Written by: Luke, Mars Finance

Wow, now everyone wants to do Perp Dex. A rising tide lifts all boats… But in the long run, the best builders will win. DYOR (Do Your Own Research). The era of Perp Dex is here!”

—— CZ, Founder of Binance

When the king of centralized exchanges (CEX) proclaims the arrival of a decentralized track, you know the game has fundamentally changed.

When the king of centralized exchanges (CEX) proclaims the arrival of a decentralized track, you know the game has fundamentally changed.

In the autumn of 2025, the whirlwind stirred up by Perp DEX (perpetual contract decentralized exchanges) is intensifying, with the new king ASTER surpassing stablecoin giant Circle in daily revenue, closely trailing Tether. In response, Gate.io has grandly launched its L2 network "Gate Layer," while OKX's "X Layer" welcomes DeFi giant Aave. This familiar scene seems to turn the clock back to 2020.

However, if you think this is just old wine in a new bottle, a replay of the Binance Smart Chain (BSC) script, you may underestimate the complexity and brutality of this war. This is no longer a simple battle for traffic. Under the immense pressure of Perpetual DEX, it resembles a "dark forest" war over economic sniping, ecological territory, and the future dominance of Web3.

Historical Echoes — 2020, the "Uprising" of Exchanges

The foreshadowing of today's game was laid back in the summer of 2020, ignited by "DeFi Summer." At that time, the Ethereum network was experiencing a sweet trouble. The explosive growth of applications like Uniswap and Compound led to unprecedented on-chain activity but also caused network congestion and soaring gas fees. A simple swap could cost dozens or even hundreds of dollars, keeping countless ordinary users out of the DeFi world.

Capital and users flow like water, always towards the lowlands. Binance keenly captured this historic window. In September 2020, Binance Smart Chain (BSC) officially launched. It was not a revolutionary technological creation but an extremely precise business decision—by "forking" Ethereum, retaining its popular EVM compatibility while replacing the consensus mechanism with a more centralized Proof of Authority.

The strategic intent of BSC was as clear as a sharp blade: to create a "parallel world" that is fully compatible with Ethereum but faster and cheaper. A block time of 3 seconds and transaction fees as low as a few cents were like a promised land for users and developers long tormented by Ethereum's high gas fees. Following this, Binance launched a $100 million seed fund to vigorously support ecological projects. Applications like PancakeSwap quickly rose, absorbing a large amount of liquidity and users spilling over from Ethereum.

Soon after, Huobi launched a similar HECO chain in December of the same year, officially igniting the exchange chain war. The essence of this war was a "traffic plundering battle" against Ethereum. Exchanges played the role of "rebels," attempting to establish a kingdom independent of Ethereum under the banner of "more inclusive DeFi," confining users and assets within their own sphere of influence as much as possible. Their weapons were high performance and low fees, with a strategic core of "replacement."

Paradigm Shift — From "Ethereum Killers" to "Ethereum Colonizers"

However, four years later, the new scripts of Gate.io and OKX have undergone a fundamental transformation. They are no longer trying to establish independent kingdoms but have chosen to build their own "city-states" within the vast empire of Ethereum—they are launching not independent Layer 1 public chains but Layer 2 scaling networks based on Ethereum.

This marks a strategic shift from "substitutes" to "co-builders," driven by technological maturity and the evolution of industry consensus. This L2 model has overwhelming advantages compared to the previous generation of L1 forks: it inherits Ethereum's top-notch security while seamlessly sharing Ethereum's vast liquidity and developer ecosystem. If 2020 was the year exchanges attempted to "detach" from Ethereum, then 2025 is the year they "embrace" Ethereum. Their goal is no longer to kill Ethereum but to carve out their own "sphere of influence" on Ethereum's ecological map.

Core Motivation — ASTER's "Pearl Harbor Moment"

What has prompted CEX to make such a significant strategic adjustment? The answer points directly to their core and most profitable business—perpetual contracts.

