作者:Seedco

据Business Insider报道,在线预测市场平台Polymarket正在进行新一轮融资,有投资者给出的估值高达 100 亿美元。

这一数字距离三个月前的 10 亿美元估值几乎是十倍的跃升,速度惊人。

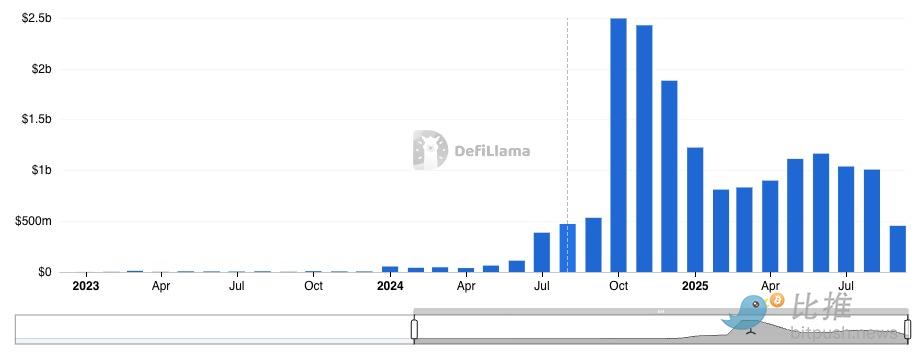

这家 2020 年创立的加密初创,如今不仅吸引了硅谷资本、政治力量和加密基金的三重加持,还在交易规模上走出了惊人的曲线:2024 年美国总统大选前夕,Polymarket 月度交易量在 2024 年 10 月达到 25 亿美元历史新高。目前虽然相比峰值有所回落,但平台仍维持每月约10亿美元的交易量,超过其 整个2023年的总和。

融资背景与支持方:资本+政治

Polymarket 成立于 2020 年,由Shayne Coplan创立。Coplan 曾就读纽约大学(NYU)计算机科学,但没等到毕业就选择辍学,之后专注于加密货币、预测市场相关技术和理念。

Polymarket 融资背景可谓豪华:

硅谷资本:三个月前,Peter Thiel的Founders Fund领投 Polymarket 的上一轮融资,将 Polymarket 估值定在约10亿美元。这轮融资使得 Polymarket 平台获得较为稳健的早期支持和资本基础。Thiel 以投资 Facebook、SpaceX、Palantir 而闻名,此次押注说明预测市场已进入主流风投视野。

政治「联结」:最新一轮融资中,Donald Trump Jr.(唐纳德·特朗普之子)的1789 Capital投入数千万美元,具体数字未公开,Donald Trump Jr.本人也加入了顾问阵容。

1789 Capital 本身是一个较新的 VC/风投资本机构,成立于 2022 年,由 Omeed Malik, Chris Buskirk, Rebekah Mercer 等人发起。基金强调「爱国资本主义」(patriotic capitalism)和以美国价值观为导向的投资。其投资组合里除了 Polymarket,还有国防科技、AI、生物科技、媒体等行业的公司。

加密资本:早期融资中,多家 Web3 基金(Polychain Capital、ParaFi Capital、Coinbase Ventures)支持 Polymarket,他们看重的是预测市场与加密支付、智能合约结合的天然契合度。

这种「硅谷 + 政治 + 加密」的组合,为 Polymarket 打造了独特护城河:既能承受监管挑战,也能借助舆论效应吸引流量。

此前2021 年,美国商品期货交易委员会(CFTC)曾禁止 Polymarket 在美国提供预测合约。但在 2024 年,美国监管态度出现转折,允许其在美国境内合规运营。这一「绿灯」不仅提升了合法性,也成为资本敢于重金押注的重要原因。

竞争与流量:超越博彩巨头

Polymarket 的崛起并不是孤立现象。预测市场整体正在经历一轮资本重估,其主要竞争对手Kalshi的估值也在今年从 20 亿美元 翻倍至 50 亿美元,显示出资本对这一赛道的集体押注。

与传统博彩平台相比,Polymarket 的增长更具爆发力。FanDuel、DraftKings等体育博彩巨头依赖 NFL、NBA 等周期性赛事驱动流量,而 Polymarket 的合约则覆盖更广泛:从美国大选、最高法院裁决,到美联储利率决议、地缘冲突甚至娱乐八卦。这样的广度让它能够在全年保持持续的热度。

更重要的是,预测市场与新闻周期紧密相连。比如在 2024 年美国总统候选人辩论期间,Polymarket 的相关市场单日交易量一度超过 1 亿美元;而在乌克兰战事或美联储议息会议临近时,相关合约也迅速成为资金焦点。这种「事件即市场」的特征,是传统博彩平台难以复制的优势。

因此,Polymarket 不仅在规模上直追甚至超越老牌博彩巨头,更在覆盖范围、用户黏性和社会影响力上展现出独特竞争力,正在从小众加密实验转型为主流的「信息化娱乐投机平台」。

为什么预测市场这么火爆?

信息效率:价格即共识

预测市场通过下注,把分散的观点转化为即时价格信号。相比民调滞后与偏差,预测市场价格更像是实时的「群体智慧」。无论是总统大选还是国际冲突,都能快速转化为市场合约。事件越热门,交易量越高,形成自我强化循环。

投机与娱乐的双重驱动

用户既能表达观点,也能博取收益。重大事件自带话题度,使预测市场兼具投机性与娱乐性。

机构的背书

Coinbase 在 「Prediction markets are having a moment」 中,将预测市场视为加密的下一个重大用例,因其依赖稳定币和链上结算,摩擦成本低、扩展性强。

a16z Crypto在 「Prediction markets and beyond」 中指出,预测市场潜力不仅在政治与金融,还可延伸至 AI、去中心化科学(DeSci)和治理机制。

a16z的 「State of Crypto」 报告更是直接点名预测市场为未来爆发的赛道之一。

当行业头部机构都押注这一方向,资本自然趋之若鹜。

未来的「信息交易所」?风险与争议

尽管估值和交易量节节攀升,预测市场仍然伴随重重风险。最常被提及的是操纵问题:市场价格理论上代表集体智慧,但在现实中,大额资金玩家完全可能通过短时间的集中下注来制造虚假的概率信号,从而误导公众的预期。

另一个长期存在的难题是仲裁与裁决机制。预测市场的合约往往需要对未来事件做出明确界定,但现实中的许多事件本身充满模糊空间,这使得最终的判定过程容易引发争议。一旦仲裁缺乏透明度或公信力,用户信任便会受到侵蚀,市场机制也会因此失效。

此外,政策与伦理担忧在华盛顿和学界也从未消停。批评者认为,预测市场可能在选举、地缘政治等敏感话题中放大极化情绪,甚至为虚假信息提供放大的舞台;支持者则强调其作为「社会预期温度计」的透明价值,这种争议决定了它的未来发展路径不会完全平坦。

从早期月交易额不足亿,到2024年10月创下25亿美元峰值,Polymarket 以惊人的速度跨越质疑、走向主流。它比传统民调更敏锐、更实时,却也伴随着争议,无论支持还是反对,市场都已无法忽视它的存在,未来的公众预期,正悄然凝结于那根随事件跳动的价格曲线之中,而不再仅仅依赖专家的解读。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。