当地时间9月14日,美国总统特朗普再度公开施压美联储,预计其将“大幅降息”。此前市场预测显示,美联储基准利率将从当前的4.5%区间下调至4.25%。 特朗普的表态并非空穴来风,而是基于近期经济数据中显现的劳动力市场疲软迹象,以及他一贯对美联储主席杰罗姆·鲍威尔的批评。

政治压力下的经济信号

特朗普在接受媒体采访时直言:“我认为会有一次大幅降息。”若成真,这将是美联储自去年12月以来首次降息。 他强调,美联储应立即行动,以应对劳动力市场的冷却和生产者价格指数(PPI)的近期下滑。 这一表态迅速在社交媒体上发酵,多位财经观察者转发并评论,称其为“对鲍威尔的公开施压”。 特朗普并非首次干预美联储事务。自其第二任期伊始,他就多次敦促美联储加速降息,甚至考虑替换鲍威尔。 此次言论的时机格外敏感,正值FOMC会议前夕,市场已普遍预期25个基点的温和降息,但特朗普的“大刀阔斧”表述暗示他期待更激进的50个基点或以上调整。

9月11日晚公布的消费者物价指数(CPI)显示,美国通胀率升至2.9%,核心通胀稳定在3.1%,虽高于美联储2%的目标,但月度涨幅仅0.4%,略高于预期。 更关键的是,8月就业报告显示,非农就业增长放缓,失业率小幅上升至4.2%,劳动力市场“冷却”迹象明显。 特朗普将此归咎于高利率的抑制效应,并借机重申其关税政策不会导致通胀失控。 然而,批评者指出,特朗普的干预可能加剧美联储的独立性危机。

