Author: Gyro Finance

Following Circle, another new rising star in the cryptocurrency market has arrived.

The concept of stablecoins is gaining traction, and after Circle took the first bite of the crab, the market is also stirring, with stablecoin companies considering entering the IPO arena. Figure is clearly one of the faster runners. However, rather than calling Figure a stablecoin company, it is more accurate to describe it as an RWA (Real World Asset) company.

With many opportunities and stories, Figure, which combines both stablecoin and RWA concepts, saw its stock surge by double digits after going public last Thursday, at one point soaring over 50%, showcasing impressive performance.

However, just recently, the once high-flying Figure had its facade torn away by DefiLlama.

Figure may not be familiar to those outside the industry, but within the RWA space, it is considered a star company. According to data from Rwa.xyz, among the existing $29.38 billion in RWA, private credit accounts for the largest share at $16.8 billion, and within this category, Figure alone holds $16.1 billion, indicating that Figure is a cornerstone in the private credit sector.

Such a powerful company naturally has an extraordinary background. The founder of Figure is Mike Cagney. This founder is no stranger to Wall Street; before Figure, Mike Cagney pioneered the student loan refinancing project SoFi with the "P2P Alumni Funding" model, packaging student debt into structured assets for sale to investors, and within just seven years, he propelled it to a valuation of over $4 billion as a fintech unicorn. After SoFi faced cultural conflicts and sexual scandals, Mike Cagney was ousted from the company and turned to the blockchain lending sector, founding Figure Technologies. Despite the controversies surrounding the founder, Figure quickly secured a $50 million initial investment from well-known institutions such as DCM Ventures, DST Global, and Ribbit Capital, indicating Wall Street's level of recognition.

Similar to the SOFI model, Figure's perspective has shifted from student loans to home equity lines of credit (HELOC). A HELOC is a revolving credit product secured by the equity in a property, allowing users to obtain a loan amount based on the remaining value of their property, which can be reused. The term "home equity" refers to the market value of the property minus the existing loan balance; in other words, it is a loan product that allows for the rapid monetization of real estate value, with a very convenient usage method similar to credit cards, but with more favorable interest rates due to asset backing.

In the United States, HELOCs are very common, reaching a peak of $611 billion in 2009, and although it subsequently declined due to the well-known subprime mortgage crisis, it has seen growth again. According to the "Household Debt and Credit Quarterly Report," as of Q2 2025, HELOC balances increased by $9 billion to $411 billion, marking the thirteenth consecutive quarter of growth. In the U.S. HELOC market, Figure holds approximately 3.4-5.1% market share, and it claims to be the largest mortgage underwriter outside of banks in 2024. Figure's business model revolves around HELOCs, forming a super trading network that integrates financial loans, tokenization, secondary trading, collateral platforms, and stablecoins.

After users initiate loans on Figure, they leverage the company's proprietary public blockchain, Provenance, to upload data and tokenize assets, and can further trade through the on-chain HELOC secondary market, Figure Connect. Additionally, Figure has built a DeFi platform, Democratized Prime, centered around HELOCs to enhance liquidity and collateral efficiency. Furthermore, in February of this year, Figure launched the stablecoin YLDS, which is designed to generate interest through securitization, achieving an annualized yield of 3.8%.

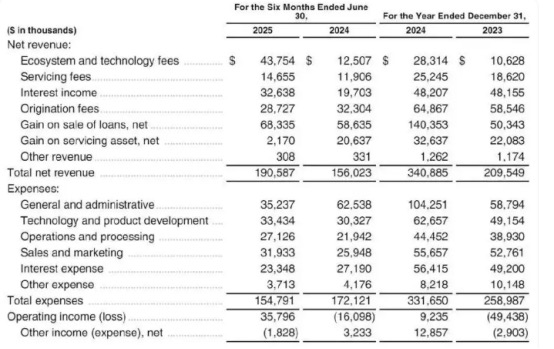

With a series of strategic moves, Figure successfully turned a profit this year. The prospectus shows that Figure's revenues for 2023 and 2024 are projected to be $210 million and $341 million, respectively; operating profits are projected to be -$49.44 million and $9.24 million; and net profits are projected to be -$52.44 million and $19.92 million. In the first half of 2025, revenue was $191 million, a 22.4% increase from $156 million in the same period last year; net profit for the first half was $29.38 million, compared to a net loss of $13.4 million in the same period last year; adjusted EBITDA was $83.44 million, up from $36.54 million in the same period last year.

On August 5 of this year, Figure submitted its IPO application. On September 11, Figure (FIGR.US) successfully listed on NASDAQ, becoming another successful publicly traded cryptocurrency company, hailed as the first stock in the RWA sector. With multiple favorable conditions and strong market demand, Figure's pricing changed several times, from an initial offering of 26.3 million shares at $18 to $20, to 31.5 million shares at $20 to $22, with the final actual issuance price set at $25. Before the opening, Figure secured several times the oversubscription, and after the opening, the price quickly soared to $36, peaking at $38.05, and has since retreated to $32.5, representing an increase of over 30% from the issuance price, showcasing impressive performance.

In this context, the newly listed Figure was riding high, but perhaps due to a lack of humility, it clashed with the data platform DefiLlama, bringing trouble upon itself. The dispute began on September 10, when Figure founder Mike Cagney announced that its HELOC products had gone live on CoinGecko. This was initially a good thing, but he also mentioned DefiLlama, accusing it of refusing to display the $13 billion TVL on Figure's proprietary chain, Provenance, due to insufficient followers on X.

