今晚 @ZKVProtocol 主网上线 + TGE,币安(alpha)、KuCoin、Gate 等大所同步开启交易。

我花了不少时间研究这个项目,分享一些观察。

1/ zkVerify 的出现是历史必然?

ZK 证明验证的成本问题已经成为整个行业的致命瓶颈。在以太坊上验证一个 ZK 证明的成本高达几十美元,这种高成本背后隐藏着一个结构性问题——通用区块链根本不是为 ZK 验证而设计的。

zkVerify 的解决方案是根本性的重新设计:专用验证链 + Rust 原生验证器。通过专用设计,验证成本降低 90%+,验证速度达到毫秒级。

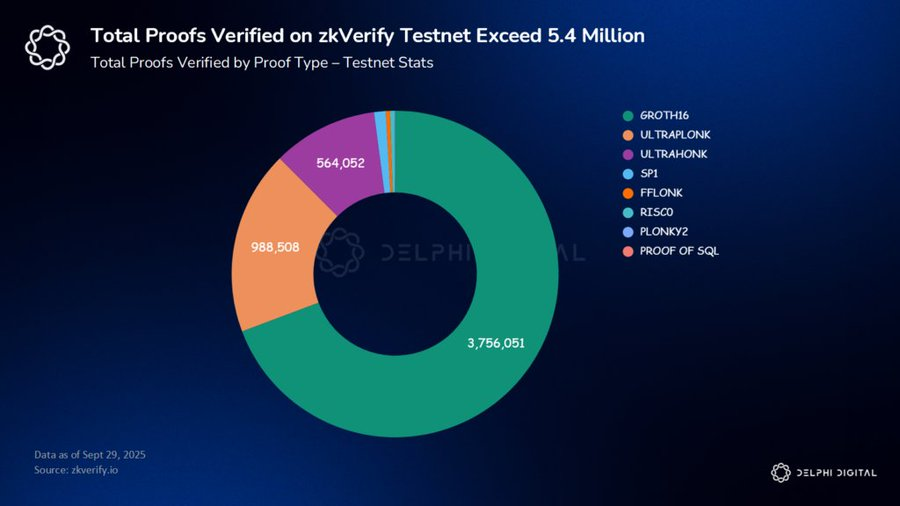

更关键的是技术中立性。zkVerify 支持整个 ZK 技术栈:STARKs、Plonky2、RiscZero、SP1、UltraHonk、Groth16、Fflonk。这种全栈兼容性在快速演进的 ZK 领域极其重要——你不需要押注特定技术路线,所有主流 ZK 方案都能无缝接入。

2/ 代币经济学的设计

$VFY 的供应结构展现了项目方的长期思维:总量 10 亿,初始流通 3.07 亿(30.66%),年通胀仅 2.5%。

释放机制:

团队和投资者 TGE 解锁 0%,锁定 12 个月

社区获得 37.31% 分配,29% 在 TGE 释放

基金会持有 33.06%,60% 在 TGE 释放用于生态建设

这种设计几乎消除了早期抛压风险,同时确保有足够资金推动生态发展。从 Horizen Labs 的 1100 万美元融资背景看,项目有充足的发展资源。

3/ 竞争格局分析

zkVerify 面临的不是传统意义上的竞争,而是一个全新赛道的开创。目前市场上虽然有其他 ZK 基础设施项目,但大多聚焦在特定环节——要么做证明生成,要么做特定类型的验证。

zkVerify 的差异化在于“通用验证层”的定位。它解决的是一个被忽视但日益严重的痛点:ZK 技术已经成熟,但验证基础设施仍然原始。就像早期互联网有了 TCP/IP 协议,但缺乏 CDN 一样。

从时机看,这个定位很精准。ZK Rollups 爆发式增长,zkApps 开始落地,ZK 身份、ZK 投票等应用场景不断涌现。所有这些都需要高效、低成本的验证基础设施。

同时,风险与机遇并存。

最大的风险 来自技术路线的不确定性。如果 ZK 技术发展方向出现重大变化,专用验证链的价值可能受到冲击。

另一个挑战 是生态建设。技术再好,没有应用使用也难以实现价值。zkVerify 需要持续投入资源吸引开发者和项目方,这是一个长期过程。

从投资角度看,zkVerify 的价值逻辑非常清晰:降低 ZK 验证成本 → 释放 ZK 应用需求 → 增加网络使用 → 推动 $VFY 价值增长。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。