As the founder of Binance, CZ has directly declared that the era of Perp Dex has arrived, and there's nothing more to say. There are many issues with Perp Dex products, such as funding rate discrepancies, cross-platform exchange rate shifts, and opaque position information. To participate in the market more efficiently, auxiliary tools have become essential for many players. Rhythm BlockBeats has compiled several practical PerpDex tools.

On-chain Wallet Analysis

Whether on-chain or on centralized trading platforms, the direction of smart money has always been a concern. They often bring higher trading momentum than KOL followers because they tend to form spontaneously, especially when tools for analyzing on-chain trading addresses emerge. During the memecoin craze or prediction market periods, such auxiliary projects are always among the first to appear, and PerpDex is no exception.

Coinglass

Players who frequently participate in secondary market trading are certainly familiar with this website. As one of the well-established data sites, its data covers most use cases of various tokens on trading platforms, including Funding Rate, institutional ETFs, options, etc.

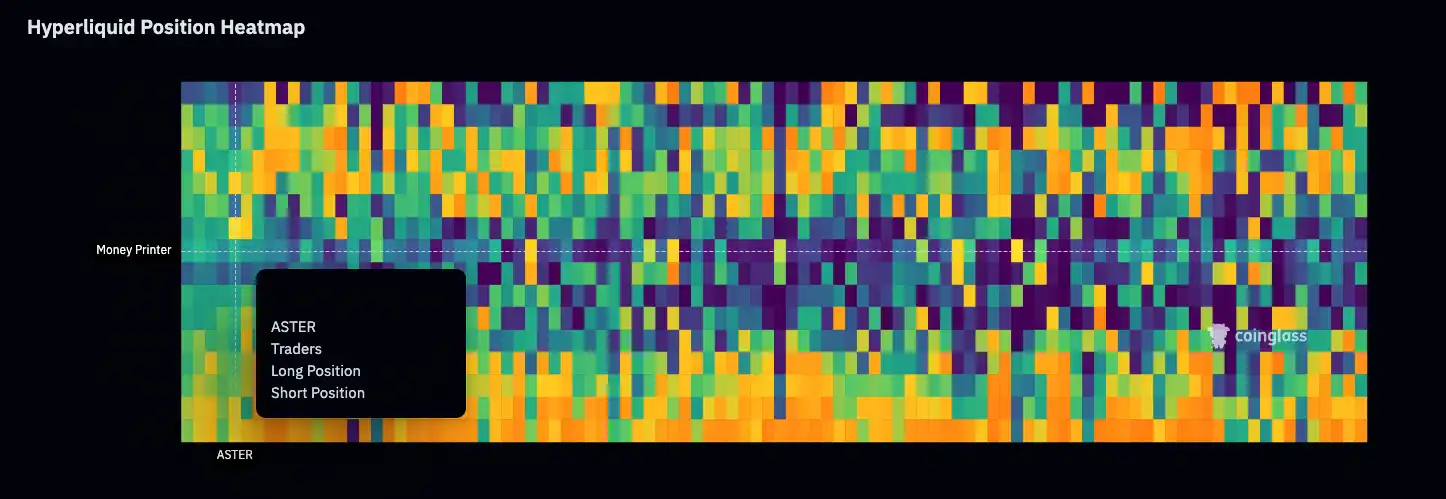

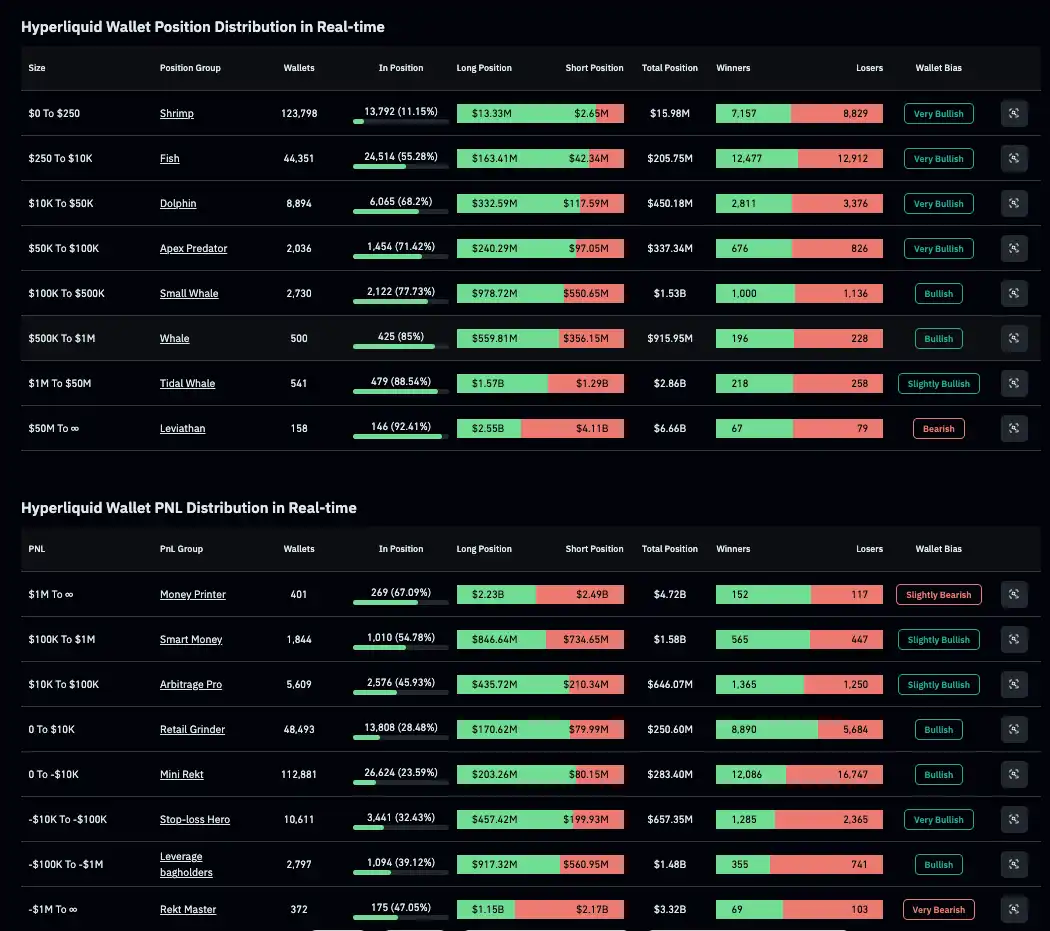

However, for PerpDex, the publicly available data currently only involves wallet analysis related to Hyperliquid, but the presentation of this data is quite interesting. Coinglass categorizes users into 16 types based on position size and whether they are making profits or losses (similar to the 16 MBTI types). The user heatmap intuitively shows the views of these 16 user types on a mainstream token (bullish or bearish).

The image shows the attitude of "MoneyPrinter," who has made over $1 million, towards the current state of the Aster token.

The second aspect is the overall ratio of long and short positions and wins and losses among these 16 user types. Generally, it can reflect how players at each position currently view the market. For example, players like the author, with positions ranging from $0 to $250 (Shrimp) or $250 to $10,000 (Fish), have a low opening ratio, while players with positions over $10,000 are almost all actively managing their positions.