DefiLlama did not respond immediately, so in the early stages of the dispute, public opinion largely sided with Figure, believing that DefiLlama indeed had neutrality issues. Another data tool, Artemis, even publicly expressed support for Provenance's data. However, unexpectedly, two days later, public opinion suddenly shifted.

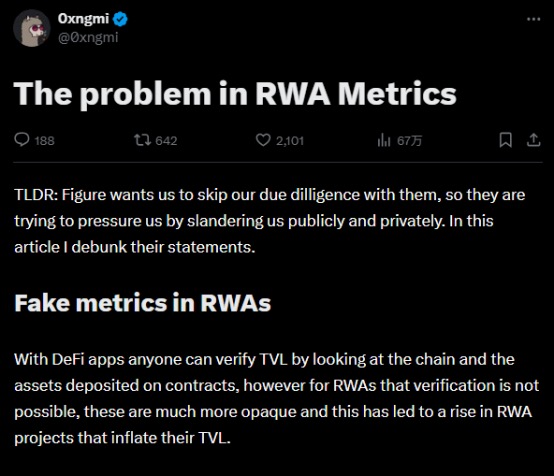

On September 13, DefiLlama co-founder 0xngmi published a lengthy article titled "The Problem in RWA Metrics," raising four points of concern after conducting due diligence on Figure. First, regarding asset scale, DefiLlama's investigation found that although Figure claimed to have $13 billion in TVL, only about $5 million in BTC and $4 million in ETH were found among the on-chain verifiable assets, with a 24-hour trading volume of BTC being only $2,000; second, regarding stablecoin supply, Figure's stablecoin YLDS is intended for quota and RWA trading use, and theoretically should match the RWA market share to achieve internal circulation. However, from the data, Figure, which has issued $16.1 billion in RWA and claims to have $13 billion in TVL, has a stablecoin supply of only $20 million, showing a significant discrepancy; third, regarding asset transfer transparency, tracking revealed that the vast majority of RWA asset transfer transactions were not conducted by asset owners but rather through other accounts, and furthermore, many addresses had no on-chain transaction data, only mappings to off-chain databases, which corresponds to the fourth point of the lack of on-chain traces, as most loan circulation mediums in Figure are still fiat currency rather than digital currency, resulting in no actual transaction data on-chain.

Based on these four points, DefiLlama concluded that Figure's on-chain data seems to be merely a mapping of an internal database. Subsequently, well-known on-chain detective ZachXBT also supported DefiLlama, stating, "Trying to pressure verified participants like DefiLlama with metrics that are not 100% verifiable on-chain."

Essentially, what DefiLlama said is not unfounded. From Figure's model, "off-chain transactions + on-chain data" is core; the operation merely maps loan data to the chain, while the actual business process remains primarily off-chain, with the blockchain providing only a data credential. Before Figure went public, the validity of its on-chain data had already faced numerous doubts, but at that time, no such data platform had exposed everything to the surface.

Beyond the dispute, a deeper issue is the definition of RWA. Broadly speaking, as long as there are off-chain entities mapped to the chain in a tokenized form, it can be called RWA. However, if we delve into the essence, if it cannot be queried, verified, or even trusted on-chain, the applicability of blockchain seems meaningless. The reality is that with the entry of traditional institutions, for these participants, constructing processes using more familiar transaction methods and then wrapping them in a blockchain shell is the simplest entry method, and such applications are emerging one after another, but this is clearly not the playbook of the native cryptocurrency space.

This is also the reason why Robinhood's stock tokenization was ridiculed within the community; no matter how glamorous the decentralized shell, the centralized core still struggles to change the essence of control. The source of institutional discomfort also begins here, as institutions accustomed to following traditional rules find it difficult to strike a balance between innovation and compliance, and even harder to adapt to the decentralization of control and the void in governance, ultimately presenting a narrative that feels hollow and substantial capital accumulation without real on-chain circulation, which is a common ailment of institutional projects today. Wall Street may be able to buy into such narratives, but the cryptocurrency community finds it hard to adapt, leading to DefiLlama's refusal to disclose data, as the original crypto purists cannot accept the ambiguity of on-chain asset data.

As Coinbase board member Conor Grogan commented on the matter, "Some major cryptocurrency institutions and venture capital firms privately contacted DefiLlama and our partners. Each needs to be named in person and asked how they can work in this industry if they can't even verify things themselves." It is foreseeable that this situation will continue for a long time.

To some extent, this is also a hidden danger for Figure. If it is deemed merely a false prosperity under the banner of being the first stock in RWA, it could impact the company's reputation. Of course, from the perspective of hidden dangers, Figure's issues are not trivial. The business centered around real estate is highly dependent on changes in the macro environment, and the fatigue of the U.S. real estate market has been visibly apparent for months. Founder Mike Cagney also has a history; he naturally possesses the ability to package risky assets into value narratives, not only having a keen eye for regulatory arbitrage but also being adept at resource integration. However, fortune and misfortune are intertwined; the ethical controversies surrounding SoFi are still fresh in memory, and Figure is not its first product, nor will it be its last, which naturally brings uncertainty to Figure.

Whether genuinely entering the market or presenting a false narrative, Figure's listing ultimately lights a beacon for RWA. However, both Figure and RWA, as I mentioned in previous articles, should have fewer tricks and more sincerity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。