「一朝 TGE,天下谁人不识 Aster」。如果你要问最近两周最火的项目,Aster 这个名字应该是所有人的第一反应。

53.5% 的大比例社区空投、发行价$0.03、TGE 几小时内暴涨 400%。在短短 5 天内创造了令人瞩目的涨幅:最高 81 倍至$2.4359 ATH,当前仍维持 63 倍至$1.9 的涨幅。这是今年 TGE 最猛的代币,没有之一。

当前大多 Perp DEX 还是在模仿 Hyperliquid,没有太大创新时,Aster 是如何通过差异化的技术路线和产品策略,为自己争取到越来越重要的市场地位呢?

Aster 有何不同?

Aster 的发展历程体现了团队对市场机会的敏锐嗅觉和执行力。这个项目最开始叫 Astherus,主要做质押资产流动性,通过 AstherusEx 和 AstherusEarn 两个产品分别切入永续合约交易和 DeFi 挖矿策略。

真正的转折点在 2024 年 3 月 31 日,Astherus 与 APX 完成战略合并升级为 Aster,项目从一个质押流动性协议全面转向"Perp DEX 终极形态"这个更宏大的目标。

团队很清楚,在链上永续合约交易快速发展的今天,单一产品模式根本满足不了不同用户的需求。所以他们创新性地推出了"1001x"和"Perpetual"双模式交易体系。

1001x 模式专为降低链上交易门槛而设计,采用完全链上的永续合约形式,通过对接外部链上的 ALP 流动性池,提供极简的交易体验。用户无需复杂的图表分析,仅需轻点即可完成交易,支持最高 1001 倍杠杆的 BTCUSD 交易对,覆盖加密货币、外汇以及热门 Meme 币等丰富资产类别。该模式同时兼容 BNB Chain 与 Arbitrum 网络,为新手用户提供了无门槛的链上交易入口。

Perpetual 模式则面向专业交易者,采用链上订单簿机制,配备深厚的流动性、实时数据和进阶交易工具。目前参与 Beta 测试的用户已经能够直接接入 Aster Chain,体验最新的隐私交易功能和高性能交易环境。这种模式不仅满足了专业交易者对深度流动性和精确价格控制的需求,更为重要的是为平台的技术创新提供了实际的测试场景。

更具创新性的是,Aster 还推出了"Dumb"预测模式,允许用户基于分钟级资产价格波动进行预测交易。这种新颖的交易方式不仅丰富了平台的功能矩阵,更重要的是为那些喜欢短期投机但不具备专业交易技能的用户提供了参与市场的新途径。

在与 BNB 生态的深度整合方面,Aster 展现出了战略布局的前瞻性。作为 YZi Labs 全资投资的项目,Aster 不仅在技术和资金层面获得了强有力的支撑,更重要的是获得了进入币安生态核心圈层的通行证。CZ 与 Aster 团队的多次互动,以及项目在 BNB Chain 官方 DappBay 门户中第 13 位的排名,都充分体现了其在 BNB 生态中的重要地位。相关阅读:《CZ 频互动,Aster 如何以「BNB 的顶级 Perp DEX」破局?》

完整的交易理财闭环

在 Perp DEX 的激烈竞争中,产品丰富度和业务闭环能力也是决定成败的关键因素。Aster 在这方面的布局之一就是「Trade & Earn」功能,为用户构建了一个真正的交易理财一体化生态系统。

