作者:蒙奇 | 编辑:HashWhale 蒙奇

1、比特币市场

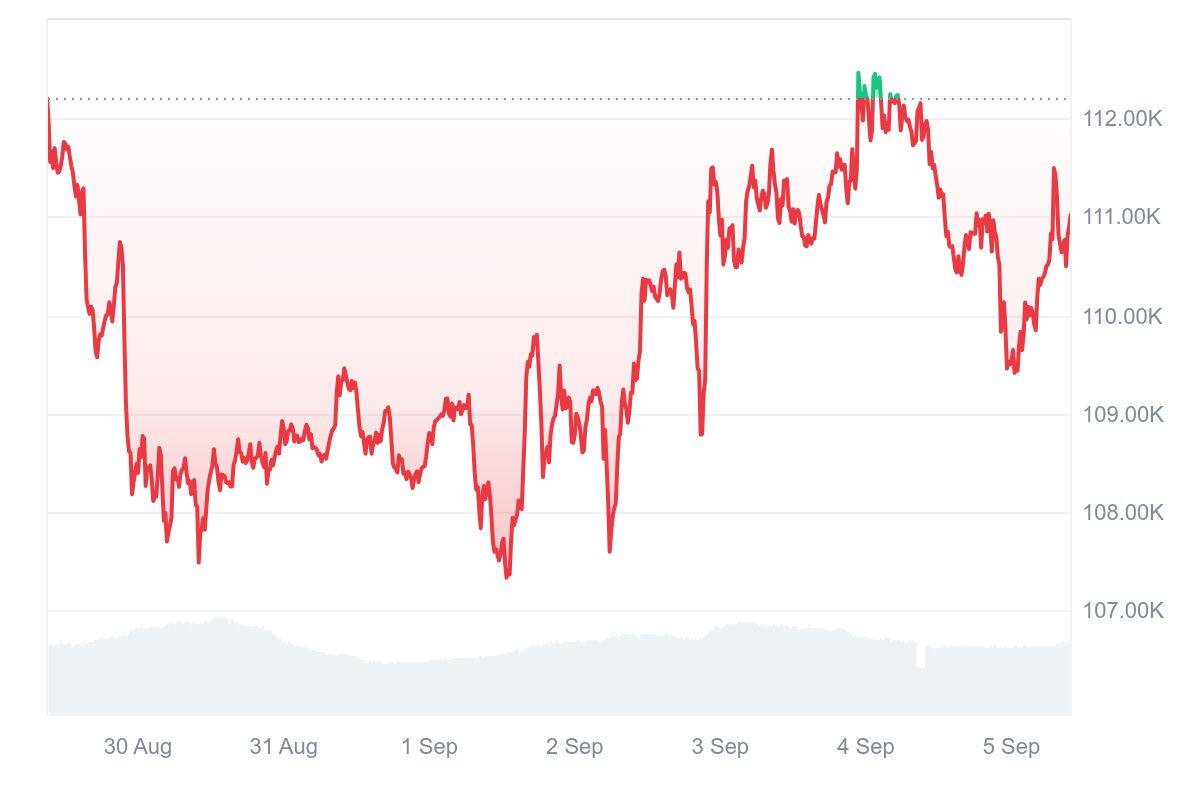

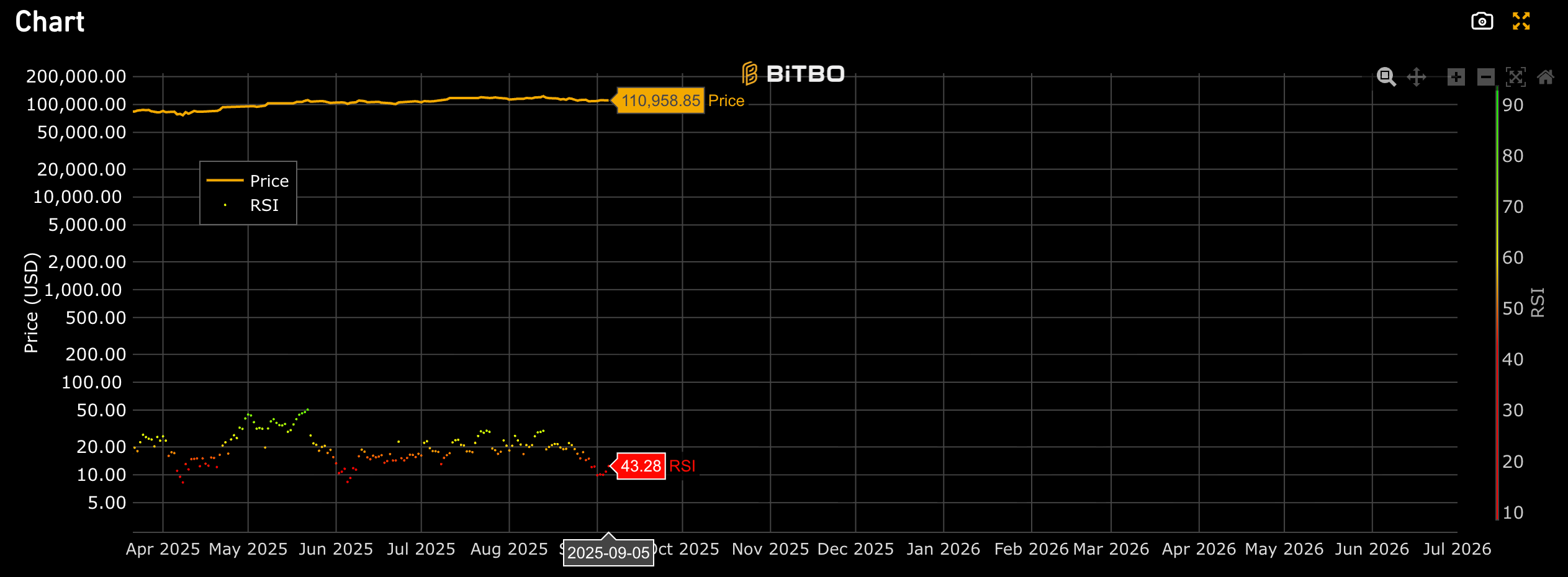

比特币价格走势(2025/08/30-2025/09/05)

本周,比特币在经历低位横盘后逐步修复,并在关键宏观数据公布前迎来阶段性调整。整体市场结构仍显脆弱,投资者情绪保持防御性。临近 9 月 5 日美国非农就业数据公布,市场普遍采取观望策略,即便降息预期强烈,价格依然呈现震荡与回调的特征。

低位横盘阶段(8 月 30 日-9 月 1 日)

8 月 29 日,比特币自 113,042 美元大幅回落至 108,178 美元,单日跌幅约 4.4%。8 月 30 日早盘进一步下探至 107,481 美元后止跌,随后维持在 108,000–109,000 美元区间震荡。8 月 31 日,震荡区间扩大至 108,200–109,500 美元。

价格下跌的主要原因之一,是巨鲸在近期的获利了结行为:

据 CryptoOnchain 监测,8 月 29 日,比特币单日实现利润接近 40 亿美元,为 2025 年 2 月以来最大规模单日获利了结,其中利润实现分布如下:

- 超级鲸鱼(\u0026gt;1 万枚 BTC):21.7 亿美元

- 大型鲸鱼(1 千-1 万枚 BTC):12.5 亿美元

- 其他鲸鱼(100-1000 枚 BTC):4.95 亿美元

单日实现利润接近40亿美元,为 2025 年 2 月以来最大规模。这类大额利润兑现通常出现在阶段性顶部,意味着比特币从“强手”向“弱手”转移,短期市场承压。虽然不必然预示长期下跌,但对短线交易者而言是重要风险信号。

筑底、逐步修复阶段(9 月 1 日-9 月 4 日)

9 月 1 日早盘,比特币触及本周低点 107,310 美元后开始逐步回升,并伴随振幅扩大。9 月 1 日至 4 日,价格依次回升至 109,830 美元、110,636 美元、111,653 美元、112,463 美元,期间(9 月 2 日)出现两轮技术性回调,市场振幅加大。

本轮修复的主要动力包括:

1、技术面突破:比特币突破了两周下行趋势线,并重新站上 100 日指数移动平均线(EMA),显示短期技术面反弹强势。

2、市场情绪改善:加密货币市场情绪由“恐惧”转向“中性”,投资者信心逐步恢复。

3、机构需求回升:机构投资者和企业需求增加,推动市场流动性改善。

4、美联储降息预期:市场普遍预期美联储 9 月降息概率超过 90%,刺激风险资产需求,为比特币价格提供支撑。

阶段性调整阶段(9 月 4 日-9 月 5 日)

9 月 4 日,比特币一度冲高至 112,000 美元上方,随后承压回落至 110,407 美元,短暂反弹至 111,000 美元附近,最终下探至 109,411 美元才企稳。9 月 5 日,价格反弹至 111,494 美元但未能突破,截止撰稿时回落至 110,888 美元。

短期回调原因包括:

获利盘抛压:触及关键阻力位后,短线资金选择兑现利润。

市场结构脆弱:此前巨鲸抛售遗留的资金压力仍限制上行空间。

宏观不确定性:尽管降息预期强烈,但就业等关键数据的不确定性引发观望。

总结与展望

整体来看,本周比特币走势呈现 “低位筑底 – 逐步回升 – 阶段性调整” 的节奏。短期内,市场依然存在波动风险,价格走势对宏观数据与巨鲸动向高度敏感。

投资者需重点关注:

巨鲸资金流向 —— 是否继续兑现利润或重新布局。

美联储政策预期变化 —— 降息落地时间与幅度对市场情绪的直接影响。

市场情绪演变 —— 若由“中性”转向“贪婪”,可能带动新一轮突破。

短线操作需保持谨慎,中长期仍建议关注宏观政策与机构资金的联动效应。

2、市场动态与宏观背景

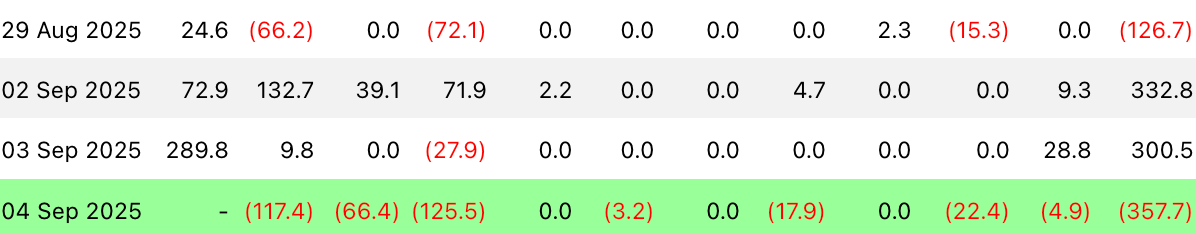

资金流向1、ETF 资金动态

本周现货比特币 ETF 资金流入趋势:

