原文标题:《为什么 HEMI 能绕过交易所「新手村」?》

原文作者:Nicky,Foresight News

2025 年 9 月 23 日,Binance 官方宣布模块化 Layer2 协议 Hemi Network(HEMI)上线 Binance HODLer 空投计划,并于当晚 20:00 开放现货交易。

此前 HEMI 虽于 8 月 29 日登陆 Binance Alpha 及合约市场,但现货仅上线 Gate、MEXC 等平台。市场数据显示,HEMI 代币价格从 8 月 29 日的 0.0148 美元升至 9 月 21 日的 0.12 美元,30 日内涨幅达 710%。(BlockBeats 注:在 23 日晚上线 Binance 现货后,HEMI 短时冲高超 0.17 美元,现已回落至 0.148 美元,但较前期价格仍大幅上涨。)

根据项目官方数据,目前 Hemi 网络总锁仓价值超过 12 亿美元,比特币安全交易量达到 690 万笔。社区成员数量为 41.1 万人,经过验证的真实用户数为 10 万,生态系统协议超过 90 个。

融资历程

Hemi Network 已完成两轮主要融资。2024 年 9 月,项目获得 1500 万美元融资,由 Binance Labs、Breyer Capital 和 Big Brain Holdings 共同领投,多家加密货币行业投资机构参与。

2025 年 8 月,项目再次完成 1500 万美元融资,由 YZi Labs(前 Binance Labs)、Republic Digital 和 HyperChain Capital 领投,其他现有投资方继续跟投。两轮融资总额达到 3000 万美元。

值得注意的是,YZi Labs(前 Binance Labs)在两轮融资中均担任领投方。

技术架构

Hemi Network 将自己定位为模块化协议,旨在整合比特币和以太坊两大区块链的核心能力,将比特币和以太坊视为统一系统的组成部分,而非相互独立的生态系统。

该协议的核心是 Hemi 虚拟机(hVM),这是一个将完整比特币节点嵌入以太坊虚拟机的技术方案,使智能合约可直接访问比特币链上数据(包括 UTXO、Ordinals 铭文等)。这一设计解决了传统跨链方案依赖合成资产的安全隐患。通过 Hemi 比特币工具包(hBK),开发者可以访问 hVM 的比特币互操作性功能,在保持以太坊开发熟悉度的同时充分利用比特币的能力。

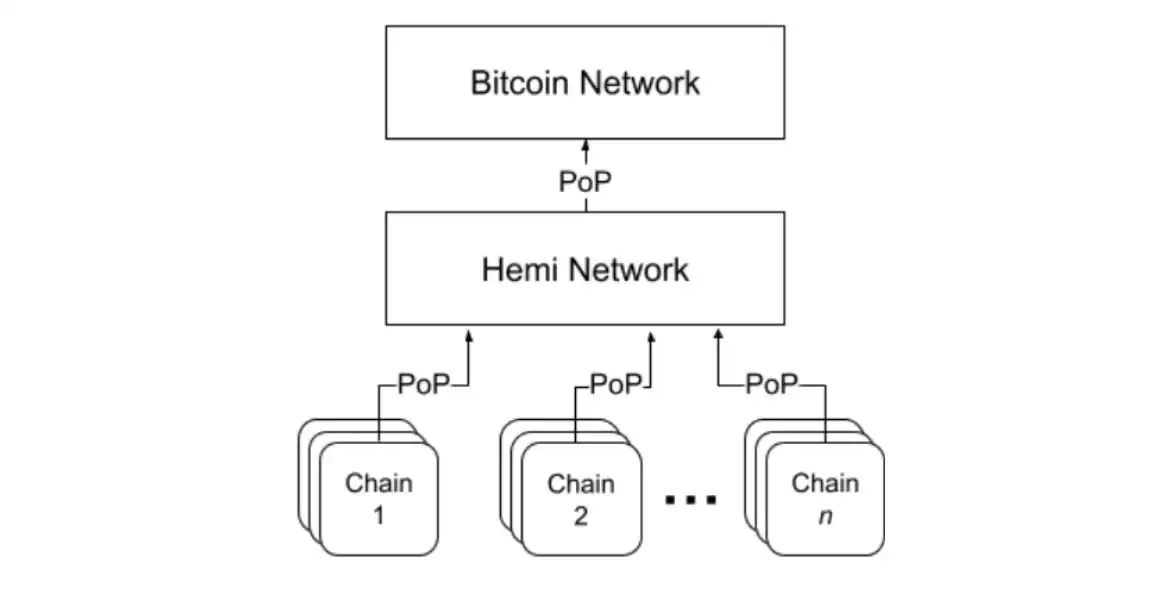

共识层采用联合创始人 Maxwell Sanchez 设计的 Proof-of-Proof(PoP)机制:轻量级矿工将 HEMI 状态数据锚定至比特币链,交易在 9 个比特币区块确认后(约 90 分钟)获得不可逆的最终性。攻击者需同时控制比特币 51% 算力与 HEMI 网络才可能发起重组,其成本远超潜在收益。

