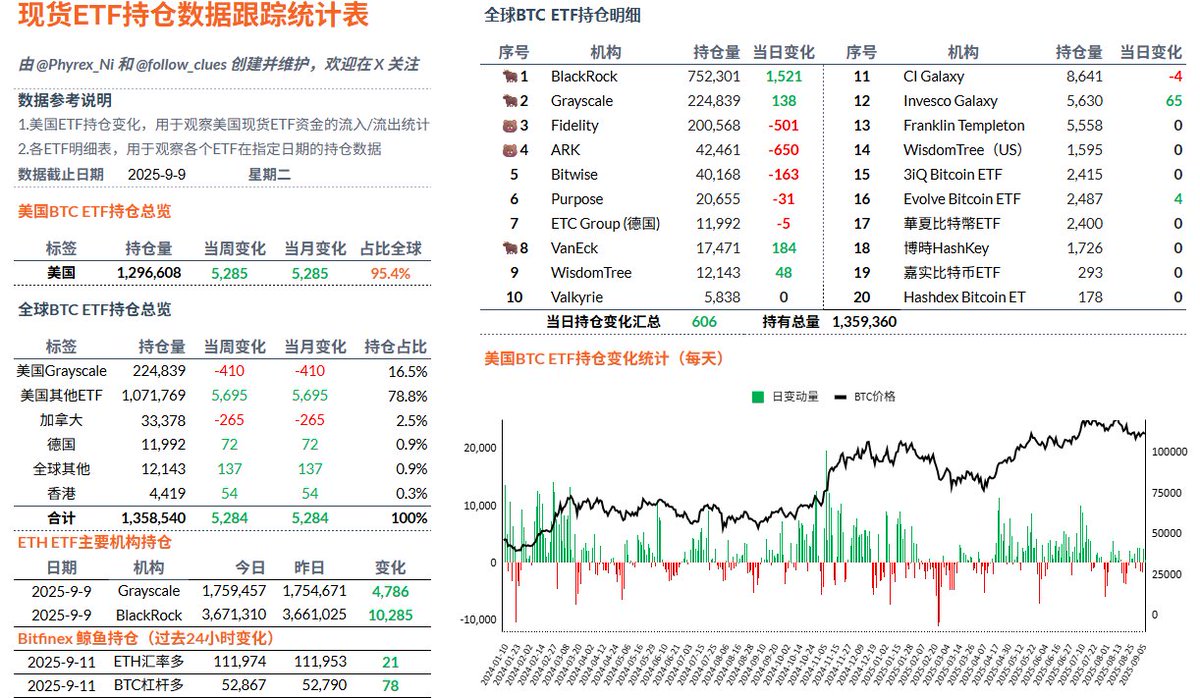

On Tuesday, the performance of the $BTC spot ETF remained largely unchanged, with U.S. investors seeing a net inflow of less than 600 Bitcoins, still at a low level. Although data shows that a significant amount of funds flowed into $IBIT earlier this year, that was mainly in the first half of the year. The liquidity in the primary market for ETFs has been terrible in the last two to three months.

This is closely related to the performance of Bitcoin prices, which have been fluctuating around $110,000 for a long time. Investors who wanted to buy have mostly done so, and the same goes for those who want to sell. As a result, overall trading volume has started to decline, primarily due to BTC lacking an independent narrative, essentially following macro trends and tech stocks.

In the second half of the year, it seems that Trump's interest in cryptocurrencies has also begun to wane. Aside from mentioning stablecoins, there has been little talk about BTC's strategic reserves, creating a sense that the market is lacking momentum.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。