原文来源:LAB

2024 年,DEX 市场占有率从 9% 增长至 20%,月均交易量现已超过 1500 亿美元,累计交易量超过 2.5 万亿美元。预计 2026 年将超过 3 万亿美元。

面对这一庞大市场,当前市场上 DEX 和交易终端功能也日益丰富,但用户往往需要在不同平台、不同链之间频繁切换,难以兼顾速度、成本和便利性。交易量的增长推动了对更高性能交易工具的需求,但不同链上部署着各自的流动性池和交易终端,跨链桥和多钱包操作增加了用户负担。

对于如今的交易者而言,既需要追逐热点,还需要关注市面上最趁手的工具和数据。在不同链的钱包间切换,试图在数十个 DEX 前端和数据分析网站间跳转以寻找 Alpha。

这一支离破碎的交易体验,极大地消耗着交易者的精力与资本。投资者急需一个工具能够整合碎片化的市场,简化繁琐的流程。

LAB 团队观察到这一痛点,认为未来交易工具应当对用户屏蔽底层技术细节,使用户更关注投资本身。因此,LAB 基于已有交易终端之上研发了多链交易终端及一系列辅助工具,让交易更快、更灵活、更低成本。

浏览器插件、侧边栏,像 L2 一样的交易终端

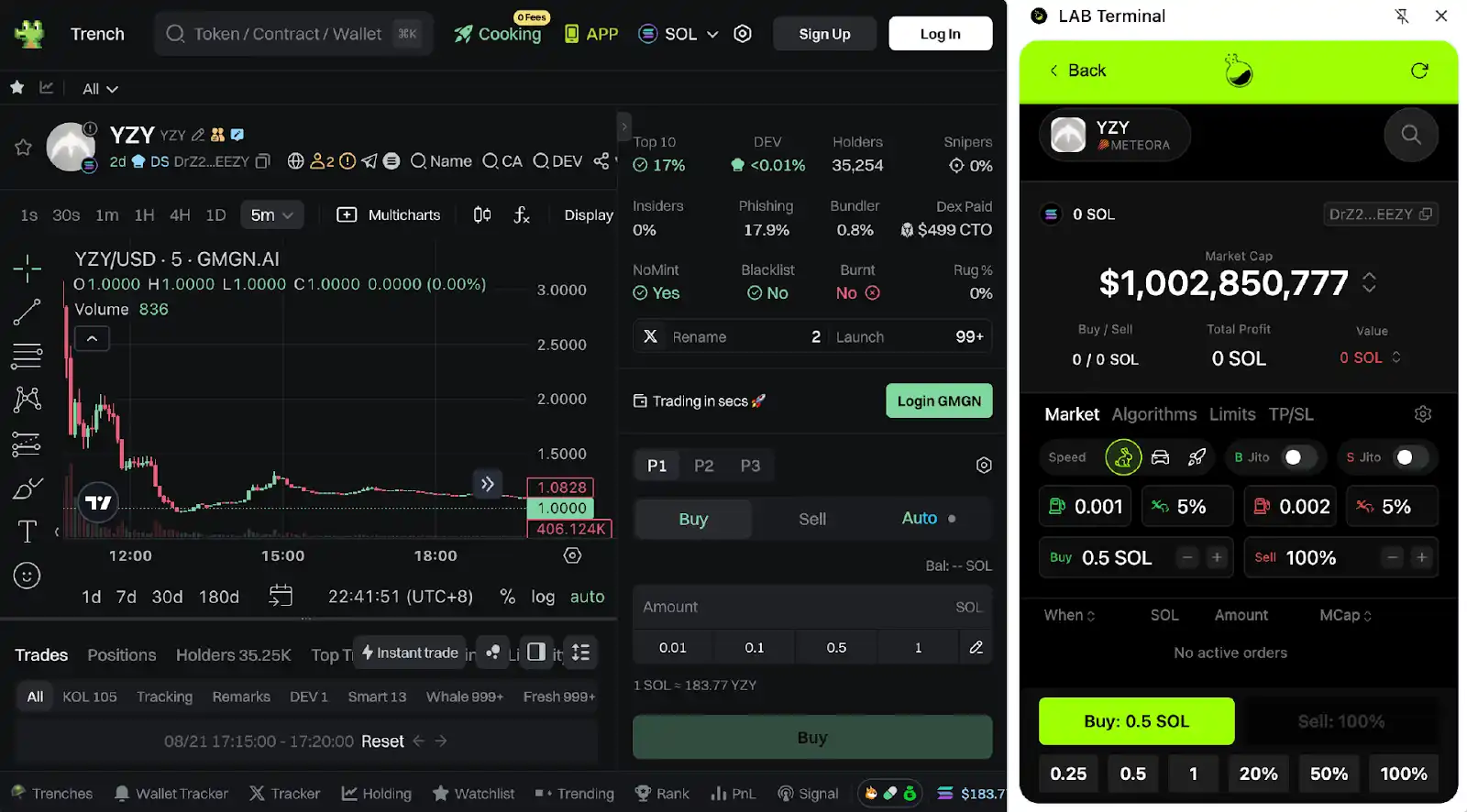

LAB 自称为「多链交易生态系统」,其核心是 LAB Terminal。这是一个性能导向的多链 DEX 交易终端,具有智能代币检测和跨多个加密平台的无缝交易能力,支持包括 Telegram 机器人、浏览器扩展插件等方式访问。目前,LAB 已经在 Solana、Ethereum、Base 与 BNB Chain 等主流公链上线,并将持续拓展至更多新兴网络。后续 LAB 将帮助用户在碎片化的链上环境中实现统一的交易体验。

