周日的作业简单了很多,并没有太大事件的发生,窄幅震荡是最好的事情了,日本首相石破茂的辞职对目前的美国风险市场还是有些帮助的,缓解了日元加息对借贷市场的影响,虽然不能是本质上改变美国的主要矛盾,但投资者的心情能缓解一些,要不在担心美联储不降息的情况下还要担心日本加息,那就烦躁了。

现在很多的数据已经在显示美国的经济有下行的可能了,尤其是美国房地产相关的走势甚至让川普都已经关心了,房产是和利率关联最大的产业之一,高利率下买房和盖房都不容易,而且劳动力市场也表现出了对经济的担心。

最近几天川普和他的支持者每天要么就是骂鲍威尔,要么就是说利率太高了,所以现在市场博弈的重点还是川普和美联储之间对于利率的博弈。

回到 Bitcoin 的数据来看,周末流动性仍然很低 $BTC 价格变动的幅度不大,说明投资者对于目前的局势还能忍耐,并未出现恐慌的迹象,下周就是九月议息会议前最后的一组通胀数据了,还有2025年的就业数据修正,可能都会对情绪有影响,但最终还是要看利率的调整。

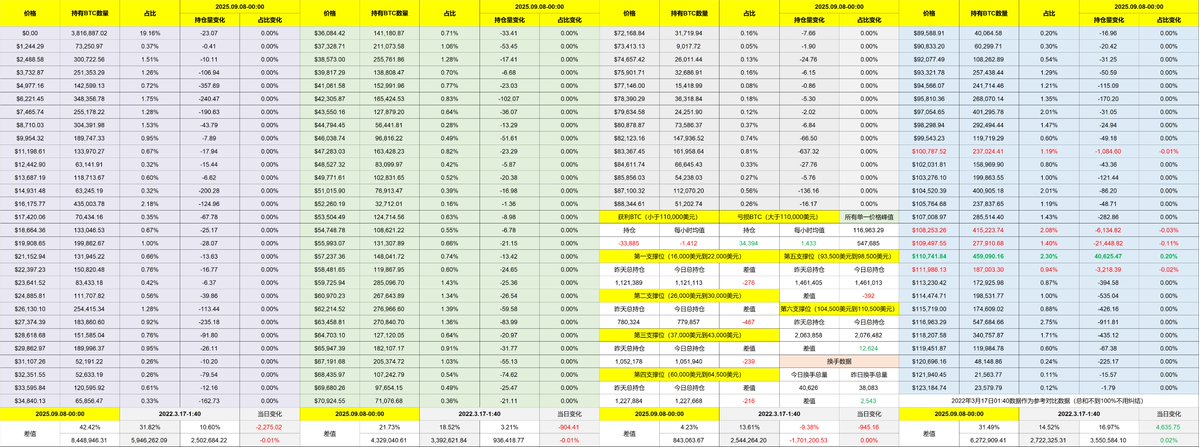

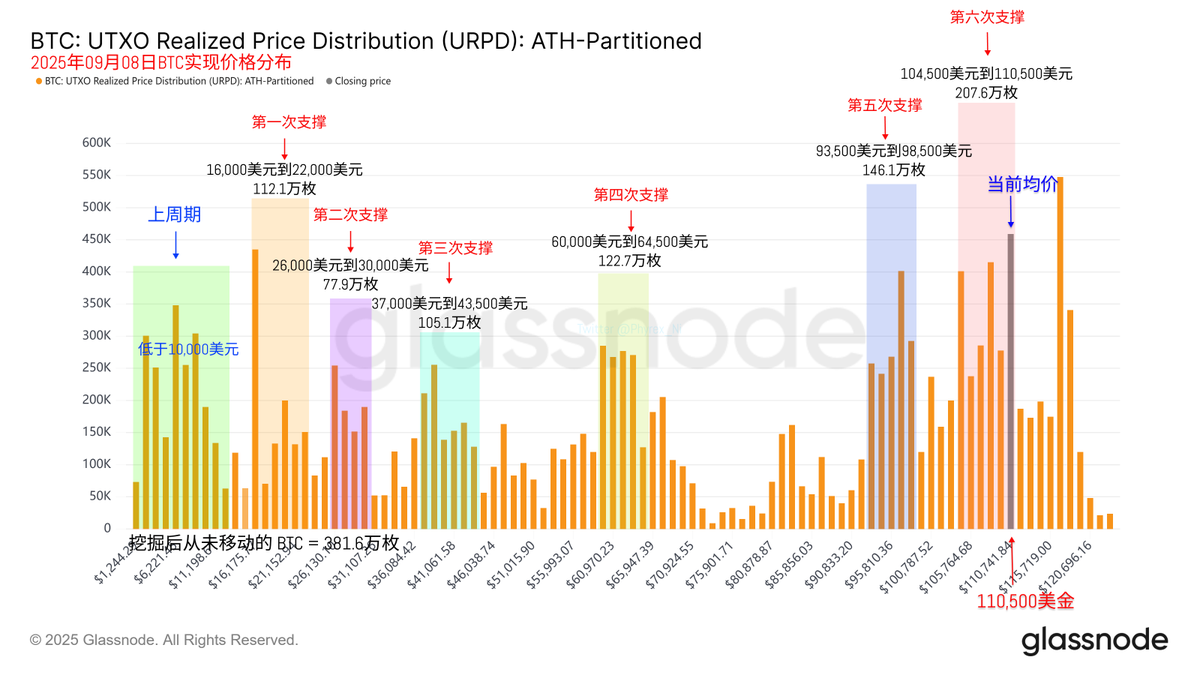

川普和鲍威尔第一次真正意义上的交手就在9月18日的议息会议了。另外在支撑面来看,我稍微做了些调整,最新的支撑区放在了 104,500 美元到 110,500 美元之间,这部分是当前存量最多的区间,超过200万枚 BTC 的堆积。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。