引言

在近年数字资产市场的发展中,中心化交易所(Centralized Exchange, CEX)与去中心化交易所(Decentralized Exchange, DEX)的角色逐渐成为投资者与研究者关注的核心议题。虽然市场对这两类交易模式已有一定认识,但它们在不同应用场景中的影响与差异,仍值得深入探讨。

过去两年,DEX 的使用率在全球范围内显著提升,越来越多的投资者开始通过链上交易与钱包管理积累经验与反思,显示出去中心化交易正在快速崭露头角。然而,尽管 DEX 增长迅速,CEX 作为传统且高度普及的交易模式,依然具备不可替代的重要性。在合规性、流动性与用户体验等方面,CEX 的优势依旧明显,许多企业与投资者对其依赖程度远超市场普遍认知。

因此,“CEX 与 DEX 的比较”不仅是交易工具的选择问题,更关乎产业结构与未来趋势的关键判断。本文将通过多维度数据对比,系统分析两者的发展现状与潜力,涵盖用户规模与渗透率、市场结构与交易格局、安全性以及全球合规布局。通过对比与交叉观察,可以更清晰地理解 CEX 与 DEX 在全球加密市场中的普及程度、风险差异与相互作用,从而为后续的市场研究与战略布局提供参考。

加密用户数据分析:市场渗透率与增长趋势

全球加密用户指数级增长

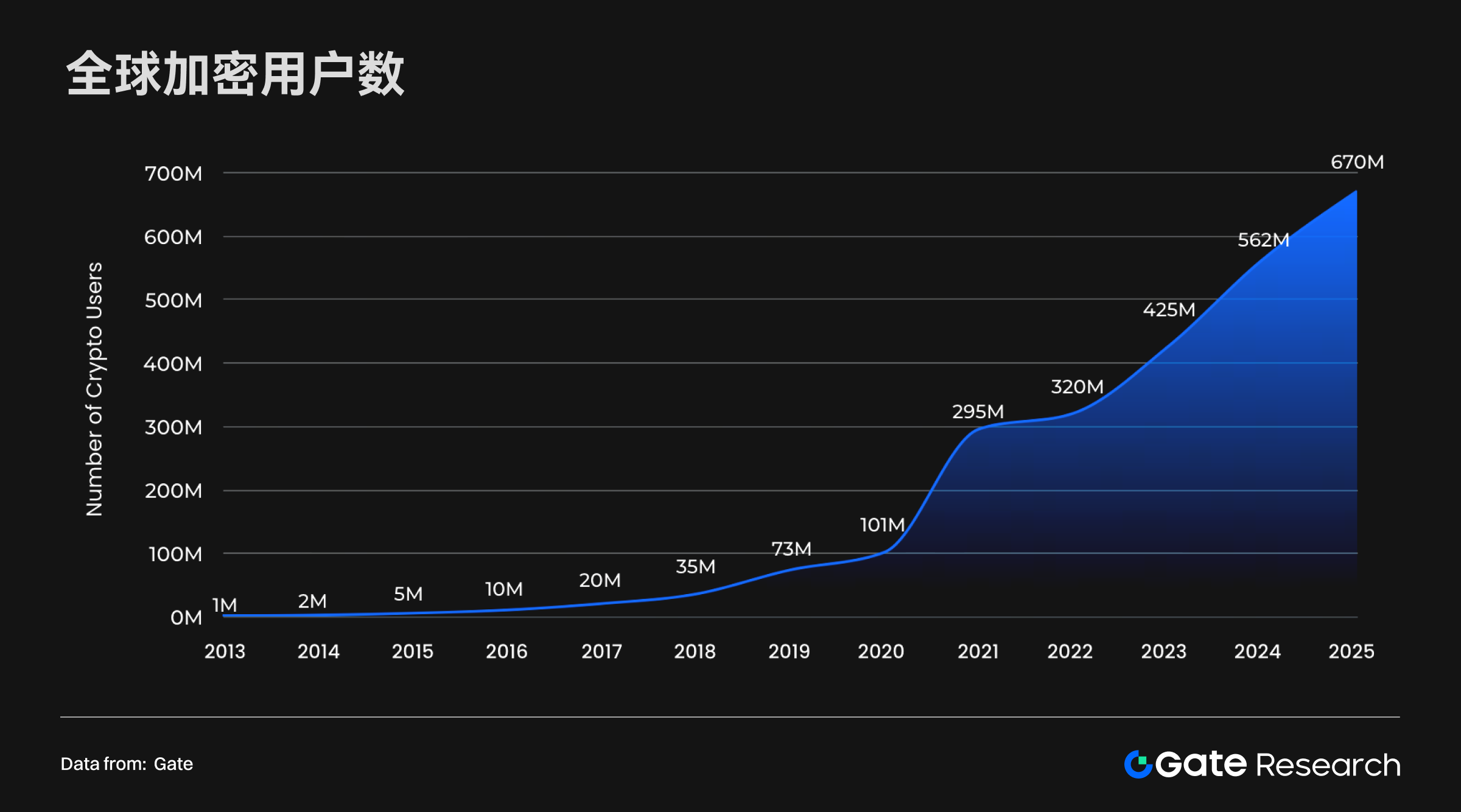

根据 Crypto 渗透率、增长趋势、市场表现以及 Demandsafe 预测数据测算,全球加密用户规模在过去十余年呈现指数级增长。用户数量从 2013 年的约 100 万人激增至 2025 年的 6.7 亿人,年均增长率极为可观。尤其是 2020 年之后,用户曲线陡然加速,标志着加密市场正从早期尝试走向大规模主流采用。

这一趋势表明,加密货币已从小众实验品转变为全球金融体系中不可忽视的力量。庞大的用户基础不仅为 DeFi、NFT 与 Web 3 等新兴赛道提供了坚实的土壤,也强化了网络效应与市场流动性。随着用户数量的持续扩张,加密市场在金融普惠、跨境支付与数字身份等应用场景的潜力将被进一步释放,推动全球数字经济迈向更加成熟与普及的阶段。

全球渗透率与地区分布:新兴市场的崛起

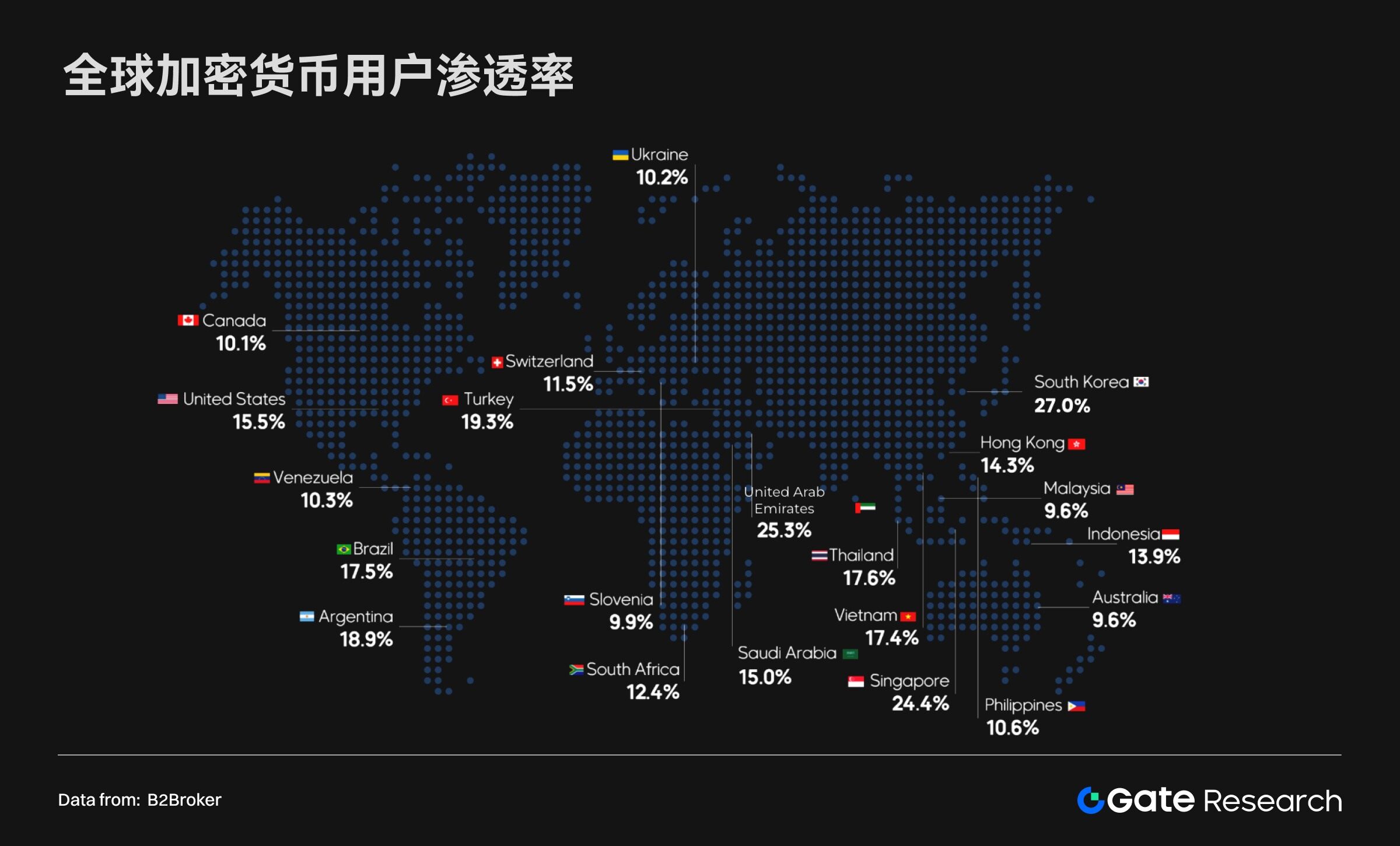

从地域分布来看,加密货币的用户渗透率差异显著:

•高渗透市:场韩国(27%)、阿联酋(25.3%)、新加坡(24.4%)、土耳其(19.3%),显示加密技术已在这些市场高度普及。高渗透市场

•新兴市场:阿根廷(18.9%)、泰国(17.6%)、巴西(17.5%)、越南(17.4%)、印尼(13.9%),渗透率均高于全球平均水平,加密货币被视为金融普惠的重要工具。

•发达市场:美国(15.5%)、加拿大(10.1%)渗透率相对温和,但依然凭借资本、技术与机构化采用占据全球加密市场核心地位。

这一格局说明,加密采用的驱动力在不同地区存在差异:新兴市场主要依赖金融替代与普惠需求,而发达市场则更多由机构化采用与技术创新推动,加密货币的全球化进程正在多元驱动下加速。

CEX 与 DEX 用户规模对比

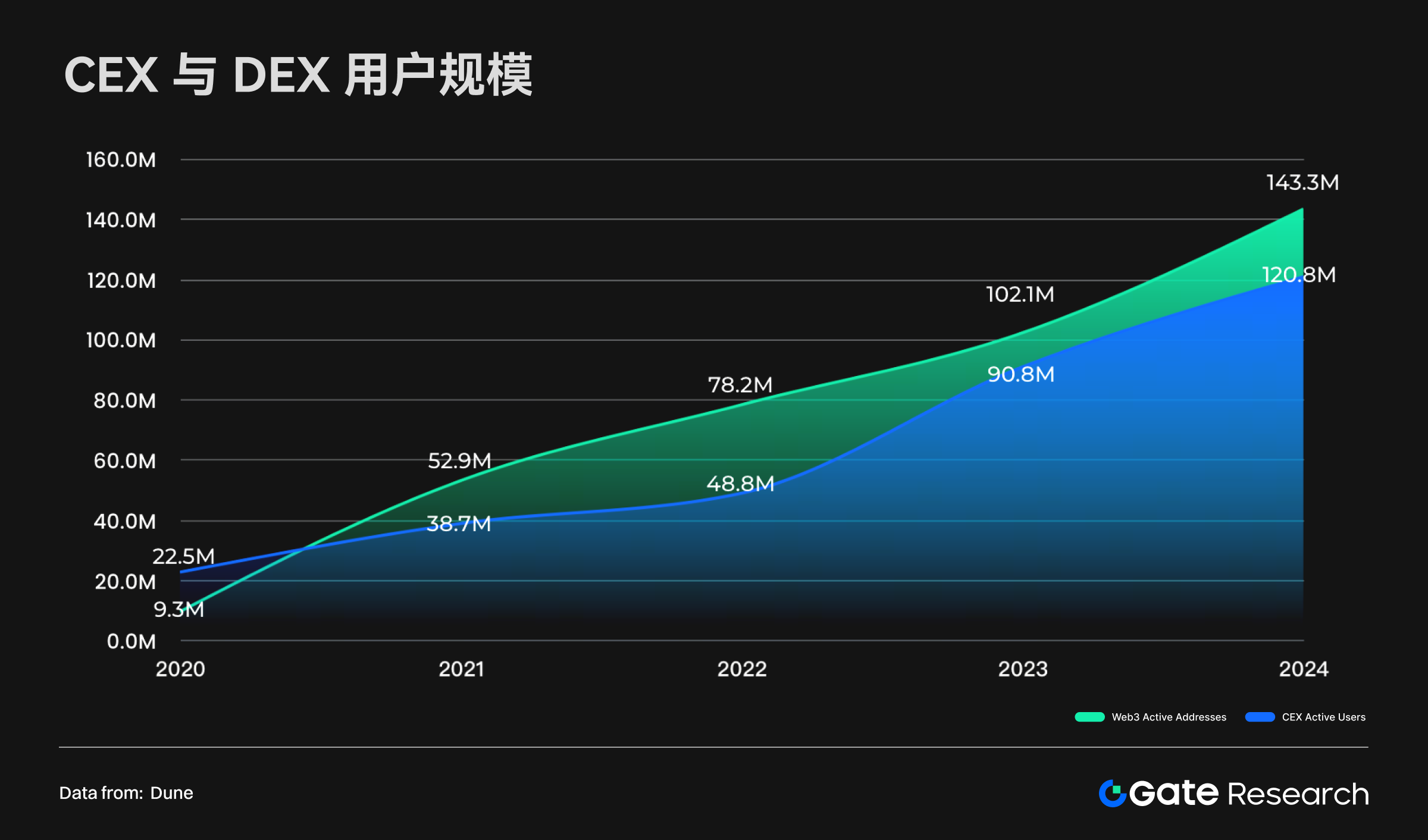

从 2020 年到 2024 年,中心化交易所(CEX)与去中心化交易所(DEX)的用户规模均保持高速增长:

•DEX 用户:年度活跃地址数从 2020 年的 930 万增至 2024 年的 1.43 亿,四年间实现了超过 10 倍的增长,显示出强劲的增长势头。

•CEX 用户:年度活跃用户从 2020 年的 2,250 万增至 2024 年的 1.2 亿,依然保持可观增长,表明中心化平台在加密市场中依旧占据关键地位。

•趋势演变:2020 年前,CEX 用户规模始终高于 DEX;但自 2021 年起,DEX 用户规模开始超越 CEX,并在 2022 年形成显著差距,尽管之后差距有所收窄,但 2024 年再度扩大。随着去中心化生态的成熟,用户正逐步从中心化平台向 Web 3 生态转移,但两类平台的用户基础均在显著扩展。

这一变化揭示出:

•用户习惯正在转移——越来越多的加密用户倾向于使用 DEX,寻求更高的透明度与自主权;

•市场格局更趋多元化—— CEX 仍是主流入口,但 Web 3 与去中心化应用的崛起正在重塑用户结构。

整体而言,加密市场的用户基础正在从传统中心化平台,向去中心化、开放式的 Web 3 生态系统扩展,市场发展方向日益呈现多元与去中心化特征。

全球资产市值趋势:加密货币的崛起

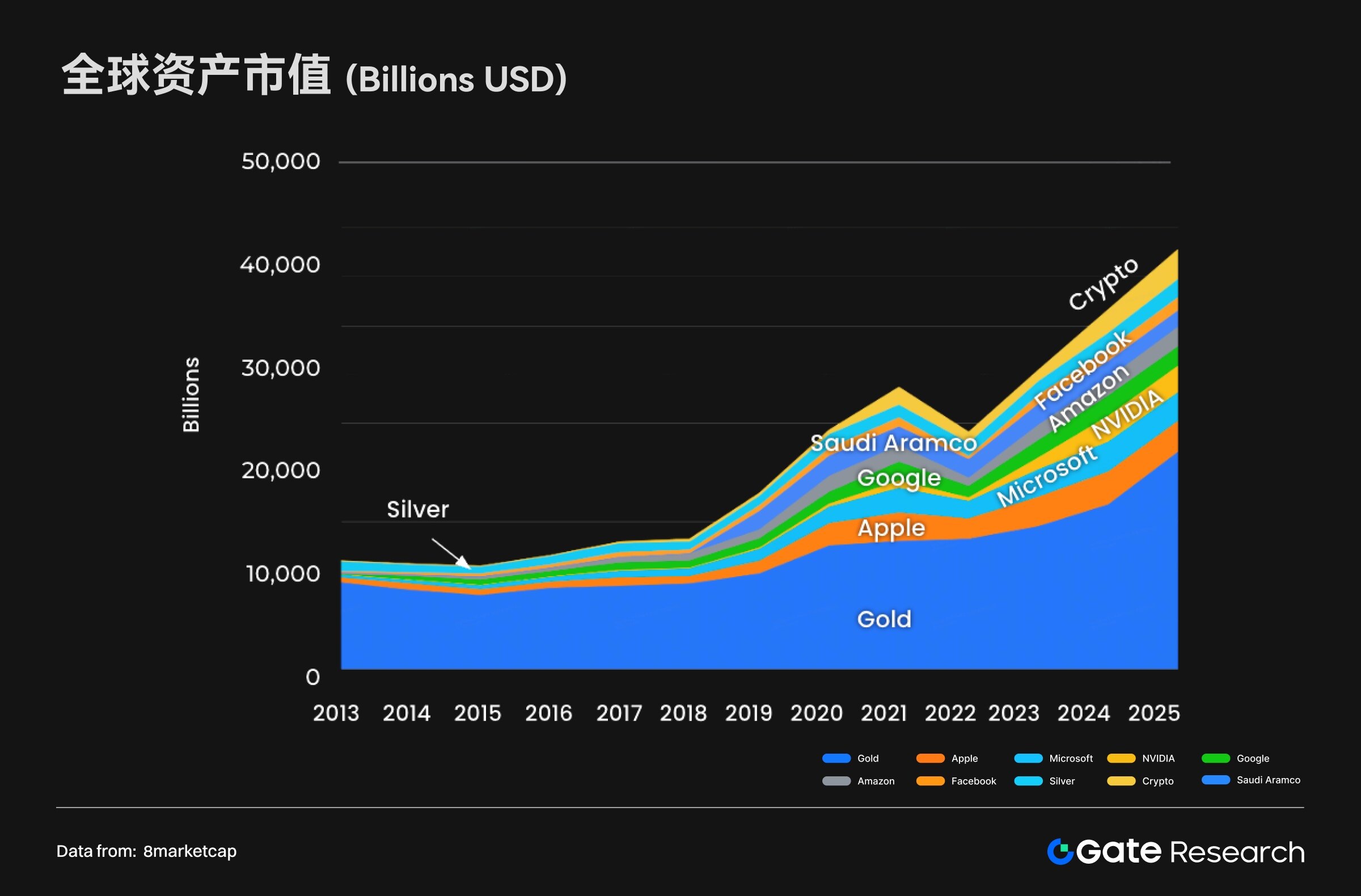

加密货币迈向全球核心资产(2013–2025)