9 月 2 日:+3.328 亿美元

9 月 3 日:+3.005 亿美元

9 月 4 日:-3.577 亿美元

ETF 流入/流出数据图片

整体来看,前两日资金持续流入,反映出市场对比特币的配置需求依旧强劲。但在 9 月 4 日出现显著流出,说明部分资金选择获利了结,市场情绪短线趋于谨慎。

2、巨鲸与长期持有者动向

比特币远古巨鲸换仓 ETH

8 月 31 日,据 @mlmabc 监测,高调换仓 ETH 的比特币远古巨鲸在过去 11 天已进行如下操作:

- 出售比特币:34,110 枚 BTC(约 37 亿美元)

- 买入以太坊:813,298.84 枚 ETH(约 36.6 亿美元)

- 钱包中仍持有 BTC 32,321 枚(约 35 亿美元)动向未明

该巨鲸似乎在逐步将 BTC 持仓转为 ETH,但真实意图尚不明确。

比特币长期持有者单日卖出创年内新高

9 月 1 日,Glassnode 数据显示:

- 单日卖出比特币总量约 97,000 枚,创 2025 年新高

- 持币 1-2 年的约 34,500 枚、持币 6-12 个月的约 16,600 枚、持币 3-5 年的约 16,000 枚

- 三类持有者合计占总支出量约 70%

长期持有者近期支出活动加速,显示部分投资者对短期市场波动做出反应。

BTC 长期持有者/短期持有者的支出量

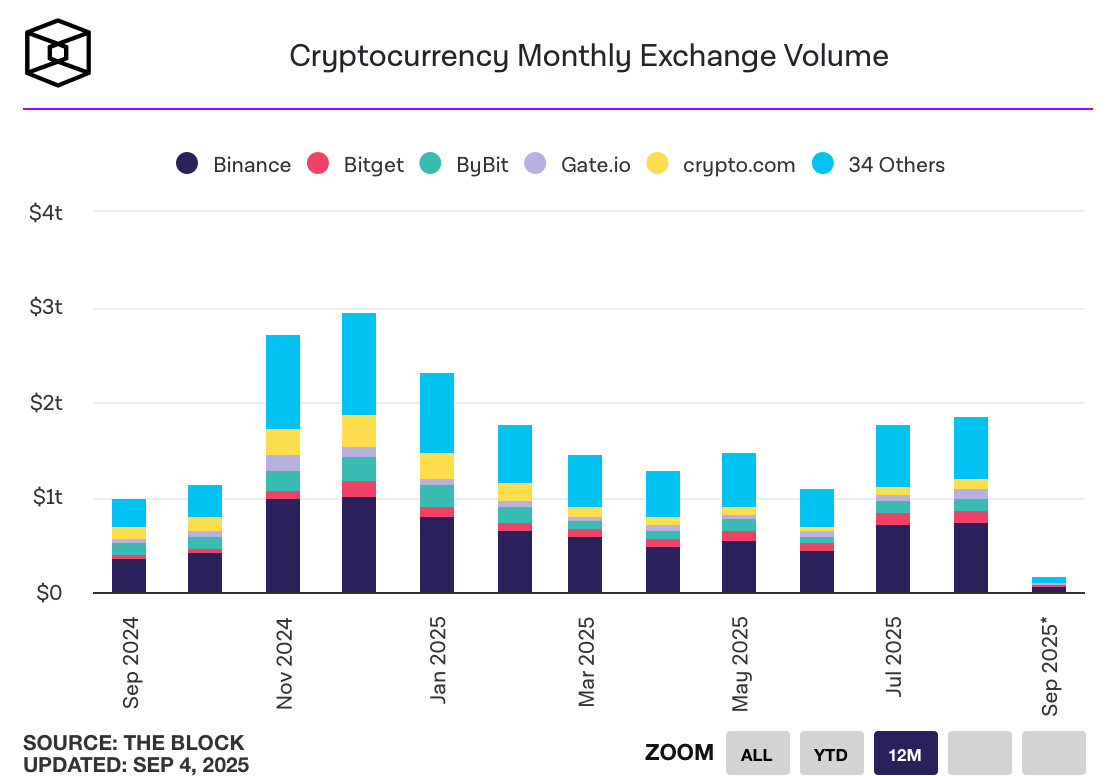

3、交易所与市场数据加密交易所交易量创年内新高

9 月 3 日,The Block 数据显示:

- 8 月加密交易所总交易量:1.86 万亿美元,同比增长 5%

- 币安:7371 亿美元(环比增长 310 亿美元)

- Bybit:126.5 亿美元,Bitget:126.1 亿美元

- 去中心化交易所(DEX)交易量:3688 亿美元,Uniswap 1430 亿美元,PancakeSwap 587 亿美元

加密货币交易所月交易量数据

ETH ETF 资金流入创纪录

- 美国现货以太坊 ETF 8 月资金流入 38.7 亿美元

- 同期比特币 ETF 流出 7.51 亿美元

投资者对 ETH 的兴趣显著增强,表明资金正在从比特币向以太坊及其他高收益资产轮动。

比特币现货 ETF 月度流入/流出数据

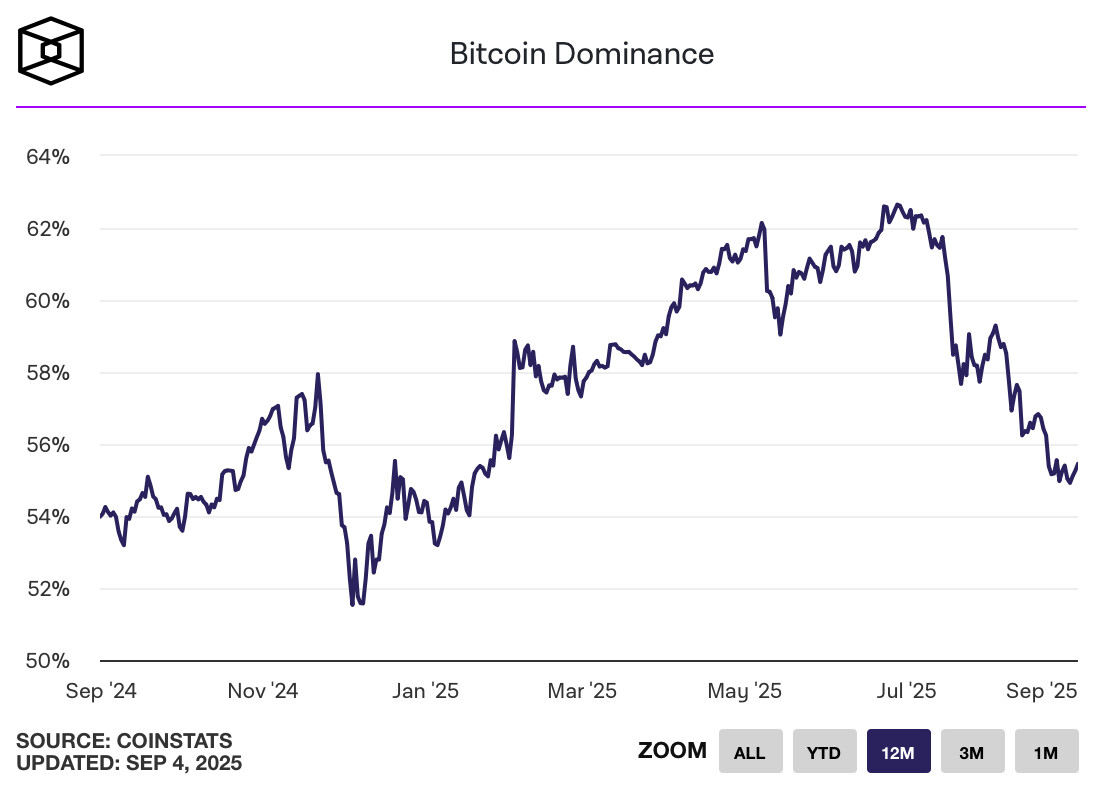

4、市场结构与山寨币动向

比特币主导地位下降

9 月 4 日,The Block 数据显示:

- 比特币占加密市场比例下降至 55%(此前峰值 62%)

- ETH、SOL 等山寨币吸引机构与散户资金重新关注

市场出现资金轮动迹象,山寨币若能形成真实现货需求,有望在第四季度迎来上涨行情。

比特币主导地位数据

ETH 交易平台储备创近 3 年新低

9 月 4 日,CryptoQuant 数据显示:

- 交易所 ETH 储备量降至约 1740 万枚(较 2022 年峰值下降约 1070 万枚)

- 过去 3 个月提币加速,约 250 万枚 ETH 离开交易所

- 现货 ETH ETF 自 7 月以来净流入超过 100 亿美元

鲸鱼持币量增加

持有 1000 至 10 万枚 ETH 的鲸鱼群体自 4 月以来持币量增加 14%

表明大额投资者在低位持续积累 ETH

总体来看,资金流动显示:比特币近期卖压增加,ETH 与山寨币受机构和鲸鱼资金关注,市场呈现高风险资产轮动趋势。

以太坊交易所储备量数据

技术指标分析

1、相对强弱指数(RSI 14)

根据 Bitbo 数据,截至 2025 年 9 月 5 日,比特币 14 日 RSI 为 43.28。从区间来看,RSI 在 30–50 之间通常被视为弱势区间,意味着市场多头力量不足,空头相对占据主动。当前 RSI 值显示出比特币的短期动能偏弱,市场资金流入有限,价格表现呈现震荡下行的倾向。虽然该水平尚未触及 30 以下的超卖区域,但已显露出下行动能的压力。如果 RSI 继续向 40 附近靠拢并企稳,市场可能在该区域获得技术性支撑,从而触发阶段性反弹;然而,一旦跌破 35,将释放更强烈的看跌信号,暗示价格可能面临进一步的下探风险。总体而言,比特币在当前 RSI 区间下仍处于多头乏力的状态,投资者需要密切关注 40–35 区间的表现,以判断后续走势的强弱转换。

