为 Polygon,这体现了其从单链向更广泛的多链生态系统的转变,旨在为兼容以太坊的区块链提供多样化的扩容解决方案。

市场对此次品牌重塑做出了积极回应。Polygon 的市值从 2021 年初的 8700 万美元飙升至 12 月的近 190 亿美元。

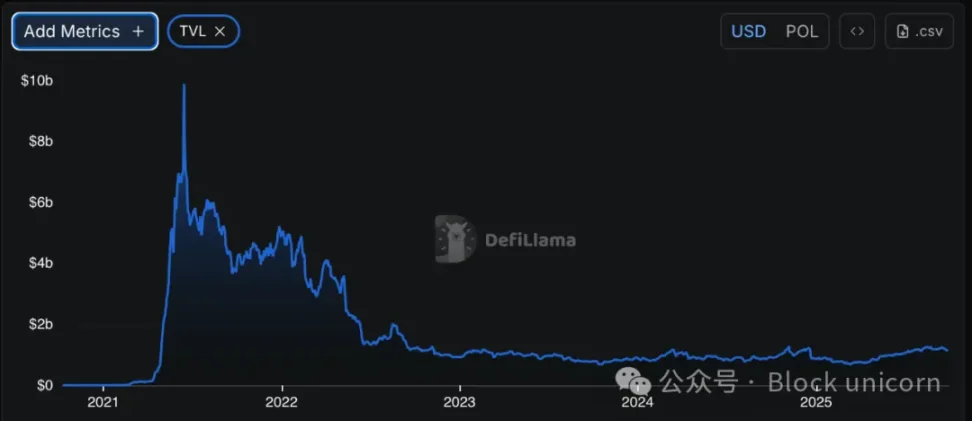

开发者纷纷涌向 Matic,网络锁定的总价值在峰值时攀升至 100 亿美元。

除此之外,原生代币也从 $MATIC(用于保障原 Polygon PoS 链的安全)过渡到 $POL(旨在支持整个 Polygon 生态系统),尤其是在即将推出的升级版本(例如 Staking Hub)下,旨在巩固和增强跨链的安全性和治理。此次代币迁移至关重要,尽管在过渡期间,它给持有者带来了一些暂时的不确定性,并导致了流动性的分散。

Polygon Labs 还大胆地将战略重心转向零知识 (ZK) Rollup,并收购了专注于 ZK 的团队来开发 zkEVM,该虚拟机能够实现与以太坊相当的执行力,同时兼具 ZK 证明的可扩展性优势。虽然乐观 Rollup (OR) 最初因其更简单的设计和更早的发布而备受关注,但 Polygon 对 ZK Rollup 的重视体现了其对以太坊终极 Layer-2 扩展解决方案的长期押注。zkEVM 技术旨在将高安全性、可扩展性以及与以太坊现有工具的完全兼容性相结合,从而有可能使 Polygon 在未来的多链架构中占据领先地位。