在 2013 至 2025 年的十二年间,全球资产市值格局经历了深刻重塑。黄金与白银等传统硬通货依旧保持稳步增长,但增速相对放缓,市场份额逐渐被稀释。与此同时,科技巨头市值迅猛扩张,尤其是微软与英伟达在 2020 年后快速崛起,凸显人工智能与云计算等前沿科技正成为全球经济增长的核心引擎。

最值得关注的是,加密货币自 2020 年起迎来爆发式增长,迅速跻身全球资产市场主流。到 2025 年,其总市值已达 3.02 万亿美元,成功超越苹果,跃升为全球第四大资产类别,仅次于黄金、英伟达和微软。其中,比特币(BTC)市值高达 2.35 万亿美元,超越亚马逊与白银;以太坊(ETH)市值接近 9,800 亿美元;稳定币总市值亦达到 2,600 亿美元。

整体来看,全球资产的核心正在从传统硬资产逐步转向高成长的创新型资产。加密货币的崛起不仅展现了数字金融的巨大潜力,也标志着其已与黄金和科技股并驾齐驱,成为全球资本配置的新支柱。

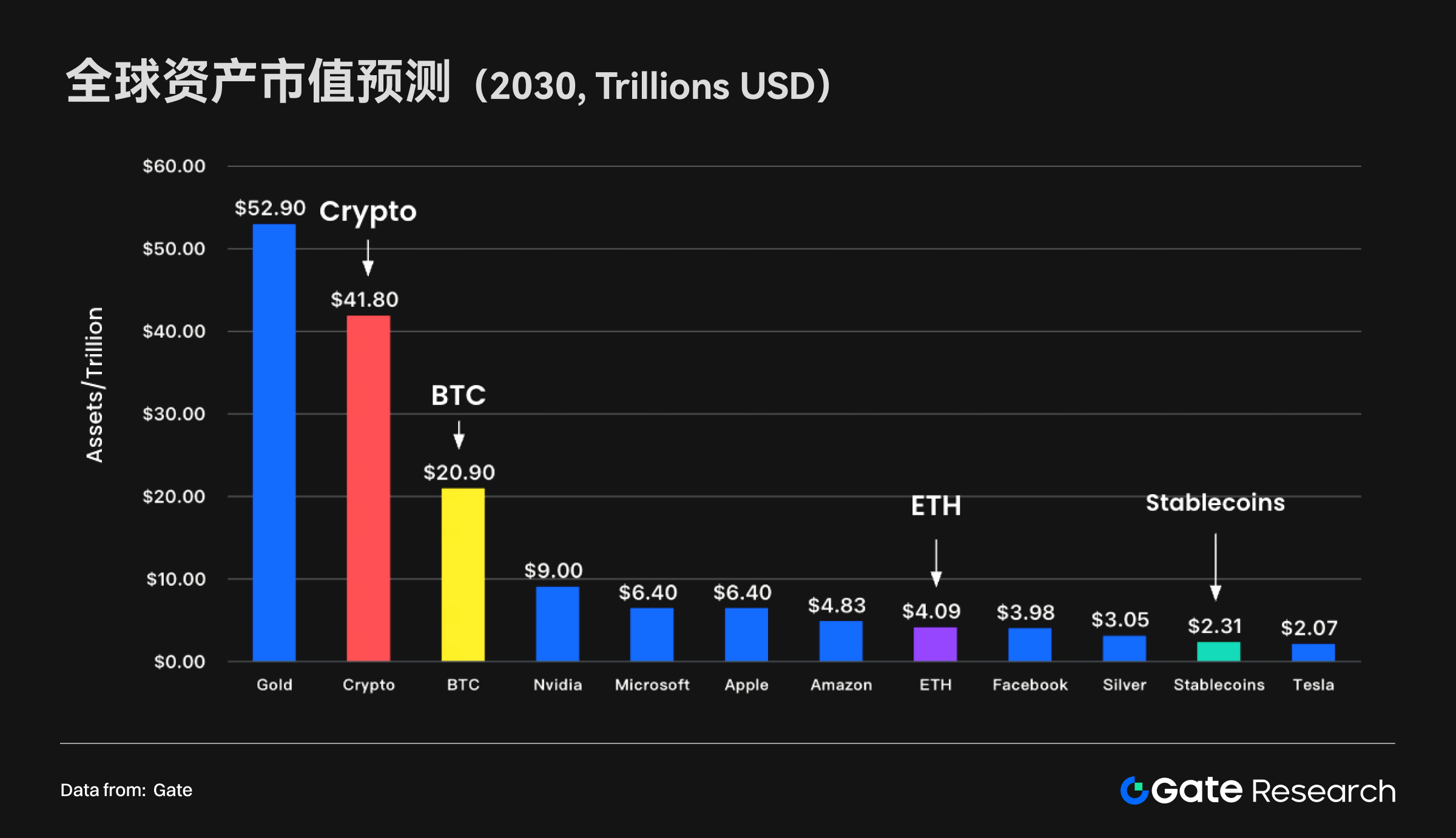

全球资产市值格局的阶段性变迁与未来趋势(2022–2025–2030)

通过对关键时间节点的市值快照分析,可以清晰看到加密货币如何从边缘资产成长为能够与全球顶级科技巨头分庭抗礼的核心类别。2022 年 8 月,全球资产格局仍由传统资产主导:黄金以 11.77 万亿美元遥遥领先,苹果和微软紧随其后。彼时,加密货币总市值约 1.08 万亿美元,虽已具一定规模,但仍处于与白银(1.38 万亿美元)体量相当的次级地位。

然而,仅仅三年间便发生了巨变。到 2025 年 8 月,在人工智能浪潮与加密牛市的双重推动下,全球资产版图被彻底改写。黄金市值升至 22.93 万亿美元;英伟达凭借 AI 领域的领先优势,市值飙升至 4.24 万亿美元。在此期间,加密货币的表现尤为亮眼,其总市值达到 3.02 万亿美元,历史性地超越白银和亚马逊,正式跻身全球资产核心梯队。

未来,这一趋势预计将持续深化,前瞻性预测显示,到 2030 年,加密货币总市值有望达到 41.80 万亿美元,成为仅次于黄金的全球第二大资产类别。这一指数级的崛起,反映了全球资本正在进行一场适应数字时代的大规模迁徙,顶级资产的构成已从传统硬资产为主,演变为由传统资产、科技巨头、数字资产三足鼎立的多元化新格局。

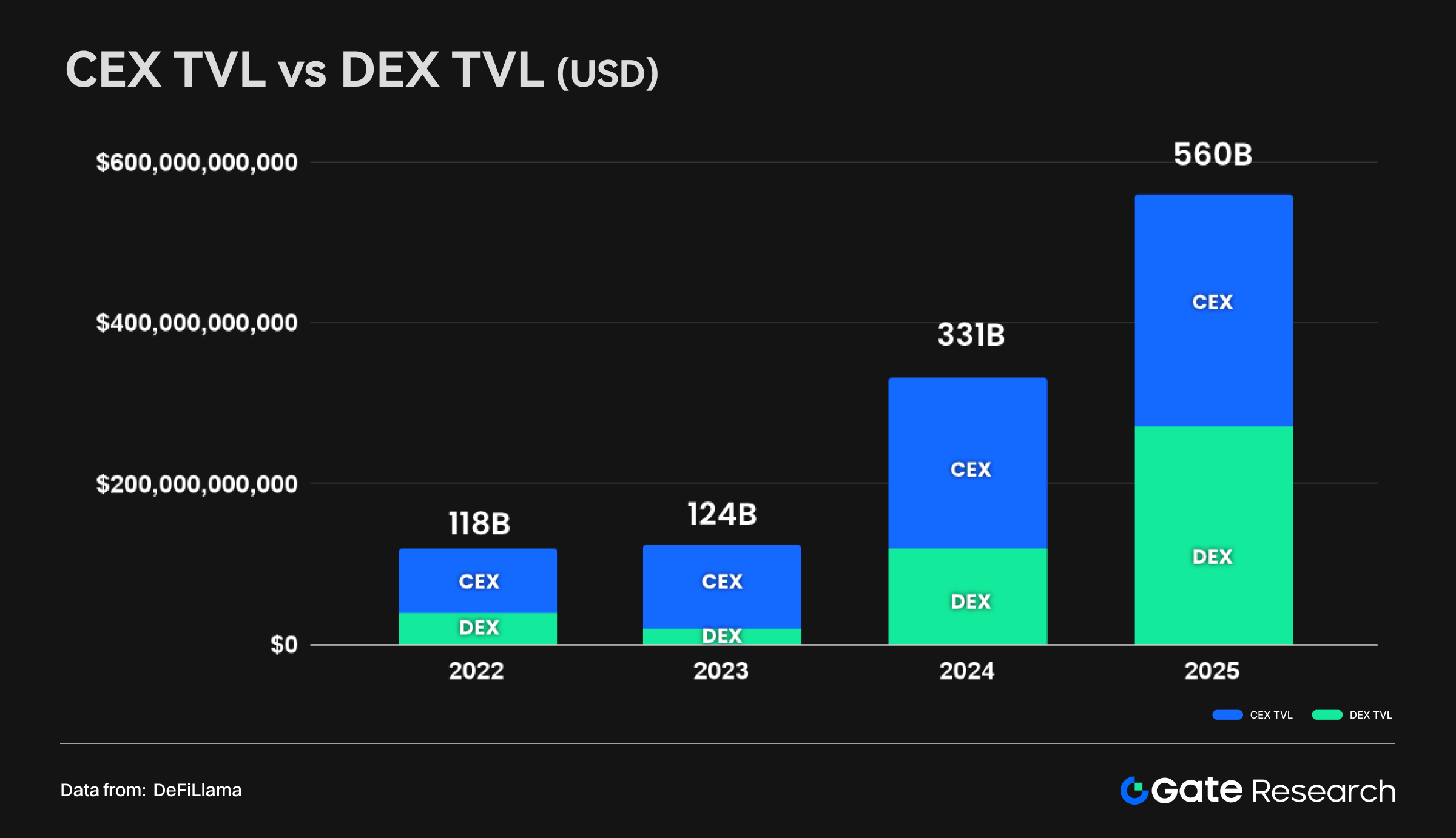

加密市场内部结构演变:CEX 与 DEX 的动态平衡

与此同时,加密货币内部的市场结构也在走向成熟与均衡。过去,资产托管与流动几乎完全依赖中心化交易所(CEX);但到 2025 年,格局已演变为 CEX 与去中心化交易所(DEX)并驾齐驱的“双轨模式”。数据显示,2022 年 CEX 与 DEX 总资产储备约为 1,180 亿美元,其中 CEX 占据绝对主导;然而到 2025 年,总资产规模已飙升至 5,600 亿美元,DEX 的锁仓价值(TVL)大幅增长,几乎与 CEX 储备金持平。

