原创|Odaily 星球日报(@OdailyChina)

作者|Wenser(@wenser 2010)

受益于 XPL、WLFI 盘前、上线及大盘市场震荡行情,Hyperliquid 8 月创下 1.06 亿美元的营收,环比增长 23%;单月合约交易量接近 4000 亿美元,DEX Perp 市场份额占比约 70%。作为如今行业内当之无愧的“现金牛”,官方主打的“高性能 L 1 公链”概念也为 Hyperliquid 稳定币版图带来了无限的想象空间。

9 月 5 日,Hyperliquid 官宣 协议保留的稳定币代号 USDH 将通过链上验证者投票流程释放,投票完全在 Hyperliquid L 1 上进行,流程与下架投票类似,获选团队需参与常规现货部署 Gas 拍卖。官方表示,USDH 作为高需求的规范代号,将用于构建合规、Hyperliquid 优先的原生稳定币,消息一出,各大稳定币发行商纷纷给出了自己的“USDH 发行方案”,Odaily 星球日报将于本文对 Hyperliquid 原生稳定币 USDH 不同方案及背后发行商之争予以简要分析。

USDH 成稳定币发行商必争之地,Paxos、Agora 等巨头入局

9 月 5 日,Hyperliquid 官方于 Discord 社区发布公告 称,

1.将在下一次网络升级中优化现货市场结构,两种现货报价资产之间的现货交易对接受者费用、挂单返利及用户交易量贡献将统一下调 80%,以提升流动性并降低用户摩擦。

2. 目前由协议保留的 USDH 稳定币代号将通过透明的链上验证者投票释放。投票通过超流动性 L 1 交易完全在链上进行,就像下架投票的工作方式一样。由于 USDH 是一个需求量很大的规范代币代号,验证者将投票选出最有能力构建本地铸造的、Hyperliquid 优先的稳定币团队。有兴趣使用该代号的团队可以在新的“usdh 论坛子频道”中提交提案,并应包括被选中的验证者法定人数的用户地址,该地址将用于部署 USDH。请注意,获批的团队仍必须参与通常的现货部署 Gas 拍卖。此外,官方强调:“USDH 代码非常适合 Hyperliquid 优先、Hyperliquid 一致且合规的美元稳定币;下一次网络升级后,验证者将能够投票允许用户地址购买 USDH 稳定币代号。”

3.就上下文而言,从测试网开始,现货报价资产将在未来变得无需许可。后续将公布质押要求和削减标准。

随后,官方 补充信息道:“此次投票仅针对 USDH 代号。USDH 不会因其代号性质而获得任何特殊特权,Hyperliquid 的原生金融原语和通用可编程性构成了一条针对稳定币发行和支付进行独特优化的链。Hyperliquid 区块链上将继续有多种稳定币,并有新的稳定币团队加入 Hyperliquid 生态系统。USDH 只是众多稳定币之一。如前所述,在等待技术实施之前,成为报价资产将变得无需许可。

关于时间:提案应在 9 月 10 日 10:00 UTC 之前发布;验证者应在 9 月 11 日 10:00 UTC 之前说明他们要投票给谁;验证者应在 9 月 14 日 10:00-11:00 UTC 之间投票,以方便用户有时间质押给与他们投票相匹配的验证者。

投票基于质押份额。验证者将通过提交与他们支持的团队相对应的地址来投票。基金会验证者将根据 9 月 11 日做出的验证者承诺(按 9 月 14 日的权益加权)投票选出非基金会投票最多的团队,从而有效弃权。”