相比其它平台动辄 1% 的手续费,LAB Terminal 仅收取 0.5% 交易费。此外,LAB 还集成了 4 级推荐制度和空投激励机制,邀请好友交易可获得最高 41% 的返佣以及 30% 交易费用折扣。通过 LAB 终端交易即可获得积分,作为后续获得 LAB 代币空投的凭证。对于 Solana 网络的代币,LAB 还提供 Boost 模式。在该模式下,经验丰富的交易者可快速执行自定义滑点、gas 费用以及 MEV 保护。

正如刚刚所描述,不同风格偏好的用户有着自己习惯的操作方式和喜欢的工具。仅靠低成本和高性能并无法赢得市场。LAB 并不专注于取代用户已经习惯的工具,而在于赋能并超越它们。LAB 创造性地提出了「L2 交易基础设施」这一核心理念。

LAB Terminal 及其 Chrome 浏览器扩展插件将交易者熟悉的分析工具与终端执行结合,形成一站式交易体验。当投资者安装后插件后在任何 DEX 网站均可即时唤起 LAB Terminal。正如 L2 网络在不改变以太坊主网共识的情况下提升其性能一样,LAB 也选择叠加在所有主流的交易平台和数据网站之上,通过其强大的技术内核,对用户的交易流程进行扩容和加速。

用户无需改变自己的操作,无论是在 Pump.fun 上追逐 Meme、使用 DexScreener 分析 K 线还是通过 Twitter 追踪 KOL 最新动态,LAB 均以非侵入式的方式介入。LAB 将自身化为覆盖 Web3 的智能交易层,让用户在任何场景下都能即时调用其强大的功能,从而将精力完全聚焦于交易策略本身,而非繁琐的操作。

除此之外,LAB 浏览器扩展插件还支持侧边栏(Sidebar)功能,方便用户在不同终端和链之间快速切换。试想,当我们正浏览追踪某巨鲸提前埋伏代币线索时,屏幕右侧的 LAB 侧边栏会即时浮现,自动抓取该代币信息,并呈现出简洁的交易面板。只需点击买入,一笔跨链交易便在数秒内完成,全程无需离开当前页面。