这种结构性转变并非 CEX 重要性的削弱,而是加密市场走向成熟的标志。一方面,整体市场规模快速扩张,为 CEX 和 DEX 都提供了充足的增长空间;另一方面,DEX 资产占比提升,反映了 DeFi 生态繁荣、技术进步,以及用户对资产自托管和链上透明度的偏好。与此同时,CEX 的角色也在演变:不再是唯一的交易中心,而是作为连接现实世界与链上经济的“核心网关”,承担法币出入金、新用户教育和机构合规入口等关键职能。

因此,加密市场正逐步形成“双轨基础设施”——CEX 作为全球资本的入口与枢纽,DEX 作为链上金融与创新的核心承载。两者并非替代关系,而是相辅相成,共同构成未来加密金融体系的双重基石。

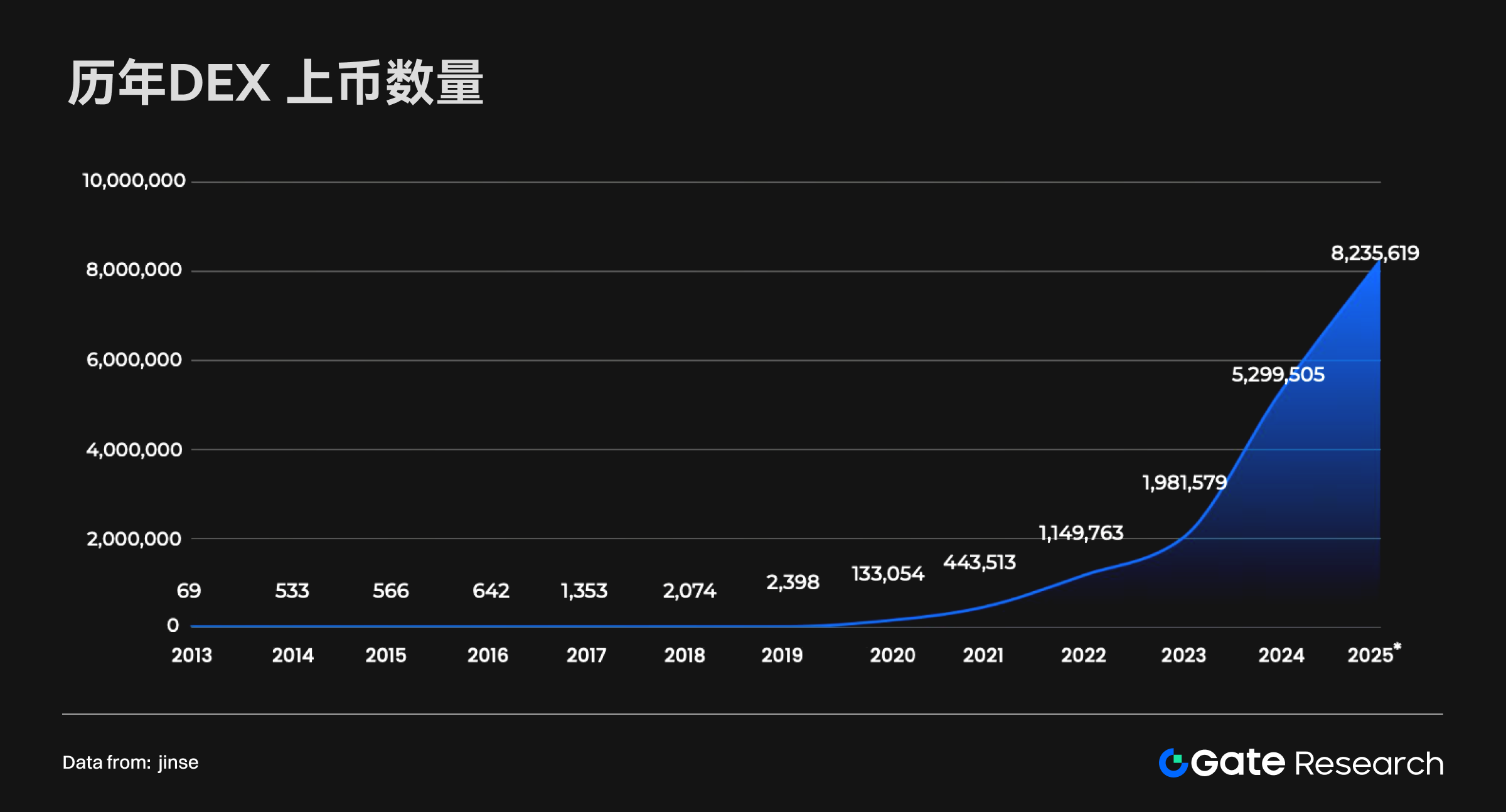

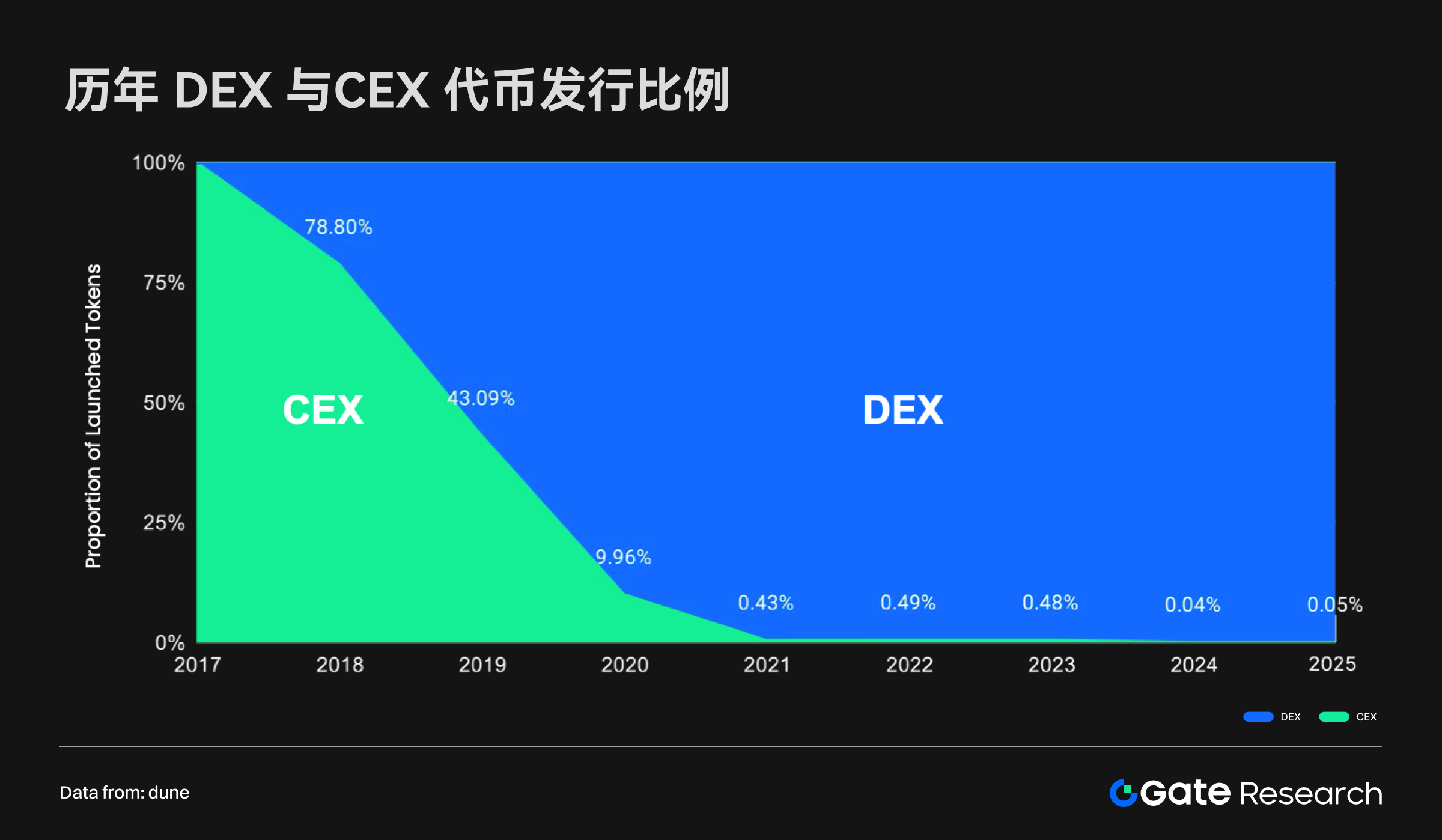

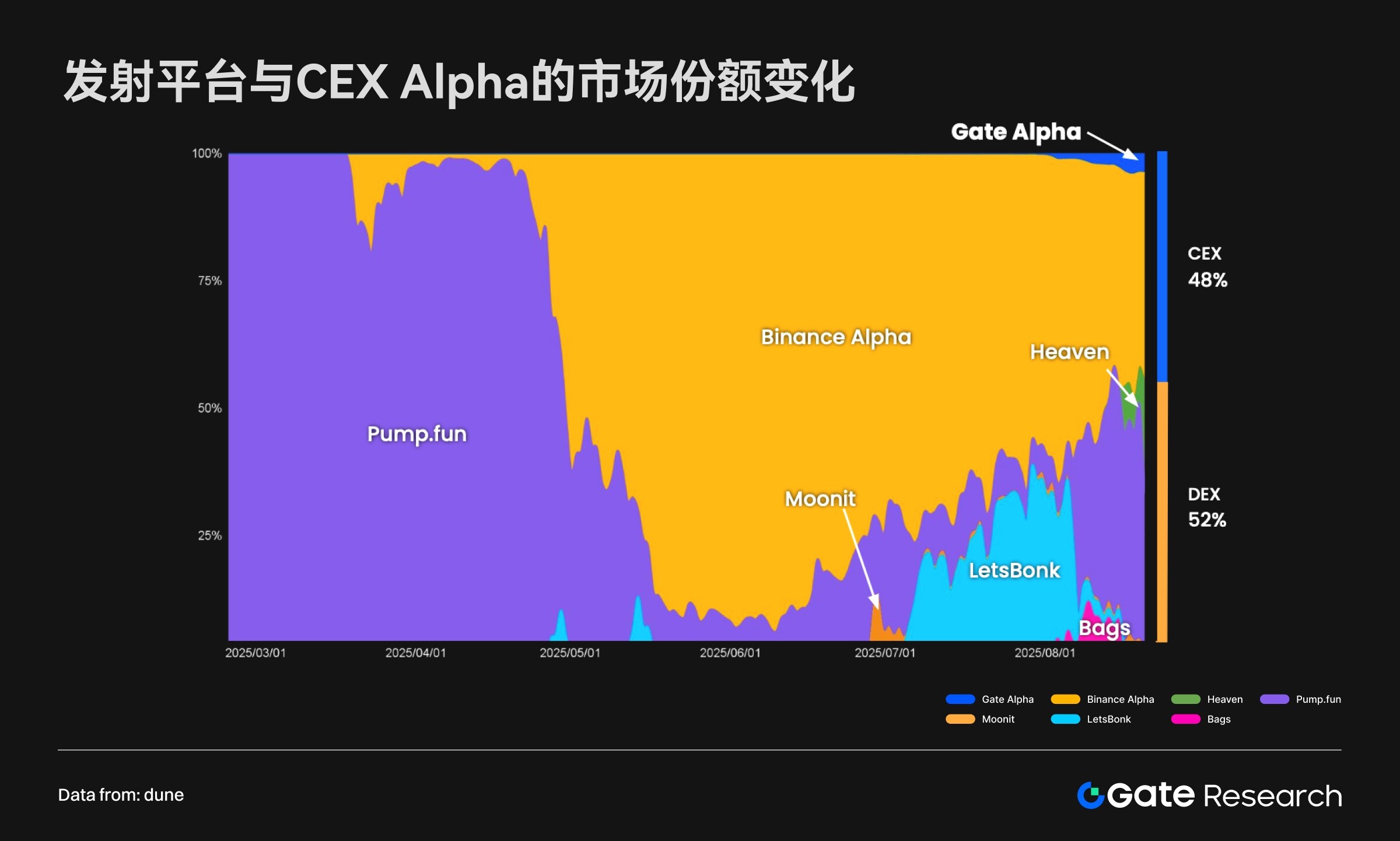

代币发行与生态繁荣度

代币发行数量在过去几年呈现出极为迅猛的增长趋势。特别是自 2020 年的“DeFi Summer”之后,去中心化交易所(DEX)逐渐成为新代币发行的主要渠道。如今,DEX 上的代币发行量已经达到令人惊讶的水平,每天都有超过五万枚新代币被推出,2025 年全年预估新增代币数将超过八百万,累计发行规模达到千万级别。相比之下,CEX 依旧有大量代币上线,但其发行速度和数量已明显落后于 DEX。

这种发行模式的变化带来了两方面的影响:

创新繁荣度提升:DEX 的开放性为开发者和创业团队提供了更广阔的舞台。新项目可以迅速上线并进入流通,推动了 GameFi、DeFi、SocialFi 等新赛道的多样化发展和快速迭代。

风险与质量分化:由于几乎没有门槛,DEX 上的大多数代币规模有限、生命周期短,市场充斥着“长尾项目”,风险高企。相较之下,CEX 仍然通过严格的审核机制筛选项目,虽然发行数量较少,但代币质量和可信度更高。

从比例上看,目前绝大多数的新代币在 DEX 上发行,而 CEX 的份额已下降至不足 1%。这说明在代币生态繁荣度的驱动因素中,DEX 已占据主动地位。但同时,CEX 在“精选项目”、品牌信誉和合规保障方面,依旧拥有不可替代的价值。

Web 3 各类 Launchpad 的代币发行规模中,超过一半来自 DEX。这表明,生态的繁荣正从单一模式转向 CEX 与 DEX 并存的双轨格局。

市场主导权的演变趋势

在交易量与市场主导权方面,CEX 与 DEX 的竞争关系正逐渐演变。整体来看,CEX 仍是市场的核心力量,但 DEX 的市场份额正在持续提升,二者的差距正在逐步缩小。

