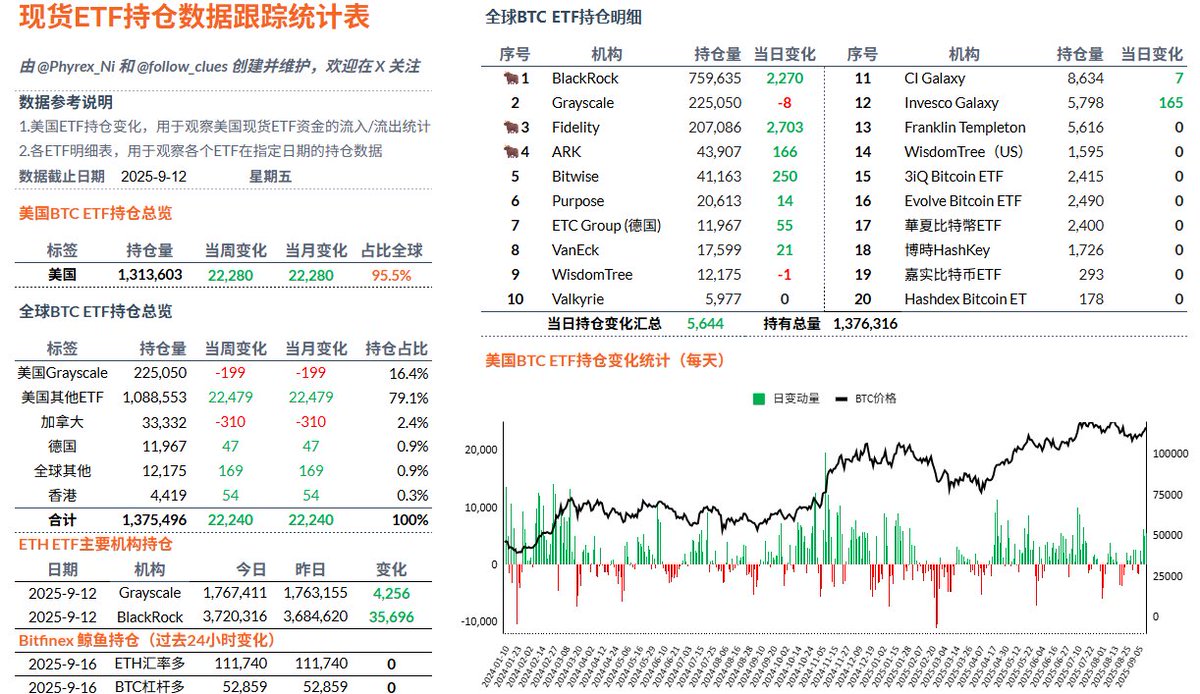

In terms of data, the Friday figures for $BTC are still good, and it has exceeded an average of 2,000 Bitcoins for three consecutive working days. This means that the capital inflow for the BTC spot ETF has significantly increased over these three days. On Friday, there was a net inflow of over 5,600 BTC, which is already a good figure; the last time it reached this level was in mid-July.

This data indicates that investors' buying sentiment has started to rise recently. It is unclear whether this is due to speculation about a rate cut in September, but it can indeed be seen from the data that the amount of capital invested is increasing, and the increase is quite substantial. From the net purchasing power in the U.S. in week 87, it is more than nine times that of week 86, which clearly illustrates the situation.

Of course, data from a single ETF cannot represent a market uptrend, but it can be observed that the sentiment among U.S. investors is increasing, and the amount of capital is rising, indicating that market speculation is beginning to rise. Some investors already believe that a rate cut will come, and that the market will perform better after the rate cut.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。