撰文:FinTax

加密基金版图扩张

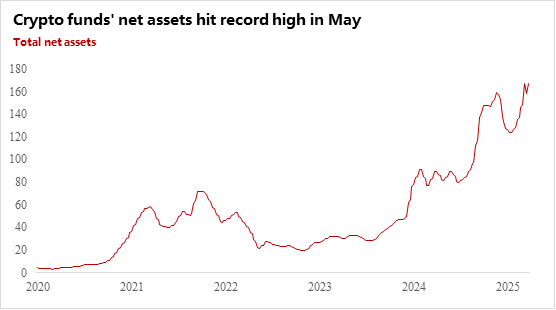

近几年,随着加密资产市场逐渐成熟,加密基金规模稳步扩张。Morningstar数据(2025年5月)显示,294只加密基金的总管理资产已达1670亿美元,单月净流入超过70亿美元,创下去年底以来最高纪录。与此同时,IMF Crypto-Assets Monitor指出,2025年二季度全球加密资产总市值已突破3.5万亿美元,市场体量与波动并存,估值与信息披露的复杂性显著上升。机构配置的意愿同样增强,EY 2025年机构投资者调研显示,59%的受访者计划将超过5%的AUM投向加密资产,进一步推高了后台合规与透明度的要求。面对业务版图中快速增长的这一环,基金行政正面临全新的挑战。

单位:十亿美元

数据来源:Morningstar;图源:FinTax Carlton

财会挑战同步升级

与传统基金相比,加密资产的交易频率更高、估值标准更复杂、数据来源更分散。基金行政往往需要在钱包、公链、交易所、托管行和DeFi协议之间拉取数据,人工对账耗时且极易出错;同时,NAV计算不仅要面对高波动资产的估值问题,还要处理不同司法辖区下的会计与披露标准差异。一旦处理不当,不仅延误投资人报表的交付,还可能在审计和合规检查中留下隐患。对于管理多只加密基金的机构来说,账簿割裂、合并视角缺失更是普遍痛点,既影响运营效率,也损害投资人的信任。

在这种背景下,如果加密基金行政能有一套面向加密资产的专业会计系统,将有助于从根本上解决数据、合规与效率的矛盾。

FinTax助力加密基金步步领先

通过内部财会与系统化管理的升级,加密基金行政完全可以建立起透明、合规、可扩展的运营体系。关键在于以自动化和标准化替代手工流程,让真实的资产状况和基金净值能够被准确呈现,赢得投资人信任,保障监管合规。

FinTax Suite致力于为加密基金行政提供企业级加密资产会计套件,帮助其在复杂环境中实现透明化与高效化:

资产追踪可视化:通过API整合钱包、交易所、托管商等数据,实时展示资产结构、余额与流向,形成统一资产视图。

NAV自动化计算:基于交易流水和链上成本核算,每日自动生成NAV报告,支持按币种、按项目等维度拆分,提升精度与透明度。

投资人对账与报表生成:系统按投资人维度自动生成对账单与估值报表,支持动态查询与定制化导出,提升服务体验。

合规与审计准备:保留完整交易记录与审计日志,满足IFRS与GAAP要求,确保税务、ESG披露及资本市场尽调时的合规与可信度。

多基金集中管理:支持跨基金、跨币种、跨主体的合并与汇总,帮助管理人轻松掌握整体资产状况,实现多维度的集中监管与分析。

我们相信,在传统基金行政体系逐步与加密资产融合的背景下,如果基金行政能更早建立起透明、合规与高效的财会基础设施,将在未来竞争中获得更多优势。FinTax Suite正在帮助越来越多的基金行政脱离手动、割裂、繁琐的低效工作,转向高效、高质量、高标准的新工作模式,从而助力加密基金从工具上的领先一步实现事业上的步步领先。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。