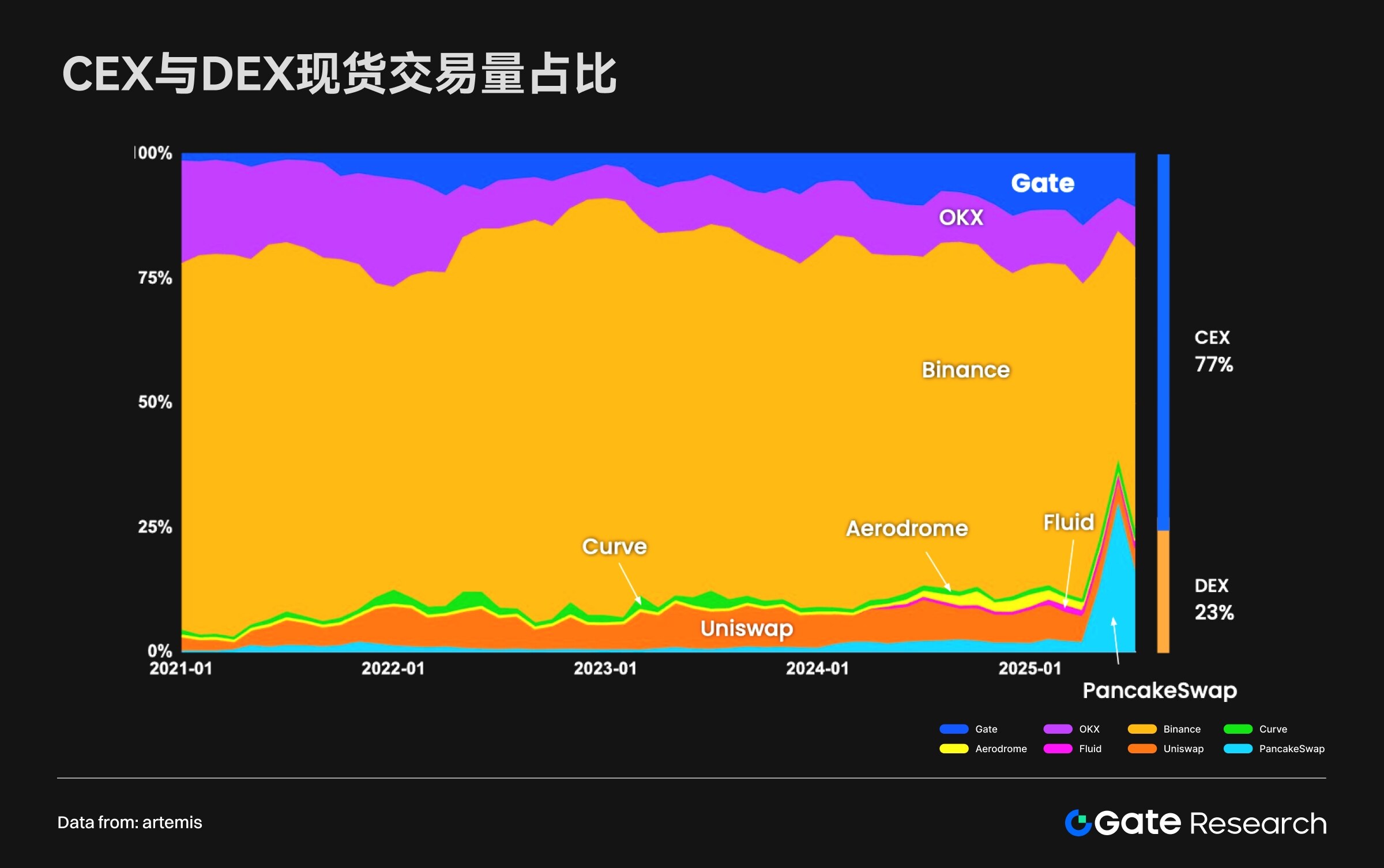

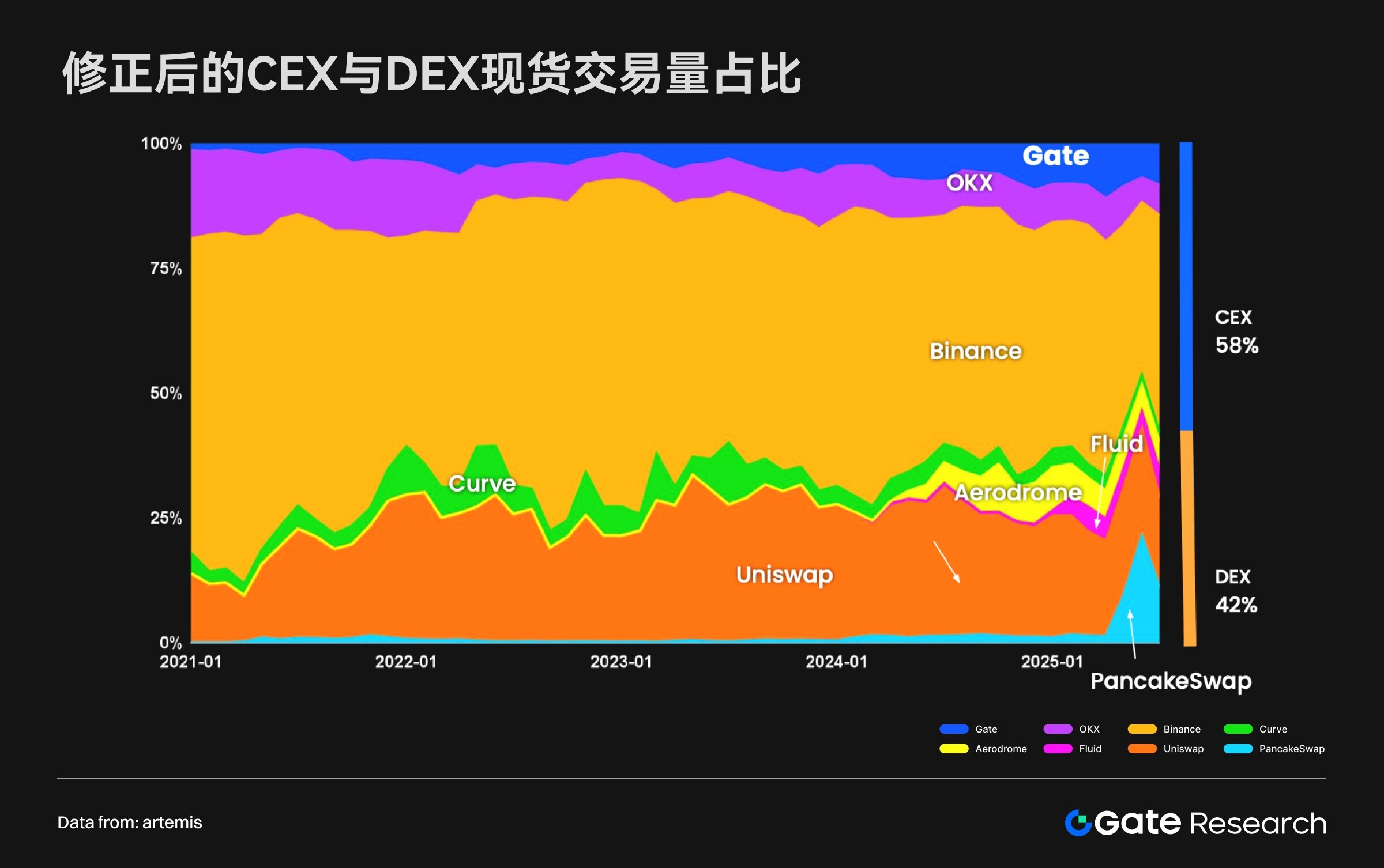

现货交易

目前全球现货交易量中,CEX 占比约 77%,DEX 占比 23%。然而,如果剔除刷量交易(Wash Trading)的影响,更能反映真实零售端活跃度的数据表明:CEX 占比 58%,DEX 占比 42%。这意味着在实际由用户驱动的交易中,DEX 已经在与 CEX 接近,展现出快速追赶的态势。

年度交易规模

过去十年间,CEX 与 DEX 的年度交易量差距逐渐缩小。虽然 CEX 在绝对规模上仍然更大,但 DEX 的增长速度更快,甚至在部分时间段和新兴资产类别中出现了与 CEX 接近或超越的情况。与此同时,从总锁仓量(TVL)的对比来看,CEX 曾经占据绝对优势,但如今 DEX 的 TVL 已逼近 CEX,形成双足鼎立的格局。

市场主导权的未来趋势

短期内,CEX 凭借深厚的流动性、合规资质和更佳的用户体验,仍将保持主导地位,尤其是在监管严格的地区。中长期来看,随着区块链基础设施的持续完善、用户对资产自主管理的意识增强,以及 DEX 安全性和易用性的不断提升,其市场份额有望继续扩大。在未来 5–10 年,DEX 有可能进一步逼近甚至挑战 CEX 的统治地位。

综合而言,市场正从“CEX 绝对主导”逐渐过渡到“CEX 领跑+ DEX 快速追赶”的双极格局。CEX 维持规模与合规优势,而 DEX 则代表了去中心化理念与生态创新的最前沿力量。