HyperBot

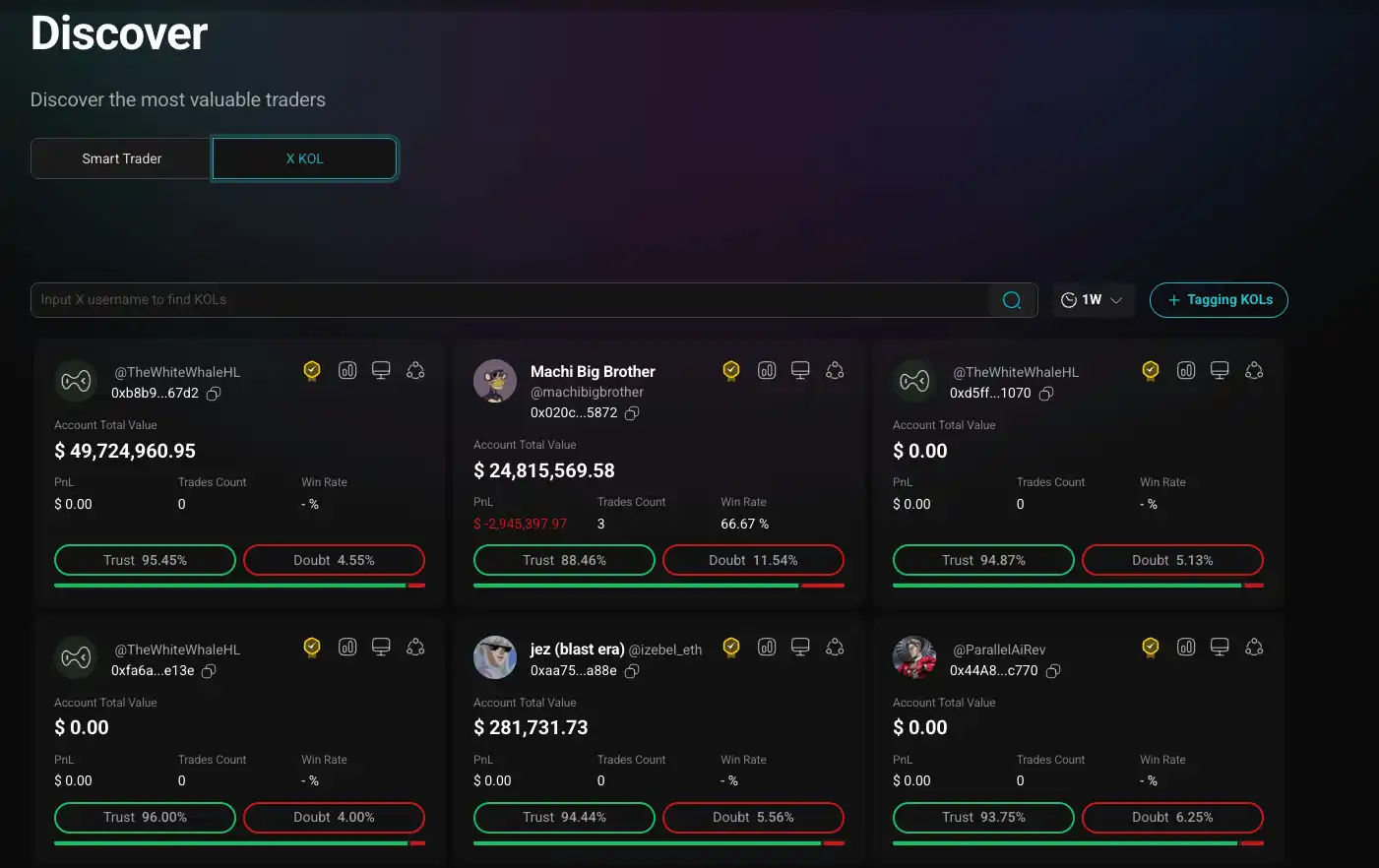

In terms of tracking smart wallets, Hyperbot is definitely a recent hotspot. Originally a tool for the Hyperliquid ecosystem, it has since expanded to the Aster platform. More importantly, it can push real-time alerts on large holder position changes and capital flow, allowing ordinary users to capture the movements of smart money immediately.

The smart money exploration page provided by HyperBot is similar to the experience of meme players on GMGN or Axiom.

The Hyperbot token, BOT, has been launched on Binance Alpha. Due to the recent popularity of Aster and the start of the second airdrop event, the price trend of HyperBot's token $BOT has also been quite favorable, with a current market cap of $15 million and an FDV reaching $1.4. For users observing capital behavior, Hyperbot has become a relatively complete assistant.

Further Reading: 《To Airdrop $700 Million, How to Best Brush Aster S2》

Arbitrage

As more PerpDex platforms emerge, price differences and interest rate discrepancies between platforms create a certain degree of arbitrage opportunities. With the prevalence of PerpDex, corresponding data platforms have also begun to consider this in their data collection.