比特币 14 日 RSI 数据图片

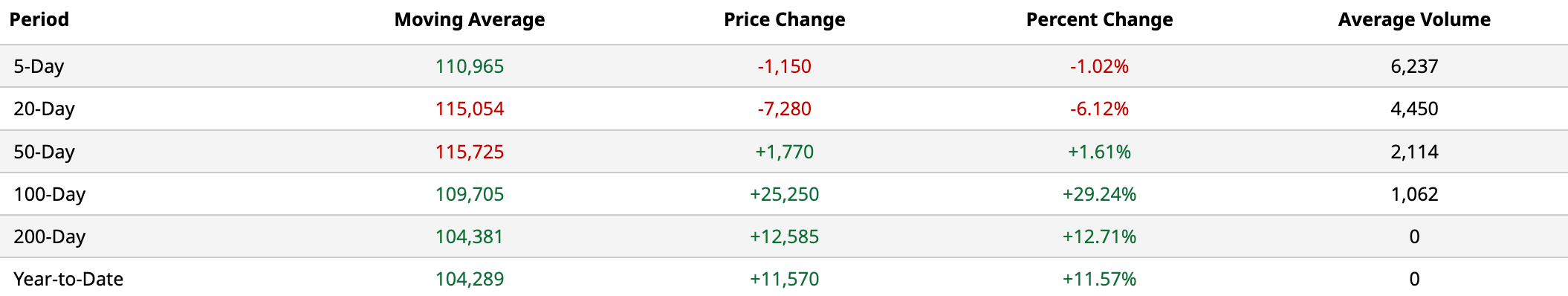

2、移动平均线(MA)分析

MA 5(5 日均线):$110,965

MA 20(20 日均线):$115,054

MA 50(50 日均线):$115,725

MA 100(100 日均线):$109,705

MA 200(200 日均线):$104,381

当前价格:$111,395

MA 5、MA 20、MA 50、MA 100 数据图片

短期来看,当前价格略高于 MA 5($110,965),但仍显著低于 MA 20 与 MA 50,说明短期价格虽有小幅企稳迹象,但整体仍处于阶段性回调趋势。

中期方面,MA 20 与 MA 50 高于现价,且两者形成压力带,表明中期阻力位在 $115,000-$116,000 区间。若价格无法突破此区间,市场可能继续维持弱势震荡。

长期来看,MA 100($109,705)与 MA 200($104,381) 均在现价下方,显示长期趋势依旧维持多头格局,比特币仍处于长期上涨通道中。

趋势解读:

短线:价格有望围绕 MA 5 与 MA 100 之间震荡整理,区间大致在 $109,700-$112,000。

中期:若能突破 MA 20 与 MA 50 压力带($115,000 附近),有望重回上升趋势。

长期:只要价格不跌破 MA 200($104,000 区域),比特币的长期牛市结构依旧完好。

3、关键支撑与阻力位

支撑位:短期关键支撑区域分别位于 $110,500 与 $109,500.9 月 3 日,比特币价格两次回调至 $110,500 水平,均未出现进一步下跌,说明该价位具备较强承接力。随后在 9 月 4 日的回落过程中,$109,500 支撑位再次得到验证,下跌动能被有效遏制,显示买盘在该区域较为积极。若该水平失守,则下方 $109,000 将成为下一道防线。

阻力位:短期阻力主要集中在 $112,000 – $113,000 区间。从技术结构来看,$112,000 为前期密集成交区上沿,叠加短期均线压制,成为首要突破点。若价格能够有效突破并稳固站上 $112,000 上方,则有望进一步挑战 $113,000 一线。该区间空头抛压较为集中,预计将成为短期行情的强劲阻力。

综合分析

整体来看,比特币短期走势依旧处于区间震荡格局,多空力量在 $109,500 – $112,500 区间内反复博弈。下方支撑层层递进,显示买盘承接意愿较强,而上方阻力带压力明显,突破难度较大。在未出现有效放量突破之前,行情大概率维持区间整理。若能企稳于 $112,000 之上,将打开进一步上行空间;反之,一旦 $109,500 被跌破,则需警惕价格向 $109,000 甚至更低支撑位寻求确认。短期操作上,宜关注区间内的支撑与阻力变化,保持灵活应对。

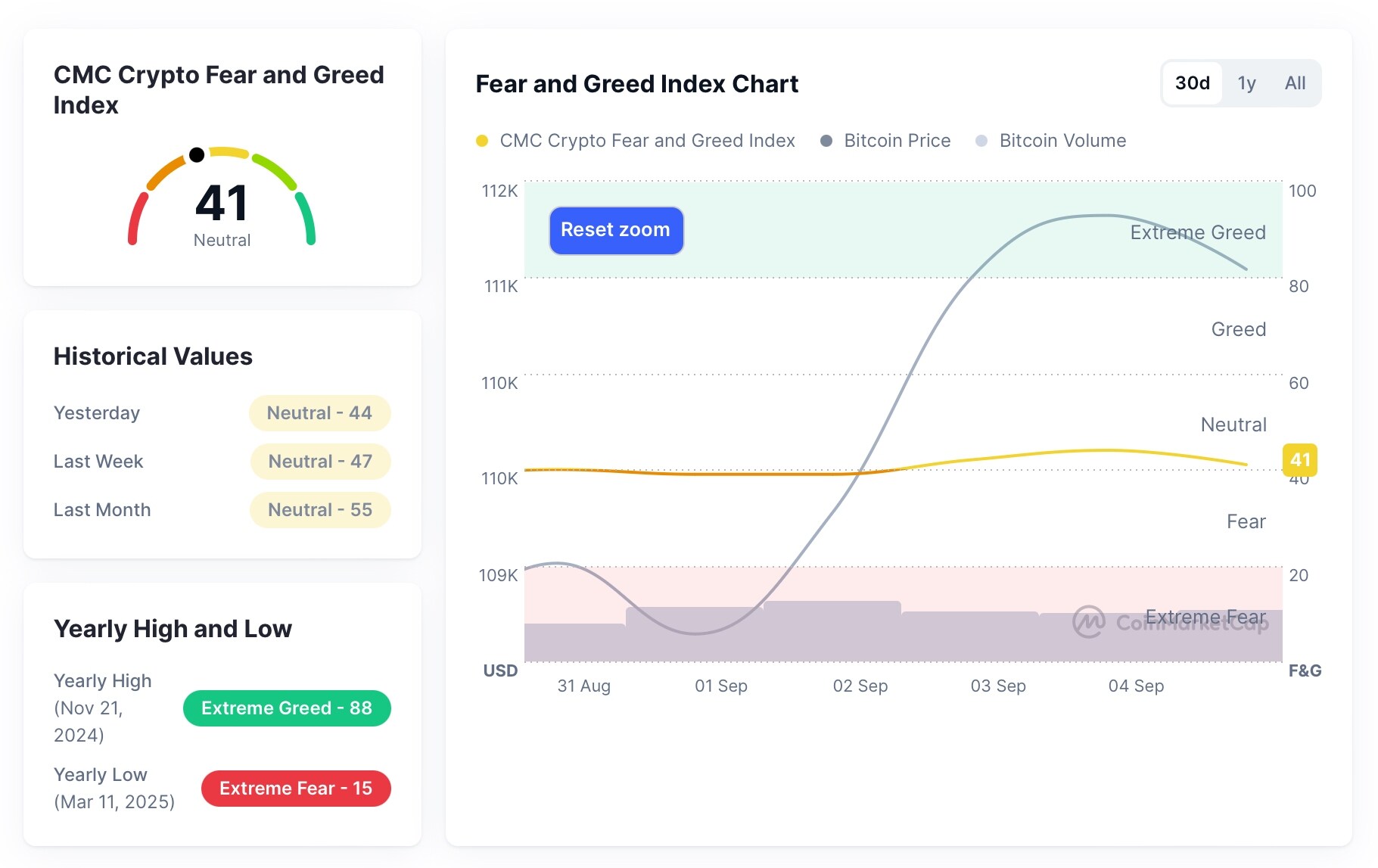

市场情绪分析

截至 9 月 5 日,恐惧与贪婪指数(Fear \u0026amp; Greed Index)报 41 点,位于“中性”(Neutral)区间的下沿,显示市场情绪依旧偏向谨慎,投资者整体维持防御姿态。

回顾本周(8 月 30 日–9 月 5 日),恐惧与贪婪指数每日值分别为:39(接近“恐惧”区间边缘)、40(中性边缘)、39(中性边缘)、39(中性边缘)、42(中性下沿)、44(中性)整体区间运行于 39–44 点,波动幅度有限。

整体而言,本周比特币市场情绪维持在“中性”下沿震荡,投资者态度趋于谨慎保守。虽然恐惧情绪未进一步加剧,但资金观望氛围浓厚,显示市场依旧缺乏强有力的上行动能。若后续价格能有效企稳并放量突破关键阻力位,市场情绪或有望进一步修复;反之,若价格再次回落,指数可能跌入“恐惧”区间。

恐惧与贪婪指数数据图片

宏观经济背景

1、美联储褐皮书(Beige Book)已发布

本周三(9 月 3 日)发布,显示美国大多数地区经济活动“几乎没有变化”或“略显疲弱”,劳动力市场依旧稳定,通胀处于温和上升状态。报告指出企业买入谨慎、AI 替代部分岗位、机构用工不愿补缺,以及移民劳动力减少等结构性挑战。

