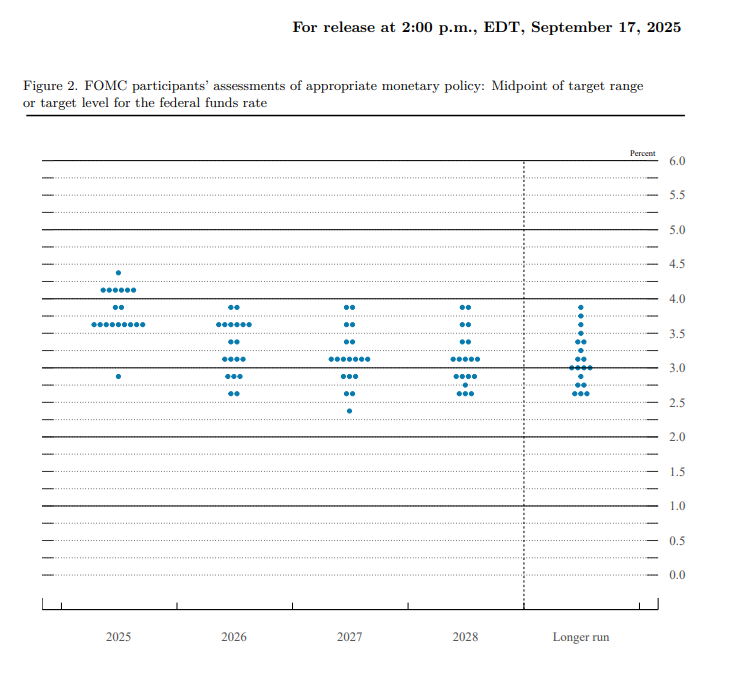

点阵图来看,2025年大部分点落在 3.25%–3.75% 区间,这意味着市场共识是 再降息1–2次(每次25个基点),最终全年降息幅度大约 50个基点。

意味着10月和12月都可能还有降息的空间。

2026年多数点集中在 3.0% 左右,相比2025年末水平再低 25–50个基点,说明市场预期 2026年仍有1–2次降息,但幅度会小于2025年。

这并不是非常的好的一个数据,说明美联储的官员普遍认为通胀还是很高,经济还是有韧性,2026年不适合大规模降息,同时也代表川普在这次的博弈中落到了下风。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。