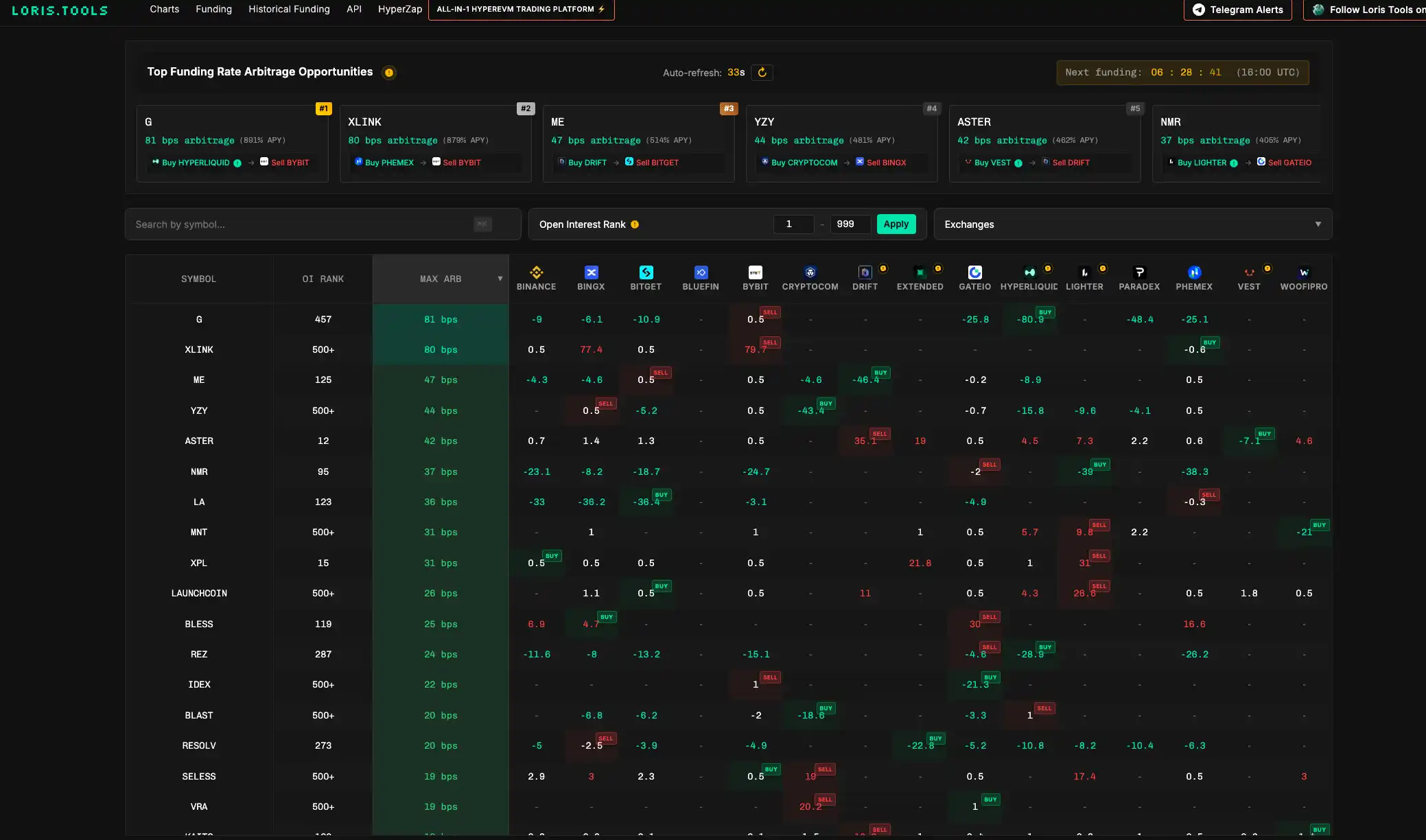

Loris Tools

Loris Tools is a funding rate arbitrage dashboard and market data platform developed by Loris, the founder of HyperZap. The data is relatively clear, such as the most needed OI, the maximum arbitrage space in basis points, and which platforms to operate on. The overall data updates automatically every 60 seconds and features a scrolling bar for the best "arbitrage opportunities."

Users can set up TG BOT alerts in addition to tracking on the dashboard. However, different platforms have different settlement times, and users need to have a good understanding of these platforms' settlement mechanisms to use them effectively.

