昨天我们讲到,大饼由宽幅过渡到了下跌通道,要想破坏掉这个通道,需要这几天收出阳线来,今天看昨天是收了阳线,初步达到了我们的目的,但对于多军来讲要走的路还很长。从小级别上看有了止跌的现象,但空头的情绪还没释放完毕,所以这里我们等一个二次探底的到来。

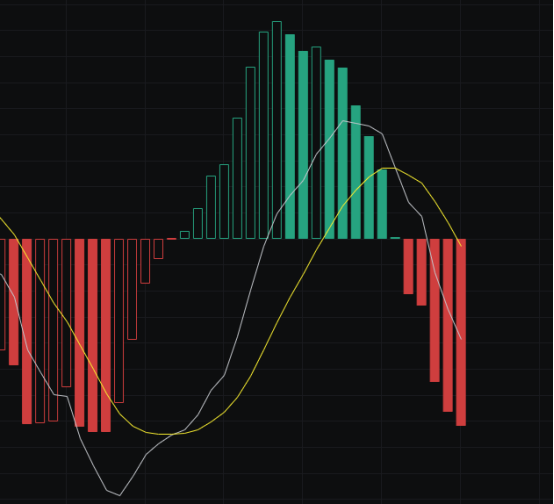

Macd上看,能量柱还在向下,快线和慢线也在向下走,所以这里空头的情绪还没释放完毕,还需要时间来消化。

Cci上看,cci还是在-100下方,这里情绪得到了稳固,但多头的情绪还没起来,所以短时间这里涨不起来。

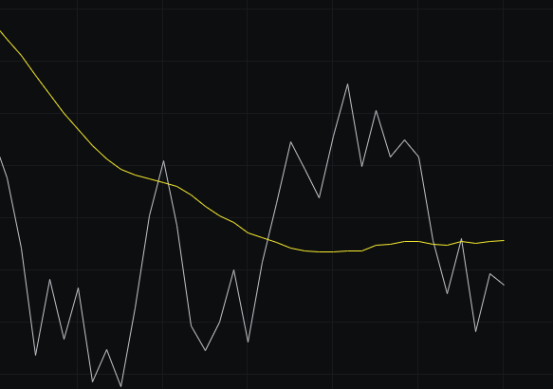

Obv上看,目前快线还是在慢线下方,好在慢线还在走平状态,这里稍微的上涨或下跌都会影响到慢线的走势,所以需要继续观察慢线后面选择的方向。

Kdj上看,目前已经来到了超卖区域,并且没有走平的迹象,所以这里还需要时间来消化。

Mfi和rsi上看,mfi在中性区间,但rsi偏弱,后面要想rsi走好,需要收出阳线来。

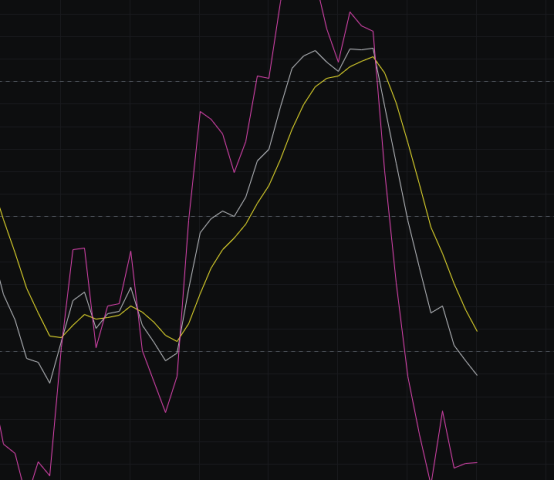

均线上看,目前价格跌破了120线,下方没有了支撑。30线也拐头向下了,目前就120线还在走平阶段,后续继续观察两条线的走势。

Boll上看,由于boll由宽幅过渡到了下跌通道,所以昨天我们提出要破坏掉这个下跌通道,需要后面这几天至少有一天收出阳线来。昨天的收线如我们所愿收出了阳线,阻止了下跌通道的发展,但目前看还是下跌通道,所以今天是最好也收出阳线来。

综上:目前指标偏向于空头,boll也发展到了下跌通道,要阻止下跌通道的发展今天最好是收出阳线来,鉴于我们要求的二次探底,最理想的走势就是今天收出阳线,明天回踩确认,然后下个周开启反攻。今天给多军的目标还是收出阳线,最好价格站上110000,下方支撑看107500-105000,上方压力看111000-112000。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。