在交易策略中,止盈和止损是风险控制的核心。而移动止盈(Trailing Stop)作为一种动态止盈方式,用于在保护利润的同时,让头寸保持灵活性。在本文中,我们将通过自定义指标代码深入探讨移动止盈的原理、应用以及实战效果,帮助大家更高效地运用移动止盈掌控市场。

一、为什么需要移动止盈

普通的固定止盈价格比较僵化,可能无法应对市场的动态波动。这就导致:

利润锁定不足:价格上升后快速回撤,利润被大幅回吐。

错过更多机会:价格强势突破,固定止盈点频繁导致出局过早。

适配波动性市场:市场行情变化较大时,移动止盈能跟随趋势,而不是被设定的固定值束缚。

因此,移动止盈通过动态调整止盈点位,帮助我们在捕捉趋势延续利润的同时,及时保护当前收益,是一种更为灵活的止盈方式。

二、移动止盈具体操作方式

移动止盈的核心机制是让止盈点随价格变化而动态调整,目前常见的操作方式包括:

1 .固定点差模式(定量法):

根据当前价格设置一个固定偏移值(例如10%或20美元)。当市场价格沿趋势方向移动时,止盈点随之上涨或下跌。

2. 基于技术指标的动态调整(定性法):

自动根据技术指标结果,如均线、均幅指标(ATR)**等,将止盈触发位置与市场波动性挂钩。例如,用ATR的2倍值设置防护线,使止盈点更加适应不同波动情况下的市场节奏。

3. 趋势线或支撑压力位法:

根据K线结构中的趋势线或关键技术位定义进场点后的止盈位置,并随趋势和支撑压力的变化动态调整。

本期的自定义指标·移动止盈,我们探讨的是定量法:

具体操作:

盈利10%开启移动止盈,回撤到最高点盈利的80%执行止盈

三、移动止盈信号效果

图 OKX-BTCUSDT永续合约 4小时周期

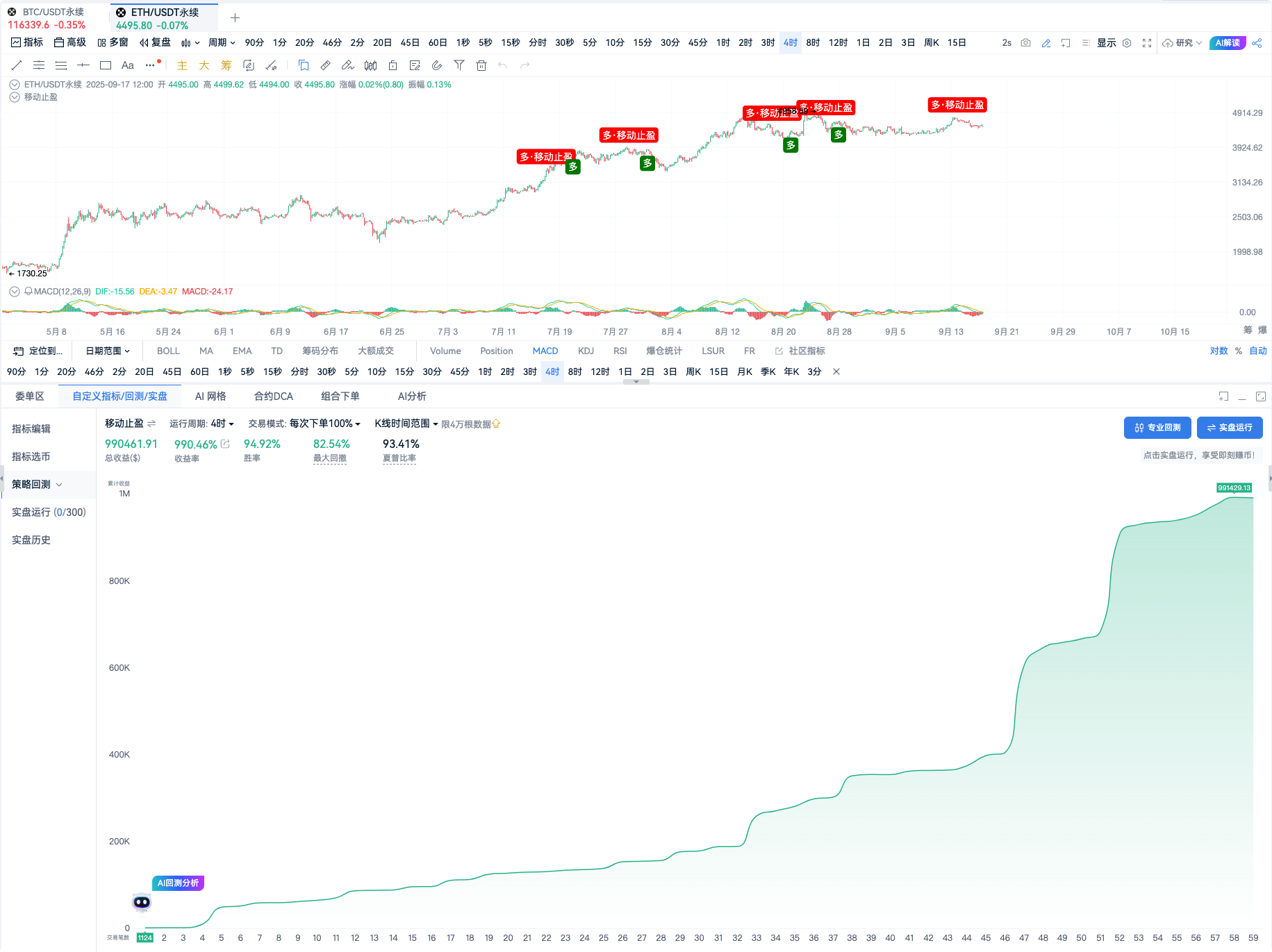

图 OKX-ETHUSDT永续合约 4小时周期

四、移动止盈回测

图 OKX-BTCUSDT永续合约 4小时周期

回测亮点:

收益率:1076.55%

胜率:92.06%

图 OKX-ETHUSDT永续合约 4小时周期

回测亮点:

收益率:990.46%

胜率:94.92%

五、指标源码

// @version=2

// 计算MACD指标

[dif, dea, macd] = macd(close, 12, 26, 9, `EMA`, `EMA`);

// 定义金叉,即DIF线上穿DEA线

golden_cross = crossup(dif, dea);

var check_profit = 0

var checke_profit_max = 0

var checke_profit_profit = 0

// 止损比例

stop_loss = 0.07

// 止盈

active_trail = 0.01 // 盈利10%开启移动止盈。计算盈利时基准价格计算是以信号发生时的最新收盘价作为标准,与实际下单时(信号发生即开市价下单)会有一定滑点

drawdown = 0.5 // 回撤到最高点盈利的80%执行止盈

var long_signal = false

var long_count = 0

var long_price = 0

// 计算止盈止损-多

var active_long_profit_monitor = false

var long_max_profit = 0

var active_long_drawdown_order = false

var stop_long_monitor = false

if(long_count > 0){

profit = (close - long_price) / long_price

if (profit > long_max_profit) {

long_max_profit := profit

}

if (profit > active_trail and long_max_profit > active_trail) {

active_long_profit_monitor := true

}

if (active_long_profit_monitor) {

back = profit/long_max_profit

if (back < drawdown and profit > 0) {

active_long_drawdown_order := true

}

check_profit := back

checke_profit_max := long_max_profit

checke_profit_profit := profit

}

// 计算止损

if(profit <= -1 * stop_loss){

stop_long_monitor := true

}

}else{

active_long_drawdown_order := false

active_long_profit_monitor := false

long_max_profit := -999999999

long_price := 0

stop_long_monitor := false

}

exitLongPercent(active_long_drawdown_order, id = `long_take_profit`,price=`market`, percent=100)

plotText(active_long_drawdown_order, title=`active_long_drawdown_order`, text = `多·移动止盈`, refSeries = high, bgColor=`red`, color=`white`, fontSize=14, placement=`top` ,display=true);

if (active_long_drawdown_order) {

long_count := 0

long_price := 0

}

if(golden_cross and long_count == 0){

long_signal := true

long_count := 1

long_price := close

}else{

long_signal := false

}

plotText(long_signal, title=`long_signal`, text = `多`, refSeries = high, bgColor=`green`, color=`white`, fontSize=14, placement=`bottom` ,display=true);

enterLong(long_signal, price=`market`, amount=1)

六、综合

移动止盈作为一种智能化动态风险控制手段,在趋势行情中效果尤为显著。相比传统固定止盈,它不仅提供了保护利润的灵活性,还可以最大化捕捉趋势延续的收益。然而,在实际使用过程中,需根据市场波动性、策略风格等因素合理设置偏移值,并通过回测与调整优化效果。

总结来说,移动止盈是一个强大的风险管理工具,在交易系统设计中不可忽视。希望本文的介绍和源码示例能为你的交易策略研究提供启发和实用参考!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。