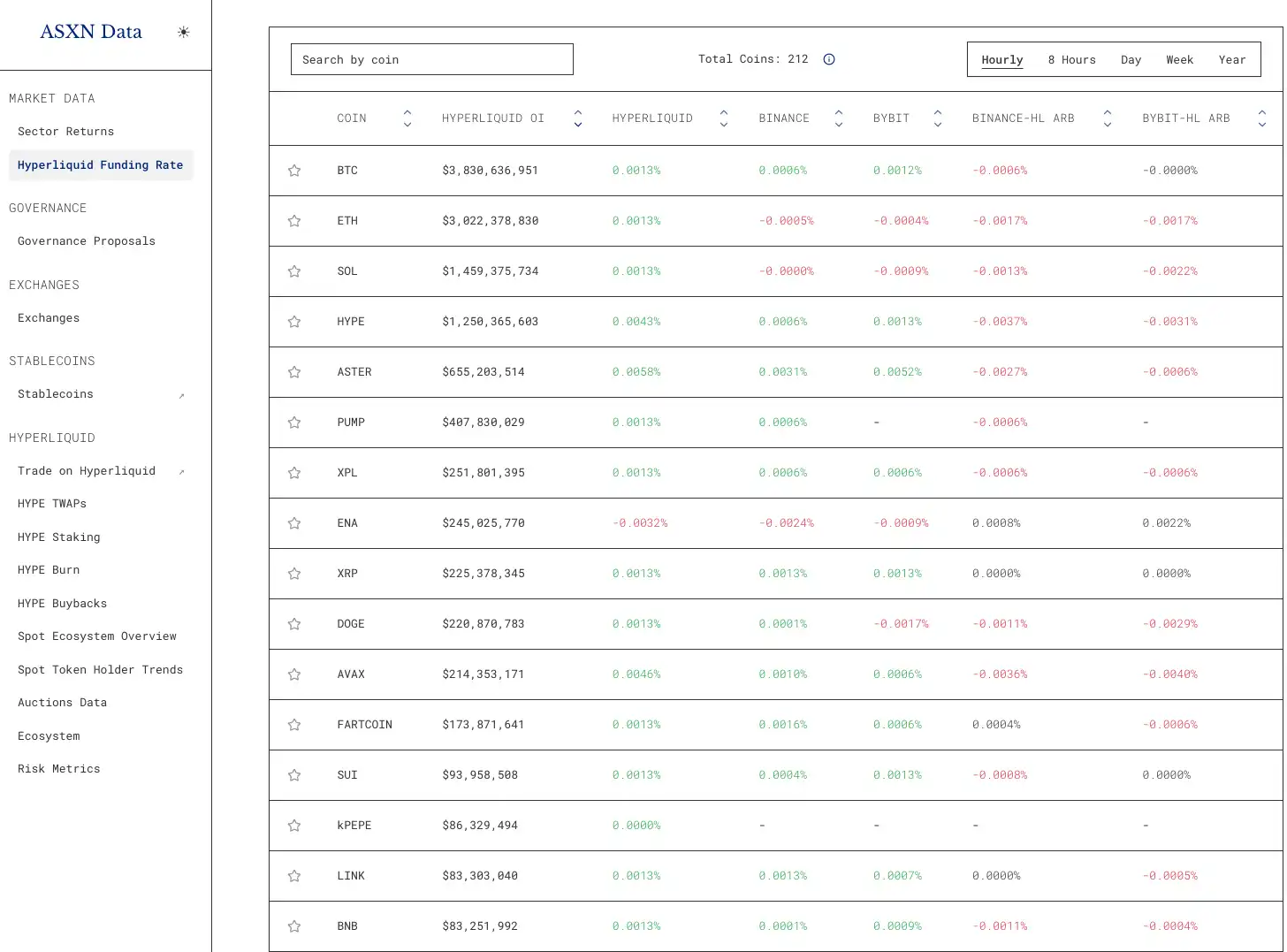

ASXN

While ASXN may not be as comprehensive as Loris in the funding rate data sector, its functionality goes far beyond that. ASXN DATA is a dashboard created by crypto researcher ASXN, providing almost a complete set of Hyperliquid data dashboards.

Users can view the overall trading situation in the Ecosystem Overview interface and delve into the liquidity risks of specific tokens in Risk Metrics, among other features. Furthermore, the TWAPs page provides a clear view of the distribution and status of validators. These tools consolidate originally scattered on-chain information into actionable data panels, providing strong support for traders with in-depth needs. Unfortunately, the current dashboard's PerpDex data only includes data from the Hyperliquid ecosystem.