对于移动用户,LAB 也推出了 Telegram Mini App,用户无论身在何处都能通过手机进行资产管理。

人均交易量 2.1 万美元

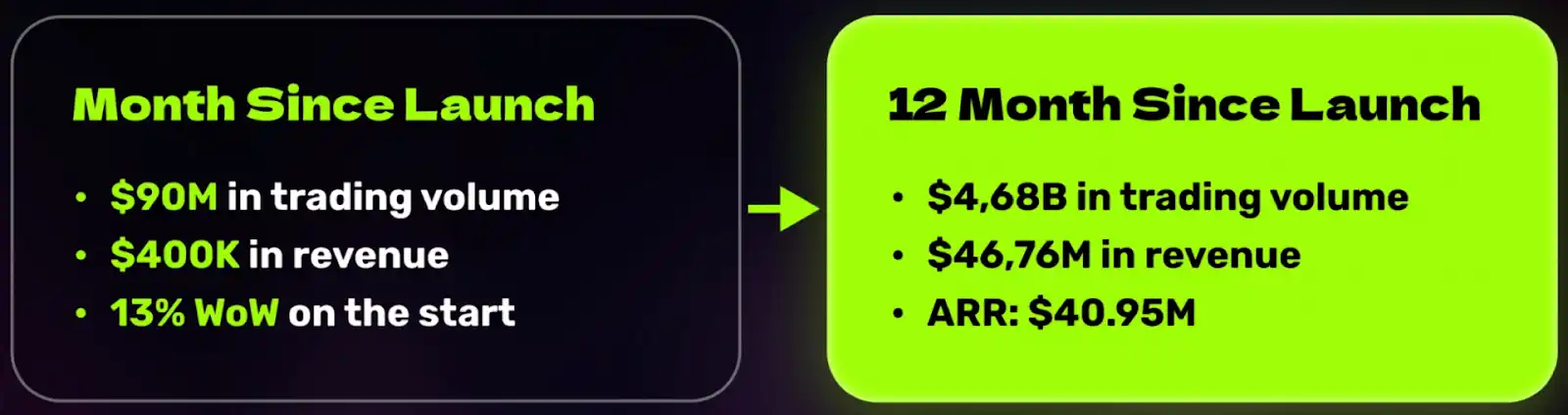

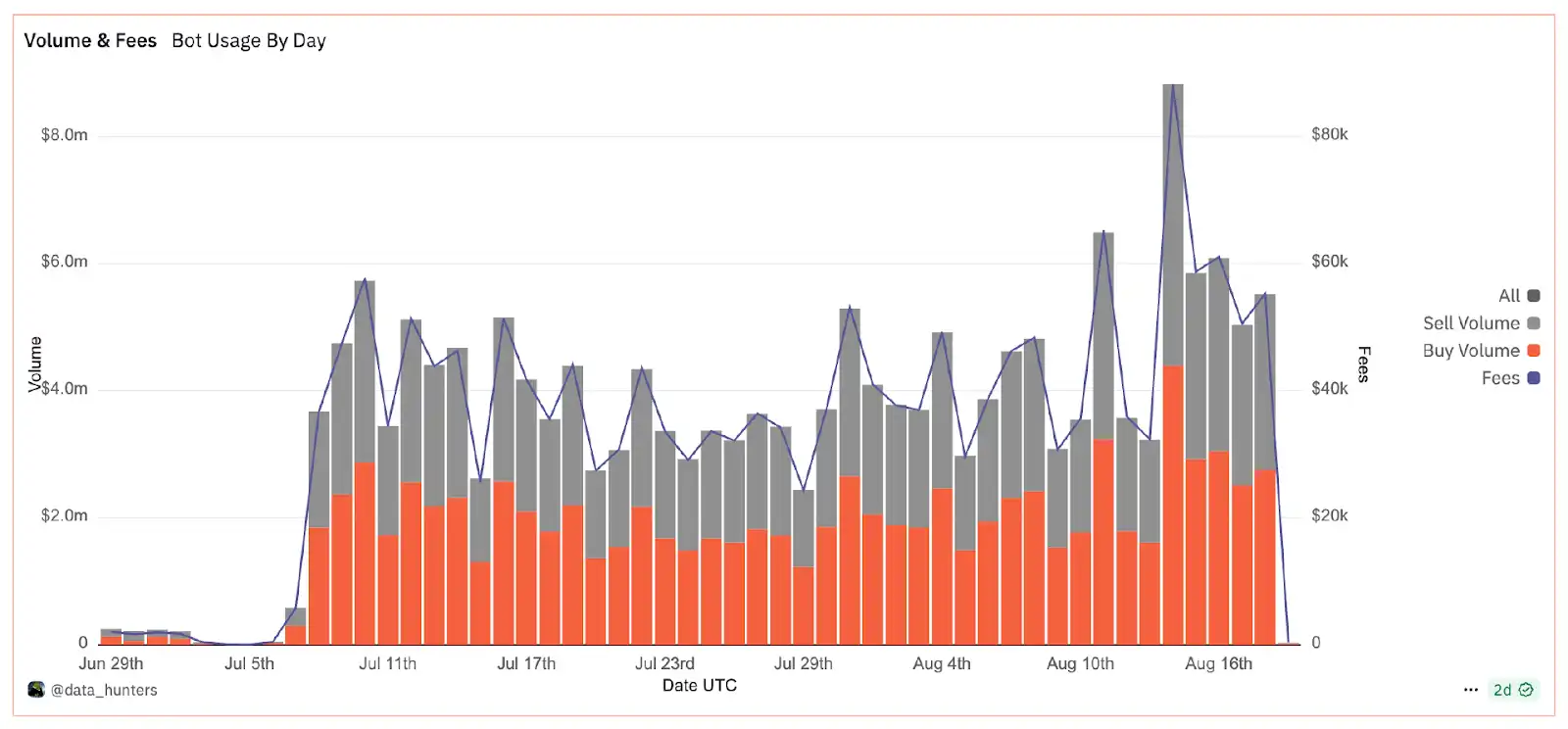

再好的想法和设计都需要经过市场的检验。自上线以来,LAB 的市场表现堪称现象级。根据官方数据,LAB 上线一个月交易量便达到了 9000 万美元,周环比增长达到了 13%。预计 LAB 有望在上线首年达到 45 亿美元的交易量以及创造 4676 万美元的收入。