美联储利率决议:从4.5%到4.25%的预测

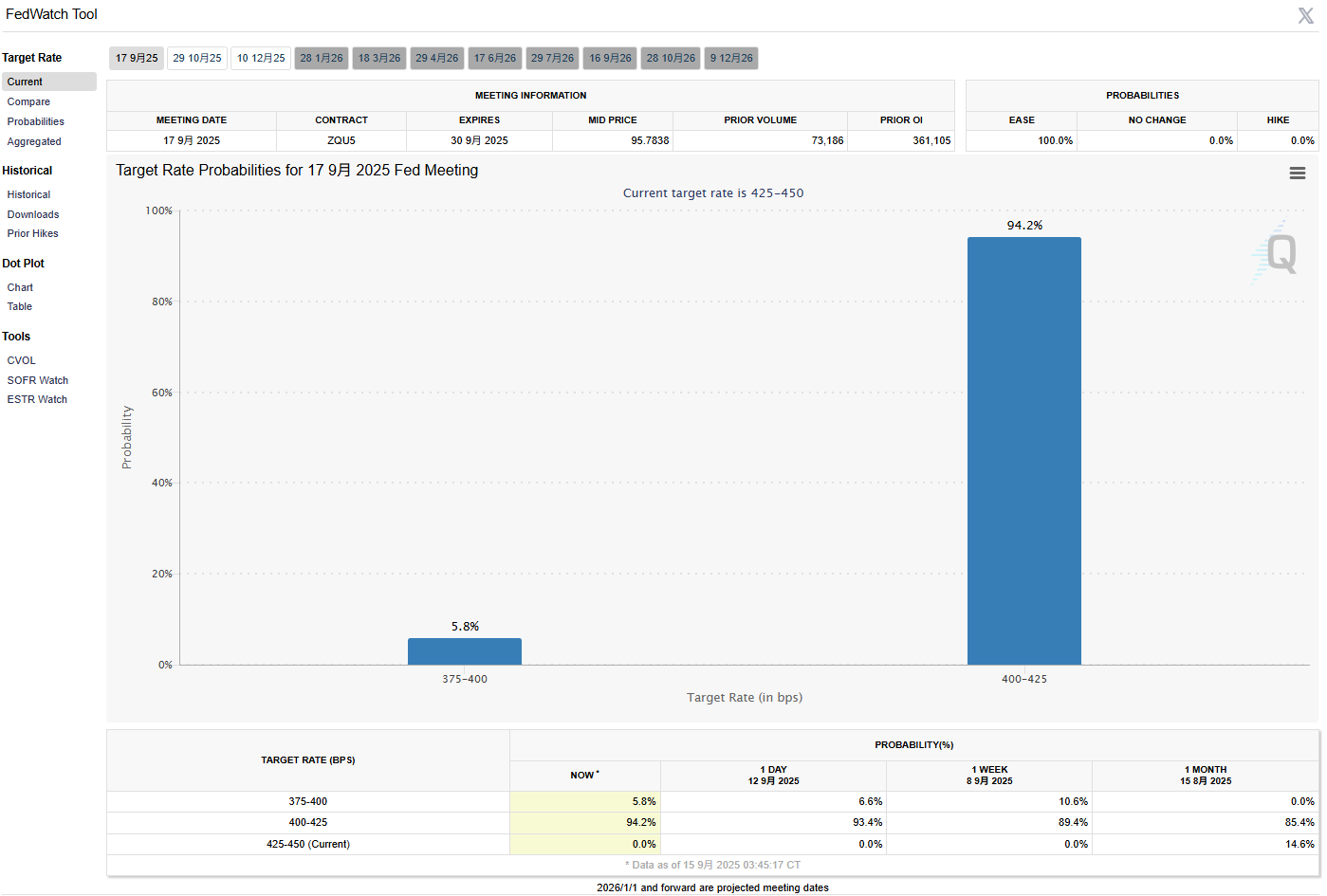

9月18日凌晨2点(新加坡时间),美联储公布利率决议,此前基准利率维持在4.25%-4.5%区间已逾九个月。 市场共识指向25个基点的降息,将利率下调至4%-4.25%。 CME集团的FedWatch工具显示,94.2%的交易者预期这一幅度。 这一预测源于多重因素:劳动力市场疲软、通胀压力趋稳,以及全球央行“36小时利率狂潮”的背景下,美国需跟进以避免美元过度走强。

美联储的谨慎源于双重风险:一方面,特朗普的关税政策可能推高进口价格,引发新一轮通胀。 另一方面,劳动力市场数据显示,8月新增就业岗位低于预期,招聘放缓,这让美联储担心“最大就业”目标岌岌可危。 美联储理事克里斯托弗·沃勒在近期表示,如果8月数据进一步恶化,他支持“更激进的降息”。 然而,多数经济学家预计美联储将“谨慎前行”,9月降息后,2025年剩余会议可能再切两次25个基点。 彭博社调查显示,40%的受访经济学家预测年底前三次降息,但中位数为两次。

鲍威尔在杰克逊霍尔会议上的讲话进一步强化了这一预期。他在8月22日表示,“经济风险平衡已开始转变”,暗示9月会议可能调整政策立场。 尽管鲍威尔避免直接回应特朗普,但强调不确定性(如关税)可能导致企业投资收缩。 9月15日后,金融时报报道称,美联储将“初始谨慎”,9月降息至4%-4.25%后,保持警惕以应对通胀和就业的双重风险。 如果降息幅度超出预期(如50个基点),市场可能解读为经济衰退信号;反之,维持现状将加剧特朗普与美联储的摩擦。

从股市到全球贸易的连锁反应

美联储降息至4.25%将直接刺激借贷成本降低,利好房地产、消费和企业投资。短期内,美股标普500指数期货在特朗普言论后上涨0.5%,科技股和加密货币领涨。 然而,这一政策并非万灵药。纽约时报分析指出,高利率已抑制经济增长,若降息过慢,可能导致失业率进一步攀升至5%以上。 另一方面,通胀风险犹存:特朗普关税若实施,将推高消费品价格,核心CPI可能反弹至3.5%。

全球视角下,美国降息导致美元走弱,资金有望流入加密市场,比特币、以太坊等风险资产可能迎来短线拉升甚至冲击新高。但需注意,美联储声明中若仍强调“通胀压力”,市场可能上演“买预期,卖事实”的戏码,即短线上涨后迅速回落。

本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。