Data Dashboard

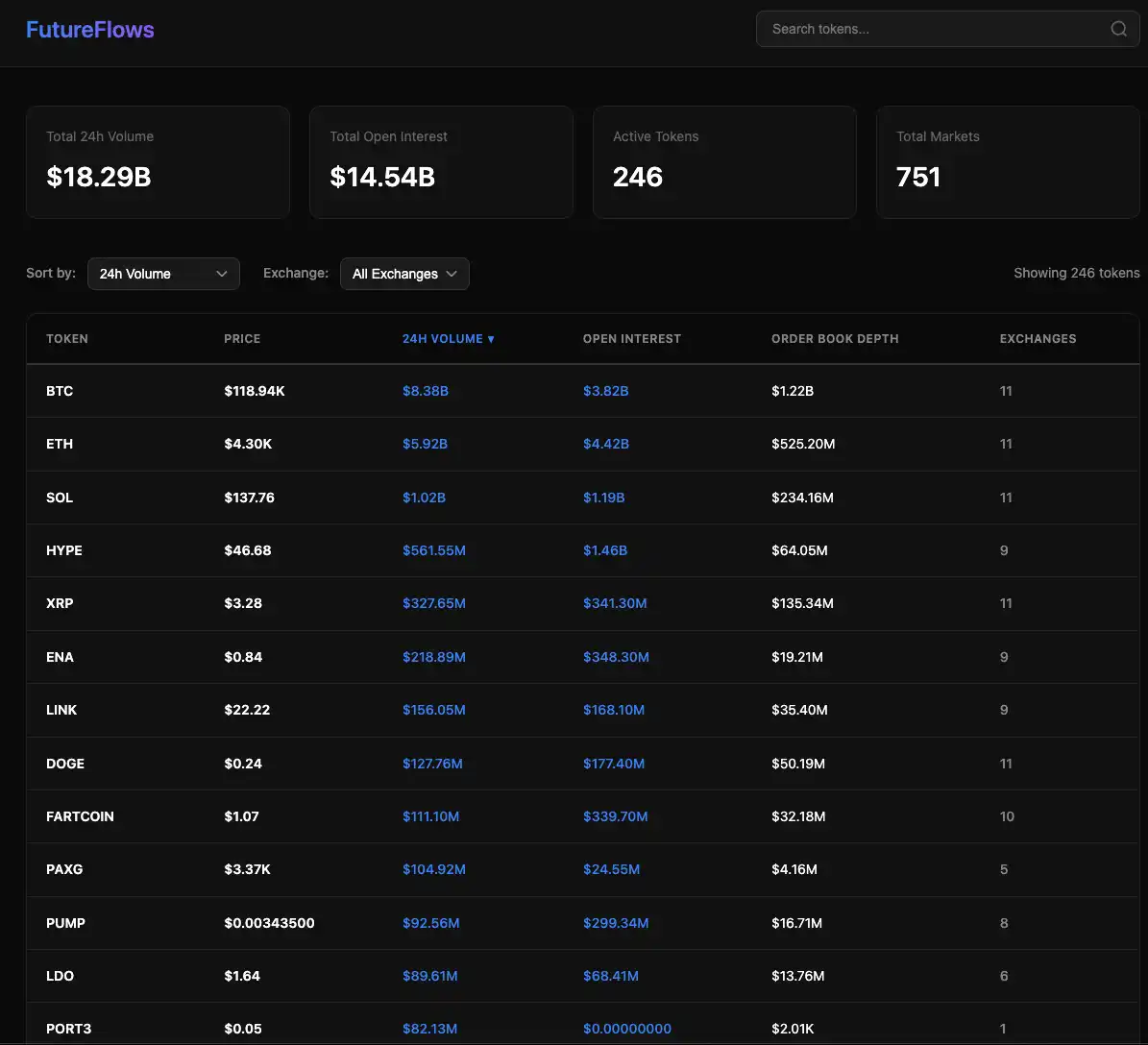

FutureFlows

Unlike Coinglass's heatmap of token trading volumes, Future Flows provides more holistic data. It collects most of the PerpDex data available on the market, allowing discussions about the overall on-chain trading situation of most tokens.