加密生态的安全风险与合规趋势

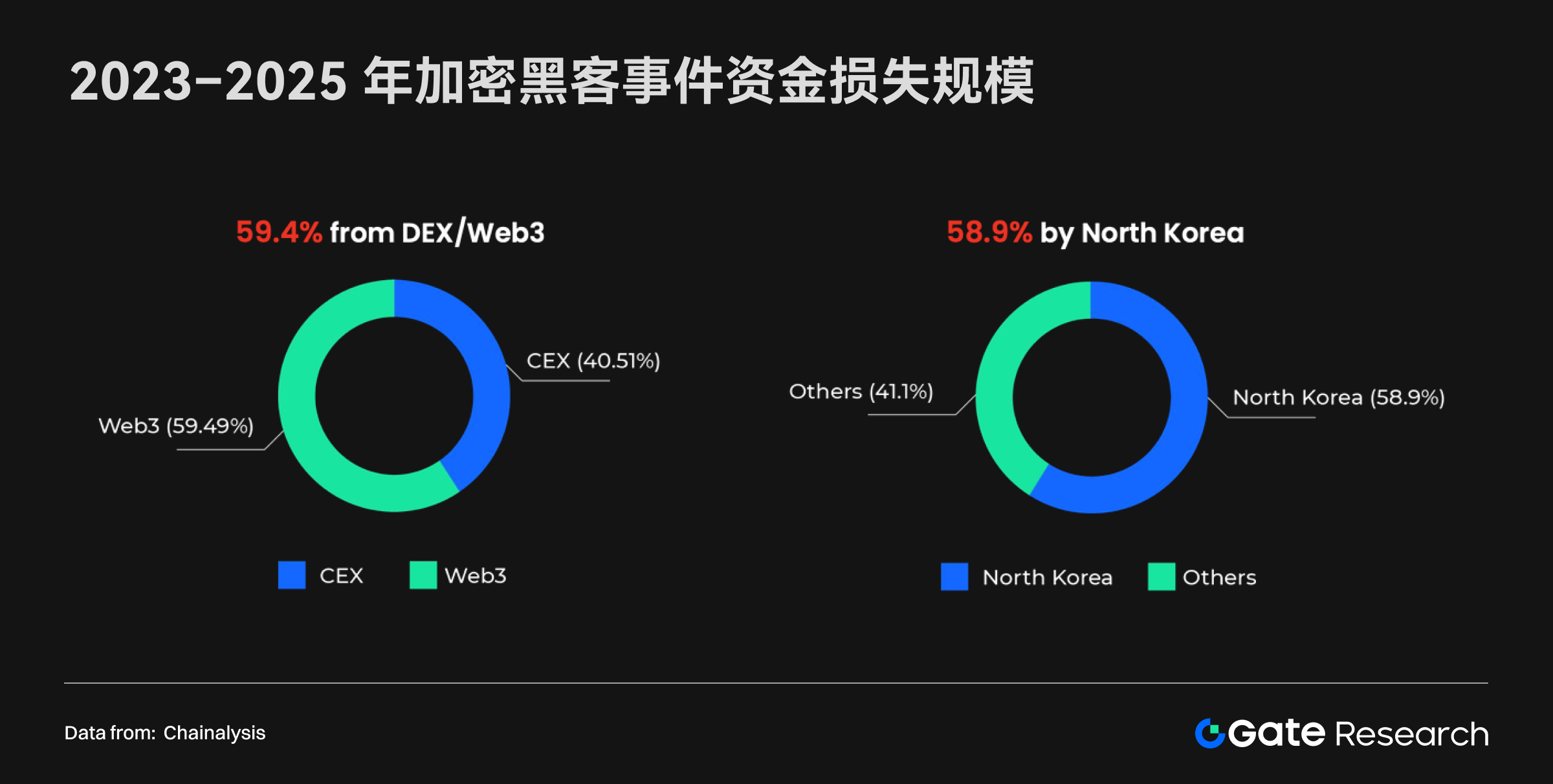

黑客事件与资金损失

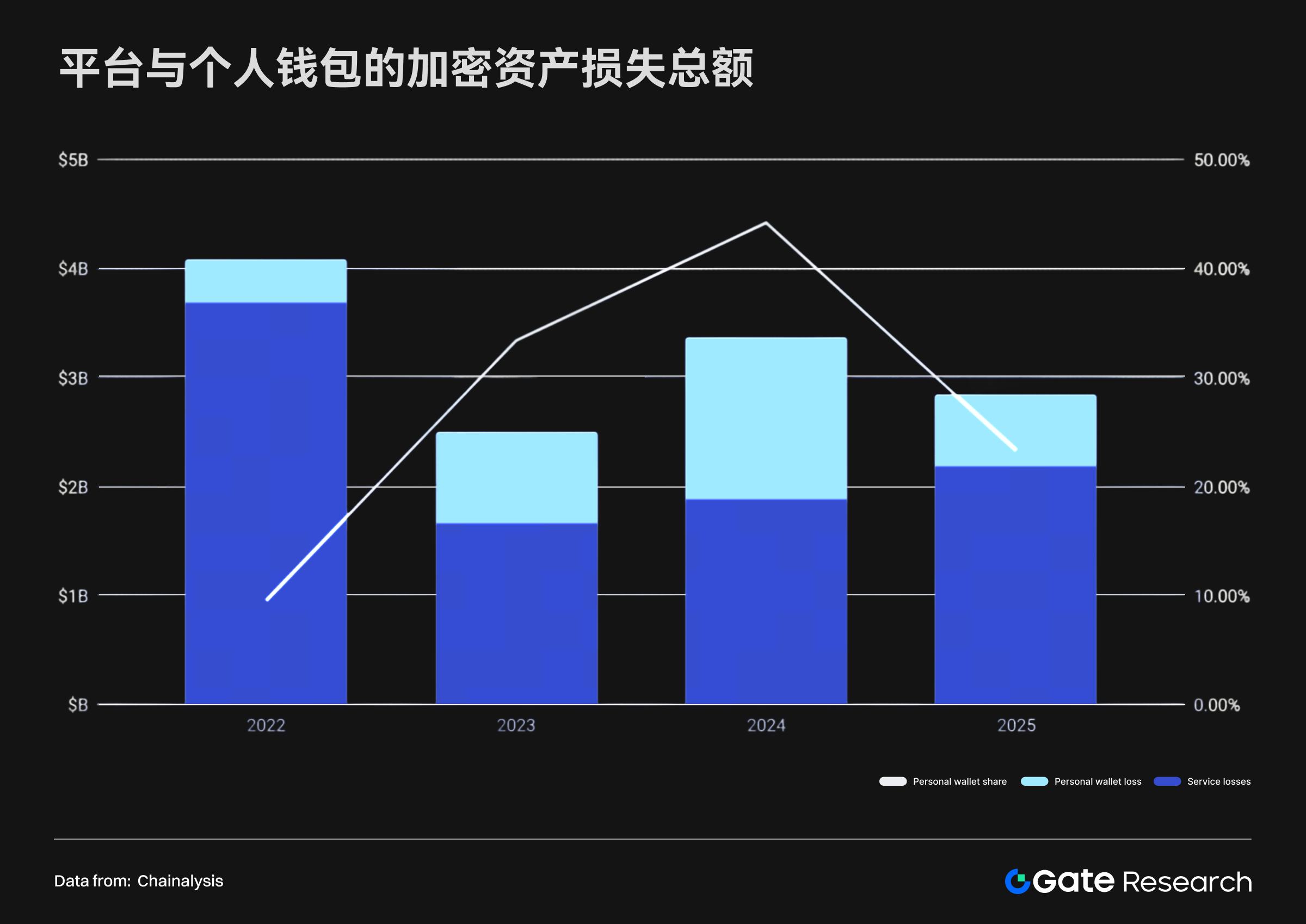

2023–2025 年间,加密资产持续遭遇大规模盗窃,据 Chainalysis 数据,其中约 59%的被盗资产来自 DEX/Web 3 协议,损失金额高达 59 亿美元,凸显去中心化系统在安全机制上的不足。主要攻击类型包括智能合约漏洞、跨链桥安全失效以及治理设计缺陷,使得 Web 3 在资金安全上承受更大风险。相比之下,CEX 虽然同样存在集中化风险,但由于其安全体系相对成熟,资金损失比例较低。

与此同时,个人钱包盗窃逐渐成为加密犯罪的新前沿。截至 2025 年 6 月,针对个人用户的钱包攻击已占所有被盗资金活动的逾 20%。由于其隐蔽性,相关事件往往报告不足,但风险水平正持续上升。推动这一趋势的主要因素包括:大型平台安全防护能力提升,迫使攻击者转向个人用户;加密货币持有人群体不断扩大;个人钱包资产价值随市场价格上涨而增加;以及黑客借助 LLM 等新兴工具使攻击技术日益复杂。

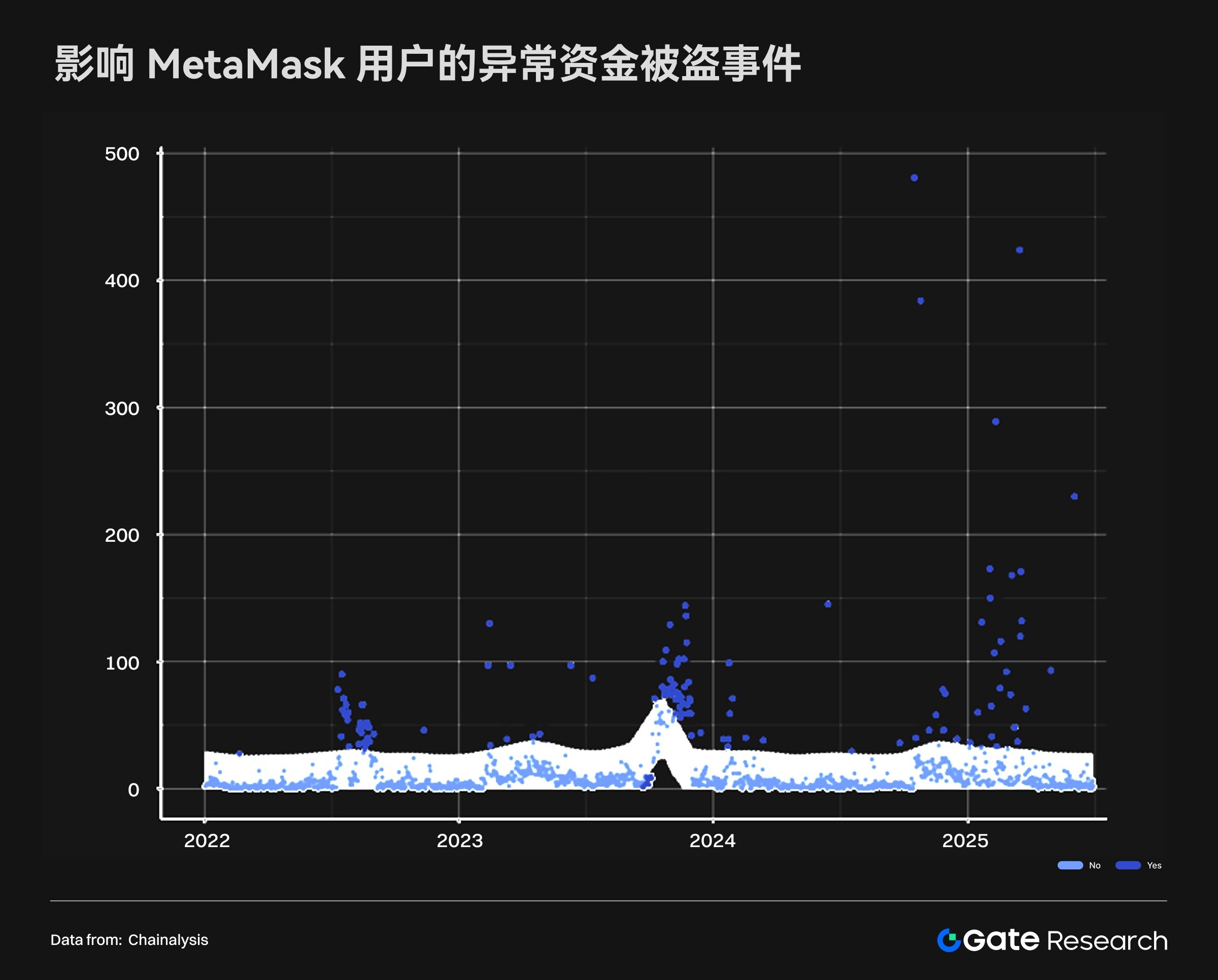

