撰文:1912212.eth,Foresight News

9 月 12 日,Tether 宣布推出全新稳定币 USAT,这是一款专为美国市场设计的、完全合规的美元支持稳定币。同时宣布任命 Bo Hines 为未来美国 Tether USAT 的首席执行官。

加密货币领域,Tether 的 USDT 市值已超过 1700 亿美元,广泛用于交易、跨境支付和 DeFi 应用。Tether2024 年全年盈利超过 130 亿美元,2025 年上半年总盈利约 57 亿美元,其中 Q2 单季度净盈利创纪录 49 亿美元,主要来自美国国债收益率和储备增值。

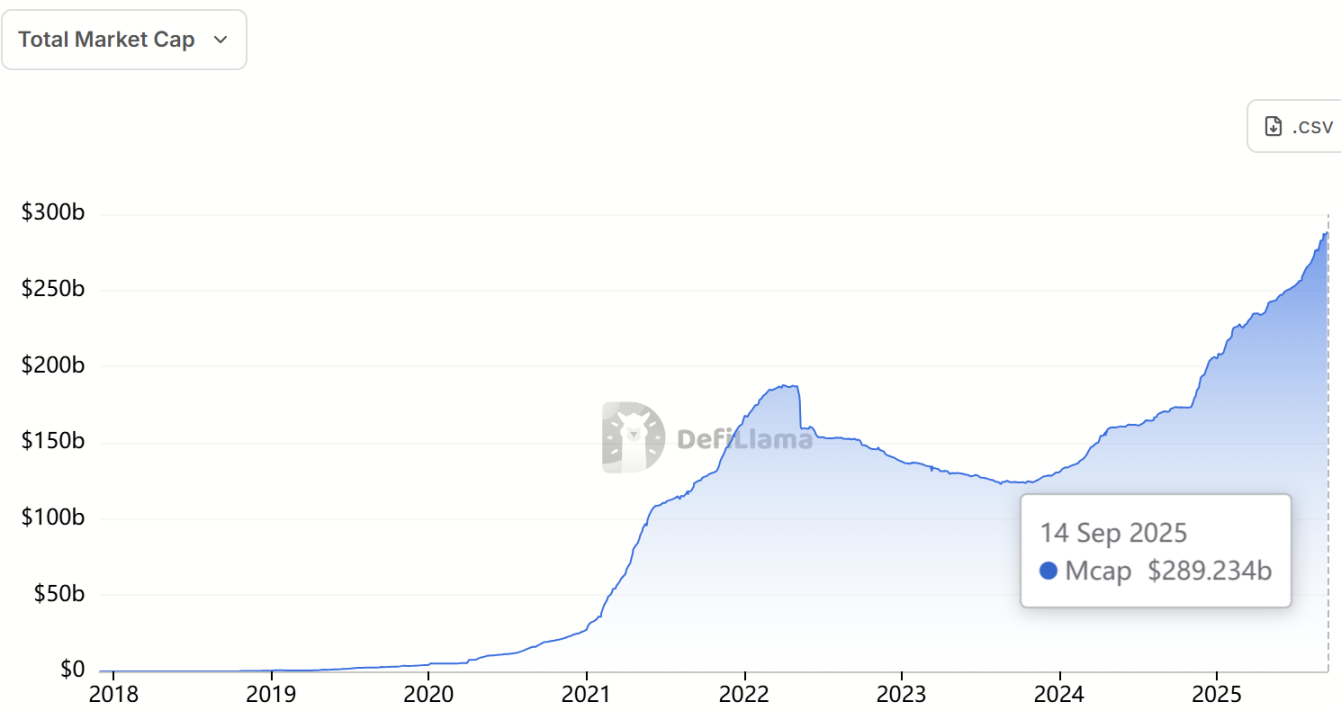

据 defiLlama 数据显示,截止 9 月 14 日,稳定币总市值约为 2892.34 亿美元,其中 USDT 占比为 58.96%,占据市场主导地位。

然而,随着美国监管环境的日益严格,Tether 面临着合规压力。Tether 推出全新稳定币 USAT,被视为进军美国本土市场的战略性举措。

Tether 的这一决定并非突发奇想,而是对全球监管趋势的回应。自 2022 年以来,美国证券交易委员会(SEC)和商品期货交易委员会(CFTC)等机构加强了对稳定币的监管力度。USDT 作为一种非美国本土发行产品,曾多次卷入争议,包括储备金透明度和反洗钱合规问题。Tether 总部位于英属维尔京群岛,虽然其稳定币在全球流通,但在美国的使用受到限制,部分交易所和机构不愿直接支持非合规资产。推出 USAT 的目的,正是为了填补这一空白,提供一款符合美国法律框架的稳定币选项。 USAT 将以 1:1 的比例锚定美元,由 Tether 的储备金支持,包括现金、美国国债等高流动性资产。

USAT 的核心亮点在于其「美国合规」属性。根据 Tether 的官方声明,该稳定币将由一家新成立的美国子公司发行和管理,预计在 2025 年底前正式上线,初期针对美国居民、企业和机构用户开放。 与 USDT 不同,USAT 将严格遵守《银行保密法》(BSA)和反洗钱(AML)规定,支持 KYC 验证。

此外,USAT 官网发布重要提示称,USAT 并非法定货币,且不会由美国政府发行、支持、批准或担保。USAT 不受美国联邦存款保险公司(FDIC)、证券投资者保护公司(SIPC)或任何其他政府机构的保险保障。

值得一提的是,Tether 任命 Bo Hines 担任新业务的 CEO,Bo Hines 是一位政治和商业领域的资深人士,曾担任前总统唐纳德·特朗普的顾问,并在 2022 年竞选北卡罗来纳州国会席位。他以保守派立场著称,尤其在加密货币监管和创新政策上持积极态度。

Hines 的加入被视为 Tether 拉拢美国政界影响力的信号。Hines 透露公司新的美国总部将设在北卡罗来纳州夏洛特。

从市场影响来看,USAT 的推出可能会重塑美国稳定币格局。目前,USDT 在全球交易量中占据主导,但在美国本土,Circle 发行的 USDC 凭借其合规优势已领先一步。USDC 的市值约为 731 亿美元,主要服务于美国机构,如 Visa 和 Mastercard 已将其集成到支付系统中。

USAT 的出现将直接挑战 USDC 的地位,尤其是在企业级应用上。Tether 声称 USAT 将支持更低的交易费用和更高的流动性,适合用于供应链金融、房地产交易和跨境汇款。例如,一家美国出口商可以使用 USAT 即时结算海外订单,避免传统银行的高手续费和延迟。这在当前全球经济不确定性加剧的背景下,具有显著吸引力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。