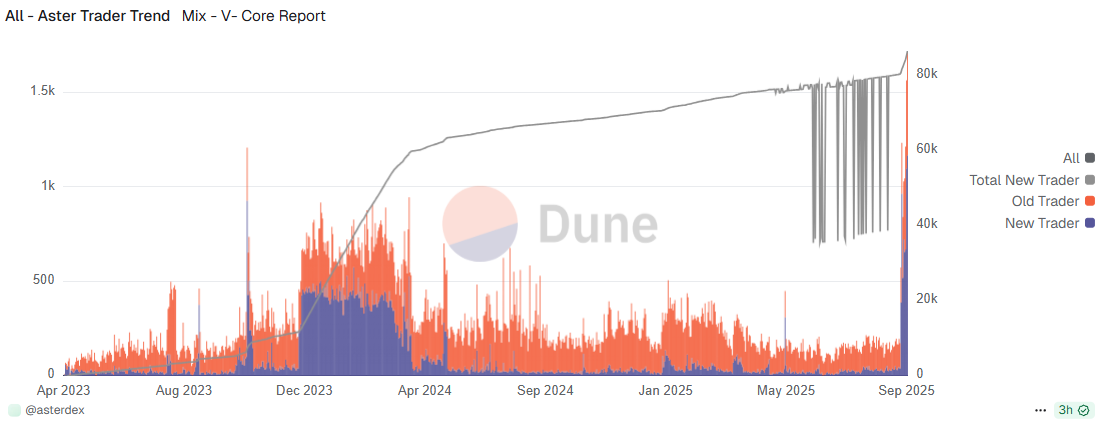

To understand the depth of CEX's anxiety, just look at the astonishing data of the new king ASTER:

Revenue: On September 24, daily revenue reached $8.56 million, surpassing stablecoin giant Circle ($7.72 million), second only to Tether, ranking as the second in the crypto world.

Trading Volume: In the past 24 hours, the trading volume of perpetual contracts reached $32.4 billion, more than double that of its main competitor Hyperliquid.

User Growth: Cumulative users exceeded 2 million, with over 710,000 added in just the past week.

These are no longer "potential" or "trends," but a substantial and formidable army at the gates. ASTER is launching a fierce attack on the core territory of CEX with self-custody, high transparency, and extreme performance. After the collapse of FTX, users have become unprecedentedly vigilant about the "counterparty risk" of CEX, and Perp DEX precisely addresses this pain point.

In response, CEX's counterattack has also become more multifaceted and brutal. In addition to launching L2 to support their "favored child," economic means to target and FUD to suppress independent Perp DEX leaders have also become options on the table. A recent meticulously planned attack on Hyperliquid has escalated this covert war, exposing CEX's true attitude towards Perp DEX: when unable to defeat you in product, they will destroy you economically, through public opinion, and even regulation.

Therefore, the strategy of CEX launching L2 is not merely passive defense but an active encirclement of "carrots and sticks."