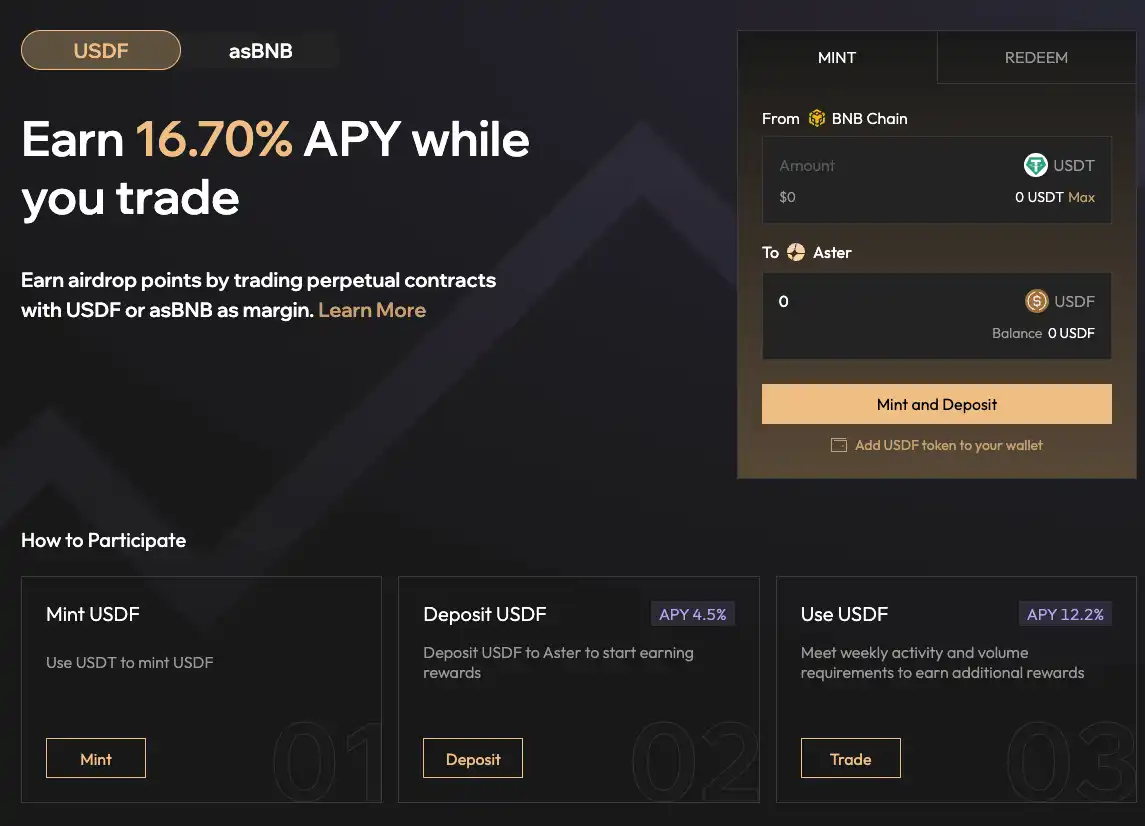

依托于前身在质押资产流动性的深耕,Aster 在「Trade & Earn」功能上最核心的是产品是 USDF 这个收益型稳定币。USDF 是 Aster 推出的生息稳定币,与 USDT 保持 1:1 完全 backed 和可赎回。

用户可以通过两种方式获得 USDF 奖励。第一种是存款奖励,只要你的交易账户里持有超过 1 个 USDF,就能享受这个收益。第二种是交易奖励,需要用户每周至少活跃 2 天,且周交易量超过 2000 USDT。

奖励分发机制也很贴心,前一周的所有奖励会在每周统一分发 USDF,并自动转入你的交易账户。用户完全不需要手动操作,收益会自动复投。

真正的亮点在于交易时的使用场景。用户可以直接将 USDF 存入交易账户作为保证金进行合约交易,在交易的同时仍然能够获得 USDF 收益。这就形成了「交易越多,赚越多」的正向循环:用户交易产生手续费收入给平台,平台将部分收益以 USDF 奖励的形式返还给用户,而用户持有的 USDF 本身也在产生收益。

这种设计的巧妙之处在于彻底改变了传统交易的成本结构。在其他平台,交易就是纯成本,手续费交了就没了。但在 Aster,活跃交易不仅能获得交易奖励,用作保证金的 USDF 还在持续产生收益,实际上降低了交易的机会成本,甚至在某些情况下能够覆盖交易手续费。

