9 月 17 日,美联储宣布降息 25 个基点,标志着货币政策再次出现方向性转折。这是继 2024 年底三次降息后的又一次宽松举措,而在此之前,美联储在 2025 年已连续五次选择按兵不动。此次决议的出台,背后是多重因素叠加的结果:美国劳动力市场出现明显降温,8 月就业增长停滞,前期数据遭大幅下修,失业率升至 4.3%,使市场愈发确信「充分就业」的支撑正在减弱。与此同时,虽然通胀仍高于 2% 的目标,8 月同比维持在 2.9% 左右,但市场普遍认为关税带来的物价扰动只是暂时现象。在这种背景下,美联储似乎正将就业稳定置于抑制通胀之上,并在一定程度上回应来自总统特朗普的持续降息压力。

值得注意的是,这场政策博弈不仅是货币政策的转变,更揭示了美联储内部前所未有的分歧。在 7 月的议息会议上,就已有两位委员罕见地投下反对票,这是自 1993 年以来的首次;与此同时,特朗普对鲍威尔的频繁施压更让这场政策调整充满火药味。市场普遍认为,此次降息不仅将影响未来的金融市场走势和政策预期,还可能重塑全球资本流动格局,成为本轮货币周期的关键拐点。

如何看待本次降息

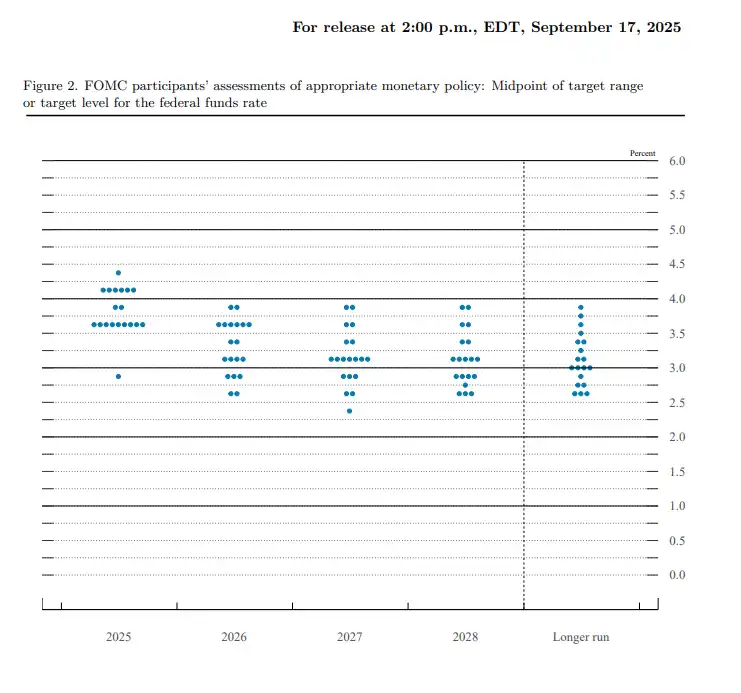

美联储本次 25 个基点的降息,更多是一种「风险管理式降息」,而非开启激进宽松的信号。点阵图显示,2025 年利率预期中值从 3.9% 下调至 3.6%,意味着在已降息一次的基础上,今年还有 50 个基点的空间,大概率会在 10 月和 12 月再各落下一刀。截止目前,10 月美联储再次降息 25 基点的概率为 87.5%。到了 2026 年和 2027 年,预期中值继续下调至 3.4% 与 3.1%,强化了市场对中长期温和宽松的判断。但长期利率锚仍稳在 3.0%,说明美联储心中的「中性利率」并未改变。

这背后传递的信号十分微妙:一方面,通胀风险依旧偏高,8 月 PCE 整体同比或升至 2.7%,核心 PCE 仍在 2.9%,官员们不会贸然大幅放松;另一方面,劳动力市场的下行风险促使他们必须提前布防。于是,鲍威尔团队选择了「小步慢走」,通过逐次会议决策与预期管理来引导市场,而不是让政策出现大幅摇摆。

政治角度上,这次利率决议也可视作鲍威尔保守派对特朗普阵营的一次「防守反击」,维护了美联储的「独立性」。除新任美联储理事米兰仍执行「总统意志」外,多数官员选择了理性与抱团,仅在点阵图上释放些许空间。短期来看,市场或许因连降两次的可能性而得到安抚,但从结果上看,特朗普在这回合与美联储的博弈中显然落了下风。