市场普遍预期美联储将在 9 月 16–17 日的 FOMC 会议上采取降息措施。

经济趋于疲软加上降息预期增强,通常会推动投资者转向非传统资产(如比特币)以寻求抗通胀或风险对冲。

相关图片

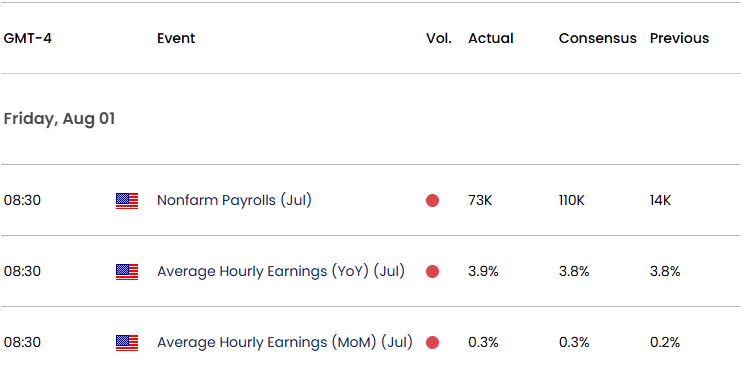

2、就业数据发布在即

美国 8 月非农报告将于本周五(9 月 5 日,08:30 ET)发布,市场普遍预测新增就业约在 73,000–75,000,失业率可能小幅上升至 4.3%。

就业数据若弱于预期,将进一步强化降息预期,利好包括比特币在内的风险资产。

相关图片

3、美国市场:政治风险与宏观不确定性上升

特朗普关税与干预美联储引发市场紧张

法院判定其多数关税措施不合法,市场担心退款风险加剧财政压力,债券收益率飙升,市场波动显著增加。这也推高了黄金和比特币等避险资产的吸引力。

投资者对未来政策的不确定性上升

特朗普试图影响美联储独立性,市场对此忧虑不断加剧,引发资金流向替代资产,包括黄金和比特币。

相关图片

4、科技龙头助推股市短暂回暖

Alphabet 和 Apple 股价暴涨

Alphabet 因反垄断案胜诉维持 Chrome 浏览器权利及与 Apple 合作,其股价飙升约 9%,带动 Apple 同期上涨近 4%。

加密资产“American Bitcoin”大幅上涨

特朗普家族相关比特币矿企 American Bitcoin(股票代码 ABTC)于纳斯达克上市首日上涨近 17 %,至每股 8.04 美元,盘中股价一度触及约 14 美元的高点。该股在纳斯达克首日交易量超过 2900 万股。

5、避险资产走高

黄金创历史新高

9 月 2 日消息,黄金价格攀升至每盎司约 3,578 美元,反映市场对美国政策与经济动荡的不安,同时支持比特币近期涨势。

相关图片

6、亚太地区政策与经济表现稳健

马来西亚央行维持利率稳定

央行于 9 月 4 日宣布关键隔夜利率维持在 2.75%,预计此利率水平将持续至 2027 年。这一决定在通胀温和、经济增长可持续的背景下作出。

相关图片

7、市场季节性与风险偏好变化

9 月市场风险再次引发关注

历史上 9 月是美股表现不佳的月份,叠加债务发行高峰、再平衡与政策模糊等因素,本周市场尤其脆弱。股票与债券双双承压,波动率上升,投资者寻求避险路径。

相关图片

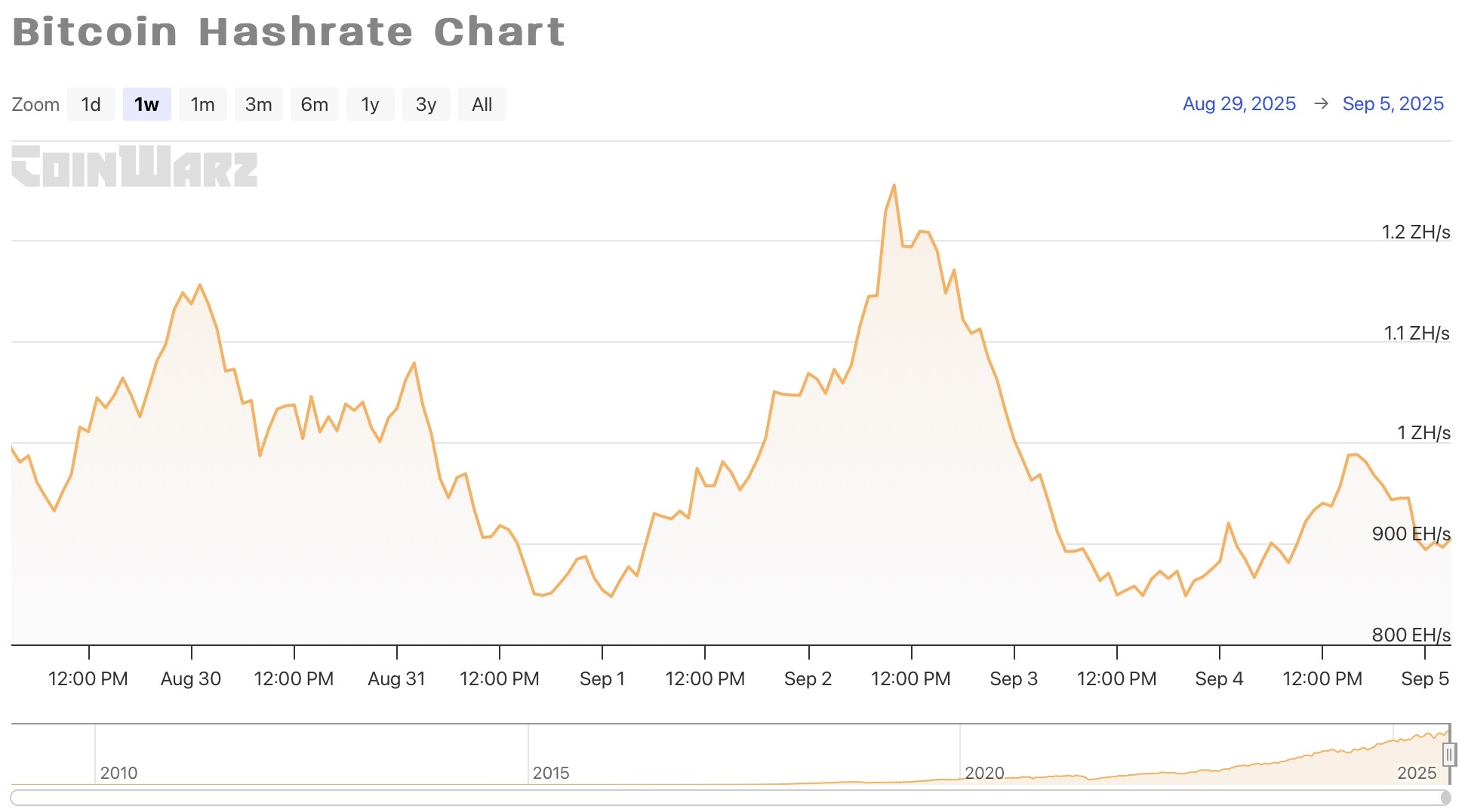

3、哈希率变化

过去七天,比特币网络哈希率整体呈现出宽幅震荡特征,形成了“回落—攀升—回落”的周期性波动格局。

从具体走势来看:

- 8 月 30 日至 9 月 1 日,哈希率持续回落,自 1.1569 ZH/s 下探至 1 ZH/s 附近并横盘,随后小幅反弹,但最终在 9 月 1 日刷新本周低点,降至 847.53 EH/s。

- 9 月 1 日至 9 月 2 日,哈希率攀升并突破,不仅恢复至 1 ZH/s 上方,更是在 9 月 2 日创下 1.2556 ZH/s 的历史新高,显示出短期算力释放的集中性。

- 9 月 2 日至 9 月 3 日,哈希率逐步回落,从峰值逐步下滑至 850 EH/s 附近。

- 9 月 3 日至 9 月 4 日,波动趋缓,9 月 3 日哈希率在 850 EH/s 左右震荡,9 月 4 日哈希率小幅升至 987.81 EH/s ,整体运行区间在 850 EH/s-1 ZH/s 震荡。

- 9 月 5 日,哈希率再度回落至 900 EH/s 附近,截止撰稿时暂报 905.55 EH/s。

整体来看,本周比特币网络算力在高位频繁波动,呈现出极强的弹性。其背后可能反映出部分矿场因电力成本、地区气候以及临时性维护而产生的周期性上线与下线现象,同时也显示出大型矿机群体在不同电价窗口期之间灵活切换运行状态。

展望

9 月 2 日,比特币单日算力创下 1.279 ZH/s 的历史新高,这一数据刷新了全网纪录,但同期比特币价格在过去 24 小时内基本持平。这说明矿工端的算力扩张与市场价格的联动并不完全同步,更多体现了矿机产能投放的节奏和电力资源的调配。

与此同时,比特币哈希率的七日移动平均值也在近期突破 1 ZH/s,确认网络整体算力正在进入高位运行区间。若这一趋势能够延续,意味着比特币网络安全性将进一步增强,但也可能加速部分中小矿工的退出,因为高算力环境下挖矿难度或将在下一次调整中上行。

未来一周需重点关注以下因素:

1. 挖矿难度调整:若算力维持在当前高位,预计下一个难度周期将出现显著上调,增加矿工的边际成本。

2. 能源市场波动:随着部分地区进入季节性用电高峰,矿场可能会再次出现算力断崖式波动,进而影响全网哈希率稳定性。

3. 宏观市场环境:比特币价格若长期横盘,而算力保持在高位,部分高成本矿工的盈利空间将被进一步压缩。

综合判断,当前比特币算力的高位震荡状态更可能是“阶段性峰值释放”,短期或继续维持在 900 EH/s—1.2 ZH/s 区间内波动,中长期则需结合比特币价格走势与挖矿难度调整结果,才能进一步判断算力趋势是否具备持续性上行动力。

周度比特币网络哈希率数据

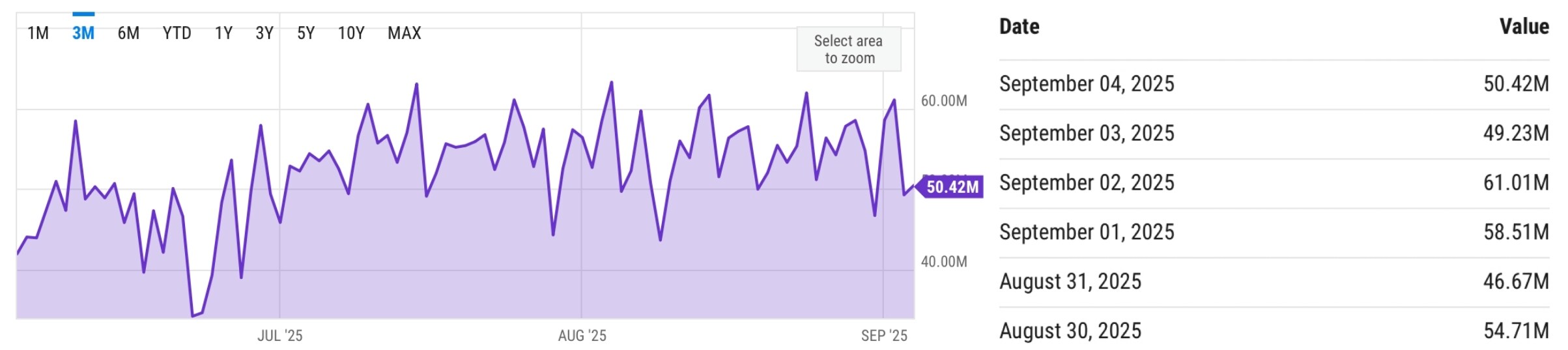

4、挖矿收入

根据 YCharts 数据,过去一周,比特币矿工的日均总收入(包括区块奖励与交易手续费)在 4,667 万美元至 6,101 万美元之间波动,具体如下:

8 月 30 日:5,471 万美元

8 月 31 日:4,667 万美元

9 月 1 日:5,851 万美元

9 月 2 日:6,101 万美元

9 月 3 日:4,923 万美元

9 月 4 日:5,042 万美元

比特币矿工每日收入数据

整体来看,本周比特币矿工收入呈现区间震荡走势。收入在 9 月 2 日短暂冲高后回落,主要受到比特币价格波动、网络算力变化及交易手续费水平的影响。

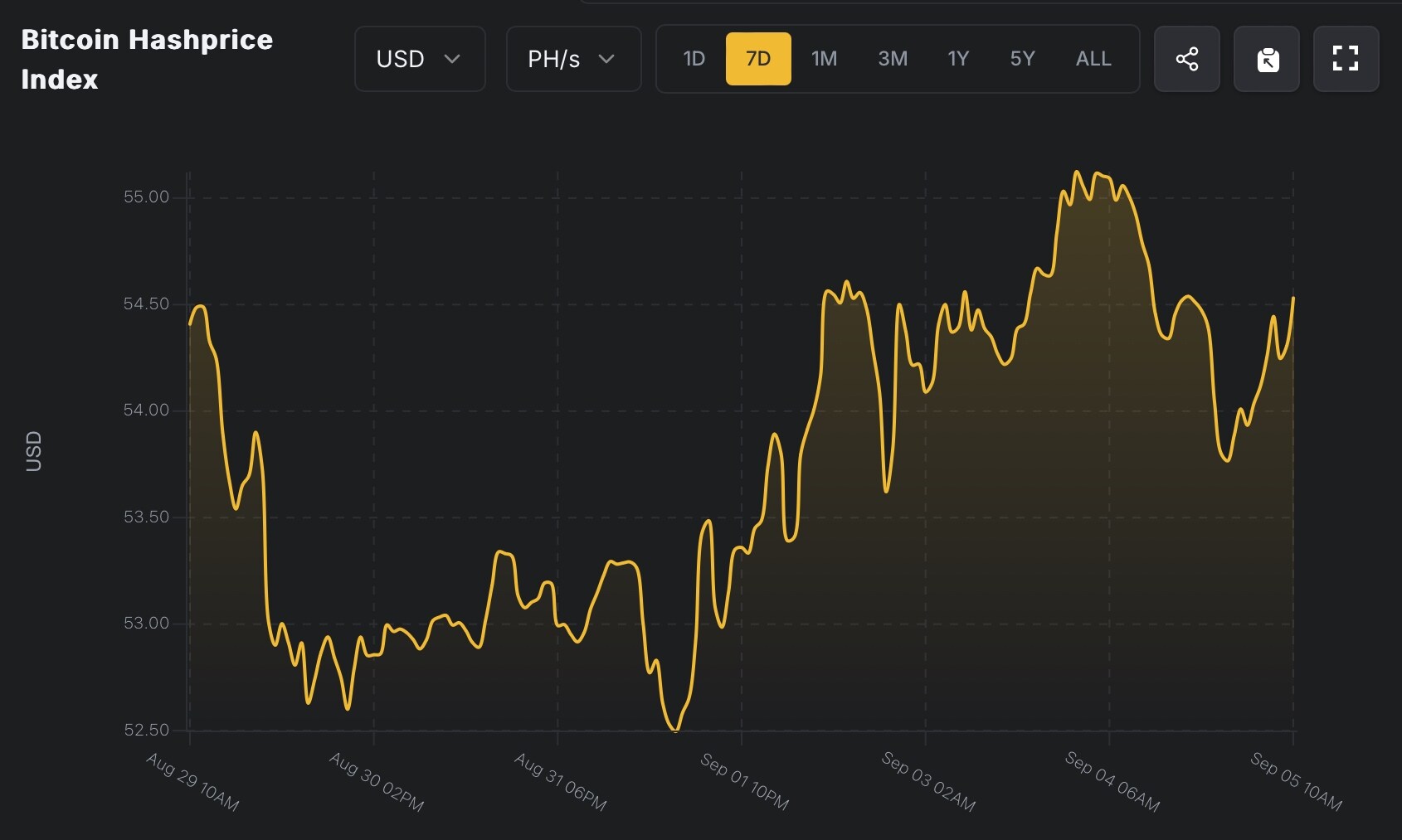

从单位算力每日收益(Hashprice)的角度观察,Hashrate Index 数据显示,截至 2025 年 9 月 5 日,Hashprice 为 54.47 美元/PH/s/天。本周 Hashprice 与比特币价格走势基本一致,表现为低位横盘后逐步攀升,于 9 月 1 日触及本周低点 52.49 美元/PH/s/天,于 9 月 4 日升至本周高点 55.12 美元/PH/s/天。整体走势表现为低位震荡后逐步回升,随后进入阶段性调整,与比特币价格基本一致。这也说明当前挖矿经济模型仍主要由价格主导,而算力的持续增长则在中长期内不断侵蚀矿工利润空间。

Hashprice 数据

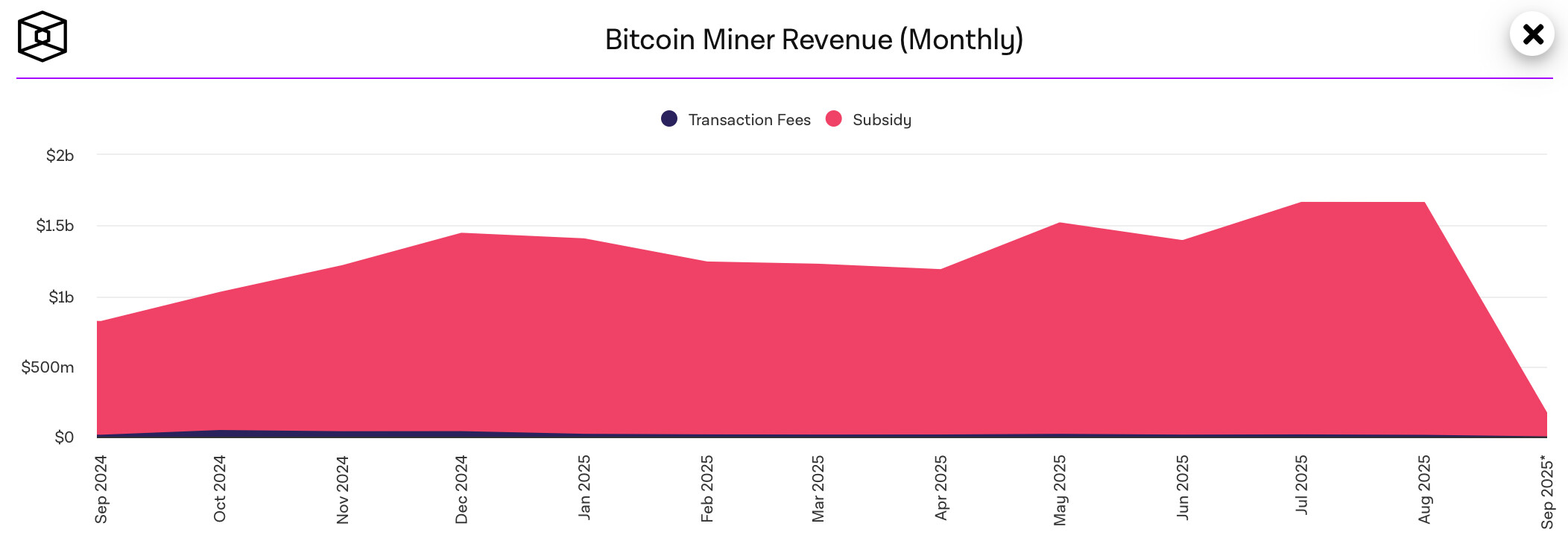

8 月月度挖矿收入回顾

根据 The Block 数据,2025 年 8 月比特币矿工总收入约为 16.6 亿美元,与 7 月基本持平(7 月收入亦为 16.6 亿美元)。然而,8 月下旬比特币价格的持续下行叠加网络算力稳步攀升,使得矿工整体收入的上行空间受到明显压制。

比特币矿工月度收入数据

未来展望

短期内,挖矿收益仍将受到比特币价格波动与全网算力持续增长的双重挤压。若价格未能突破前高,矿工的盈利能力将进一步承压。

中期来看:

若价格重回上升趋势,矿工收入有望修复,Hashprice 亦将同步改善。

若算力继续扩张(受新一代矿机部署与北美、哈萨克等地新增算力推动),Hashprice 或将进一步下探,行业利润分化加剧。

部分高成本矿工可能面临盈利困难,行业或出现算力出清与集中化现象,这对头部矿企反而构成利好。

5、能源成本和挖矿效率

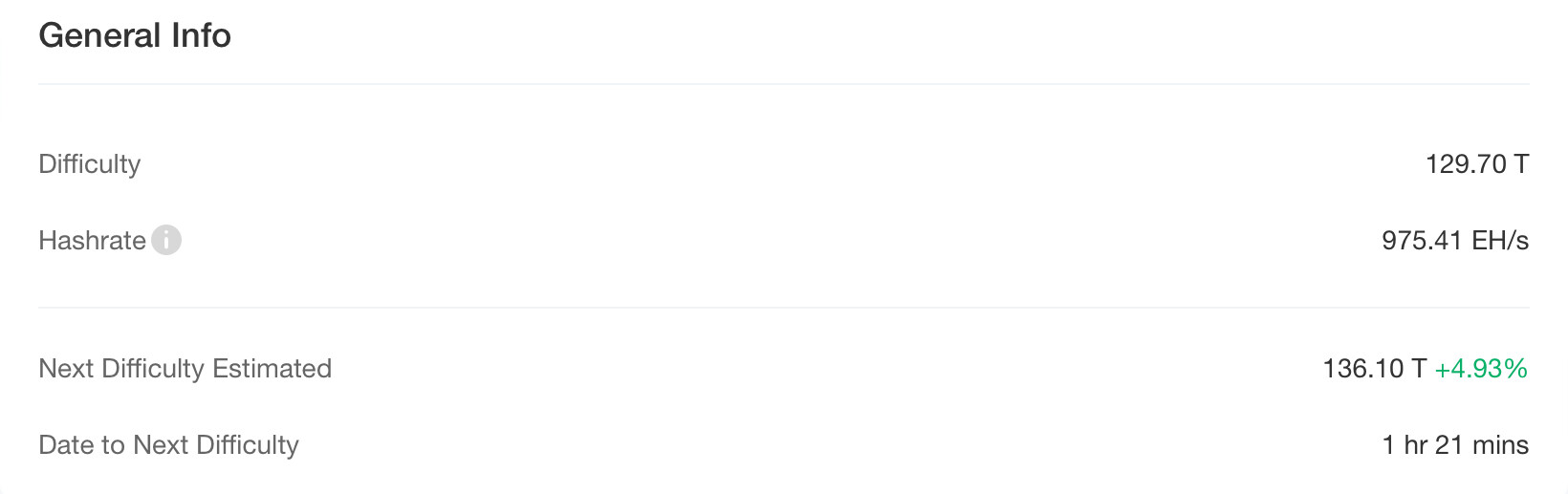

根据 CloverPool 数据,截至 2025 年 9 月 5 日,比特币全网算力达到 975.41 EH/s,挖矿难度为 129.70 T。预计下一次难度调整将在当日进行,预估将上调约 4.93%,调整后难度预计为 136.10 T。这一趋势显示,比特币网络算力仍在稳步增长,矿工竞争持续加剧。难度上调意味着在当前电力成本和硬件效率条件下,每块区块的挖矿难度将进一步增加,矿工需要更高效率的矿机或更低成本的电力来维持盈利能力。

从长期来看,难度上调通常伴随算力的集中化趋势,规模化矿场和拥有高效 ASIC 矿机的矿工在利润空间上占据优势。对于中小矿工而言,如果电力成本或设备效率无法匹配难度增长,其挖矿收益可能受到压缩。

比特币挖矿难度数据

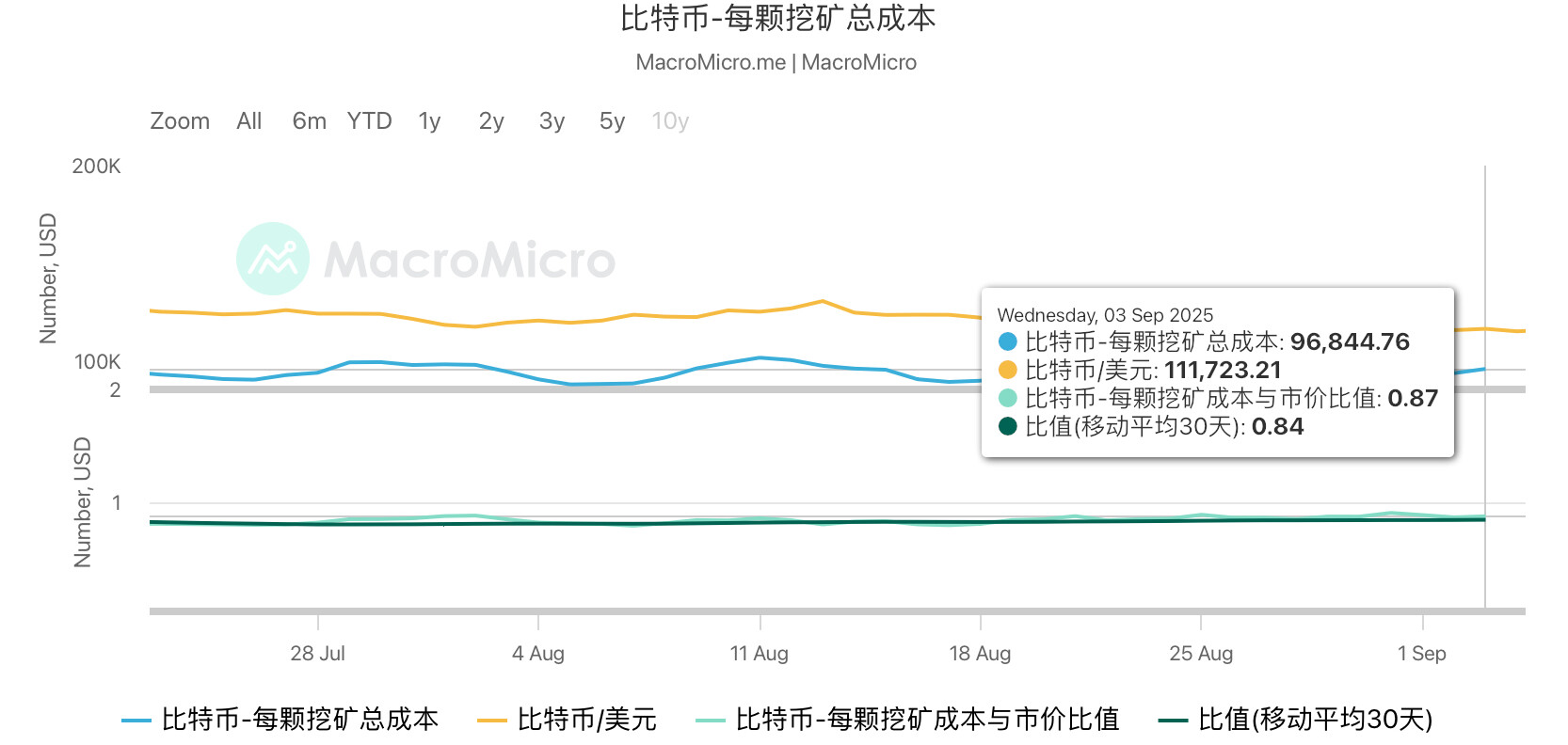

从挖矿成本角度来看,根据 MacroMicro 最新模型测算,截至 2025 年 8 月 3 日,比特币的单位生产成本约为 96,844.76 美元,而同期现货价格为 111,723.21 美元,挖矿成本-现价比(Mining Cost-to-Price Ratio)为 0.84,显示矿工平均仍有约 16%的毛利空间。这一数据表明,虽然矿工仍保持盈利,但盈利水平相较前期略有收紧。这可能与挖矿难度上升和比特币价格变化相关,市场在短期内盈利压力略增,但整体仍具有可观利润空间,支撑矿工持续参与网络维护。

每枚比特币的挖矿总成本数据

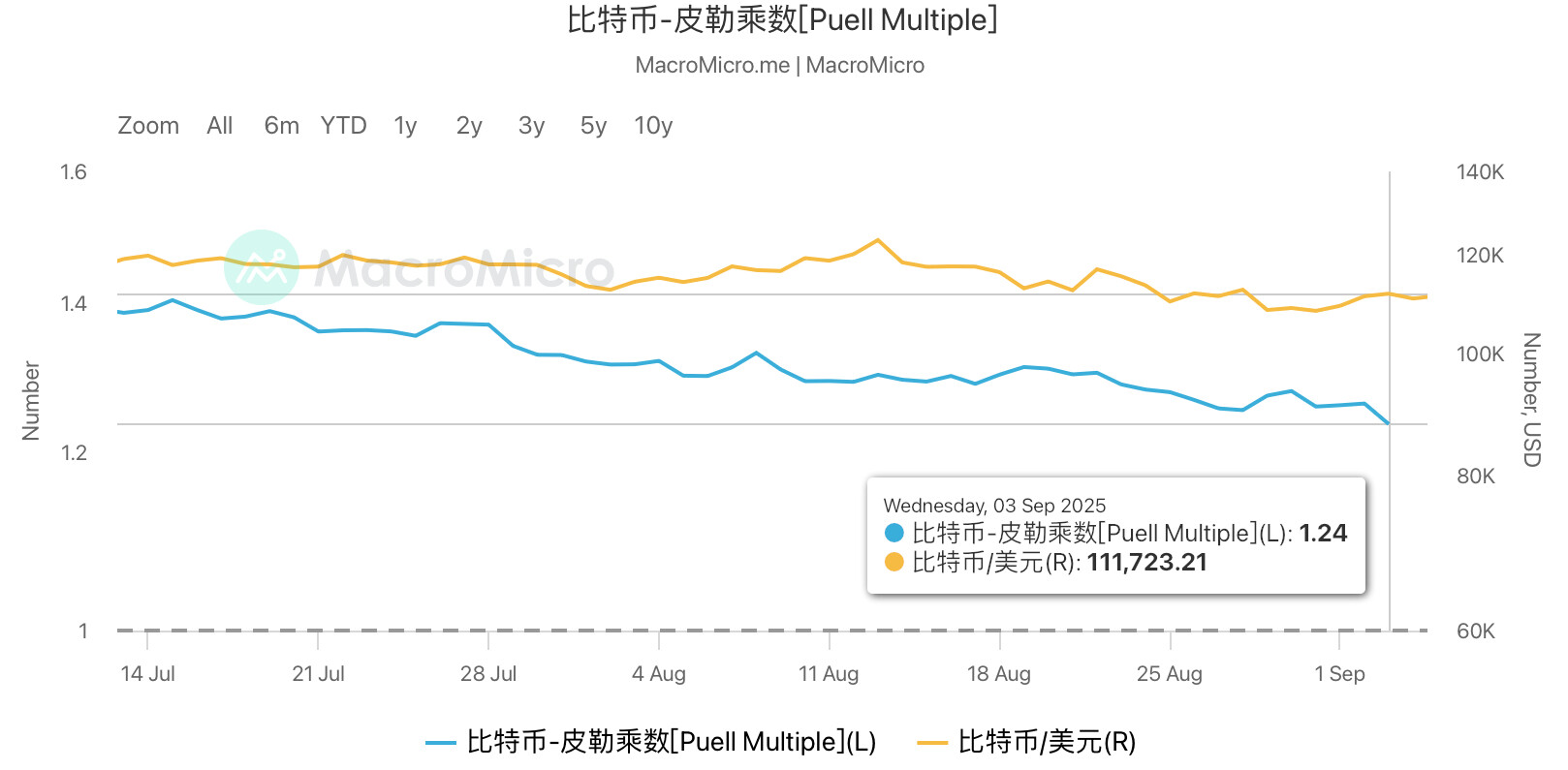

同时,链上指标 Puell Multiple (比特币-皮勒乘数)有所下降,维持在 1.24–1.28 区间。Puell Multiple 是通过比较每日比特币发行价值与其年度平均发行价值的比率,用于衡量矿工盈利水平和市场过热程度。当前水平显示:

矿工仍保持盈利,但盈利空间相较历史高位有所压缩。

Puell Multiple 低于 2 时,通常意味着市场挖矿利润中等或偏低,市场不处于过热状态,有利于比特币健康积累。

结合成本-现价比来看,虽然矿工盈利存在,但市场压力可能逐步增加,尤其在难度上升或电力成本波动的情况下,高成本矿工面临收益压力。

BTC Puell Multiple 数据

综合来看,比特币全网算力持续增长,网络安全性稳健,但随着挖矿难度上调及比特币价格变化,矿工盈利空间有所压缩。综合算力、成本与链上指标,当前比特币挖矿生态稳健,但未来仍需关注难度上调、电力成本波动、硬件效率变化以及比特币价格波动对矿工边际收益和网络算力可能产生的影响。

6、政策和监管新闻

印度法庭判处某涉加密货币敲诈勒索案件的 14 人终身监禁

8 月 30 日消息,据 Deshgujarat 报道,印度反腐败法庭判处 14 人终身监禁,其中包括 11 名警察官员和一名前印度人民党 (BJP) 立法议会议员,他们的罪名是绑架一名印度商人并勒索加密货币。法官认定该团伙犯有犯罪阴谋、绑架勒索、非法拘留和袭击罪。

据悉,印度商人 Shailesh Bhatt 在他投资的 BitConnect 公司倒闭后以比特币的形式收回了部分投资,然而得知他追回部分投资后,上述官员策划了一场夺取加密货币的绑架阴谋,最终 Shailesh Bhatt 同意转移部分比特币和 360 万美元现金后才获释。

相关图片

派盾:8 月加密货币安全事件造成 1.63 亿美元损失,较 7 月增加 15%

9 月 1 日消息,据 PeckShieldAlert 监测,2025 年共发生约 16 起重大加密货币安全事件,总损失达 1.63 亿美元,较 7 月的 1.42 亿美元增加 15 %。

其中,最大规模的五起安全事件分别为:某比特币持有者损失 9140 万美元;土耳其加密货币交易所 BTCTurk 遭受 5400 万美元损失;ODIN•FUN 项目损失 700 万美元;BetterBank.io 损失 500 万美元;CrediX Finance 损失 450 万美元。值得注意的是,BTCTurk 在过去一年内已两次遭受重大安全事件,继 2024 年损失 5400 万美元后,累计损失已超过 1 亿美元。

相关图片

7、矿业新闻

IREN 将向 NYDIG 支付 2000 万美元解决因比特币挖矿设备贷款违约而引发的纠纷

8 月 30 日消息,据 Theminermag 报道,纳斯达克上市比特币矿企 IREN 在其年度报告中表示将向 NYDIG 支付 2000 万美元,以解决多年来因比特币挖矿设备贷款违约而引发的纠纷。

该和解协议于 8 月首次达成,IREN 公司涉及 2022 年底拖欠了 1.078 亿美元的债务,其中包括利息和滞纳金,这些贷款于 2021 年通过 NYDIG 安排,为约 35,000 台 Antminer S 19 矿机提供了融资。IREN 表示该和解协议结束了所有相关诉讼并保护其附属公司、高管和股东免受进一步索赔,目前等待法院批准正式结案。

相关图片

研究:企业买入比特币的速度约是开采速度的四倍

8 月 31 日消息,据 CoinDesk 报道,比特币金融服务公司 River 在研究报告中表示,企业每天吸收的比特币远远超过矿工创造的比特币。

企业每天吸收约 1,755 个比特币,到 2025 年,比特币的新增发行量约为每天 450 个比特币,这意味着企业吸收的比特币几乎是矿工供应量的四倍,基金和现货 ETF 每天又增加了 1,430 个比特币,进一步推高了机构需求。

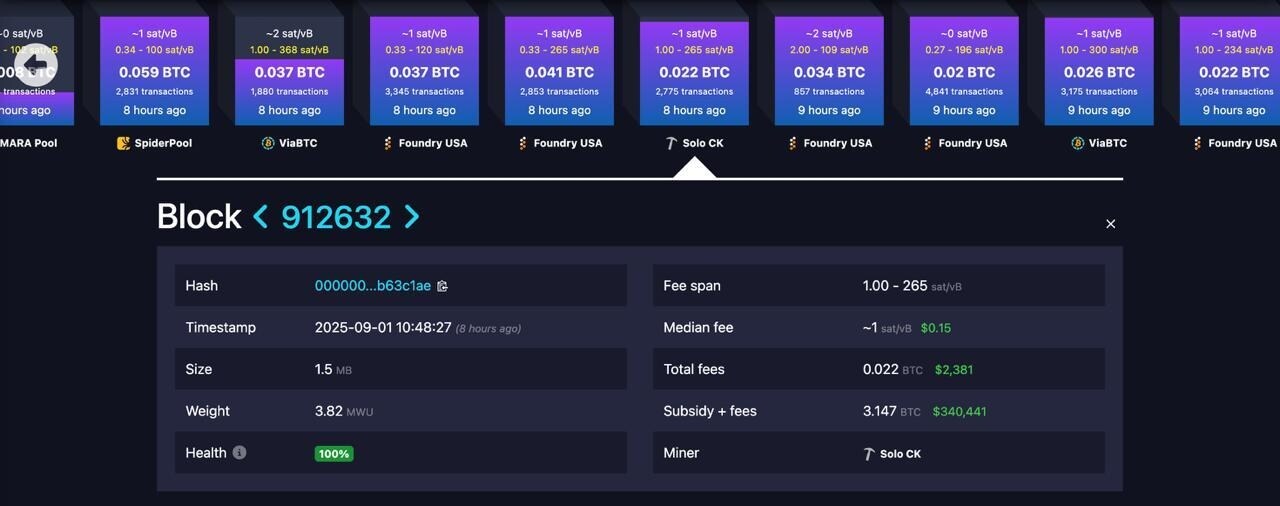

数据:某独立矿工成功挖出比特币新区块,赚取约 34 万美元

9 月 2 日消息,据 Cointelegraph 报道,24 小时前,一名独立矿工成功挖出比特币区块 912632,赚取了约 34 万美元。

相关图片

摩根大通:13 家美国上市比特币矿企总市值 8 月创历史新高,环比增长 23%

9 月 2 日消息,摩根大通发布研究报告指出,比特币网络哈希率上个月重回历史高位,达到平均 949 EH/s。13 家美国上市比特币矿企总市值创历史新高,达到约 74 亿美元,环比增长 23%。TeraWulf 的表现优于其他公司,上涨了 83%,而 Greenidge Generation (GREE) 的表现逊于其他公司,下跌了 22%。

特朗普家族支持的比特币矿企 American Bitcoin(ABTC)成功登陆纳斯达克,首日股价上涨近 17%

9 月 3 日消息,特朗普家族支持的比特币矿企 American Bitcoin(ABTC)完成与 Gryphon Digital Mining 的合并后于纳斯达克上市,特朗普长子 Donald Trump Jr.、次子 Eric Trump 与矿企 Hut 8 共同持有新实体 98% 股份。9 月 4 日,该公司首日股价上涨近 17% 至 8.04 美元,盘中一度触及 14 美元,高成交量超 2900 万股;Eric Trump 表示其挖矿成本仅为比特币市价的一半,并拥有数亿美元资产及数据中心作为支撑。据彭博社测算,其持股价值已超 5 亿美元。American Bitcoin 还计划效仿 MicroStrategy,通过在日本及香港收购上市公司打造比特币储备平台。

相关图片

小唐纳德·特朗普支持的 Thumzup 将购买 2500 台 DOGE 矿机并增持 SOL、LTC、XRP 和 ETH 等加密货币

9 月 5 日消息,据 PRNewswire 报道,特朗普长子小唐纳德·特朗普投资持有加密货币储备的社交媒体公司 Thumzup Media Corporation 发布股东信,其中指出该公司已斥资 100 万美元购买比特币,同时其董事会已授权增持 DOGE、LTC、SOL、XRP、ETH 和 USDC 等加密货币,目前还达成了一项收购最终协议,将购买 2500 台 DOGE 矿机,后续可能会再增加购买 1000 台矿机。

8、比特币相关新闻

全球企业与国家比特币持仓情况(本周统计)

1、Bitcoin Treasury Capital 募资 200 万瑞典克朗,将继续购入比特币

8 月 30 日,瑞典上市公司 Bitcoin Treasury Capital 公布认股权证行权结果,共募资约 200 万瑞典克朗。公司计划将资金继续用于比特币购入。

2、中国金融租赁集团投资比特币与以太坊 ETF

8 月 30 日,中国金融租赁集团在中期业绩报告中披露已开始投资加密货币 ETF,重点布局持有实物资产的产品。目前主要持有贝莱德比特币信托 ETF、华夏比特币 ETF 及以太坊相关 ETF。

3、萨尔瓦多一周增持 8 枚 BTC,总持仓达 6285 枚

8 月 31 日,萨尔瓦多过去 7 日增持 8 枚比特币,总持仓升至 6,285.18 枚,价值约 6.83 亿美元。

4、S-Science 将比特币投资额度提升至 96 亿日元

9 月 1 日,S-Science 宣布将比特币投资额度从 5 亿日元大幅提升至 96 亿日元(约 6,530 万美元)。

5、日本美甲品牌 Convano 启动募资并持续增持比特币

8 月 31 日,日本美甲品牌 Convano 宣布筹资 30 亿美元,目标购入 21,000 枚比特币,占总供应量约 0.1%。公司计划分阶段购入:2025 年底达到 2,000 枚,2026 年 1 万枚,2027 年达到 2.1 万枚。随后,该公司于 9 月 1 日新增 155 枚比特币,总持仓升至 519.93 枚,持续推进比特币储备计划。