USDF 作为 Delta 中性收益稳定币,进一步锚定了 BNB Chain 的 TVL,创造了自循环的流动性生态。这种设计让资本效率大幅提升,用户可以将 asBNB 收益代币和 USDF 稳定币桥接至 Aster Chain 作为抵押品,然后重新存入 Aster Earn 获得复合收益。

股票永续合约

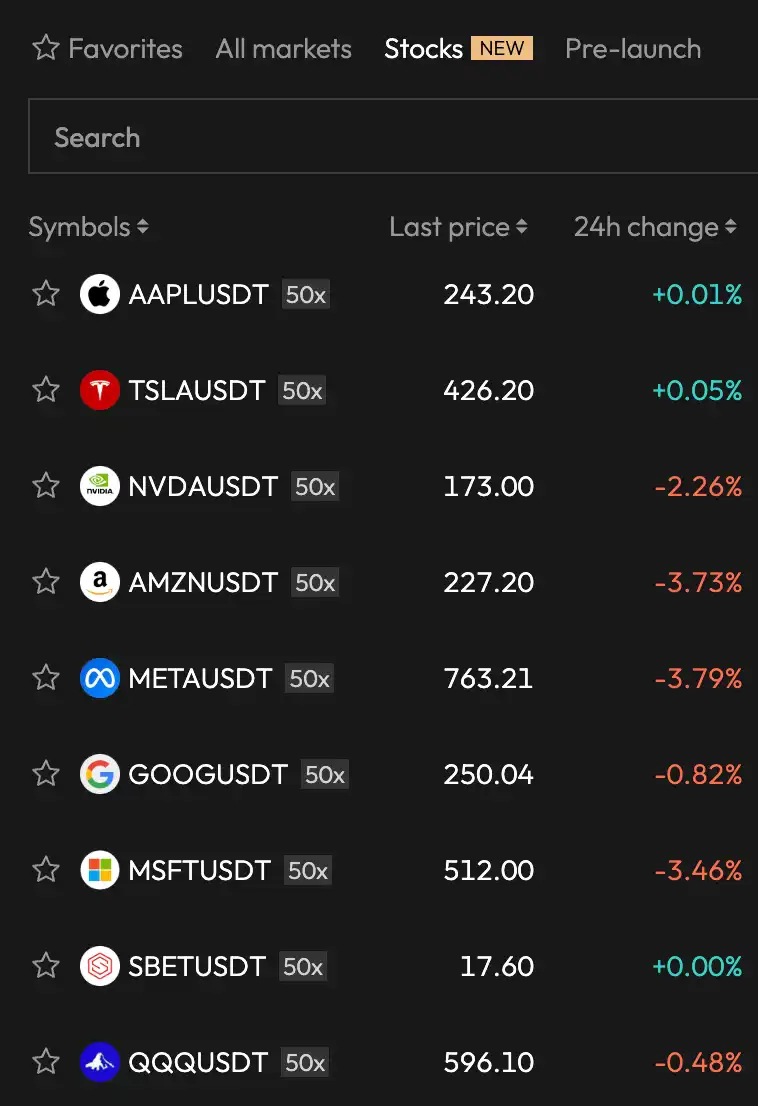

在主流 Perp DEX 里,Aster 是目前唯一提供股票交易的平台。

我们都知道在传统金融市场中,股票交易受到诸多限制,包括严格的交易时间窗口、有限的杠杆倍数以及繁琐的开户流程。而 Aster 的股票永续合约功能帮助解决了这一问题,为用户提供了前所未有的交易自由度。

这个功能覆盖了从苹果、微软、英伟达这些科技巨头,到特斯拉、亚马逊等热门股票,还包括纳斯达克 100 指数 ETF 和 RWA 代币 ONDO Finance 等创新资产。每个合约都支持高达 50 倍杠杆,这在传统股票交易中基本不可能,因为美国 FINRA Reg-T 规定通常把杠杆限制在 2 倍以内。