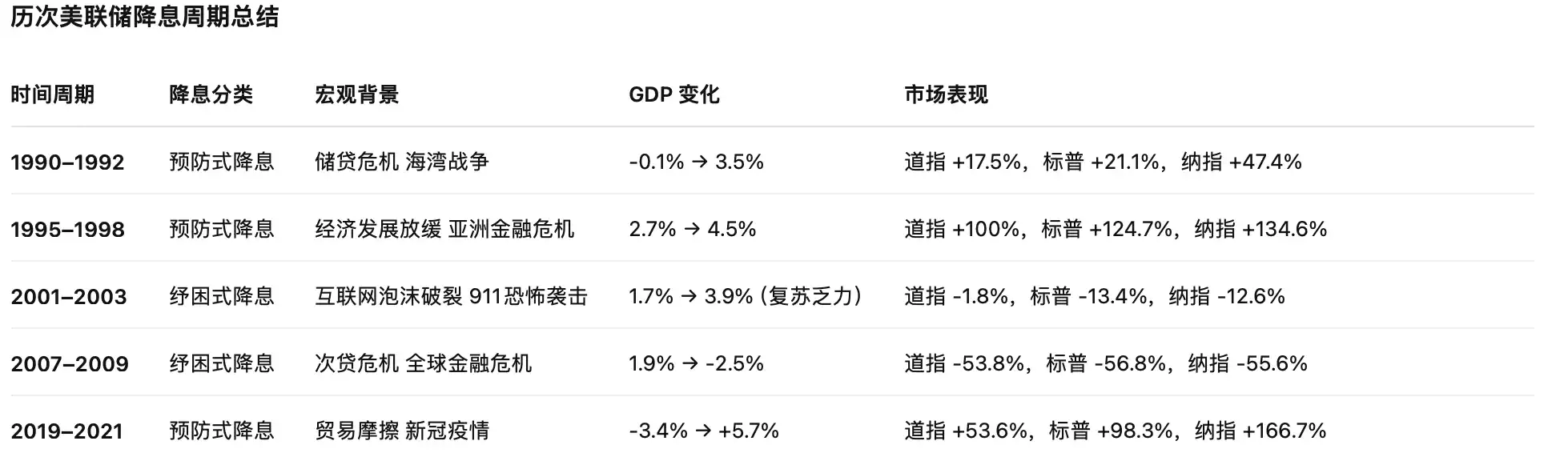

历史上的降息:降息周期下的市场表现

从历史复盘来看,美联储的降息大体可以分为两类:预防式降息与纾困式降息。1990、1995、2019 年的降息属于前者,发生在经济尚未全面衰退之前,更多是为了对冲潜在风险,往往能够为市场注入新一轮增长动能;而 2001、2008 年的降息则是在金融危机的重压下被迫启动,最终伴随着市场的剧烈下跌。放到当下,美国劳动力市场疲软,关税和地缘政治持续制造不确定性,但通胀已有缓和迹象,整体环境更接近「预防式降息」而非危机背景。也正因如此,风险资产才得以在今年延续强势行情,比特币和美股双双创下历史新高。

