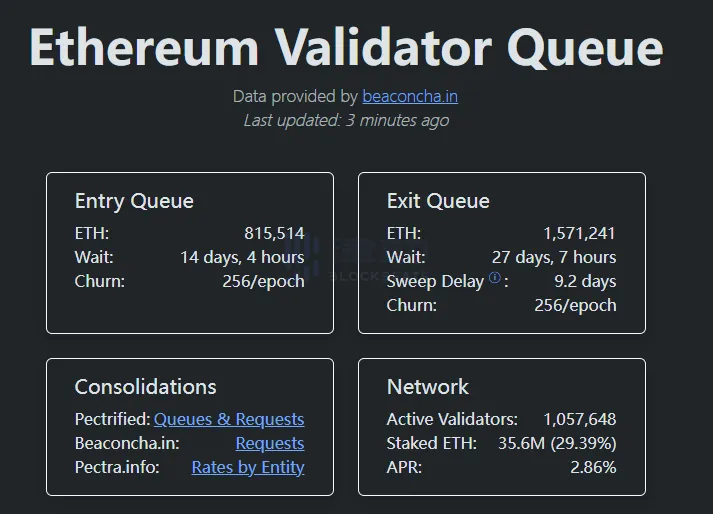

🧐 The number of ETH queued to exit the Ethereum PoS network has surged again, now exceeding 1.57 million. Is this a bearish signal?

That's a great question:

In fact, the surge in ETH exiting the Ethereum queue cannot be directly interpreted as a single signal for price increase or decrease; it should be viewed in conjunction with market sentiment, capital flow, and on-chain behavior.

In addition to the queued exits, there are approximately 815,514 ETH waiting to join the network, valued at about $3.516 billion, indicating that some investors are optimistic about long-term returns.

So, it's not a one-sided negative signal, but rather a reflection of market differentiation: some capital wants to cash out, while some capital wants to lock in for the long term.

So how should we view the impact on the market?

If the price of ETH sees a significant net inflow into exchanges at the same time as the surge in queued exits, that would be bearish;

If the exiting ETH primarily flows into Lido, EigenLayer, or DeFi protocols, that would actually be bullish, as it indicates that capital is still circulating within the chain.

According to the latest report from CoinDesk:

Currently, the amount of ETH in the Entry Queue (pool application) exceeds that in the Exit Queue, indicating that the market's demand for staking has rebounded, with capital flow leaning towards long-term locking. Some exits may not be for selling, but rather to heavily invest in staking ETFs or to re-enter the market through institutional products.

Therefore, this wave of exits does not equate to selling pressure, but rather resembles an adjustment in market structure and capital redistribution—short-term volatility may occur, but in the medium to long term, the outlook remains positive.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。