先说BTC,9.1号的文章提到过,当BTC突破下降趋势线后,不会V反,大概率是由下降转为震荡修复,之后再选择方向,本周走势已经验证了文章中的观点。

从目前的走势看,震荡区间可以看作是10.75-11.35w之间,幅度6%左右,震荡时间已经接近半个月,下周很可能出现方向性的变化,无论是哪边,顺势而上即可。如果直接突破11.35w,则BTC还出现了一个头肩底的造型,至少看到11.75w+。如果往下突破,那就继续等磨底吧。

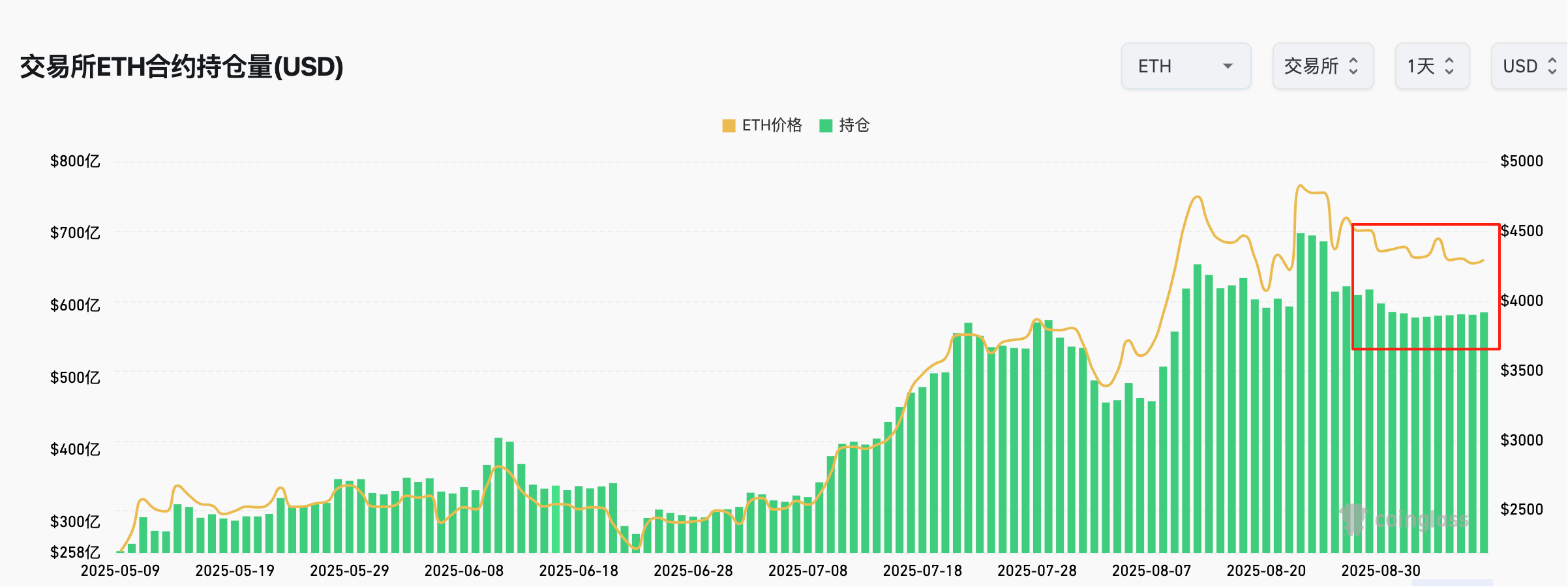

ETH震荡了近10天,振幅同样不足6%,等待方向性的选择。近期震荡行情,ETH的持仓量基本保持稳定,注意后续合约持仓量的变化,如果价格再次往上,一定要有合约持仓量上涨的配合,否则隐患极大。

总体而言,下周很可能是变盘时间点。

关注我,用最少的操作赚取最大化的趋势利润。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。