Today's homework should actually be called Aster. The two most talked-about topics on Twitter are one, Hu Chenfeng, and the other is Aster. Even when my friends and I were having dinner, we mentioned Aster countless times. I still held back from discussing this topic; it was too uncomfortable. Let's talk about $BTC instead. Although liquidity is poor over the weekend, and Bitcoin had a slight decline on Friday, I am a bit worried about whether there will be any surprises over the weekend.

At least for now, it seems fine. Not only is there no surprise with BTC, but Trump hasn't caused any major issues aside from H-1B. I think the H-1B situation could potentially cause some turbulence in the U.S. stock market on Monday, as a significant portion of high-tech talent in tech companies comes from H-1B visas. While we can try to avoid going abroad, it's impossible to completely eliminate such situations, which could increase company costs. More importantly, there's the uncertainty brought by Trump's policies.

Uncertainty is something the stock market fears. The previous tariffs were like this, and now the H-1B issue will affect many tech companies. In 2020, Trump also restricted H-1B and other work visas, leading to a short-term decline in tech stocks, but that was quickly overshadowed by the high volatility during the pandemic. So this time, there is a possibility it could impact the U.S. stock market, and the correlation between U.S. stocks and cryptocurrencies, especially tech stocks and cryptocurrencies, is higher, which could also affect Bitcoin's trend.

Of course, this is just a possibility. If you decide to short now and end up losing money on Monday, don't come to me for rights protection. I'm only talking about probabilities. I'm already considering closing 20% of my long positions before the futures market opens on Monday.

Interestingly, I remember the golden card used to be $5 million, but now you can immigrate to the U.S. (get a green card) for just $1 million. Many suddenly wealthy friends might be tempted. If you're really interested, what you need to do now is figure out how to comply with KYC for your $1 million. This is also the original intention behind my ideas for #BTCFi and #DeBroker.

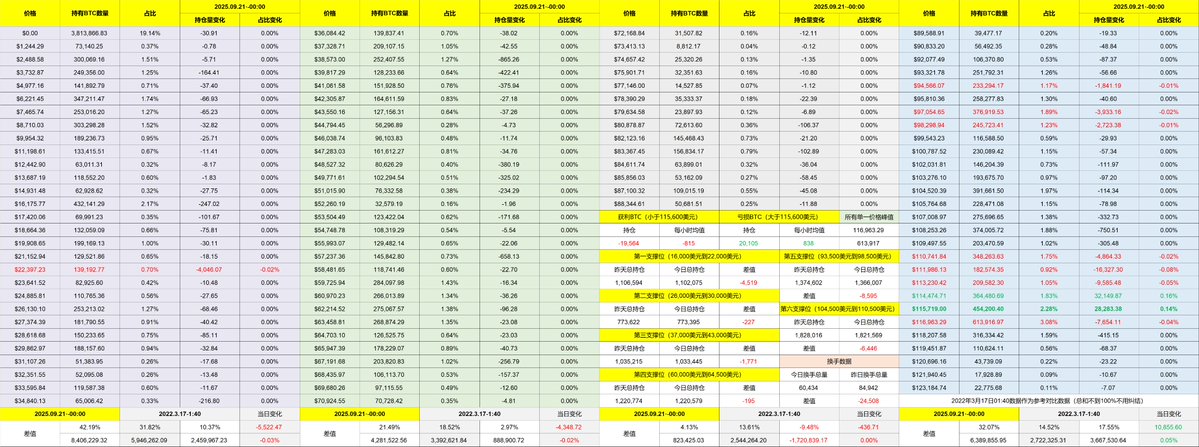

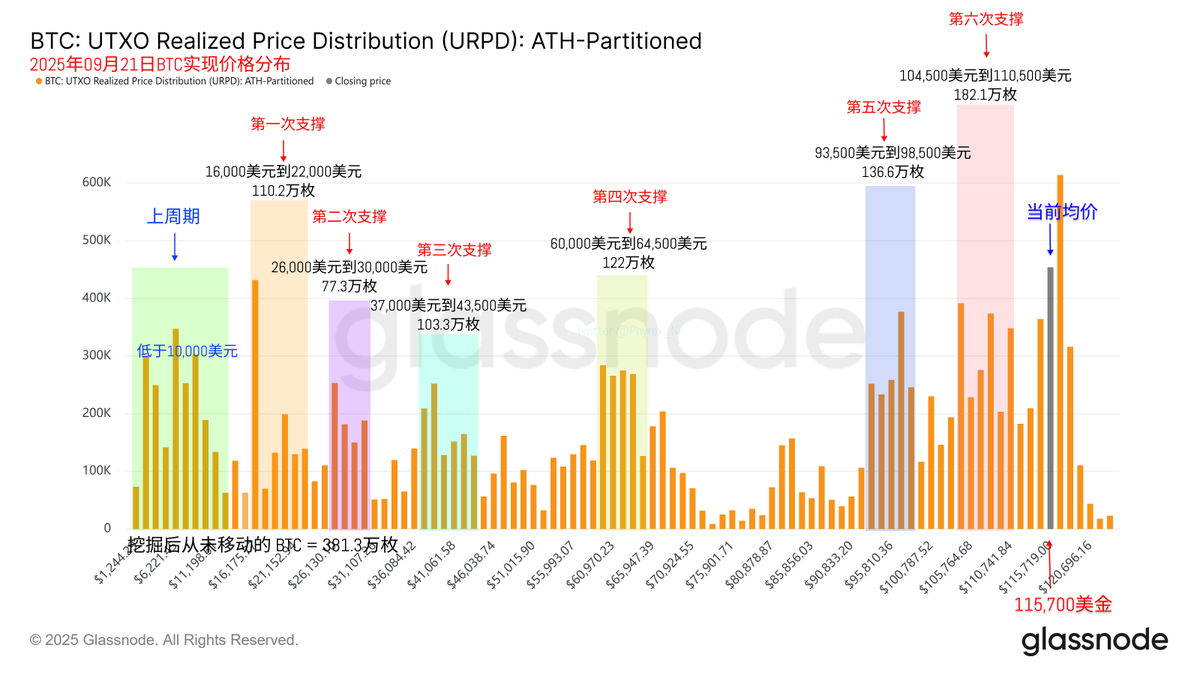

Looking back at Bitcoin's data, the turnover rate has significantly decreased over the weekend, which is normal. I mention this every week; I've said most of what needs to be said. On Monday, we will see the trend of the U.S. stock market, which will indicate the attitude of international and U.S. investors towards Trump's H-1B policy. My view is not to gamble, as this is not the main contradiction in the U.S. right now. Although there may be some twists and turns, these issues cannot be resolved before the interest rate game.

There's not much else to say. I hope Sunday goes smoothly as well. I've been feeling much better lately, and if all goes well, I should be able to return to a near-normal working state by next Monday. But it will probably only last a week, and then there's Token2049, which I expect will keep me busy for another week.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。