参赛选手:3 大稳定币发行商+2 个项目方各显神通

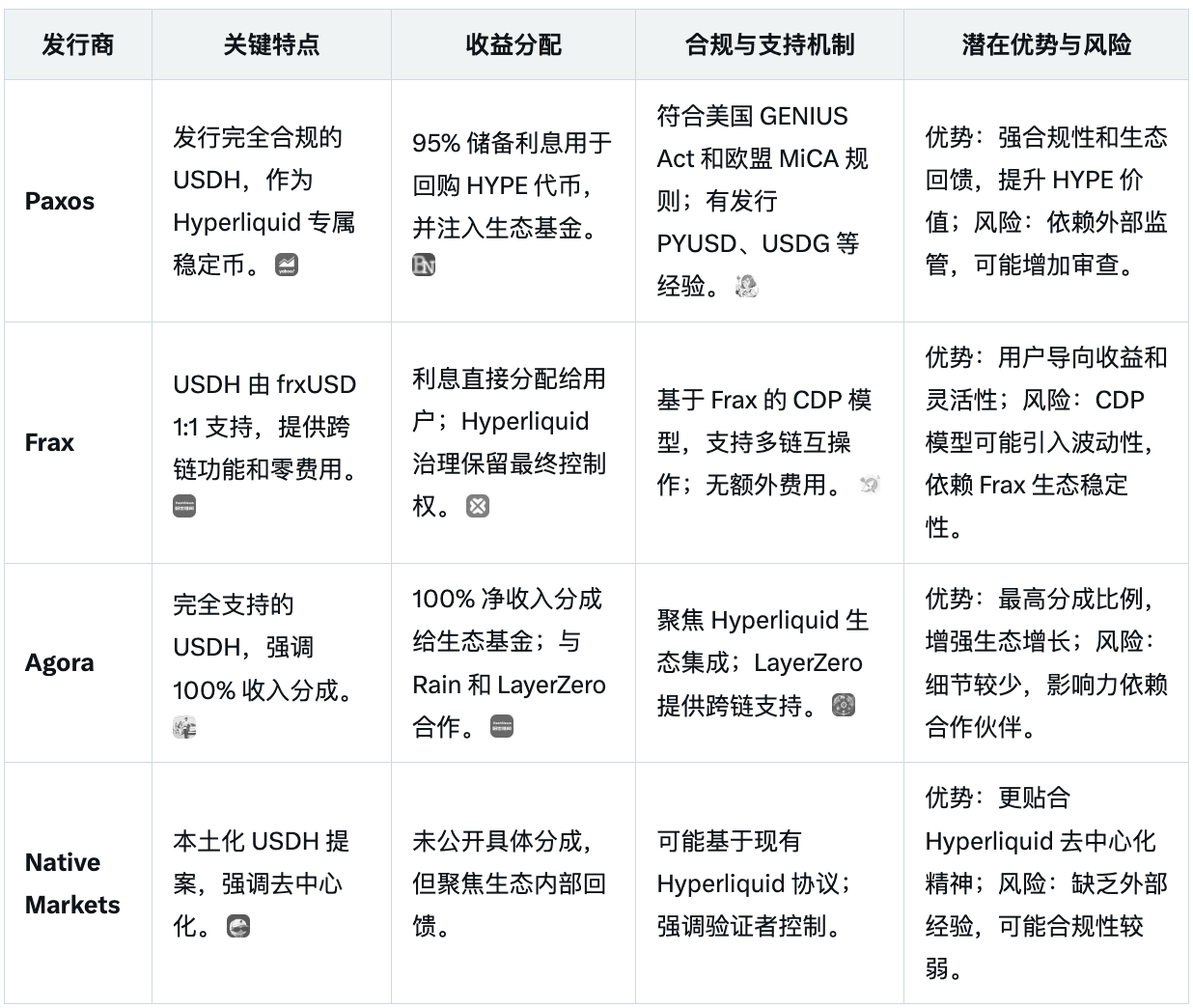

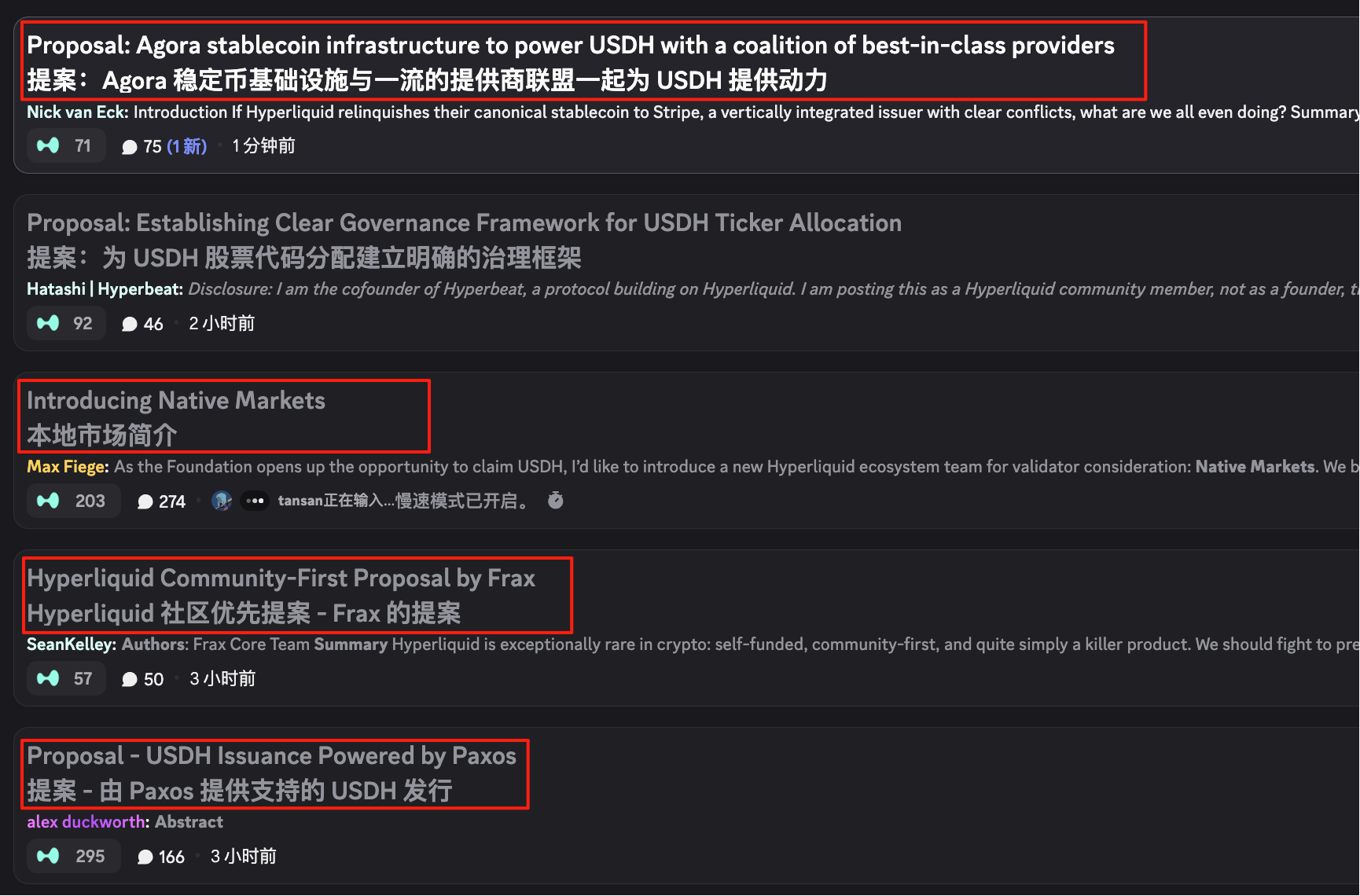

截止目前,Hyperliquid 社区 USDH 子频道已有 5 份稳定币发行提案,除去 Paxos、Agora、Frax 等知名稳定币发行商以外,由 Max Fiege 领衔的 Native Markets 以及 Konelia 团队也同样给出了自己的 USDH 发行方案。

综合现有信息来看,各大稳定币发行商拥有成熟的发行方案和丰富的合规经验,最终赢家或将从他们中脱颖而出。

除此以外,各大发行商也在提案中对自己的优势进行了简要介绍——

- Paxos 强调了自己在全球地区的合规专业性以及强大的合作网络,据 Paxos Labs 团队成员表示,Paxos 已经在 Hyperliquid 生态系统中开始建立合作伙伴关系,为成功部署 USDH 做准备,其初期合作伙伴包括:FalconX、Looping Collective、HyperLend、Pendle、HybraSwap、Hyperswap、Neko、HypurrFi、DotHYPE、RubFi、Nunchi 等。

