On the night of September 25, U.S. time, both the Wall Street stock market and the cryptocurrency market experienced a sharp decline, reflecting multiple risks intertwined with unclear policies, valuation pressures, and high leverage. The S&P 500 fell for the third consecutive day, Bitcoin dropped below $109,000, reaching a low of $108,631, with a 24-hour decline of 4.23%. In the past 4 hours, the total liquidation across the network amounted to $574 million, with long positions accounting for $540 million and short positions only $34.33 million, indicating that the market's overly optimistic leveraged positions are being gradually cleared.

As of September 25, the annualized growth rate of U.S. GDP for the second quarter reached a nearly two-year high, and the number of first-time unemployment claims fell to its lowest point since mid-July. Originally positive data has raised concerns among investors about the stickiness of inflation, leading to questions about the necessity of a rate cut by the Federal Reserve in its October meeting. Market interest rate futures pricing shows that the probability of a rate cut in October has dropped from 92% to 83.4% within a week. As a result of these influences, the S&P 500 and Nasdaq recorded their longest decline in over a month, while the Dow Jones Industrial Average also closed in the red.

The cryptocurrency market, due to excessive leverage, has amplified volatility, triggering a chain liquidation. According to statistics, $740 million in positions were liquidated within 12 hours, with long positions accounting for over 94%, and the total liquidation for the day reached $1.18 billion. This month, $22 billion in Bitcoin options are set to settle, with short positions betting that Bitcoin prices will not hold the $110,000 level, exacerbating price declines.

In the coming weeks, the core personal consumption expenditure price index will be a key data point for assessing inflation trends and the Federal Reserve's stance. If inflation cools less than expected, the timeline for rate cuts may be delayed again, tightening the financial environment further. Additionally, a new round of corporate earnings season is approaching, and the market will conduct a final test on whether revenue and profits can support high valuations.

In the cryptocurrency market, it is essential to focus on changes in positions and leverage levels after the options settlement to determine if there is a structural reduction in leverage. Investors are reminded to strictly control their positions in a highly volatile environment, waiting for signals from policies and fundamentals to avoid losses.