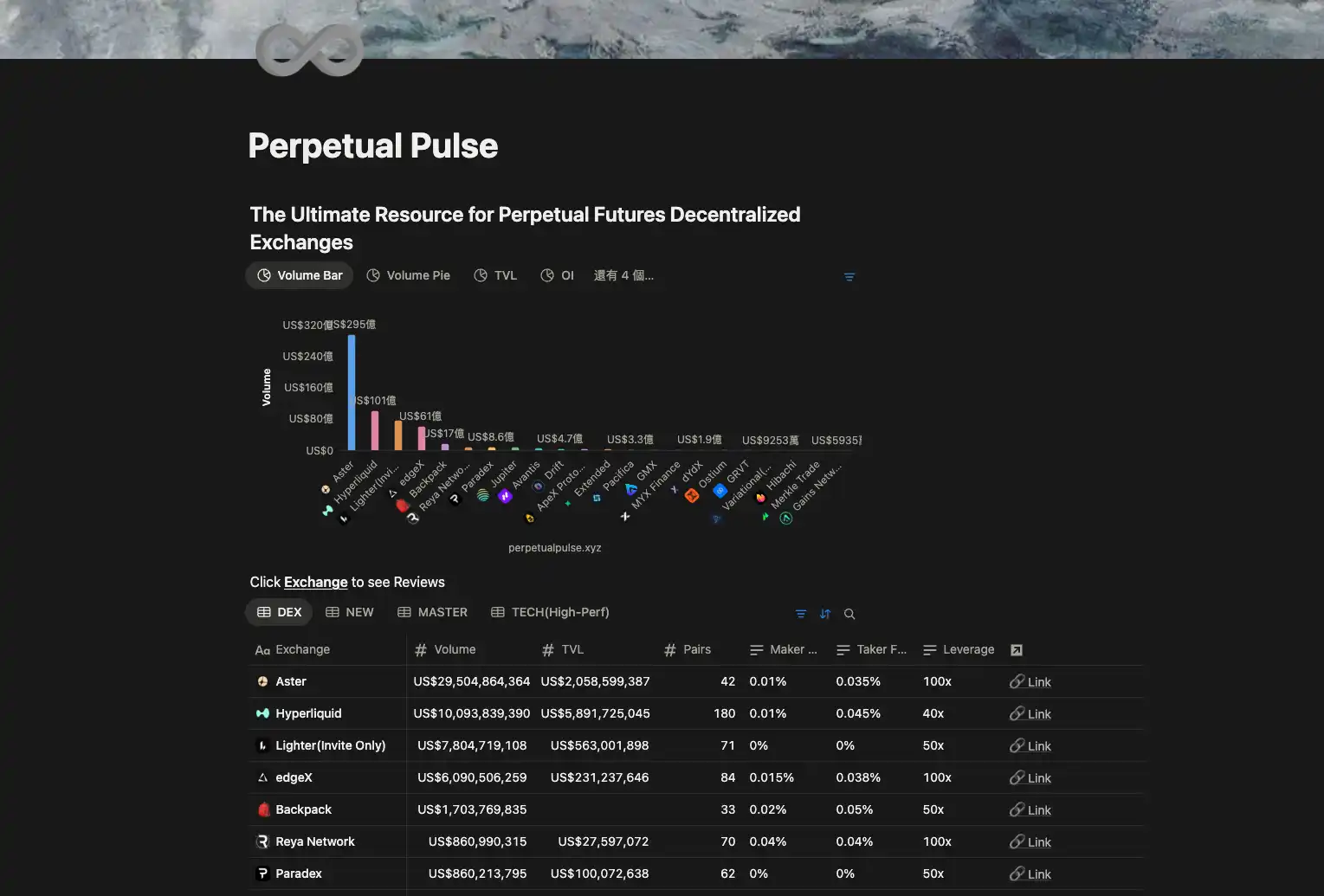

Perpetual Pulse

Perpetual Pulse is a PerpDex data dashboard created by hansolar, a member of the Lighter team, providing similar overall market data monitoring functions. It tracks multi-chain contract trading volumes, TVL, and OI, and can update market changes in real-time.

Traders can use this platform to view trading volume trends, capital flows, and other information to assist in judging market sentiment and hot sectors.

Trading Tools

Pear Protocol

Pear Protocol is a contract trading aggregation tool that supports the SYMM (Symmetric Network) and Hyperliquid ecosystems. It has already accumulated nearly $1 billion in trading volume.

Users can access the contract markets of both networks simultaneously through the Pear platform, eliminating the hassle of manually switching wallets and exchanges. It is suitable for active derivatives traders. Its biggest product advantage is the ability to open both long and short positions on two trading pairs for hedging, and it has opened Pair Markets to update suitable trading pairs for hedging in real-time.

The image shows that in the Hyperliquid environment, the BNB/FTT pair can be leveraged up to 3x, while in the SYMM environment, trading pairs like BTC/ETH can be leveraged up to 54x.

Currently, Pear Protocol's platform token $Pear is issued on Arbitrum, with a current market cap of $4.2 million and an FDV of $15 million.

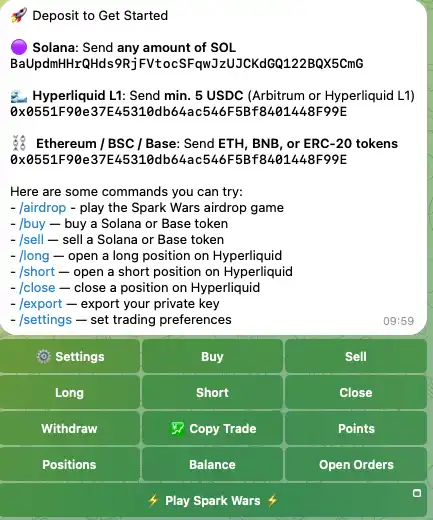

Spark

Spark is a TG trading terminal dedicated to multi-chain trading. Recently, it has started supporting operations such as opening and closing contracts on multiple PerpDex platforms and following smart wallets, greatly simplifying the steps for switching between different PerpDex platforms with its one-stop interface.

This tool currently covers several mainstream on-chain PerpDex platforms, including Hyperliquid and Aster, and also provides real-time quotes for deep order books, funding rates, and more. Although the advantages of TGBOT are not as pronounced now with the widespread adoption of mobile platforms, it still brings convenience for multi-platform trading.

Live Streaming Platforms for PerpDex?

Recently, at a SideEvent (Perp-Dex Day) during KBW, traders live-streamed trading on four major PerpDex platforms, which gained significant attention and was widely interpreted as "Koreans have started treating trading as a live streaming game."