相关阅读:《降息再近一步,9 月后市场会开启狂暴牛市吗?》

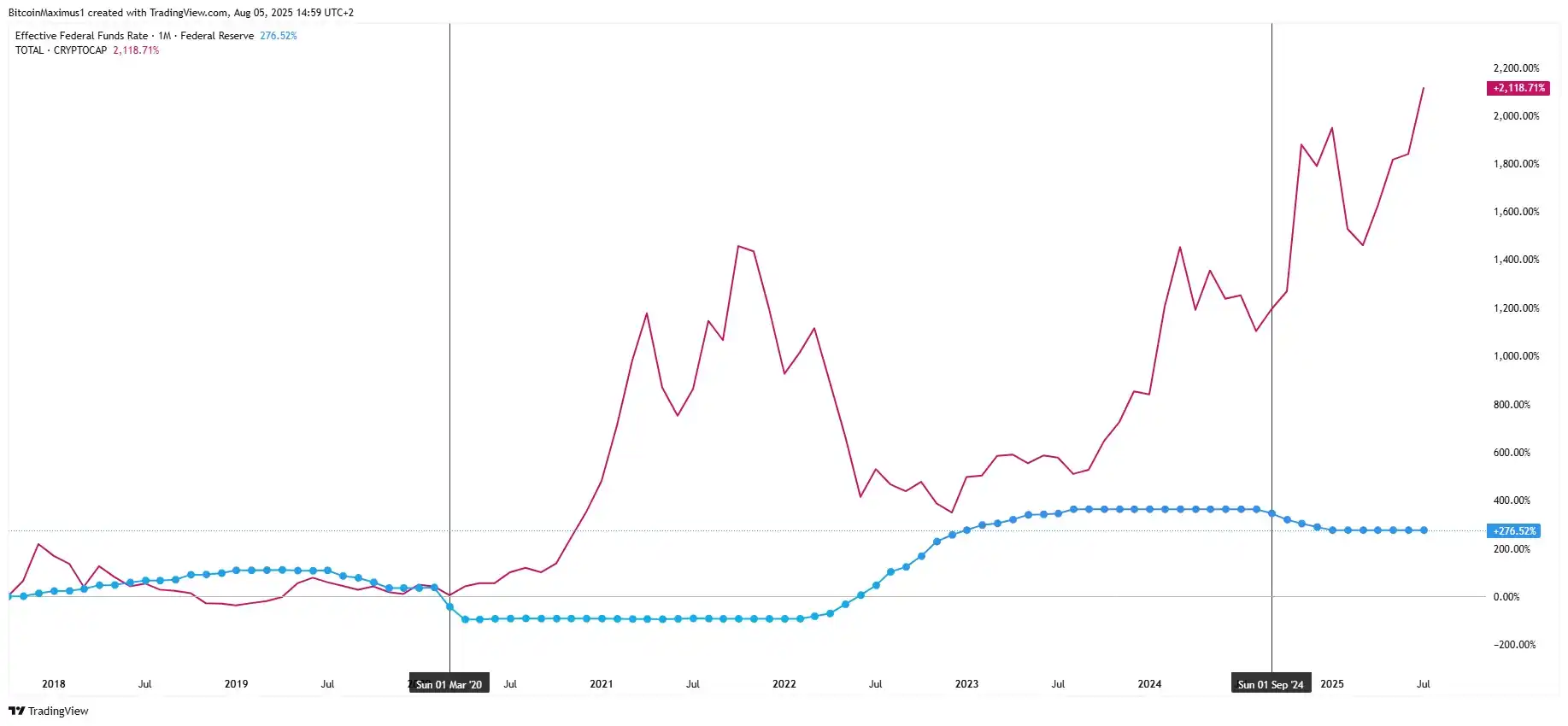

如果将降息路径与加密货币市值并排绘制,不难发现两者的高度相关性:利率下行往往与加密市场的牛市周期同步。2020 年和 2024 年的降息,均标志着加密货币抛物线式上涨的起点。这一规律再次印证,利率下降对加密货币等风险资产具有显著的正面影响。

机构如何看待降息后的行情

Coinbase 在研报中指出,加密牛市在 2025 年第四季度初仍有延续空间,背后动力来自充裕的流动性环境、友好的宏观背景以及支持性的监管动态。比特币被认为是最大受益者,其表现有望持续超越市场预期。除非能源价格剧烈波动、进而推升通胀压力,否则干扰美国货币政策路径的即时风险相当有限。同时,数字资产财库(DATs)的技术需求仍将为加密市场注入增量资金。尽管「九月魔咒」长期困扰市场——比特币在 2017 至 2022 年连续六年九月兑美元下跌,但这一季节性规律已在 2023 和 2024 年被打破。