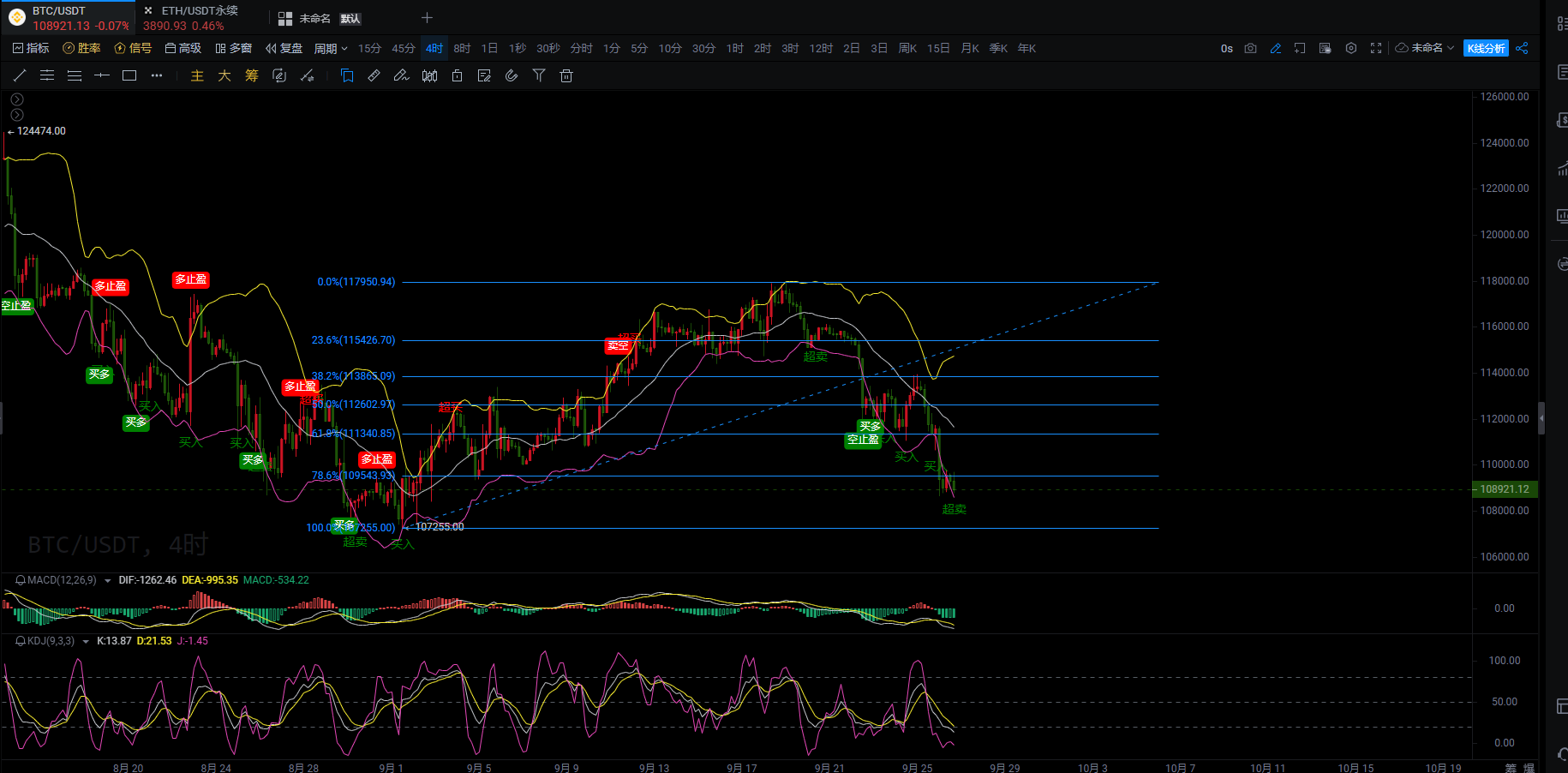

Bitcoin Four-Hour Chart

The current price is hovering around $108,900, having broken below the 76.8% retracement level, and is now testing the 100% retracement level of the previous low at $107,250. If this level is breached, the downward trend may further extend to around $105,000. The current resistance levels above are the 50% retracement level at $112,600, the 38.2% retracement level at $113,800, and the 23.6% retracement level at $115,400.

The price is currently hovering near the lower Bollinger Band, with multiple candlesticks continuously touching the lower band, indicating strong bearish momentum, but also suggesting a potential oversold rebound. The middle band around $113,000 constitutes a key short-term resistance level. The continuous downward movement of the lower band indicates a bearish short-term trend, and unless there is a rapid surge, the likelihood of continued weakness is high.

The MACD indicator shows the DIF line at -1262.46 and the DEA line at -995.35, with a significant gap between the two and the MACD green histogram continuing to expand, indicating strong bearish momentum. Currently, there are no signs of a golden cross, and the downward trend remains dominant. However, if the MACD green histogram begins to contract, it may indicate a weakening of bearish momentum, at which point a valid rebound could be expected.

In the KDJ indicator, the K line value is 13.87, the D line value is 21.53, and the J line value is -1.45, which has entered the oversold area. The indicator has been continuously operating in the oversold zone, indicating that the short-term decline has been too rapid, creating a certain technical rebound demand. If the K line crosses above the D line to form a golden cross signal, a short-term rebound will become more evident.

In summary, the market remains in a bearish trend, with the MACD green histogram showing strong bearish momentum, and the lower Bollinger Band being continuously breached. However, the deep oversold condition in the KDJ suggests that a rebound could occur at any time, with the strength of the rebound depending on whether it can effectively break through the middle band resistance at $113,000. If it fails to break out of the $113,000-$113,800 range with volume, the rebound may only be a weak correction, and the overall trend will still lean bearish.

Based on the above analysis, the following conclusions are provided for reference:

1. If Bitcoin's price stabilizes in the $109,500-$108,900 range and a KDJ golden cross signal appears, then a rebound testing the $112,600-$113,800 range is expected;

2. If it effectively breaks below the $109,500-$108,900 support, it may continue to probe down to $107,200, potentially triggering a deeper decline.

Giving you a 100% accurate suggestion is not as good as providing you with the right mindset and trend; teaching a person to fish is better than giving them fish. It is suggested to earn for a moment, but learning the mindset will allow you to earn for a lifetime!

Written on: (2025-09-26, 18:20)

(Text - Master Says Coin) Disclaimer: Online publication has delays, and the above suggestions are for reference only. Investment carries risks; please proceed with caution!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。