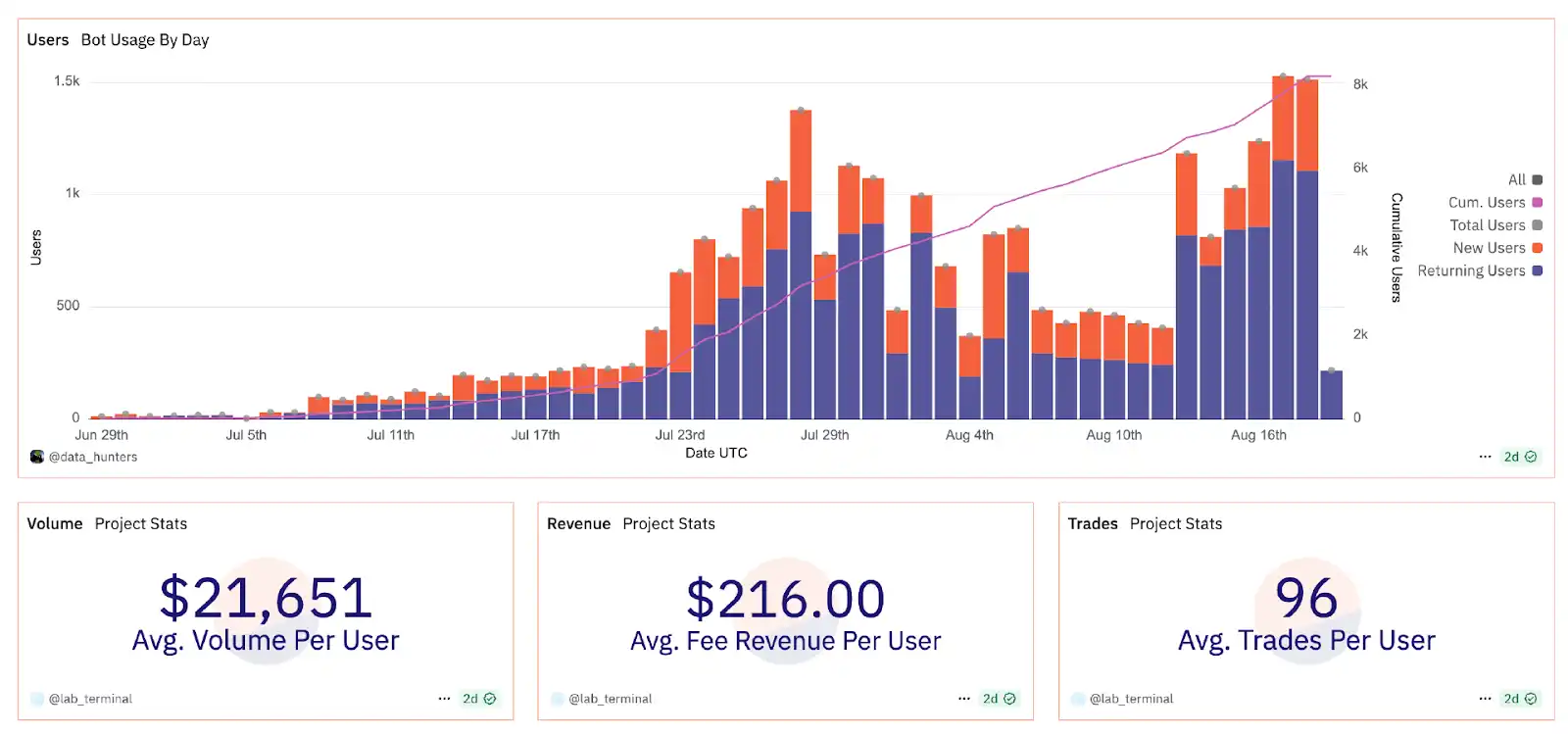

Dune Analytics 数据显示,LAB 目前累计交易量 2.3 亿美元,吸引了 超过 8000 名用户。

这些数字背后,是用户用真金白银投出的信任票。高达 2.1 万美元的人均交易量和 216 美元的人均手续费贡献以及 96 次的户均交易次数。在与 BonkBot、Trojan 等先行者的激烈竞争中,LAB 凭借其只需一半的交易费用以及体验上的优势,正展现出巨大潜力。

LAB 背后的领导核心

LAB 由 Naveed Rao 和 Vova Sadkov 两位在 Web3 领域拥有丰富经验的创始人主导。

Naveed Rao 作为 CEO,拥有拥有超过十年的商业开发经验,涉足 Web3、机器学习与网络安全。他曾在 MetaTor 领导元宇宙基础设施建设,如今将注意力集中在 TON 与 SocialFi 上。致力于通过 LAB 将 9 亿 Telegram 用户引入 Web3,推动社交网络与去中心化金融的深度融合。更重要的是,LAB 的战略目标从一开始就超越了单一人群的覆盖。一方面,借助 Telegram 的巨大用户基数,LAB 拓展了面向新用户的入口,将社交网络的流量直接转化为 Web3 的活跃度。另一方面,LAB 也将深耕 Solana 上的 DEX 交易者群体,为这些高频活跃的链上用户提供更快、更低费、更灵活的交易环境。