Proxy War — The Ecological Chess Game of Giants

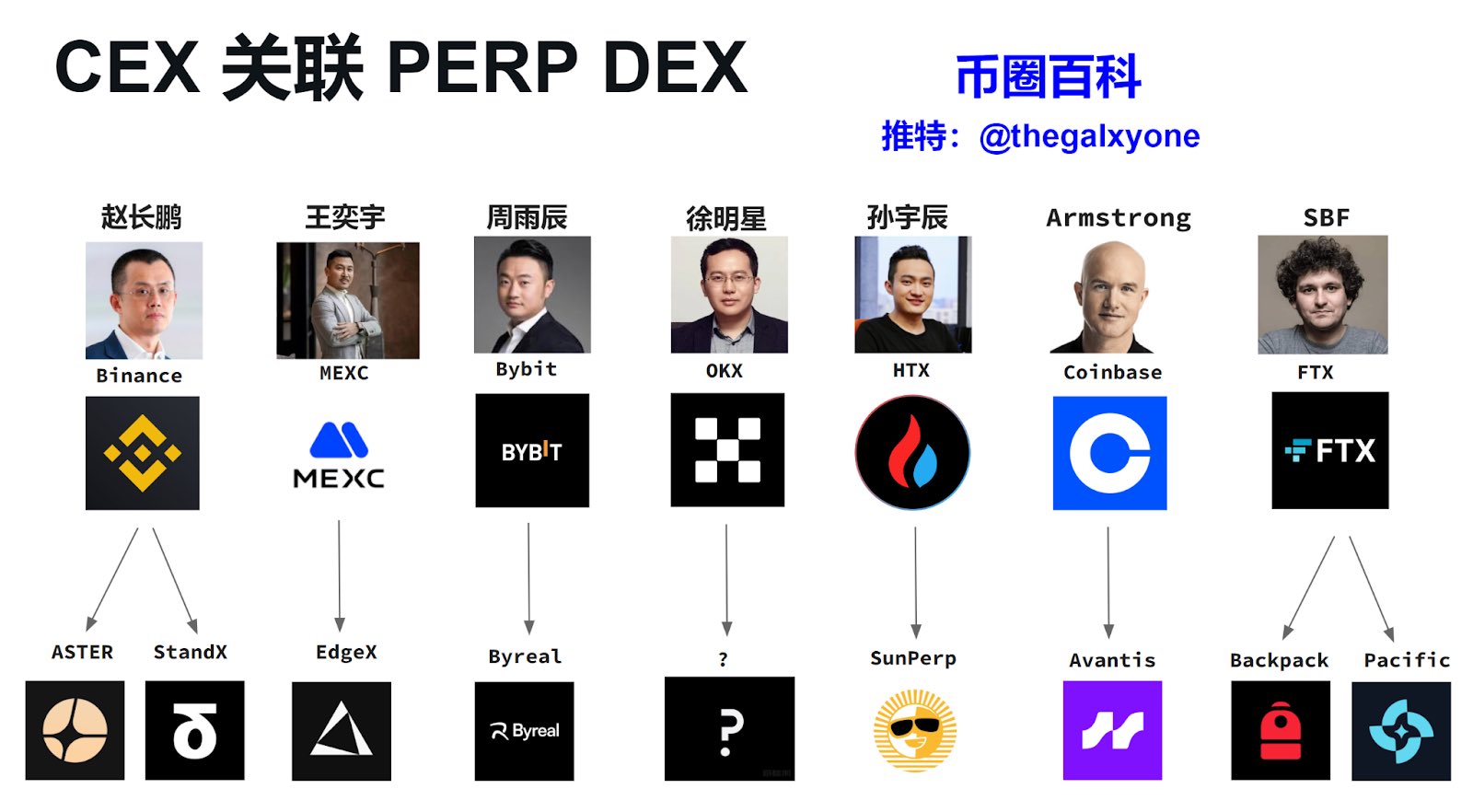

Observing the current market landscape, a clear "proxy war" map has emerged. Major CEX giants are no longer personally engaging in hand-to-hand combat but are supporting their respective Perp DEX players through investment, incubation, and L2 strategies.

Source: Crypto Circle Encyclopedia@thegalxyone

This map reveals a new form of warfare, and ASTER is undoubtedly the ace of the Binance camp. It has not only received strategic investment from Binance, being regarded as a "Binance OGs" startup but is also the leading Perp DEX on BNB Chain. CZ himself has repeatedly mentioned it on social media, personally endorsing it. This makes the matchup between ASTER from the Binance & BNB Chain camp and Avantis from the Coinbase & Base camp charged with tension.

Interestingly, the situation is escalating. Just as CEXs are building L2 infrastructure, ASTER has also announced the upcoming launch of its own Aster Chain, a dedicated blockchain with sub-second confirmation, native perpetual contract integration, and low fees. This marks the beginning of top applications moving towards "application chains," attempting to seize the discourse power of infrastructure.

The future war will be a dual game between CEX L2 ecology and DEX native application chains.

The ultimate goal of exchanges is to build a self-reinforcing, continuously growing "ecological flywheel" around their L2 networks. This is a perfect business closed loop, tightly integrating the traffic advantages of CEX, the technological advantages of L2, and the economic model of tokens.

The Laws of the Dark Forest and the Road Ahead

A new round of exchange chain wars has begun. This is no longer a simple technological competition but a comprehensive war concerning the future Web3 entry, liquidity distribution, and ecological dominance, following the laws of the dark forest—survival is the primary need, and any existence that exposes itself and poses a threat to others may face attack.

For new players like Gate Layer and X Layer, the challenges are immense. Their competitors are not only each other, not just native application chains like ASTER Chain, but also "neutral" L2s like Arbitrum and Optimism that already have strong, organic communities and decentralized genes.

While exchange L2s undoubtedly possess unparalleled traffic and capital advantages, their inherent "centralization" label will also be an Achilles' heel they find hard to shake off. The centralization issue of sequencers has already been exposed in the Hyperliquid incident. When facing a massive impact, does a centralized team have the right to intervene in protocol rules for the "greater good"? This conflict with the decentralization and anti-censorship spirit pursued by the crypto world will be the ultimate question all CEX L2s must answer.

The future landscape is full of variables. Will users ultimately choose the "one-stop" Web3 ecology provided by CEX, which offers a smooth experience but is relatively centralized, or will they insist on choosing the more open, decentralized native L2 networks that may have higher usage thresholds?

The only certainty is that exchanges have sounded the horn of attack. They are no longer satisfied with merely serving as a bridge between the real world and the crypto world; they want to step onto the field themselves and establish their own city-states in this vast new land of chains. The outcome of this war will profoundly impact the landscape of the crypto world for years to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。