在美股正常开盘时间内,平台提供最深的流动性和正常的价格波动环境;而在非开盘时间,系统通过智能风控机制确保市场稳定,限制过度波动的同时保持订单簿的开放。这就意味着即使在节假日期间,交易者仍然可以进行全天候的建仓和平仓操作。

在结算机制上看,Aster 采用 USDT 即时结算,彻底摆脱了传统股票市场 T+2 交割的束缚。交易者无需经历繁琐的券商开户和 KYC 流程,仅凭一个加密钱包即可开始交易。加密原生用户轻松获得纳斯达克 100 指数的 Beta 敞口,而无需开设传统证券账户。

与 BNB 生态系统的深度整合

作为原本就是 BNB 生态的质押资产流动性协议,Aster 在升级为去中心化永续合约交易平台之前,就已经有不少 BNB 生态资源了。所以 Aster 与 BNB 生态系统的紧密合作是它最大的特点之一。

在基础设施部署方面,Aster 的 DEX 合约、收益金库 Aster Earn 以及各种流动性质押产品全部部署在 BNB 智能链上。目前平台在 BNB Chain 官方 DappBay 门户中排名第 13 位,这离不开它在 BNB 生态中的积极贡献和深度整合。

asBNB 流动性质押衍生品是这种整合的典型体现,它不仅为用户提供流动性质押收益,还能自动复合 Binance Launchpool 和 Megadrop 奖励。USDF 作为 Delta 中性收益稳定币,进一步锚定了 BNB Chain 的 TVL,创造了自循环的流动性生态。这种设计让资本效率大幅提升,用户可以将 asBNB 收益代币和 USDF 稳定币桥接至 Aster Chain 作为抵押品,然后重新存入 Aster Earn 获得复合收益。而 Aster 的 Binance Launchpool 和 Megadrop 正是通过与 BNB 生态的另一大 DeFi 基础设施 Lista DAO 合作实现的。

此外,Aster 还是 CoinMarketCap 专为 Pre-TGE 项目打造的启动平台 CMC Launch 首期上线的项目。值得一提的是,基于 AI 的链上身份验证与信用评分平台 Creditlink 上线 Four.Meme 开启 CDL 代币预售时,CDL 流动性池也同时在 Aster DEX 和 PancakeSwap 上提供。