在个人钱包攻击日益增多的背景下,MetaMask 成为最具代表性的案例之一。从 2024 年底开始,MetaMask 用户遭遇的异常资金被盗事件明显增多,并在 2025 年持续提升。部分攻击在单日内造成接近 500 个钱包受害,显示黑客已具备通过系统化手段针对大规模用户群体的能力。相比之下,2022 年中期与 2023 年底虽也出现过零星高峰,但频率与严重性均远低于当前水平,显示出威胁模式的演变。

造成这一现象的潜在原因包括:钱包软件存在可被系统性利用的漏洞、第三方基础设施(如浏览器插件或恶意 dApp)的安全风险,以及随着用户规模扩大而形成的更大攻击目标池。总体而言,MetaMask 相关案例表明,广泛使用的钱包应用正成为黑客的重点目标,而随着加密货币应用的普及,这类攻击在未来可能进一步蔓延。

综上所述,当前加密生态的安全风险正呈现出规模扩大与手法多样化的特征,且目标逐步向个人用户转移。行业在安全策略上需在两方面同步推进:其一,服务型平台应持续强化基础设施防护,包括智能合约审计、跨链桥安全验证以及热钱包多重签名机制,以降低系统性风险;其二,个人用户教育与防护也需同步提升,涵盖操作安全(OpSec)、冷钱包使用以及对社会工程攻击的防范。

同时,监管层面或需逐步推动对 DeFi 协议与钱包应用的合规要求,在透明度与去中心化之间寻求平衡,从而减少非法资金通过链上渠道的渗透。这些风险特征也为后续资金流向与洗钱分析提供了重要背景。

