在昨天我们的分析中,提到了行情即将再次变盘,然后晚上就走了拉升行情,所以这里我们认为多空胜负已分。同时我们还提到趋向于向上,随着昨天晚上的拉升,我们的预测也准确命中,在几个预测都正确的情况下,我们更确信多空胜负已分。

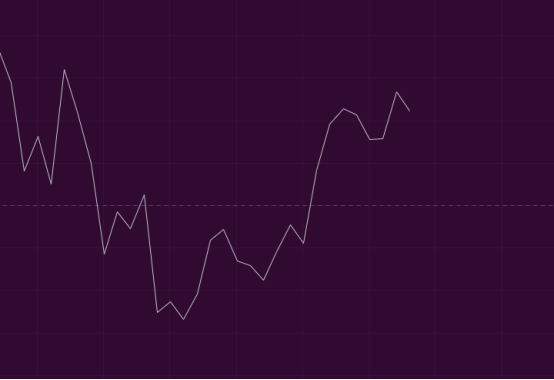

Macd上看,能量柱目前处于衰退现象,但目前没收盘,最终形态没有确定,昨天也是最后才收的阳线,所以我们继续关注即可。但确定的是我们看到了慢线站上了零轴,对多军而言是好事,但要警惕站不稳零轴而造成的下跌。

Cci上看,随着昨天的收阳,cci来到了50左右,这里是一个中性区间,多空力量均衡,处于一个可上可下的区域,还需要继续注意动态。

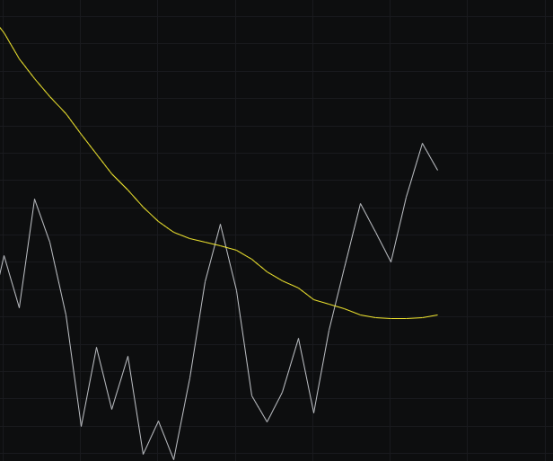

Obv上看,昨天我们强调后面注意看慢线是否走平,今天我们就看到了慢线已经走平,说明行情即将选择方向,因为走平了要么向上,要么继续向下。但结束了下跌走势,对多军而言就是好事。

Kdj上看,目前处于超买区域,行情处于强势区域,后面观察何时能形成死叉。

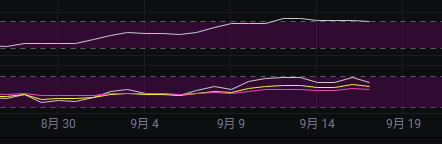

Mfi和rsi上看,mfi还处于超买区域,rsi由于目前是阴线,所以回到了中性区域,不过总体还是偏向于多军。

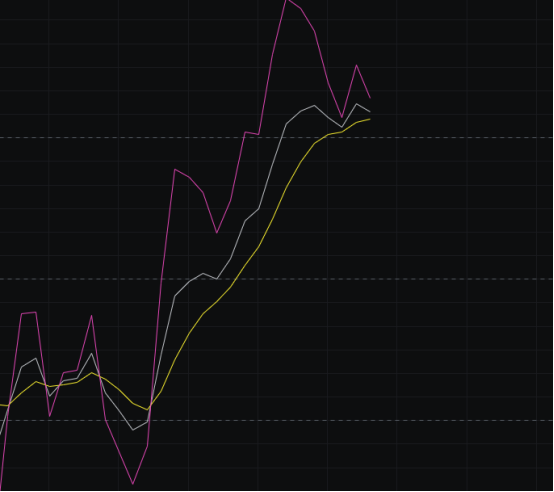

均线上看,60线连续5天对行情进行了支撑,我们认为支撑有效。同时我们之前强调注意观察30线什么时候能走平,现在我们就看到了30线走平的现象了,也是说明行情即将选择方向。

Boll上看,前面几天我们一直担心的boll,随着昨天的拉升,目前形态上在微微走好了,诱多的嫌疑在解除,但要完全解除还需要阳线来撑开让上下轨完全同步。但至少解除了诱多形态,对多军而言就是好事。

综上:昨天我们强调即将再次变盘,随着晚上了拉升,也达到了我们说的变盘的要求。同时之前没走好的均线和boll在今天看来也趋向于走好,所以后市继续上涨的可能性更大。由于今晚2点有利率决定,难免会有上下针,不管多空都要带好止损。下方支撑看115100-114000,上方压力看117000-119000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。