像这样 Aster 与 BNB 生态项目的合作例子比比皆是,最大限度地吸引了 BNB 生态的原生用户。

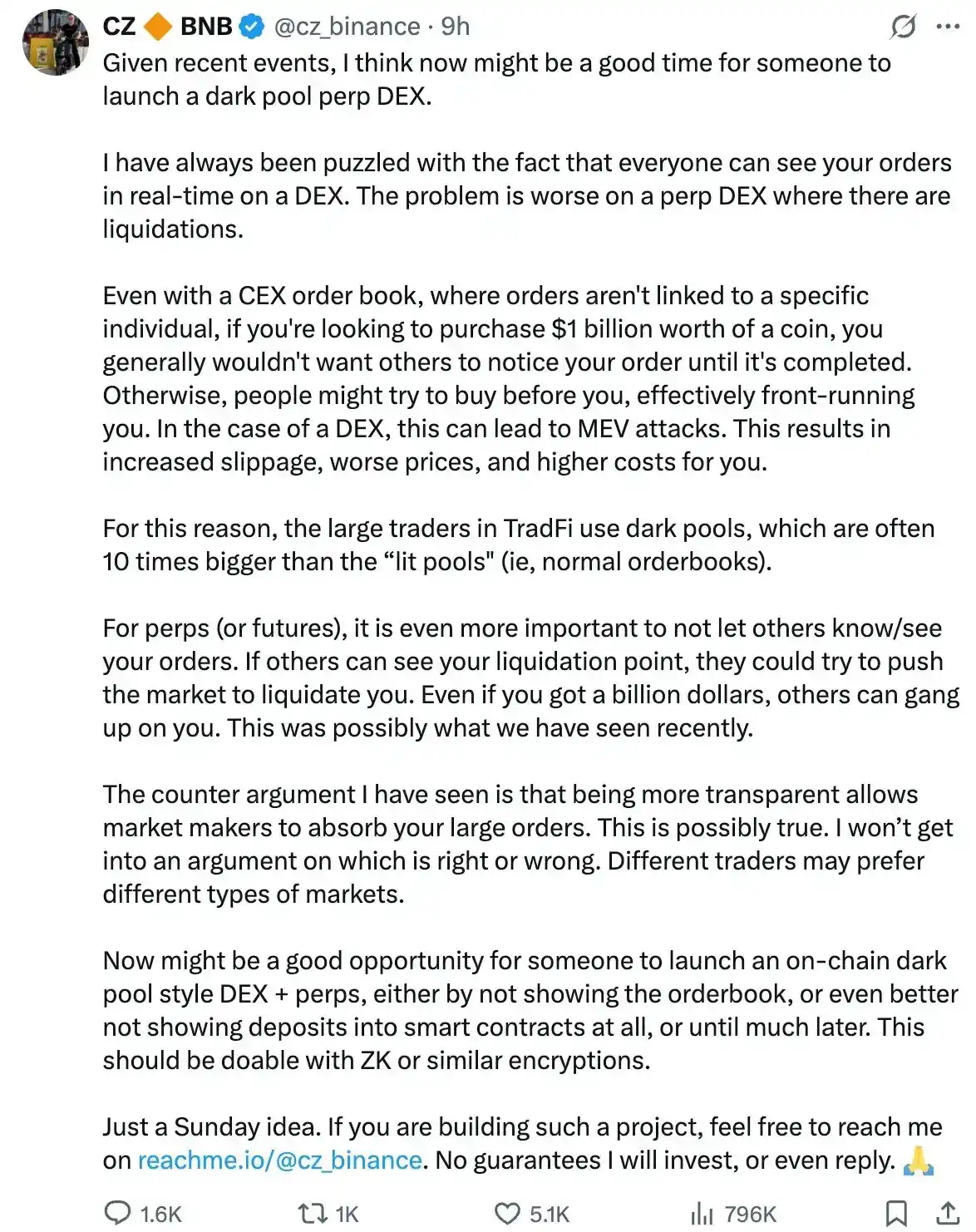

Aster L1 和零知识证明:技术创新的集大成

6 月 1 日,CZ 发布了一篇关于暗池的推文,提议「现在或许是推出暗池 perp dex 的好时机」,并指出 DEX 实时公开订单的透明性反而可能会导致 MEV 攻击,从而损害交易者的利益。CZ 的话题快速引发了市场关于加密货币交易隐私与效率问题的讨论。

而在 20 天后,Aster 就迅速上线了 Hidden Order(隐藏委托)功能,实现了真正意义上的隐藏订单功能。

订单的规模、价格、方向甚至存在都被完全隐藏,只有在匹配到对手方时才会执行。这种隐私订单的设计消除了抢跑风险,同时提供了足够的隐私保护方面。以创新的方式隐私提高了系统的高流动性,同时确保交易者的仓位、盈亏和清算点等敏感信息不会被泄露。这种技术实现使得 Aster 能够提供机构级别的隐私保护,这在当前的去中心化交易所生态中是极为罕见的。

这种隐私保护机制的实际价值在高风险交易场景中尤为突出。参考 Hyperliquid 上知名交易者 James Wynn 因 12 亿美元 BTC 多头仓位的可见性而遭受 175 万美元损失的案例,Aster 的隐藏订单功能可以有效隐藏清算点位,威慑恶意的"猎杀"行为,为大资金交易者提供更安全的交易环境。

