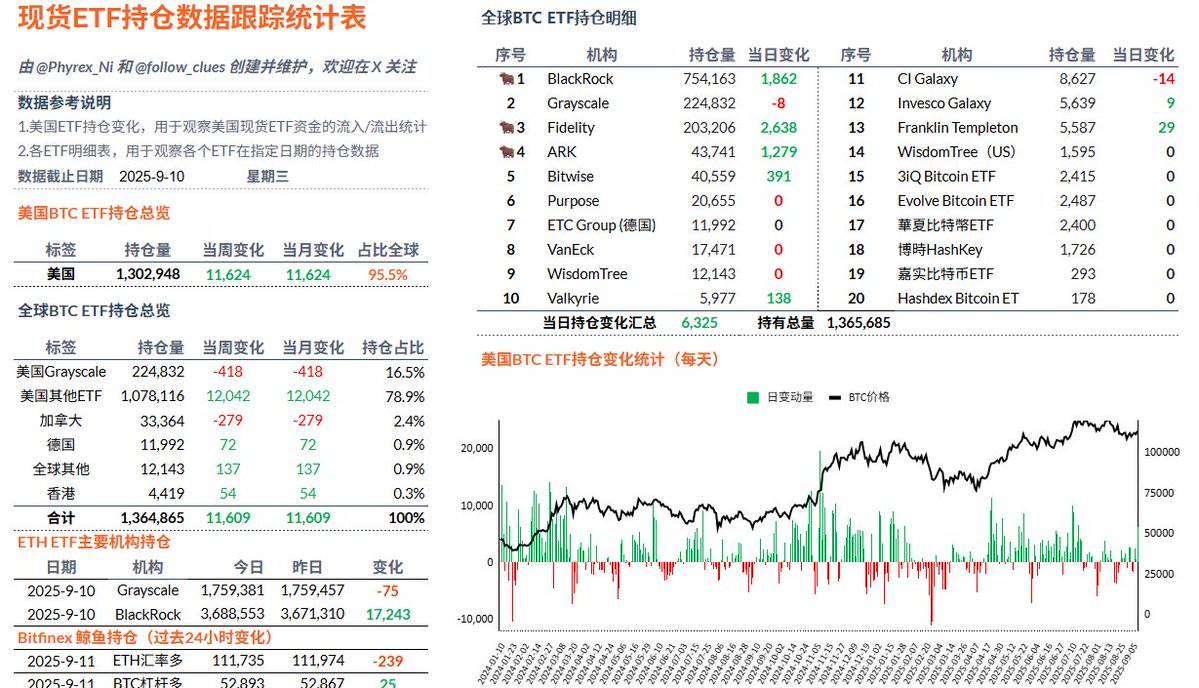

I really didn't expect that the $BTC spot ETF suddenly surged yesterday, with a net inflow of over 6,300 Bitcoins. I was shocked when I saw this data. What happened yesterday? It was probably the explosion of the PPI data. Why did it trigger so many investors to buy? The last time there was such a large-scale purchase was on July 16, nearly two months ago. The market should have fully anticipated that the Federal Reserve would cut interest rates in September, so they increased their bets?

It's very likely that's the case. Even though today's CPI data isn't friendly, BTC's price is still rising nicely. It may very well break through again before the interest rate meeting, which is a good boost for market sentiment. Next, we will see the interest rate meeting and the dot plot.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。