- Frax 团队则强调了自己与 Hyperliquid 同样的“去中心化愿景”,其中提到:“Frax 在各个周期中设计、运输和运营了数十亿美元规模的多种稳定币,安全事件为零。我们的优势是严格的激励和机制设计,并拥有良好的业绩记录。我们致力于去中心化和超越所有解锁,从长远来看,而不是为了提取,这就是为什么 USDH 的抵押品收益率将以 0% 的接受率回流。”

- Agora 发言人 Nick van Eck 则强调了自身背靠资管巨头 VanEck 以及与拥有 20 亿用户的信用卡支付网络 Rain、互操作性基础设施 LayerZero 以及 EtherFi 等知名平台合作的优势。此外,其还强调了 Agora 作为发行商的中立性,趁机还拉踩了一把 Paxos,原话为:“Agora 没有自己的结算网络、经纪业务( Paxos 则相反)”。

- Max Fiege 领先的 Native Markets 则强调了自身的“本地化属性”,其计划“将其储备收益的相当一部分捐赠给援助基金;USDH 将直接在 HyperEVM 上铸造,第一天就启用了 HyperCore 传输;USDH 还将继承了发行人 Bridge(Stripe 旗下公司)的全球合规属性和发行渠道”。而得益于 Max 在 Hyperliquid 社区的深度参与与声望,该提案评论区得到了不少人的声援支持。

- Konelia 团队提出的 稳定币发行方案 由于将收益寄希望于“短期美债的自动复利收益率”并强调 Hyperliquid 生态目前并不重视的 MEV 保护而遭到社区成员的冷眼,甚至嘲讽。

以下为现有稳定币发行商提案的部署地址:

Paxos——0x999000B7c80550C5D3858a9C9505dd9A3654B339 ;

Frax——0x6e74053a3798e0fc9a9775f7995316b27f21c4d2;

Agora——0x8010f766AA84bB0Cc57e7C0bf13149cF9BC62b65;

Native Markets——0xc4bb9B6FdA3112B381Cb94f571bc72db541e7577;

Konelia——0x274f2c145B413f76cD3ED52C05221ddAb0E582A1。

由于目前链上投票并未开启,根据社区提案反馈来看,稳定币发行商 Paxos 和 Max Fiege 发布的相应提案支持相对较高。

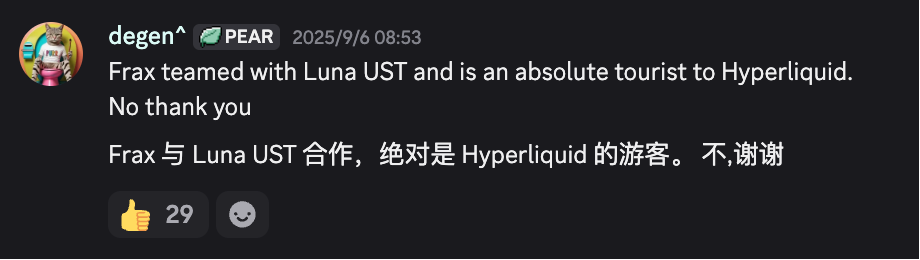

Hyperliquid 社区 USDH 子频道页面

值得一提的是,Frax 因此前与 Luna 算法稳定币 UST 存在合作,而遭到了 Hyperliquid 社区成员的非议,尽管随后有人 澄清道:“合作伙伴关系是 Curve 中的 4 代币对池 USDC/USDT/UST/Frax 池,当时它们是 EVM 中排名前四的稳定币。”

Hyperliquid社区成员质疑 Frax

Hyperliquid 生态项目态度不一:有人大喊不公,有人直接弃权

针对 USDH 提案投票一事,Hyperliquid 生态内项目也给出了自己不同的态度:

流动性质押协议 Kinetiq 官方 发文表示 将从美国东部时间 9 月 10 日中午 12 点至美国东部时间 9 月 15 日中午 12 点将所有权益重新委托给 Hyperliquid 基金会节点,以在此次投票中弃权。

Hyperliquid 生态超额抵押稳定币项目 Hyperstable 团队则 发文表示,自去年年底就已计划推出一种由 HYPE、HYPE LST 等支持的去中心化和超额抵押稳定币,但彼时所有 USD 开头的代币名称都被列入了黑名单,而 USDH 也在此列,但此次突然开放的 USDH 发行却凸显了很多团队(比如 Max Fiege)提前收到了消息,这是极不公平的,建议将 USDH 代号继续加入黑名单。

USDH 即将上线,USDC 背后的 Circle 先坐不住了

USDH 发行争夺战还未正式开启,作为 Hyperliquid 生态目前唯一稳定币的 USDC 背后的 Circle 首先坐不住了——Circle 联合创始人兼 CEO Jeremy Allaire 表示,不要被炒作迷惑。Circle 将成为 Hyperliquid 生态中的主要参与者和贡献者。很高兴看到其他人购买新的美元稳定币代码并参与竞争,但有着深度流动性以及几乎即时跨链互操作性的 USDC 一定会受到市场的热烈欢迎。

值得一提的是,早在 7 月,Circle 就 官宣 了原生 USDC 及 CCTP V 2 即将部署至 Hyperliquid 链上,但一个多月后的今天,原生 USDC 仍未上马,而 USDH 的出现无疑让 Circle 感受到了威胁,CEO Jeremy Allaire 的回应看起来稍显无力。令人发笑的是,稳定币 USDe 发行商 Ethena Labs 官方今日 于 X 平台发文 暗示曾向 Circle CEO 发送 USDH 提案,但并未获得对方回应。

稳定币发行商乱战:只为抢占分发与市场份额

在美国稳定币监管法案《GENIUS 法案》通过即将落地之际,稳定币赛道还将迎来新一轮的爆发,而 USDH 的出现,为各大稳定币发行商提供了一块新的蛋糕。

而对于目前稍显饱和的稳定币市场而言,坐拥数十万高频交易用户、单月数千亿交易量的 Hyperliquid 无疑将为稳定币市场带来不小增量,这也是诸多发行商纷纷下场争夺 USDH 代号部署权的原因。BitMEX 联创 Arthur Hayes 此前曾 发文指出,稳定币成功的关键在于分发渠道。

正如 Frax 创始人 Sam Kazemian 所言,“对稳定币发行方和基础设施公司而言,各方竞争提交 Hyperliquid 稳定币 USDH 发行提案的要点不在于收益分成,真正的价值在于实现与 Hyperliquid 这个超大分发场景的互操作性及深度 1:1 集成。事实上,入围提案的各方(Frax、Paxos、Agora)均已提出愿意将 100% 的收益返还。”(Odaily 星球日报注:Paxos 提案为借助 USDH 储备产生的 95% 利息将用于回购 HYPE 代币,并分配给用户、验证者和合作伙伴协议。)

如果用零售业来做比喻的话,Hyperliquid 相当于一个自带零售渠道的饮料品牌,Paxos、Agora、Frax 等则相当于饮料生产代工厂,而现在他们争夺的,就是这个庞大的零售渠道网络。

而对于 Hyperliquid 社区而言,多数成员最为关心的问题仍然是 USDH 的发行如何服务于 Hyperliquid 生态发展,尤其是相应收入对 HYPE 代币回购的分配,以及项目团队成员此前在 Hyperliquid 生态及社区的活跃度。

值得一提的是,USDH 的发行与应用或将为 Hyperliquid 带来高达 2.2 亿美元的潜在年收入。另据 BitMEX 联创 Arthur Hayes 预测,2028 年,稳定币市场规模将达 10 万亿美元,届时,基于原生稳定币 USDH 发展下,作为生态代币的 HYPE 价格增长堪称未来可期。

文章最后,Odaily星球日报提醒 HYPE 质押用户注意节点投票声明,以免错过对应的投票委托。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。