在这基础上,Aster 将零知识证明应用在了 Aster L1 公链上。

从 2025 年 6 月 7 日启动的私有 Beta 阶段开始,该公链已经展现出了令人瞩目的技术性能指标。实现了仅 50 毫秒的区块时间和 10 毫秒的执行终局性,这种性能表现即使在当前的区块链技术水平下也属于顶尖水准。实验室测试显示,其峰值 TPS 能够超过 150,000,这为高频交易场景提供了强有力的技术支撑。

该公链的架构设计采用了多节点内置订单簿的创新模式,订单意图在链上记录,而撮合结算在链下执行,随后通过 Brevis 零知识证明对用户仓位和资产进行链上验证,且在链上验证以后,能保证用户资产安全的退出。这种设计既保证了效率,又维护了去中心化的核心理念。

Aster L1 支持来自以太坊、BNB Chain 和 Solana 的等多条公链的跨链划转,这种多链兼容性为用户提供了更大的灵活性。用户订单行为上链的同时,仓位和资产只以零知识证明的方式上链保存,有效保护了交易者的仓位和盈亏隐私。

数据说话:Aster 的真实表现

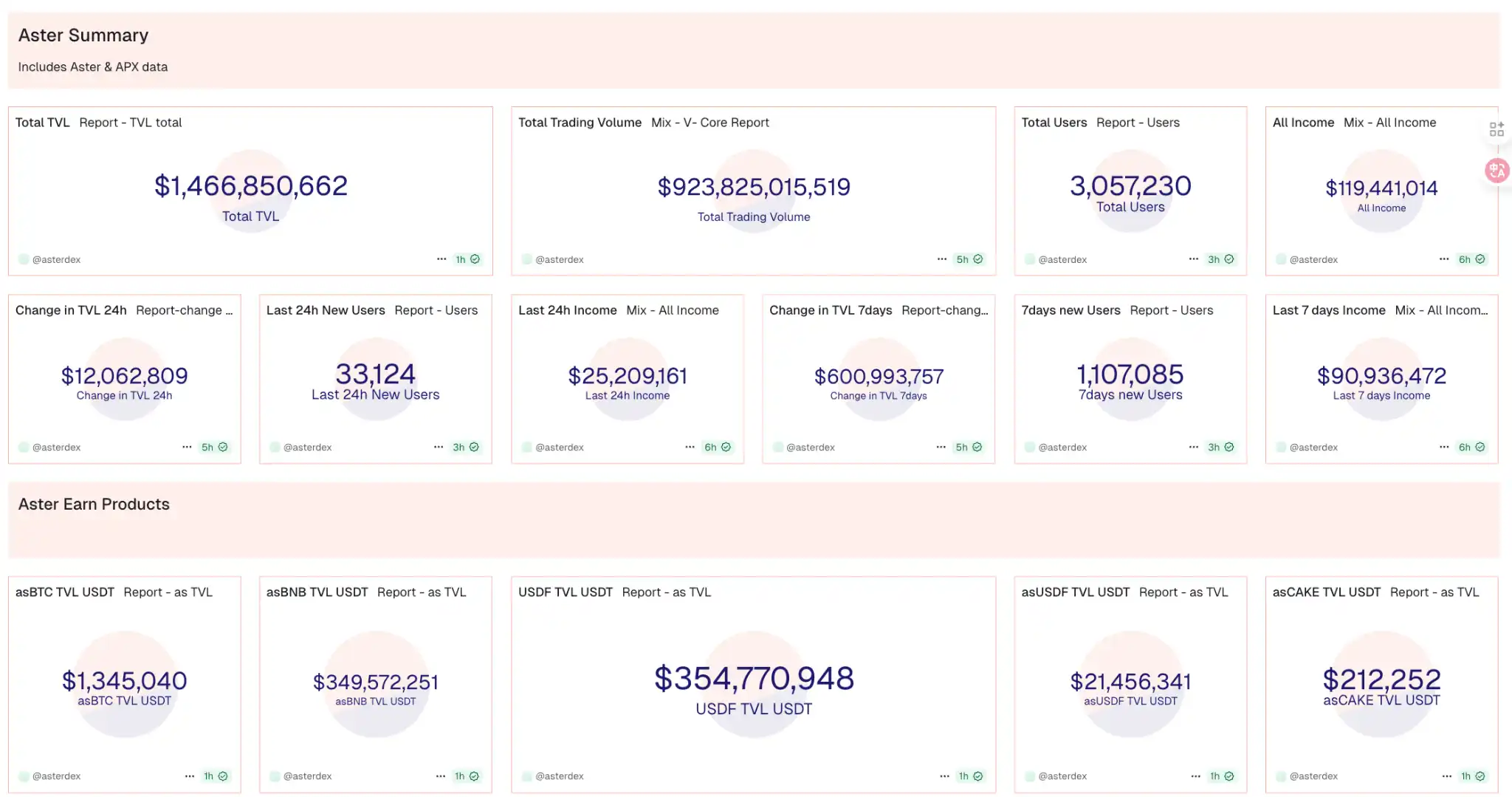

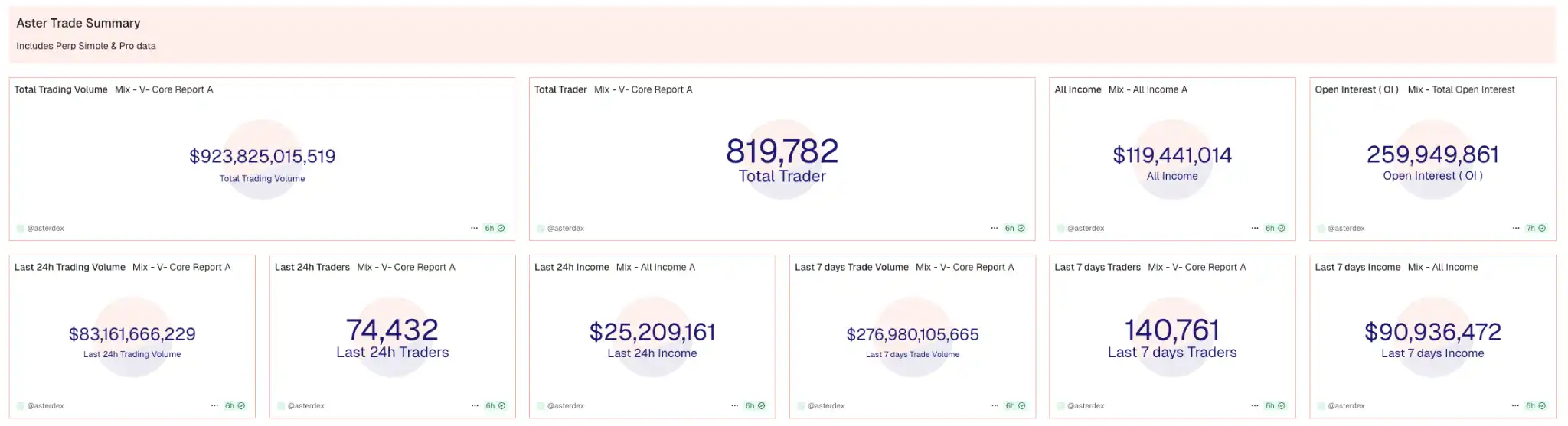

根据 Dune 上的最新数据,Aster 在多个关键指标上的增长表现相当亮眼。总锁仓价值(TVL)达到 14.67 亿美元,充分体现了项目的资金吸引力和市场认可度。更厉害的是累计交易量突破 9238 亿美元,这个数字不仅体现了平台的交易活跃程度,更反映出用户对平台的高度粘性和信任。用户规模方面,平台已经积累了 305.7 万总用户,为项目长期发展打下了坚实基础。协议累计收入 11.94 亿美元,有力证明了平台盈利模式的有效性。

