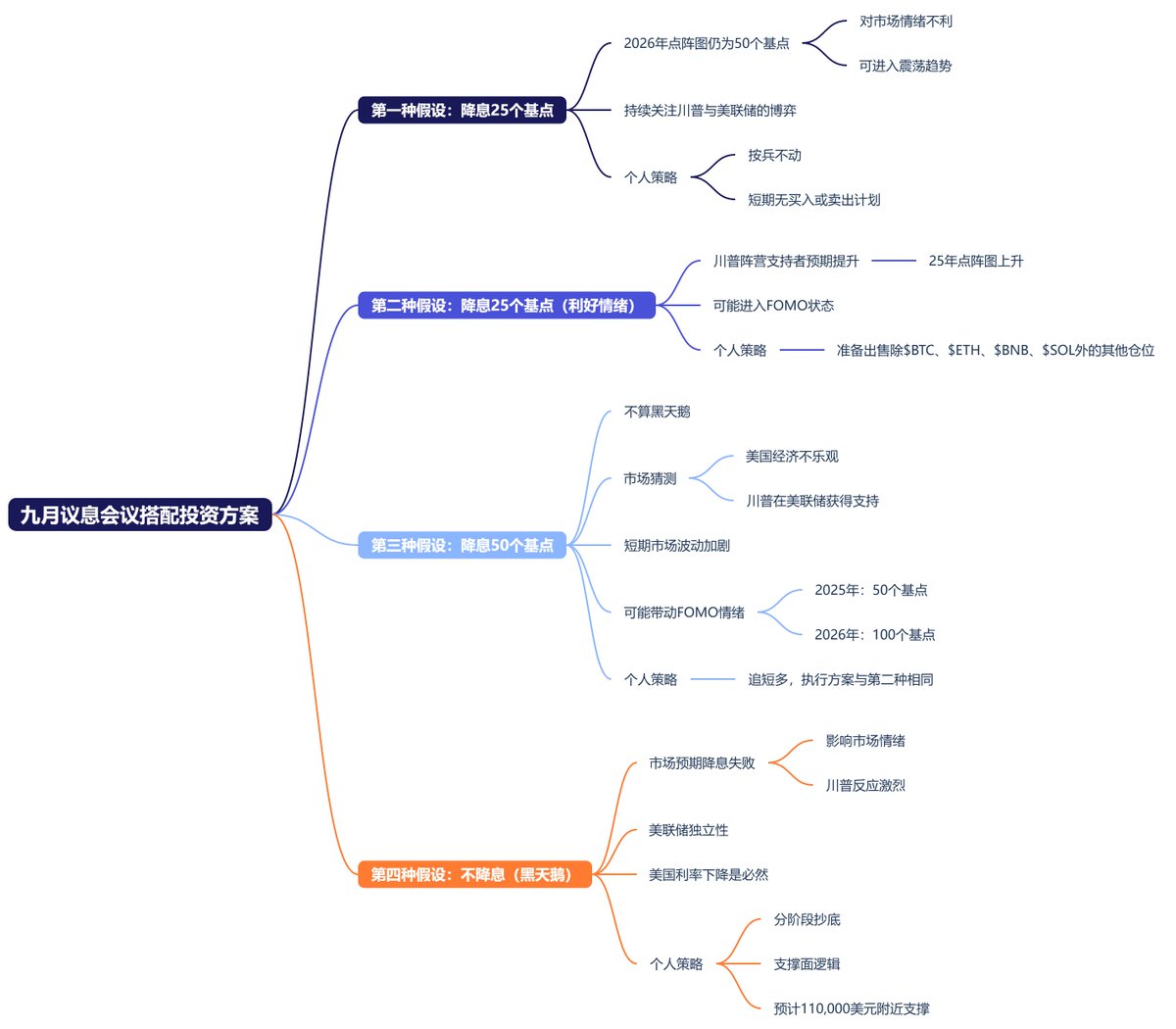

Given the current situation, the significance of the outcome of the Thursday morning gamble is not very substantial; the focus should be on one's own investment logic when placing bets. Therefore, I have made a personal investment hypothesis based on three possible scenarios.

The first scenario is a 25 basis point rate cut, and the dot plot for 2026 remains at 50 basis points. This is indeed unfavorable for market sentiment, but the subsequent game between Trump and Powell is not without opportunities. The market may enter a period of consolidation, and this possibility is relatively the largest.

The Federal Reserve has met public opinion by lowering interest rates without being overly accommodative, still insisting that combating inflation is the most important. More data is needed to decide on future rate cuts, which also represents the Fed's independence in the game with Trump.

In this case, I personally lean towards holding my position, not planning to make any buying moves in the short term, nor considering selling right now, and will continue to watch for changes in the market.

The second scenario is also a 25 basis point rate cut, but supporters of Trump have raised their expectations for future rate cuts, such as an increase in the 2025 dot plot and more rate cuts in 2026. If this situation occurs, it would still be a positive sentiment for the market, as it can be anticipated that the Fed will enter a phase of rapid rate cuts, at least alleviating concerns about economic downturns.

In this case, I would consider that the market might enter a FOMO state, and I would likely sell positions other than $BTC, $ETH, $BNB, and $SOL. The target for SOL is to wait for the spot ETF to pass, and since BNB is already at zero cost, it doesn't matter much.

The third scenario is a 50 basis point rate cut. This situation is not considered a black swan; the market will speculate on two possibilities: one is that the U.S. economy is already very pessimistic, and the other is that Trump has gained more support than expected within the Fed. If this situation occurs, the short-term market is likely to react very positively.

In this case, the dot plot for 2025 and 2026 is also expected to be favorable, with at least 50 basis points in 2025 and at least 100 basis points in 2026. This situation is likely to trigger a wave of FOMO sentiment, but how long this sentiment can last is still uncertain.

The third scenario is a PLUS version of the second FOMO, but it will be even more intense, with potentially larger initial fluctuations. If this situation occurs, I might chase a short-term long position, not completely certain, and then execute the same plan as in the second scenario.

The fourth scenario is no rate cut, which would be a black swan. If the market is fully expecting a rate cut, and the Fed can withstand the pressure and insist on not cutting rates, market sentiment is likely to be very poor. I can already imagine Trump jumping up and cursing, marking the first direct confrontation failure between Trump and the Fed.

However, the Fed will still have its own rhythm; the U.S. entering a phase of comprehensive rate cuts is just a matter of time. The decline in U.S. interest rates is inevitable. Although this situation may not be the final drop, the decline caused by market sentiment is likely to recover.

Therefore, what I need to do is to phase in bottom-fishing, buying more as prices drop. The logic of bottom-fishing is based on support levels; if a support level is broken, I will increase the intensity of my bottom-fishing. Theoretically, I believe the probability of breaking $100,000 is very low, and it is more likely to remain around $110,000.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。