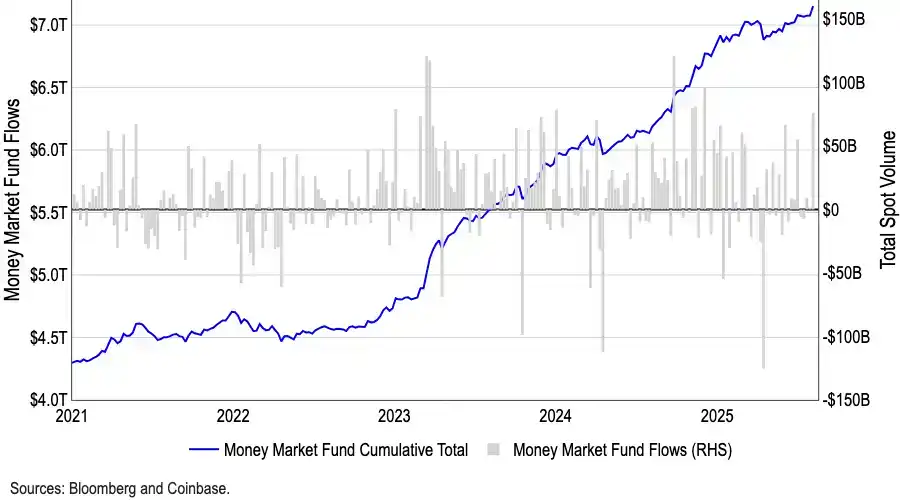

美国货币市场基金规模已达创纪录的 7.2 万亿美元,大量资金被困在低风险工具中。历史上,货币市场基金的资金外流常常与风险资产的上涨形成正相关。随着降息落地,其收益吸引力将逐渐减弱,更多资金有望释放进入加密与其他高风险资产。可以说,这笔史无前例的现金储备,是这轮牛市最强大的潜在火药库。

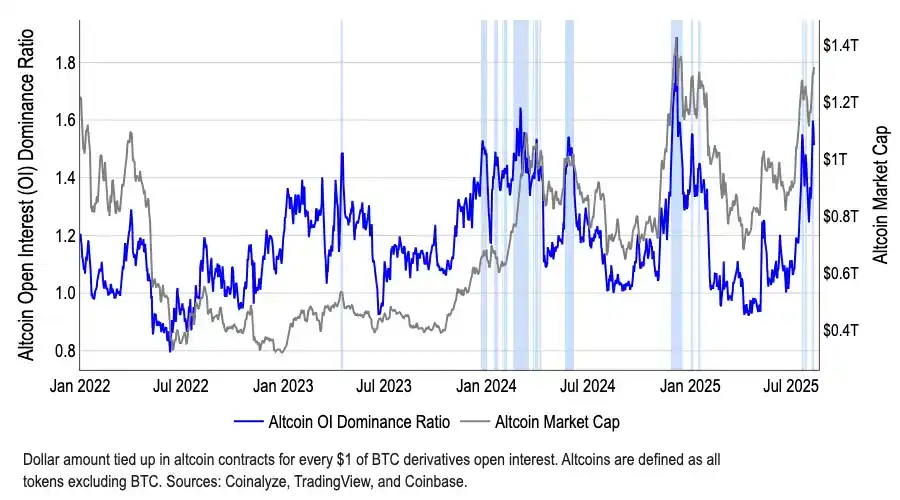

此外,从结构上看,资金已开始逐渐离开 BTC。BTC 的市场主导地位自今年 5 月的 65% 下滑至 8 月的 59%,与此同时,山寨币总市值自 7 月初以来已增长超过 50%,达到 1.4 万亿美元。虽然 CoinMarketCap 的「山寨季指数」仍停留在 40 左右,远未触及传统定义山寨季的 75 阈值,但这种「指标低迷—市值狂飙」的背离,恰恰揭示了资金正在有选择地进入特定板块,尤其是 ETH。ETH 不仅受益于 ETF 规模突破 220 亿美元的机构兴趣,还承载了稳定币与 RWA 的核心叙事,具备超越 BTC 的资金吸引力。

其他机构对于 BTC 的价格预期同样乐观。Derive 的 Sean Dawson 预测,比特币年底有望触及 14 万美元,若机构资金持续流入,甚至可能升至 25 万美元。Bitmine CEO Tom Lee 在 CNBC 的采访中表示,「今年年底之前,比特币价格很容易达到 20 万美元。」BitMEX 联合创始人 Arthur Hayes 也在访谈中预测,到 2025 年底比特币或攀升至 20 万美元,理由是美国政府潜在的国债回购计划将为市场释放流动性,把投资者资金引向更高风险资产。

不过,部分股票交易员则在对冲短期波动风险,因 25 个基点的降息已基本被市场消化。期权交易员预计,标普 500 指数周三可能出现约 1% 的双向波动,为近三周最大单日波动。IUR Capital CEO Gareth Ryan 表示,关键要看点阵图是否确认 2025 年底和 2026 年一季度各追加一次降息。若确认,股市反应或较温和;若意向模糊,市场可能迎来更大幅震荡。摩根大通交易部门也发出警告,认为会议可能演变成「利好出尽」的事件。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。