从短期数据变化来看,Aster 也正处于快速增长期。TVL 在 24 小时内增长 1206 万美元,7 天内增加 6.01 亿美元,这种持续稳定的资金流入充分展现了市场信心。用户增长同样强劲,24 小时新增 3.31 万用户,7 天新增用户 110.7 万,显示出平台强大的用户获取能力。日收入稳定在 2520.9 万美元,7 天收入高达 9093.6 万美元,为平台持续运营提供了充足的资金支持。

在产品 TVL 分布上,平台展现出很好的多元化布局。USDF 稳定币以 35.48 亿美元的规模成为最大单一产品,反映了用户对收益型稳定币的强烈需求。asBNB 产品贡献 34.96 亿美元,体现了平台与 BNB 生态深度整合的价值。包括 asBTC(134.5 万美元)、asUSDF(2145.6 万美元)、asCAKE(21.2 万美元)在内的其他产品构成了完整的多元化产品矩阵,为不同风险偏好的用户提供了丰富选择。

交易数据进一步印证了平台的强劲表现。9238 亿美元的总交易量数据一致性很好,81.98 万交易者的规模展现了平台在永续合约交易领域的强大吸引力。25.99 亿美元的未平仓合约规模,反映出市场的高度活跃状态。

近期交易数据更是让人眼前一亮。24 小时交易量 831.6 亿美元,活跃交易者 7.44 万人,单日收入 2520.9 万美元,显示出平台日常运营的稳健性。7 天数据更印证了增长趋势:交易量 2.77 万亿美元,交易者 14.08 万人,收入 9093.6 万美元。

Aster 通过构建隐私优先的技术栈和多元化产品线,在竞争激烈的永续 DEX 赛道中走出了一条与 Hyperliquid 截然不同的差异化道路。这种差异化不仅体现在技术架构的选择上,更深层次地反映在对用户需求理解和市场定位的战略思考中。

作为一个专注于隐私保护和多资产交易的平台,Aster 的核心创新围绕几个关键维度:全天候股票永续合约交易、基于零知识证明的隐藏订单系统、原生移动端应用体验,以及创新的收益型抵押品机制。这些功能的整合让 Aster 不仅仅是一个简单的衍生品交易平台,而是一个综合性的金融基础设施,为传统金融与去中心化金融之间搭建了桥梁。

盈利模式已经得到市场充分验证,5185 万美元的协议总收入以及持续稳定的日收入增长,有力证明了 Aster 商业模式的可持续性和长期价值创造能力。产品多元化战略取得显著成效,从 Earn 产品线多样化的 TVL 分布可以清晰看出,Aster 成功构建了能够满足不同风险偏好用户需求的完整产品生态系统。

对于想要参与 Aster 生态建设的用户来说,也将有新的机会。Aster Genesis Stage 2 将于 10 月 5 日 23:59 UTC 结束,目前还剩下 2 个周期,用户仍然可以通过交易来赚取 Rh 积分。总供应量的 4%(即 3.2 亿枚$ASTER)专门分配给了 Stage 2 奖励,这个奖励池的规模在当前预售价格下价值超过 3200 万美元,平摊到活跃用户身上是相当可观的收益。

Stage 2 结束后,Stage 3 会立即启动,届时将加入现货交易计分机制,并推出全新的奖励体系。从项目方的节奏安排来看,每个阶段的奖励机制都在不断优化升级,早期参与者往往能获得更优厚的回报。而这也标志着 Aster 正从一个专注于永续合约的 DEX 向全功能交易平台演进。

综合来看,这些数据为 Aster 在 23 亿美元 FDV 估值水平下的投资价值提供了强有力的数据支撑,也为其在日益激烈的 DeFi 市场竞争中占据有利地位奠定了坚实基础。在众多 Perp DEX 项目中,Aster 通过独特的技术创新和产品策略,正在向 Perp DEX 赛道发起有力冲击。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。