原创 | Odaily 星球日报(@OdailyChina)

作者|Azuma(@azuma_eth)

继 Plasma、Falcon 在短时间内接连 TGE,并分别以上百亿美元、数十亿美元的 FDV 再创造富神话之后,资金已开始寻找下一个潜在的高收益“神矿”,而凭借着“AI + 稳定币”、“YZi Labs 投资”、“Plasma 合作伙伴”、“5 亿额度一坑难求”等亮眼标签,USD.AI 已成为了诸多用户心中的头号备选。

AI 与稳定币的结合

USD.AI 的定位为合成型美元稳定币协议,旨在为人工智能和其他新兴领域的物理基础设施提供资金。

8 月 14 日,USD.AI 曾宣布完成 1300 万美元 A 轮融资,Framework Ventures 领投,Bullish、Dragonfly、Arbitrum 等参投;之后在 8 月 26 日,YZi Labs 又宣布投资 USD.AI ,具体金额暂未披露;之后在 8 月 28 日,USD.AI 宣布与 Plasma 达成合作,将成为 Plasma 主网上线首日的初始部署之一。

在 USD.AI 看来,当前新兴人工智能行业的主要渠道仍以传统金融收益型产品为主,例如贷款、债券和可转换优先股,但这一融资形式与市场需求之间却存在着明显缺口,因此该协议希望构建一个围绕 AI 周期量身定制的金融层来弥合这一需求差。

具体而言,USD.AI 允许具有融资需求的对象以硬件本身作为贷款抵押物,并将相关风险重组为标准化的可投资标的,并从中赚取收益 —— 简单来说,就是会接受 AI 公司以图形处理器 (GPU) 硬件作为抵押品,并向其发放贷款,再将贷款收益发给存款质押用户。

USD.AI 协议的运转依赖于三种角色 —— 一是存款人(Depositors),用户可通过存款获取稳定币 USDai,继而质押成 sUSDai 以赚取协议收益;二是借款人(Borrowers),通常是无法通过传统融资渠道满足其贷款需求的中小型 AI 公司;三则是策展人(Curators),这个角色相对特殊,其主要负责提供首损资本,赚取相应溢价,并通过代币化方式实现资本与运营主体的风险隔离。

如上文所述,USD.AI 当前提供有两种形式的稳定币产品,一是锚定美元的全额抵押稳定币 USDai(实际上现在有溢价),该稳定币支持随时赎回;二是可分享协议收益的质押版本稳定币 sUSDai(当前质押收益率 13.22%),sUSDai 的价格会随着收益的积累逐步提高,且解除质押有着 30 天的时间限制。

积分计划 —— IC0、空投二选一

USD.AI 在上线之初便以推出了积分(Allo™)计划,且明确了积分会对应未来的 IC0(FDV 估值 3 亿美元)或空投权益,其潜在的价值预期也是当下该协议吸引用户的主要原因所在。

不过需要明确的是,USD.AI 的积分所对应的权益只能在 IC0 或空投之间二选一 ——如果你选择利用 USDai 获取积分,对应的是 IC 0 权益(总计分配 70% 代币),需要 KYC 并出资认购;如果你选择利用 sUSDai 获取积分,对应的是空投权益(总计分配 30% 代币) ,无需 KYC 也无需额度出资。

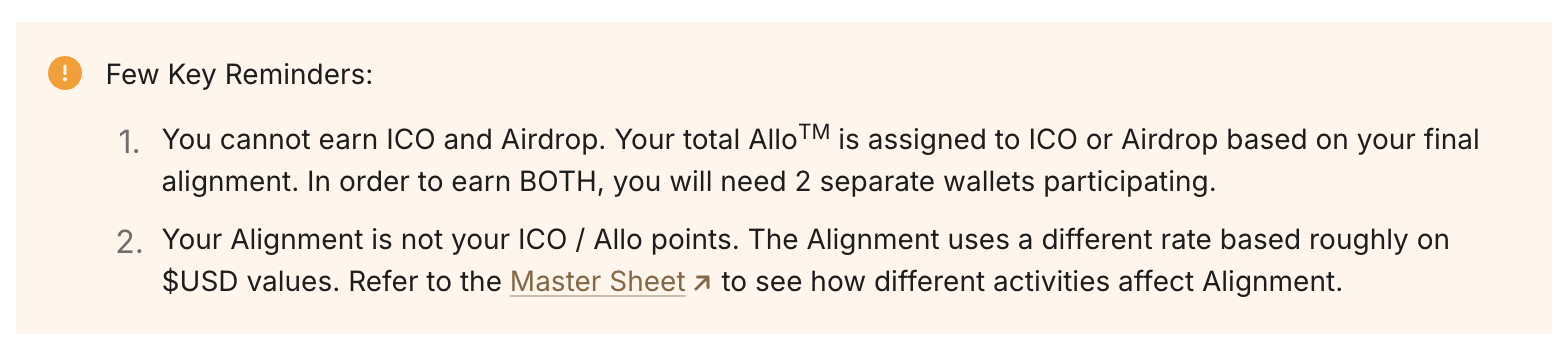

USD.AI 方面已明确表示,单一地址无法同时获得 IC0 和空投份额,用户的总分配额度将根据最终的积分贡献值,被划定到 IC0 或空投其中一项。如果想两者兼得,必须使用两个独立的钱包来参与积分活动。