新冠疫情的转折点

2021 年 4 月,新冠疫情第二波重创印度。医院人满为患,氧气供应短缺。奈尔瓦尔的家人在印度全部感染了新冠,而他远在迪拜,无能为力。

「当时很明显,我们的家人不可能 100% 都挺过来,」他说,「不是每个人都能活下来。」

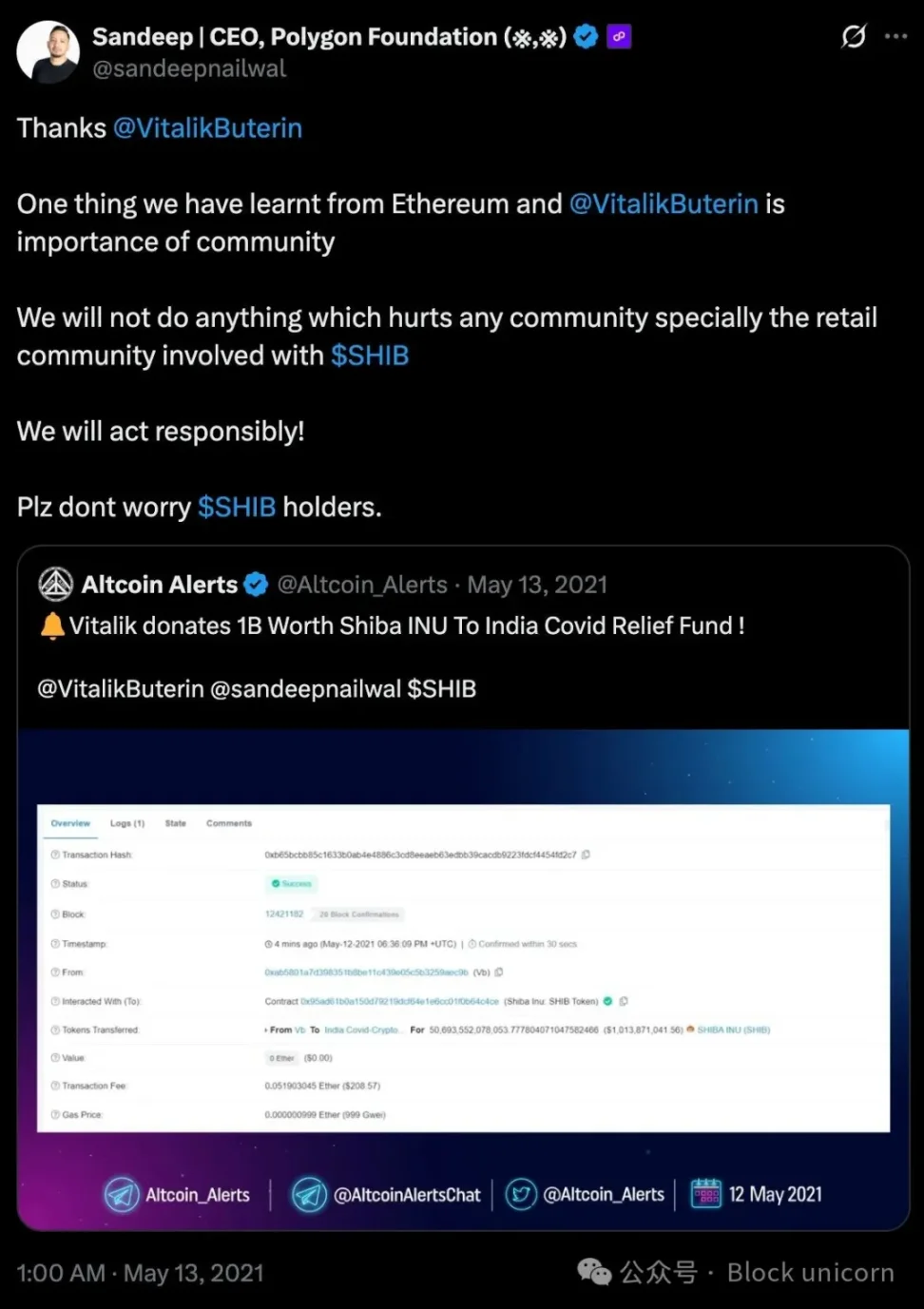

他在推特上表示无法对这场危机坐视不管。他创建了一个加密多重签名钱包用于接收捐款,预期总计可能募集 500 万美元。几天内,捐款就达到了 1000 万美元。随后,以太坊创始人维塔利克·布特林捐出了价值 10 亿美元的柴犬币。

实际的挑战是:如何在不导致市场崩盘的情况下清算价值 10 亿美元的模因币呢?

奈尔瓦尔与做市商合作,历时数月缓慢出售。柴犬币社区最初因担心大规模抛售而恐慌,但在奈尔瓦尔承诺谨慎执行后平静下来。最终,他净赚了 4.74 亿美元,远超布特林的预期。

加密新冠救援基金在紧急情况下向印度部署了 7400 万美元。奈尔瓦尔将 2 亿美元返还给布特林,后者将其捐给了美国生物医学研究。其余 2 亿美元则留给「区块链影响力」的长期项目。

在逆境中塑造品格

到 2025 年中,Polygon 面临新的挑战。$POL 价格从高点下跌超 80%。来自 Arbitrum 和 Optimism 的竞争性第二层解决方案正在抢占市场份额。公司在繁荣时期扩张到 600 名员工,导致文化问题和组织臃肿。

奈尔瓦尔做出了艰难决定。两轮裁员将团队精简到更具凝聚力的规模。多个耗费数月工程时间的项目因不再符合战略而被取消。

2025 年 6 月,奈尔瓦尔成为 Polygon 基金会的首任 CEO,整合了此前分散在联合创始人与董事会成员之间的领导权。四位联合创始人中有三位已退出活跃角色,他是最后一个留下的。

「当关键时刻到来时,大多数创始人无法做出艰难决定,」他在一次采访中说,「以艰难的方式执行市场策略,解雇不适合当前战略的人,放弃投入了大量时间和情感资源的项目。」

当你削减你个人支持的项目或解雇那些在困难时期相信你的愿景的人时,这些决定的感觉会有所不同。

在奈尔瓦尔的全权领导下,Polygon 重新聚焦于 AggLayer ,这是一种旨在统一区块链网络的互操作性协议。其技术愿景是创建基础设施,让数千条独立的区块链在终端用户看来如同一个单一、无缝的网络。

「到 2030 年,可能会有 10 万到 100 万条链,」奈尔瓦尔预测,「所有活动都将转移到这些应用链上。」

这是一个大胆的主张。能否实现取决于未来几年的执行。

长期博弈

奈尔瓦尔以十年为单位思考,而非季度。在讨论 Polygon 的竞争或 DePIN 的未来时,他不断提到 10 年和 50 年的时间线。

「如果你给我 10 年时间,我可以 100% 地告诉你,这就是加密货币走向大众市场的终极架构,」他谈到 AggLayer 时说道。「但无论是 Polygon 的版本,还是其他人加入进来构建类似的东西,都无人能预测。」

他对区块链基础设施的愿景深信不疑。无论是由 Polygon 实现,还是由其他人实现,都远不如看到它建成重要。

通过「区块链影响力」项目,他正从紧急救援转向「激励型」慈善事业。他正在筹划类似印度诺贝尔奖的奖项,以激励下一代科学家和工程师。

「我希望从这家 2 亿美元的 BFI 获得 2 万亿美元的产出,」他解释道,他所描述的杠杆率听起来很荒谬,直到你记起他将 3 万美元的种子资金变成了一家市值短暂达到 300 亿美元的公司。

然而,Polygon 面临着逆风。Arbitrum 和 Base 等竞争对手已经占据了更多的市场份额,提供了更简单的用户体验和更强大的支持。Polygon 的桥梁技术仍然很复杂,从 MATIC 到 POL 的转变也带来了不确定性。该公司以开发者为中心的宣传尚未像竞争对手那样转化为大规模零售应用。奈尔瓦尔的长期基础设施投资能否获得回报,取决于在日益拥挤的市场中的执行力。

已经确定的是,桑迪普·奈尔瓦尔从起点走过的路程,超出了大多数人的想象。但所构建的基础设施能否像加密货币帮助他那样,帮助他人,还有待观察。

从一个没有电的村庄到构建价值互联网,目的地尚不确定,旅程仍在继续。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。