6、Metaplanet 跃升全球第六大比特币持仓公司,计划 2027 年前累计购入 21 万枚 BTC

9 月 1 日,据 Bitcoin Treasuries 数据显示,日本上市公司 Metaplanet 在最新披露增持后,比特币持仓已超越特朗普媒体科技集团(1.5 万枚 BTC)和矿企 Riot Platforms(19,239 枚 BTC),跻身全球第六大持仓上市公司。此前,Metaplanet 股东已批准通过发行优先股等方式,最高筹资 38 亿美元,用于进一步收购比特币。公司总裁 Simon Gerovich 表示,计划在 2027 年前累计购入 21 万枚 BTC(约占总供应量 1%),并将推出永续优先股等新型金融工具以助力扩张。

7、Hyperscale Data 加码比特币,募资 1.25 亿美元并新增 2000 万美元 BTC 入账

8 月 30 日,纽约证券交易所上市公司 Hyperscale Data 宣布通过“ATM”股票发行计划拟募资 1.25 亿美元,部分资金将用于购买比特币和 XRP,并扩建密歇根数据设施。随后,该公司于 9 月 2 日宣布在资产负债表中新增约 2000 万美元的比特币,作为增强硬资产储备的重要举措。

8、Strategy 斥资 4.49 亿美元购入 4048 枚 BTC

9 月 2 日,Strategy 在一周内购入 4048 枚比特币,总价 4.493 亿美元,继续扩大储备。

9、 9 月 2 日,Empery Digital 宣布增持 16.51 枚比特币,总持仓达 4081.39 枚,累计投入约 4.8 亿美元。同时还回购逾 100 万股普通股。

10、Yoshiharu Global 更名 Vestand,启动加密财库战略

9 月 2 日,日本拉面连锁运营商 Yoshiharu Global 宣布更名为 Vestand Inc.,并将比特币等数字资产纳入资本结构。

11、加拿大餐饮品牌 Tahini’s 再度购入 BTC,细节未披露

9 月 3 日,加拿大连锁餐厅 Tahini’s 宣布再次购入比特币,但未公布具体金额。该公司自 2020 年起持续增持 BTC,并在餐厅设有比特币 ATM。

12、摩根士丹利二季度购入 1.88 亿美元比特币 ETF

9 月 3 日,摩根士丹利披露在 2025 年 Q 2 期间购入了价值 1.88 亿美元的比特币 ETF。

13、H 100 Group 增持 47 枚 BTC,总持仓突破 1000 枚

9 月 3 日,H 100 Group 增持 47.16 枚比特币,总持仓升至 1004.56 枚。

14、Treasury B.V. 完成 1.47 亿美元融资,并已购买超 1000 枚 BTC

9 月 3 日,据 Cointelegraph 发文,总部位于欧洲的比特币公司 Treasury 完成 1.47 亿美元融资, Gemini 创始人 Winklevoss Capital 和 Nakamoto Holdings 领投。该公司已购买超过 1000 枚 BTC

15、American Bitcoin 持仓增至 2443 枚 BTC,大幅高于首次披露

9 月 4 日,American Bitcoin 披露持仓升至 2443 枚,价值 2.73 亿美元,较首次披露的 152 枚大幅增加。

16、巴西上市公司 Méliuz 增持 9 枚 BTC,总持仓达 605 枚

9 月 4 日,Méliuz 披露增持 9.01 枚比特币,总持仓升至 604.69 枚。

17、澳大利亚 Monochrome 现货比特币 ETF 持仓升至 1028 枚

9 月 4 日,澳大利亚 Monochrome 现货比特币 ETF (IBTC) 披露持仓量已达到 1,028 枚比特币,市值约 1.74 亿澳元。

18、CIMG 启动 5500 万美元比特币财库,与 Merlin Chain 合作

9 月 4 日,纳斯达克上市公司 CIMG Inc. (Nasdaq: IMG) 宣布与 Merlin Chain 达成战略合作,启动规模 5,500 万美元的比特币财库。首批 500 枚 BTC 将通过 Merlin Chain 的 Institutional HODL+ 上链并参与生息。这是业内首次由上市公司推动的链上比特币财库试点,为企业级财库提供合规、安全、可持续的 BTCfi 路径。

19、Figma Q 2 营收近 2.5 亿美元,持有约 9080 万美元比特币现货 ETF

9 月 5 日,Figma 发布美国 IPO 以来第一份业绩报告。二季度营收 2.496 亿美元,同比增长 41%,预计全年营收 10.21 亿-10.25 亿美元,三季度营收预计 2.63 亿-2.65 亿美元。截至 6 月 30 日,Figma 持有约 16 亿美元的现金、现金等价物和可出售证券,其中包括 9,080 万美元的比特币现货 ETF。公司表示,这一比特币持仓属于资产负债表和多元化财资策略的一部分,而非专门的比特币金库公司。

Bitwise 分析师:比特币可对冲美债抛售压力

8 月 31 日消息,Bitwise 欧洲研究主管 André Dragosch 表示,黄金在股市下跌时通常是最佳对冲工具,而在美国国债承压时,比特币表现更具韧性。

历史数据亦显示,黄金多在股市熊市中上涨,而比特币则在美债抛售期间更有支撑力。截至 2025 年,黄金价格累计上涨超 30 %,比特币上涨约 16.46 %,反映出投资者在收益率上升、股市波动及现任总统特朗普支持加密货币立场下,对两者的差异化选择。

相关图片

分析师:人工智能将使股票过时 投资者将转向比特币

9 月 1 日消息,分析师兼投资者 Jordi Visser 表示,人工智能正加快创新周期,使发展缓慢的上市公司逐渐成为低效的投资工具,比特币将在未来几十年内优于股票。

Visser 指出:“比特币是一种信仰,信念比想法更持久。黄金自公元前便存在,比特币也将长期存在。”他补充称,人工智能可能会将原本需要百年的进程压缩至五年完成。在同一背景下,Eric Trump 近日在香港举行的 Bitcoin Asia 2025 大会上预测,比特币价格将达到 100 万美元,并称民族国家、富裕家族及上市公司正大量买入比特币。

阿联酋公司 RAK Properties 将接受比特币等加密货币进行房地产交易

9 月 2 日消息,据 Cointelegraph 报道,阿联酋(UAE)哈伊马角酋长国规模最大的上市房地产公司之一——RAK Properties,将开始接受加密货币用于国际房产交易。

根据周一发布的公告,RAK Properties 将开始接受比特币、以太坊、USDT 等加密货币支付。加密货币交易将由该地区全球支付平台 Hubpay 处理。Hubpay 会先将数字资产兑换成阿联酋当地法定货币,再存入 RAK Properties 的账户。据 TradingView 数据,自 2005 年在阿布扎比证券交易所上市以来,RAK Properties 市值已达 47 亿迪拉姆(约合 13 亿美元)。

相关图片

Bitwise 顾问:传统价值投资已失效,比特币是“意识形态投资”的深度价值资产

9 月 3 日消息,BitwiseInvest 顾问 Jeff Park 在文章中指出,本杰明·格雷厄姆的《聪明的投资者》已不再适用于当下市场,传统依赖收益和贴现模型的“牛顿式投资者”正逐渐失效。他认为,全球投资正在进入“意识形态投资者”时代,资本配置更大程度受到地缘政治、人工智能与文化因素的驱动,而非单纯的收益率模型。

在这一框架下,Park 将比特币视为深度价值资产:其代码运行超越地缘政治干预;其共识机制体现计算力的价值而与 AI 范式无关;其社区文化全球统一且去中心化。他表示,比特币兼具避险与信念属性,能够在制度变迁和意识形态冲突中保持韧性,因此将成为意识形态投资者的核心资产。

QCP:美联储独立性引关注,黄金和比特币成避险工具

9 月 3 日消息, QCP 发布简报表示,市场焦点已从降息本身转向美联储独立性问题。分析显示,市场正在长期端定价更高的期限溢价,同时降低美元下行周期的门槛。在此背景下,即使实施宽松政策,收益率曲线趋于陡峭,美元走软,而黄金和比特币则因投资者寻求对冲通胀和治理风险而获得支撑。

杰克逊霍尔会议后,降息仍被视为可能,尽管通胀难以迅速回落至 2% 目标。市场预计今年可能有两次降息,但新关税可能推高通胀预期,值得关注。

Coinbase 拟推出美国首支涵盖股票及加密货币的指数期货,股指构成包括七巨头、COIN 及 2 支贝莱德现货 ETF

9 月 3 日消息, Coinbase 宣布其衍生品交易平台持续扩展产品矩阵,拟推出创新性 Mag 7 + 加密资产股票指数期货,为美国首支同时涵盖股票与加密货币的上市衍生品期货合约。

指数构成包括:美股 “七巨头”:苹果 ( AAPL )、微软 ( MSFT )、谷歌 ( GOOGL )、亚马逊 ( AMZN )、英伟达 ( NVDA )、 Meta ( META )、特斯拉 ( TSLA ); Coinbase 股票 ( COIN );加密货币 ETF :贝莱德比特币信托 ( IBIT )、以太坊信托 ( ETHA )。指数采用等权重计算方法,10 个成分各占 10% 权重,每季度再平衡以反映市场变化。 MarketVector 担任官方指数提供商。合约采用月度现金结算模式,每份合约代表指数价值的 1 倍,预计在未来数月内向零售用户开放该产品交易。

美国企业家 Grant Cardone 以 400 枚比特币挂牌迈阿密豪宅,72 小时内达成交易

9 月 4 日消息,据 Bitcoin News 报道,美国企业家 Grant Cardone 近日以 400 枚比特币的价格(约合 4,300 万美元)在迈阿密 Golden Beach 挂牌出售其豪宅,该房产在上市后 72 小时内便达成了交易。

相关图片

Strike 创始人:ETH 无法翻转超越 BTC, 比特币是货币而以太坊是技术

9 月 5 日消息,比特币生态支付公司 Strike 创始人 Jack Mallers 在 X 平台发文回应以太坊联合创始人 Joseph Lubin 此前关于以太坊将颠覆比特币货币基础的观点,他表示以太坊无法翻转超越比特币,因为比特币是货币,是一个价值 500 万亿美元的机遇,而以太坊是一种技术,充其量也是一家新兴的科技公司,两者之间无法进行比较。

Jack Mallers 特别指出,需要注意的是 Joseph Lubin 和他的团队曾经一度拥有 100% 的 ETH 供应量,这与比特币形成鲜明对比,因为即使是中本聪也无法进行预挖矿,每一枚比特币都是通过工作量证明获得的,与现实世界的价值和收入挂钩。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。