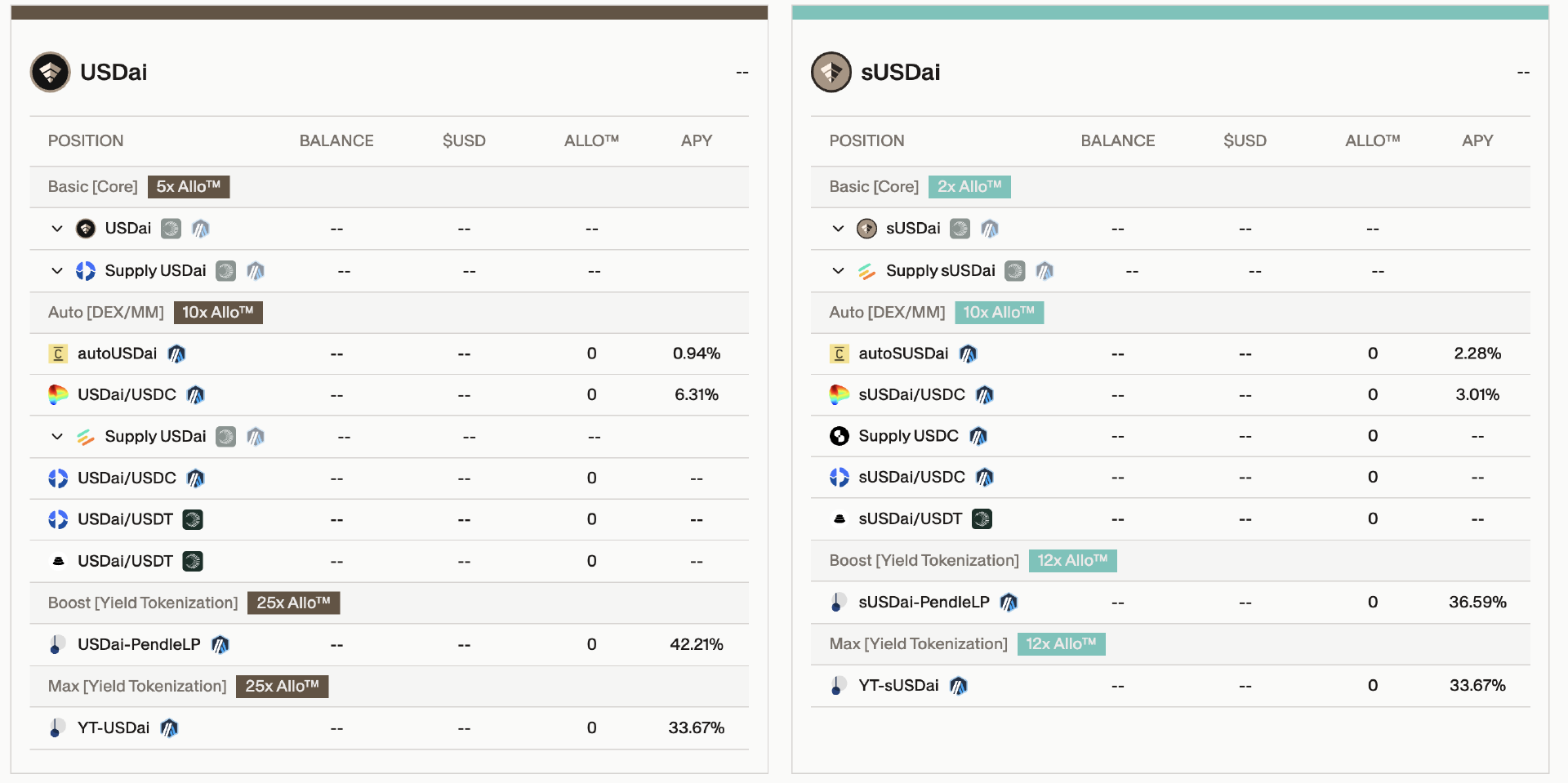

如下图所示,用户可通过 USDai 及 sUSDai 获取积分的渠道(含对应收益率及积分倍率)如下图所示,其中左侧 USDai 对应的是 IC0 权益,右侧 sUSDai 对应的是空投权益。

不难发现,无论是 USDai 还是 sUSDai,当前在 Pendle 做 LP 或是买入 YT 都是积分倍率最高的方式(注意 LP 只有 SY 部分会计分),且做 LP 还有着不菲的年化收益(42.21%,36.59%)——不过你现在可千万别脑热直接冲进去了,由于 USD.AI 的铸造上限已满,现在获取 USDai 只能从二级市场溢价买入(大概 1.03 美元),暂时入场磨损过大,不妨等等下一次提高铸造限额。

到底值得挖吗?