Vova Sadkov 是连续创业者,曾在医疗科技与教育科技领域创办并退出两家公司,覆盖超过 30 万用户。Sadkov 曾入选过 Forbes 报道,被视为兼具创业精神与执行力的新一代领袖。在 LAB,他负责整体运营与战略落地。

CTO Usman Rafiq 和 CMO Alex Kotlyarov 等核心成员均具备多年行业经验,曾领导多个项目。

根据公开信息,LAB 已完成完成 230 万美元种子轮融资,由 Lemniscap 领投,并得到 tvm ventures、OKX Ventures、Mirana Ventures、KuCoin Ventures、Gate Ventures、GSR、Cypher Capital、Animoca Brands 的支持。

代币

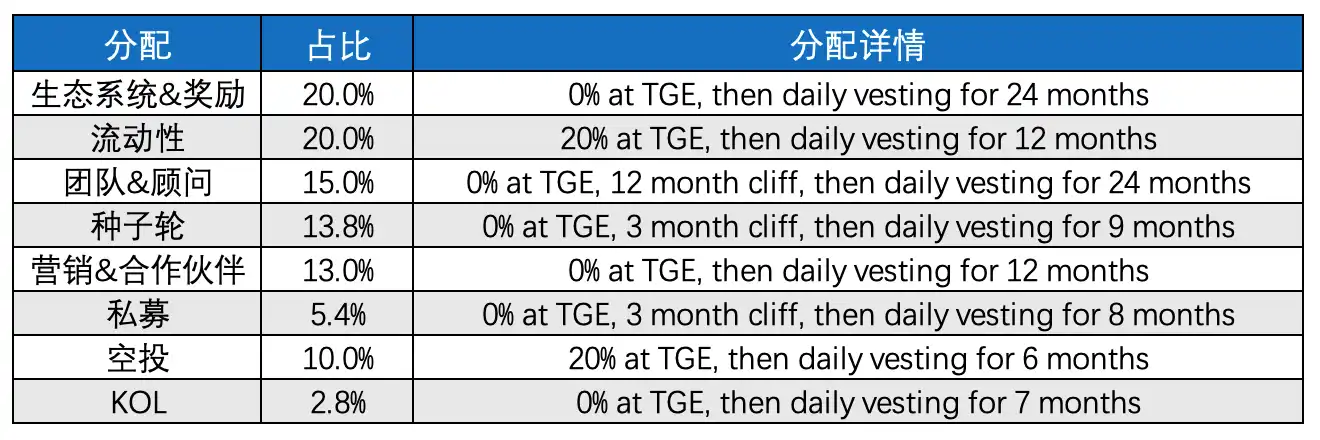

LAB 代币是整个 LAB 生态系统的核心价值,其设计的核心思想是确保所有参与者的利益长期一致。LAB 的总供应量为 10 亿枚,旨在构建一个可自我强化持续发展的经济飞轮分配方案。主要分配详情:

·生态系统&奖励:20%

·流动性:20%

·团队&顾问:15%

·种子轮:13.8%

·营销&合作伙伴:13%

·私募:5.4%

·空投:10%

·KOL:2.8%

LAB 采用「分期释放 + 长期线性解锁」的模式,试图降低早期的市场冲击。在 TGE 时,若不计入流动性部分,市场实际流通的代币仅占 21%。随着时间推移,LAB 逐渐进行释放。前三个月种子轮与私募轮代币处于完全锁定状态,只有少量空投代币进入市场。

这一代币分配与释放方案的最大优势,在于将长期激励与生态建设紧密结合。低初始流通让代币在早期具备稀缺性,吸引市场关注。但代币启动 3 个月后种子轮和私募轮集中进入释放阶段,叠加生态与市场的持续放量,抛压可能增大。这也意味着 LAB 团队需要给出超越市场预期的成绩。

与此同时,LAB 还启动了 Loyalty Airdrop 计划,所有曾经在 Solana、Base、Ethereum、BSC 等链上热门终端 Photon、BullX、Axiom、Pump.fun、Banana Gun、Maestro 进行过交易的用户,都可能获得 LAB 的 Lootbox 奖励。用户只需连接钱包并签署只读消息,验证历史交易量即可领取奖励。

Lootbox 中的部分 LAB 奖励最初是锁定的,用户需在 LAB Terminal 上持续交易才能解锁。这种设计既实现了对早期贡献者的回馈,也推动了 LAB Terminal 的使用增长,形成正向循环。在该机制下,LAB 不仅奖励了曾经的交易活跃度,还通过额外积分的方式,将未来的参与度绑定到生态中。

根据官方规划,LAB Airdrop 将分阶段进行,Season 1 主要面向外部交易者,作为拉新与用户基础的扩展。Season 2 则在 TGE 前启动,奖励重点完全转向 LAB Terminal 内部的交易行为,以鼓励用户深度参与生态发展。

综合来看,LAB 在 2025 年启动并非偶然,而是对整个 Web3 行业发展趋势的一种回应。LAB 试图解决当前链上交易生态的核心矛盾,多链无限机会与交易者实际面临的混乱、低效体验之间的巨大鸿沟。LAB 并非简单地创造另一个交易平台,而是通过其创新的「L2 交易基础设施」理念,构建了一个覆盖全网的智能交易层。通过交易终端与浏览器插件将碎片化的流程整合为一体,为用户提供极致交互体验。

更为重要的是,LAB 还试图将 Telegram 上近 9 亿用户有效导入 Web3 世界。这意味着,普通用户能够绕过复杂的钱包和私钥概念,以社交方式轻松参与到链上经济中,将潜在的 Web3 兴趣用户转化为真实的活跃参与者。

展望未来,LAB 已经规划了一系列清晰的发展路线图。2025 年 Q3,LAB 将推出浏览器插件及「Instant Trade」功能,为用户带来更快的下单体验。同时,LAB 还将在这一阶段上线 Meme 永续合约和 AI 驱动的智能工具,例如「叙事分析」与「相似代币搜索」,帮助交易者更快捕捉市场热点。进入 Q4,LAB 将发布更多面向长期用户的激励机制,包括质押与忠诚度奖励体系,并开放专业级的高级功能,如快速代币发现与算法交易支持。此外,LAB 的手机端应用也将在这一阶段上线,搭配巨鲸追踪与自动交易提醒,为用户提供随时随地的交易体验。年底前,LAB 还将推出跟单交易排行榜与游戏化任务系统,通过奖励机制与社交元素进一步增强社区黏性。

2026 年,LAB 的愿景将拓展至更宏大的层面。首先是多链资产管理与跨链兑换的全套工具,配合治理模块的上线,让 LAB 代币持有者真正参与到生态决策中。随后,LAB 将推出开发者 SDK 与 API 工具,开放第三方策略与交易算法的市场降低新用户进入 Web3 的门槛。

可以说,LAB 的未来计划不仅限于做一款「更好用的交易终端」,而是着眼于打造一整套覆盖从工具、用户到社区与开发者生态的完整体系。

本文来自投稿,不代表 BlockBeats 观点

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。