原文标题:《Saylor model struggles as crypto treasury hype turns to doubt》

撰文:OLGA KHARIF、DAVID PAN,FORTUNECRYPTO

编译:J1N,Techub News

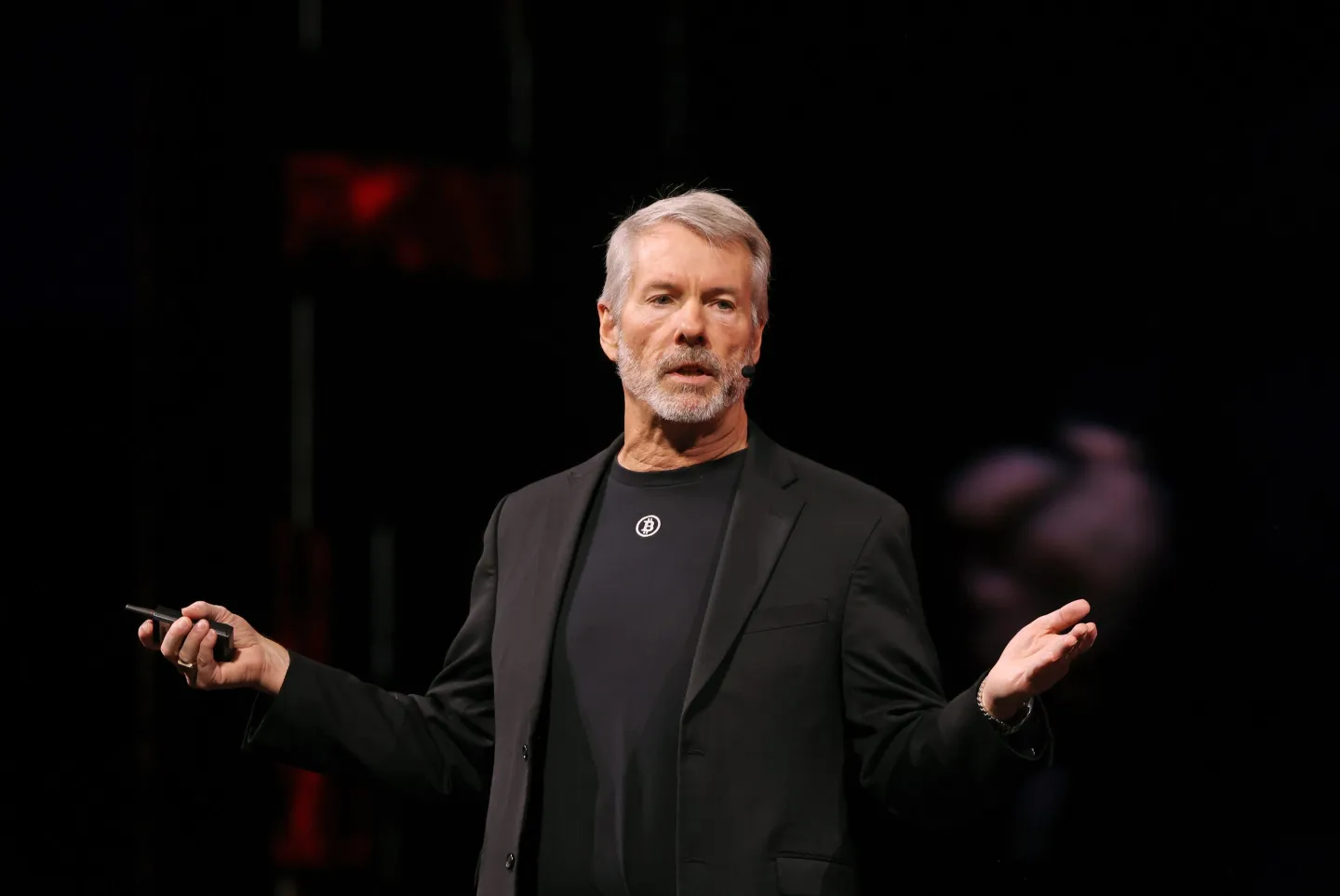

受 Michael Saylor 启发的加密货币资产财库公司(DATs)模式正面临严峻考验。这些以购买加密货币为主要业务的上市公司,原本被视为投资者参与加密货币资产繁荣的有利途径,如今却在股价下跌和市场信心流失中陷入困境。同时,复杂融资工具增加了经营风险,而监管趋严、要求股东批准新股发行,更对其核心融资模式形成冲击。

其实,加密货币资产财库公司(Digital Asset Treasury,简称 DAT)出现如今的现状并不难预见。股价涨得太快,故事吹得太大,财务逻辑也越来越「离谱」。新冒出来的公司,上市之后几乎只干一件事:疯狂买入加密货币资产。原本被视为投资者进入加密繁荣的捷径。如今,随着股价下跌、市场信心动摇,问题已不在于这种模式是否承压,而在于它会以怎样的方式、在多大程度上逐渐「泡沫破裂」。