在 USD.AI 热度不断攀升的同时,围绕着该协议也出现了一些 FUD 声音,市场对于该协议的看法似乎出现了较明显的分裂。

看好的一方会认为,USD.AI 叠加了“稳定币”和“AI”两大热门叙事,抛开基本面不谈也是一个极好的炒作标的;此外 USD.AI 的领投方 Framework 近期战绩极佳(同样也是 Plasma 的领投方),再加之YZi Labs 所带来的上线币安预期,这进一步拔高了 USD.AI 的想象力天花板;此外 USD.AI 过往几次提高存款上线之后很快被疯抢一空的情况也很难不让人联想到 Plamsa。

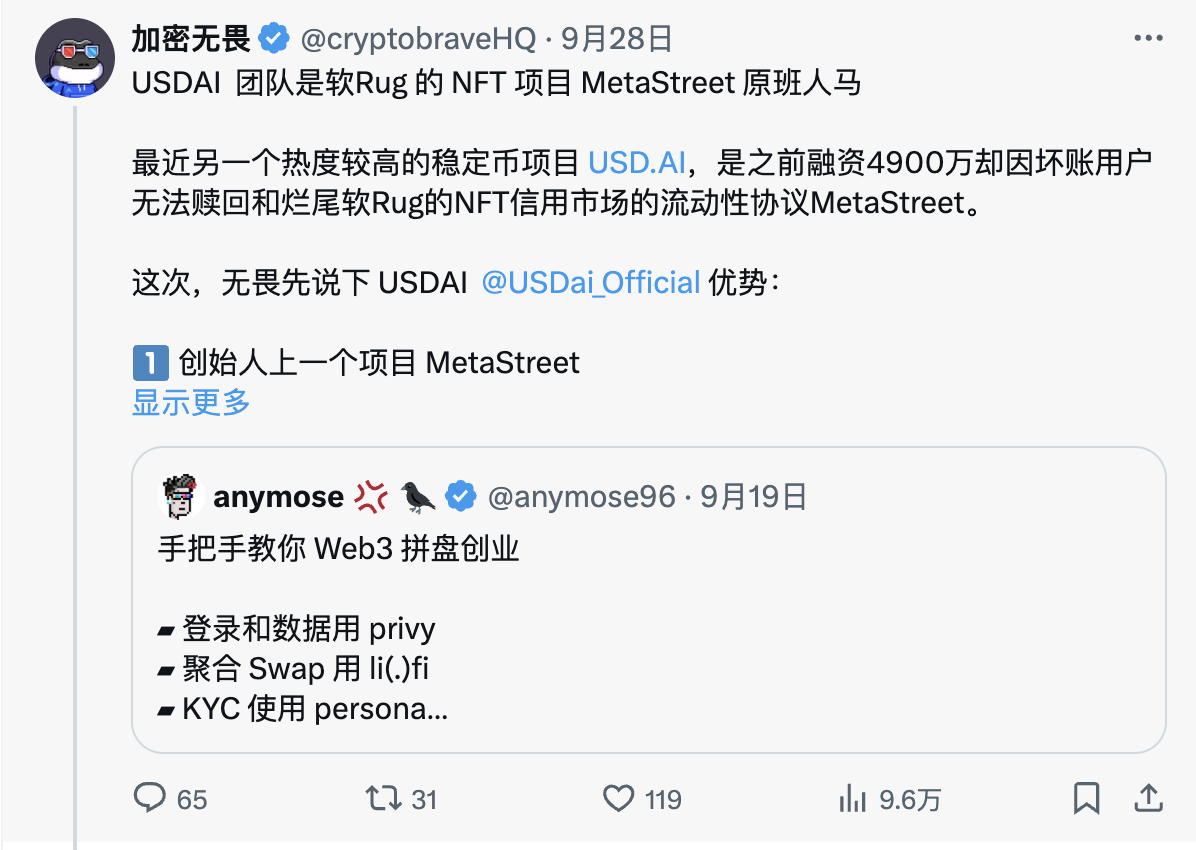

但看衰的一方则认为,USD.AI 所引入的借贷模型尚未经过市场的充分验证,以无法通过传统渠道获得足额融资的 AI 公司作为主要借款方,这其实是个 Debuff,该机制能否长期有效持续仍是个未知数;此外 KOL “加密无畏(@cryptobraveHQ)” 还曝出 USD.AI 的团队疑似为曾 Rug 的前 NFT 项目 MetaStreet 的原班人马,可能存在黑历史……

就个人操作而言,我在 8 月下旬 USD.AI 上线后存了些资金在 Pendle USDai LP,但仓位限制在了较小比例,后续考虑会在价格再低一些时换号另买一些 sUSDai YT。

对于仍有意参与 USD.AI 的用户,个人还是比较建议在可承受的风险范围内尽量围绕着 Pendle 进行操作(哪怕只是冲着 LP 本身的基础收益去,APY 也足够理想),但着实不建议当前顶着溢价入场 —— 除非你认为在下一次开放限额前的这段时间内的收益可覆盖近 3% 的磨损。至于是选 USDai 参与 IC0,还是选择 sUSDai 拿空投,这就见仁见智了。

另外,有意存款的家人们求走一下邀请链接,在此给大家磕头了:https://app.usd.ai/i/vg59p

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。