与传统的封装比特币方案不同,Hemi 通过隧道系统实现比特币资产在不同链间的安全转移,不依赖中间人或封装代币。

团队构成

Hemi Network 由三位在区块链领域具有深厚经验的创始人领导。Jeff Garzik 作为联合创始人兼首席工程负责人,曾是比特币核心开发者,在比特币早期开发阶段贡献了五年时间。他还在 Red Hat 工作十年,对 Linux 内核开发有重要贡献。

联合创始人 Maxwell Sanchez 担任首席架构师,是 Proof-of-Proof 共识协议的共同发明者,拥有丰富的区块链安全经验。他早在 2011 年就进入区块链领域,曾推出使用后量子密码学的测试网。

第三位联合创始人 Matthew Roszak 是区块链投资者和企业家,作为 Bloq 公司董事长,他曾早期投资以太坊、Coinbase 和 Kraken 等项目。在 Hemi 项目中负责战略和生态发展。

团队现有成员约 30 人,多数具有比特币、以太坊和 DeFi 领域的技术背景,涵盖工程、共识协议创新和投资等多个专业领域。

代币经济学

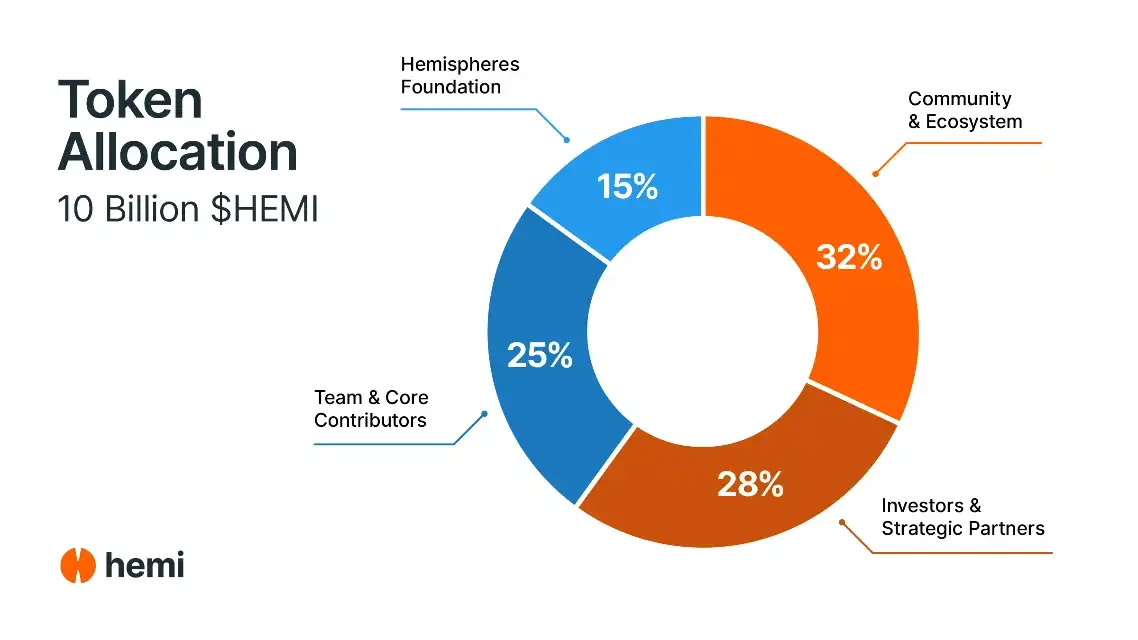

HEMI 代币总供应量为 100 亿枚,分配方案包括团队及核心贡献者 25%,Hemispheres 基金会 15%,社区及生态 32%,投资人及战略伙伴 28%。代币主要用于质押、治理、交易费用和通过 PoP 共识保障网络安全。

社区热议

HEMI 的价格韧性引发了社区的广泛讨论。2025 年 9 月 22 日,主流加密货币价格普遍回调,但 HEMI 却在下探超 20% 后强势回升,当日收盘跌幅仅 2.12%。同日,HEMI 在 Binance Alpha 的成交量达到历史新高,单日交易额超 14.7 亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。