In terms of reach, the event's organizers par_D & Magon were undoubtedly quite successful, which also indirectly indicates that this trading state seems to have been accepted by most crypto players. During the previous boom in live streaming, aside from various abstract streamers, live trading was the most popular, accompanying many late-night "dog fighters" in inadvertently finding some golden dogs.

FLIPgo

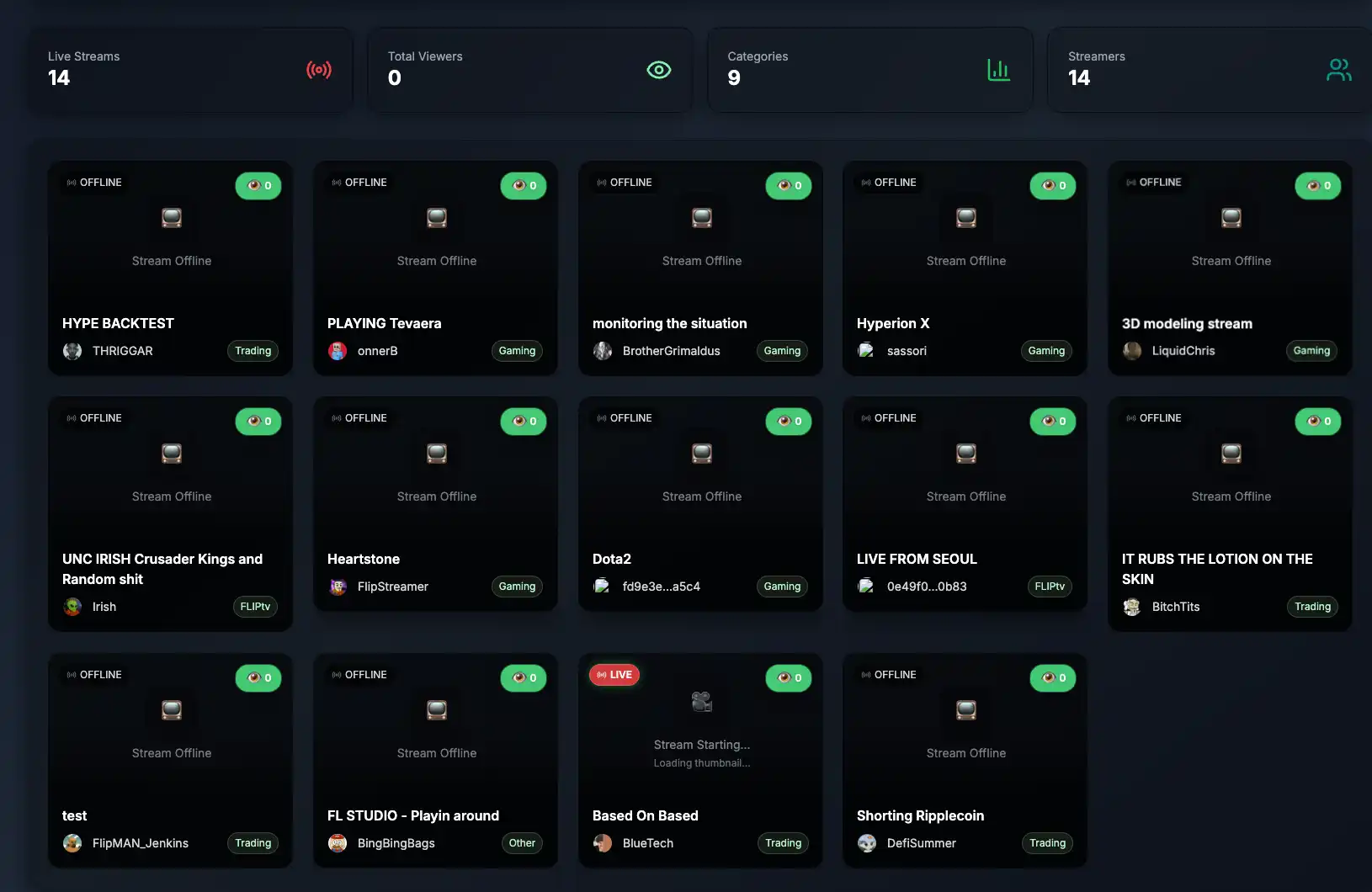

In addition to Solana, Base, and BSC, there is also a live streaming platform on Hyperliquid. Although FLIPgo has not yet fully formed in terms of the number of live streams and product UI, if it can excel in the vertical track of PerpDex, it seems to have considerable potential as an "e-sports platform."

Naturally, FLIPgo also has its own live streaming token $FLIP, which is currently issued on HyperEVM, with a market cap quoted at $1.5 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。