昨天我们在晚上消息出来前讲到,多空的胜负已分,并且看后市会涨。然后行情一路下跌,到消息出来了才反拉上来,然后昨天收了一个长下影线,符合我们后市会涨的预测,同时今天大饼走势强势,已经突破了前高,所以我们认为多军反攻时刻来临了。

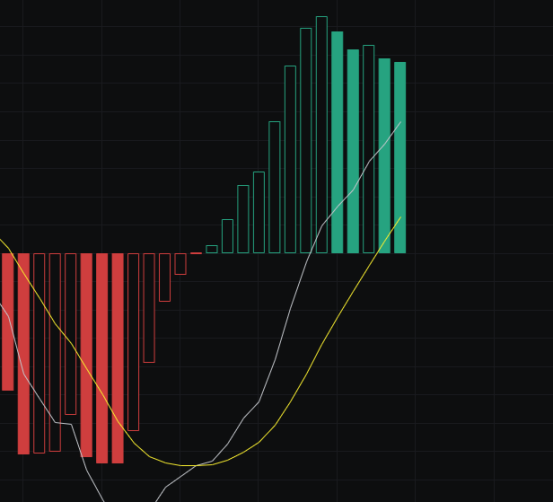

Macd上看,这两天量能没有多大变化,一直阴阳交替,但是币价却是真实的抬高了的,同时慢线上穿零轴完成,一切都在向着多军的方向前进,这里没有理由看空。

Cci上看,随着今天的上攻,目前cci来到了60附近,已经脱离了零轴区域,所以在这里更倾向于向上攻。

Obv上看,目前快线在慢线上方站稳了,同时我们一直强调的慢线也拐头向上了,所以我们继续看多的思路保持不变。

Kdj上看,目前已经来到了超买区域了,行情还在维持着多头情绪,要想看跌先要看到kdj掉头。

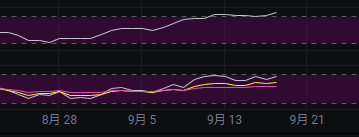

Mfi和rsi上看,目前mfi已经在超买区域运行了近一个周了,这一个周内的两次下跌都没有让mfi跌下来,所以行情还是很强势的,rsi也处于强势区域内。

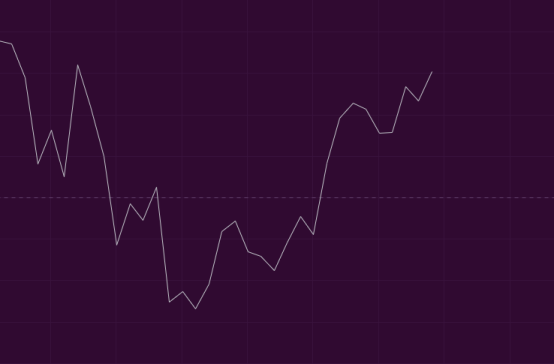

均线上看,60线连续6天对行情进行了支撑,这里形成的支撑就为有效的,同时我们这几天一直强调的30线也开始拐头向上,均线上也是看多。

Boll上看,随着今天的拉升,上下轨走势开始同步,前面几天我们担心的诱多嫌疑得到解除。目前上下轨都在向上,有发展为上升通道的可能,后续要想走上升通道的走势,需要连续的阳线来形成,中间穿插一点小阴线不影响,同时收的阳线不能太大,最好别超过1%。

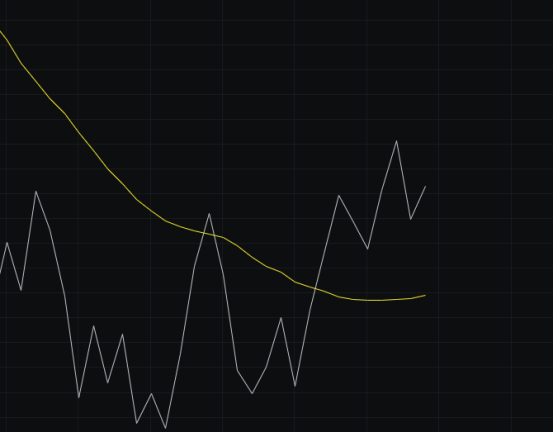

综上:行情的走势大体在我们预测的走势范围内,后市继续看涨,但可能会采取小碎步的走势上攻。今天多军的目标是收个0.5%左右的阳线就算完成,大饼下方支撑116200-115100,上方压力118200-119000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。