即使在美联储预期降息推动下,股票和公司债券等资产普遍上涨,加密货币资产财库公司的股价却持续下滑,代币价格也一路阴跌。根据 Architect Partners 追踪的 15 家 DATs 数据,上周平均股价跌幅达 15%。

个股表现更为惨烈。持有特朗普相关 World Liberty Financial 发行 WLFI 代币的 ALT5 Sigma Corp. 在一周多时间内下跌约 50%;通过子公司 Nakamoto Holdings 持有比特币的医疗服务提供商 Kindly MD Inc. 较 5 月高点跌幅达80%。其他与以太坊和 Solana 的 DATs 也同样大幅下跌,连带账面代币价值缩水。

Parataxis Capital 联合创始人 Ed Chin 表示:「在美国,这类公司数量过多,而差异化程度很低。」

目前已有超过100家公司将加密货币纳入其资产负债表,其中大部分于今年推出。许多小公司在短时间内完成转型重塑,从日本美甲沙龙、大麻销售商到营销代理公司,纷纷改名转型买币,市场迅速被掀起一阵「加密货币资产财库」热潮。

尽管如此,投机热潮并未完全消退。Eightco Holdings Inc. 在宣布将买入 Worldcoin,并任命华尔街分析师 Dan Ives 为董事后,股价单日暴涨逾 3,000%。

对部分投资者来说,这类模式依然有吸引力:用上市公司做包装,以股票形式提供加密货币资产敞口,还能加杠杆。然而,这种「拥挤交易」正在逐渐侵蚀投资者信心。很多公司除了持有代币外几乎没有其他业务,随着股价下滑,支撑溢价的信心也在动摇。行业先驱 Strategy 以及日本的 Metaplanet Inc. 等知名 DAT 公司股价近期同样大幅下跌,表明即使是市场龙头也难以抵御情绪转变的冲击。

数据同样反映出该模式的衰退迹象,CryptoQuant 数据显示,8 月份数字资产财库公司仅购入 1.48 万枚比特币,较 6 月份的 6.6 万枚大幅下滑。同时,平均购买规模也在明显缩减,从 2025 年峰值时期缩水 86%,至上月仅 343 枚比特币。财库公司比特币持有量的累积增速也从 3 月份的 163% 暴跌至 8 月份的 8%。

为获得更多资金购买加密货币,DATs 开始采用更复杂的融资策略。加密贷款机构、经纪商和衍生品交易台构建了专门服务财库公司的融资生态系统,包括比特币抵押贷款、代币挂钩可转债和结构化支付等工具。

例如,伦敦网页设计公司 Smarter Web 发行了与比特币价值挂钩而非英镑的债券,这意味着比特币上涨时公司欠款也会增加。CEO Andrew Webley 表示,认为该债券仅占公司财库 5%,风险可控,但这类创新金融工具实际上在波动资产基础上叠加了新风险。

另一家原本做餐饮的 DDC Enterprise Ltd. 则通过复杂的债务、股权额度和货架发行获得了超过 10 亿美元的资金,但股价在暴涨后也迅速回落。

与此同时,纳斯达克已开始要求一些代币持有公司在发行新股为代币购买融资前须获得股东批准。而「卖股买币」恰恰是 DAT 的核心融资手段。

Strategy 和日本的 Metaplanet Inc. 是最出名的 DATs,过去一年股价暴涨,近期股价同样回落,说明连领头羊都扛不住市场情绪转变。业内甚至已经在聊并购整合,强者或许会直接收购弱者的代币资产。

Strategy 在上周五的标普 500 指数调整中被刷掉,尽管已符合标准。自 4 月以来,股价基本没动静,即便比特币反弹,它的比特币市值倍数(mNAV)也降到 1.5 左右。公司最新通过 ATM 融资仅购入 2.17 亿美元比特币,低于市场预期。

另一方面,加密放贷机构正在加速布局。Two Prime CEO Alexander Blume 表示,DAT 已成为比特币抵押贷款的主要客户群之一,单笔规模通常在 1,000 万至 5 亿美元之间,目前活跃贷款规模已达 12.5 亿美元。公司还推出了「到期一次性还本」的新型结构,取消月度利息支付,目的是给借款人在波动市中留出更多空间。

Blume 表示:「比特币财库公司是我们业务增长的重点」,「过去一年我们见证了越来越大的融资需求。」

至于这种融资生态能走多远,目前尚无定论。但可以预见,接下来或许不会出现突然崩盘的现象,而是股价阴跌、购币停滞的「慢性退潮」。

一些投资者已开始怀疑:为什么要通过叠加费用、风险和股权稀释的公司来间接持有加密货币资产,而不是直接买币或通过 ETF?Ikigai Asset Management 首席投资官 Travis Kling 对整个模式表示质疑:「我一直试图说服自己购买一些 DAT,但没有成功,可能永远不会。」他认为这种模式「像是一个周期的最后一口气,想不出比这种荒谬做法更好的东西了」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。