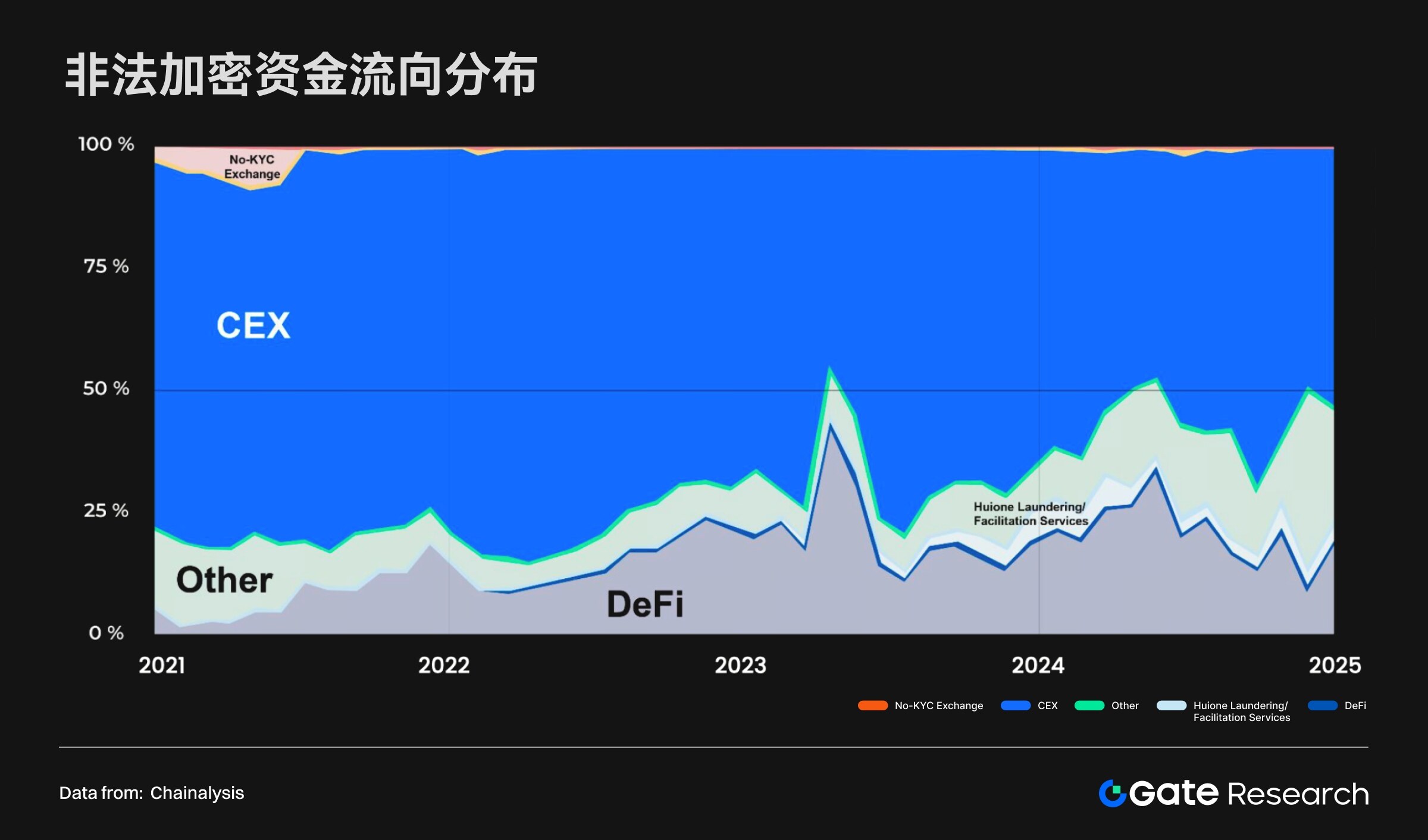

洗钱与加密资金流向

2021–2024 年间,每年约有 500 亿美元的非法资金通过加密渠道进行洗钱与诈骗活动,其中 CEX 依然是主要的资金接收端。但随着 DeFi 与无 KYC 平台的发展,链上协议逐渐成为非法资金的重要出口,尤其在市场活跃阶段,DeFi 的参与比例明显上升。缺乏身份认证与跨链匿名性便利,使得 DEX 在 AML(反洗钱)风险管理上更为脆弱。

而在 2024–2025 年间,不同攻击类型展现出差异化的洗钱路径,服务型平台的攻击者更常利用跨链桥(Bridge) 与混币器(Mixers) 转移资金,而个人钱包被盗资金则多流向代币智能合约与 CEX。值得注意的是,洗钱成本并未因区块链技术进步而下降,反而因追求速度与不可逆性而提高,2022 至 2025 年 6 月,区块链平均交易成本因 Solana 和 Layer 2 的技术进步而下降超过 80%,但盗窃资金操作者支付的费用溢价却上升逾 100%。同时,并非所有资金都会立即流转,截至 2025 年 6 月,仍有超过 37%的个人钱包被盗资金留存于攻击者地址,呈现囤币特征。

总体而言,加密洗钱正呈现路径复杂化、资金转移高溢价化、工具稳定币化的特征。尽管技术降低了合法交易成本,但非法资金反而付出更高成本以换取效率与隐匿性。这对监管和执法在跨链追踪、混币器监测与受制裁实体监管上提出更高要求,也预示未来对 DeFi 与稳定币生态的合规压力将进一步增强。这也凸显了合规架构在行业风险管理中的核心作用。

合规应对与全球布局

在安全风险与洗钱路径不断演化的背景下,合规已成为区分 CEX 与 DEX 的关键领域。CEX(如 Gate)在全球范围内逐步建立合规架构与牌照体系,以满足不同司法辖区的 AML/KYC 要求。这类布局涵盖交易、托管及衍生品等多元业务形态,同时也意味着 CEX 需履行信息披露、客户身份验证(KYC)、交易监控与反洗钱报告等义务。通过建立全球化的合规框架,CEX 能够在制度层面提升用户信任度,并为跨区域业务拓展与长期发展奠定基础。

相比之下,DEX 的运作模式存在显著差异。由于缺乏集中化法人实体与统一的跨境监管框架,大多数 DEX 并未建立强制性的合规机制,通常不进行 KYC 或身份验证。这种开放性与匿名性虽为用户提供了更大自由度,但也在 AML 风险管理上形成明显缺口。相关数据显示,非法资金在 DEX 的流通比例逐年上升,尤其在市场波动阶段,DEX 更易成为诈骗与黑客资金的重要流转通道。因此,合规不仅是行业分化的制度基准,也将成为未来市场格局演变的重要决定因素。

结语

CEX 与 DEX 的对比不仅体现在交易模式的差异,更深刻地折射出加密行业在用户增长、市场结构、安全风险与合规框架上的多维演化。过去十年,用户规模的指数级扩张推动了加密市场从小众实验走向全球主流,而 DEX 的快速崛起与 CEX 的稳健扩展共同塑造了当前多元并存的市场格局。

然而,安全与合规始终是行业发展的关键变量。黑客事件、个人钱包盗窃以及跨链洗钱路径的复杂化,揭示出 DeFi 与 DEX 在风险管理上的脆弱点;与此同时,CEX 通过全球化的合规布局与更成熟的安全防护体系,在制度与信任层面提供了相对稳健的保障。这种差异也使得两类平台在未来市场竞争与监管环境中将扮演不同角色。

展望未来,CEX 与 DEX 并非单一的替代关系,而更可能形成互补共存的生态格局。CEX 在合规、流动性与用户信任方面的优势,将继续支撑其作为市场主流入口的地位;DEX 则凭借开放性与创新能力,推动代币发行与新兴应用的发展。随着用户规模持续扩大,监管政策逐步完善,如何在透明度、效率与风险控制之间找到平衡,将决定加密产业能否迈入更加成熟与可持续的阶段。

参考资料:

1. ExplodingTopics, https://explodingtopics.com/blog/cryptocurrency-stats

2. economictimes, https://economictimes.indiatimes.com/markets/stocks/news/from-uae-to-south-korea-the-worlds-most-crypto-obsessed-countries-in-2025/crypto-watch/slideshow/119897178.cms?utm_source=chatgpt.com\u0026amp;from=mdr

3. Dune, https://dune.com/queries/3365957/5669035

4. 8 MarketCap, https://8 marketcap.com/#google_vignette https://www.physicalgold.com/insights/how-much-silver-is-there-in-the-world/

5. CoinGecko, https://www.coingecko.com/

6. Statmuse, https://www.statmuse.com/money/ask/tesla-market-cap-in-august-2022

7. CompaniesMarketCap, https://companiesmarketcap.com/time-machine/2025-08-01/#google_vignette

8. ARK, https://www.ark-invest.com/articles/valuation-models/arks-bitcoin-price-target-2030

9. DefiLlama, https://defillama.com/chains, https://defillama.com/cexs

10. CoinMarketCap, https://www.jinse.cn/blockchain/3681462.html

11. Dune, https://dune.com/queries/3830496/6442441?start+date_d 83555=2016-12-01+00%3 A 00%3 A 00

12. Dune, https://dune.com/adam_tehc/memecoin-wars, https://dune.com/kucoinventures/cexonchain

13. Artemis, https://app.artemisanalytics.com/sectors?tab=spotdexs

14. The Block, https://www.theblock.co/data/crypto-markets/spot/cryptocurrency-exchange-volume-monthlys

15. CoinMarketCap, https://coinmarketcap.com/;DEX:https://defillama.com/dexs

16. Slowmist, https://hacked.slowmist.io/

17. Chainalysis, https://hacked.slowmist.io/ https://www.chainalysis.com/wp-content/uploads/2025/03/the-2025-crypto-crime-report-release.pdf

18. Chainalysis, https://www.chainalysis.com/wp-content/uploads/2025/03/the-2025-crypto-crime-report-release.pdf

Gate 研究院是一个全面的区块链和加密货币研究平台,为读者提供深度内容,包括技术分析、热点洞察、市场回顾、行业研究、趋势预测和宏观经济政策分析。

免责声明

加密货币市场投资涉及高风险,建议用户在做出任何投资决定之前进行独立研究并充分了解所购买资产和产品的性质。Gate不对此类投资决策造成的任何损失或损害承担责任。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。