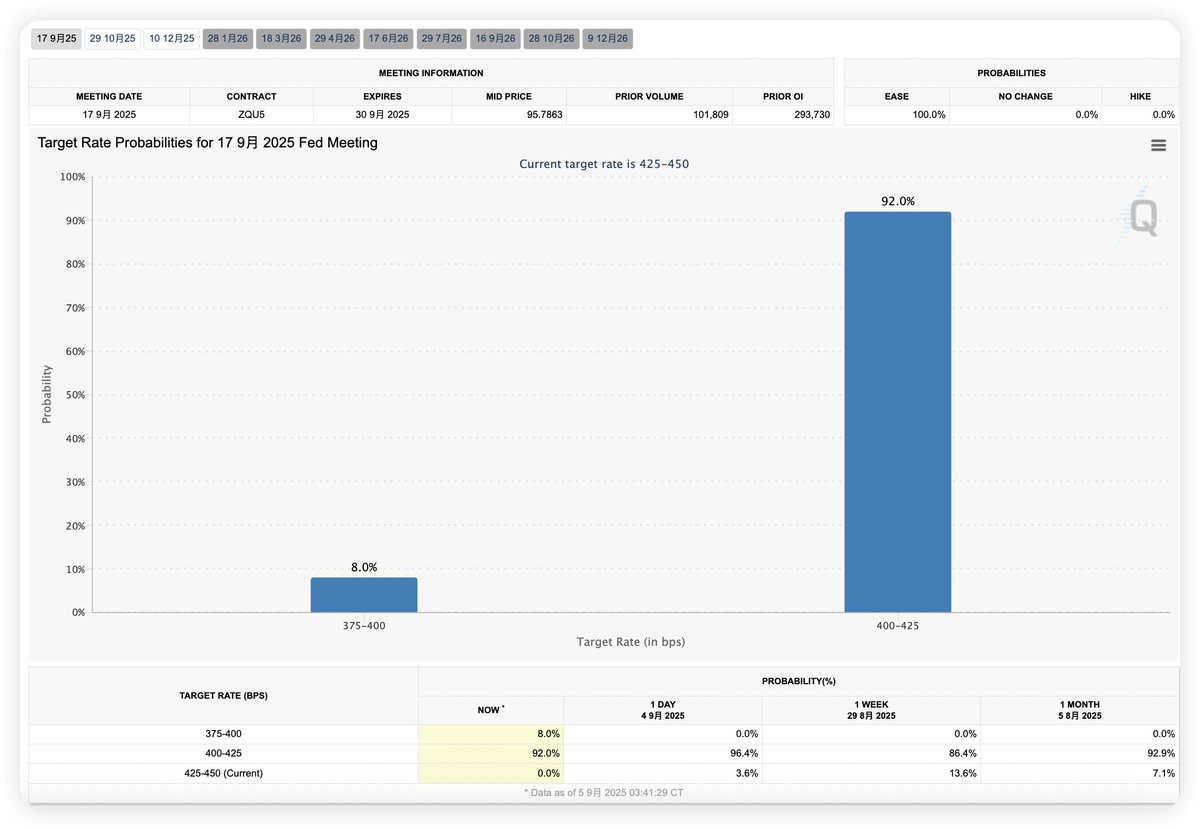

最近两天的作业难度直线上升,其实我觉得理解了降息和经济的联系难度就能降低很多,就像今天很多小伙伴问为什么九月降息的概率增加但风险市场下跌一样,重点就在于降息不能独立讲,一定要配合美国的经济状态,现在的美国经济就是下行的,在这种时候降息很有可能是美联储承认经济下行难以阻挡,只能通过降息来延缓。

我们举一个例子,拔过牙的小伙伴都知道要打麻药,避免过于疼痛,降息就像是打麻药,如果是在拔牙之前打,而且计量合理的时候,即便是拔牙你也不会觉得痛,如果稍微有些感觉的时候,大夫可以补一针麻药,确保你对疼痛无感,这种有效麻药就是防御性降息。

而如果开始大夫给你打错了麻药的计量,导致你已经很痛了,这时候给你补打麻药,你的疼痛也是在缓慢消失的,该痛还是会疼,而如果医生再次打错了计量,再次拔的时候你又疼了,就要继续给你补针,这种时候就是“亡羊补牢”式的降息,已经对经济产生影响了,再降息也很难短时间平息经济的问题。

说人话就是在经济强劲时的降息意味着风险市场还能安全前行,而在经济下行时的降息则代表衰退的痛苦已经发生,即使打麻药(降息),市场也会感受到更深层次的不安。即便是九月降息50个基点的预期都不行。

从杰克逊霍尔年会上开始就一直是这个反应,鲍威尔担心的就是经济上的下行,并且说如果经济下行了,确实可以考虑会降息,但这对于市场来说并不是好事,因为你已经疼了,再去止疼,疼仍然还会维持一段时间。所以市场才会比较纠结,一方面降息确实能缓解,另一方面是担心即便是降息也不能根除疼痛(经济下行)。

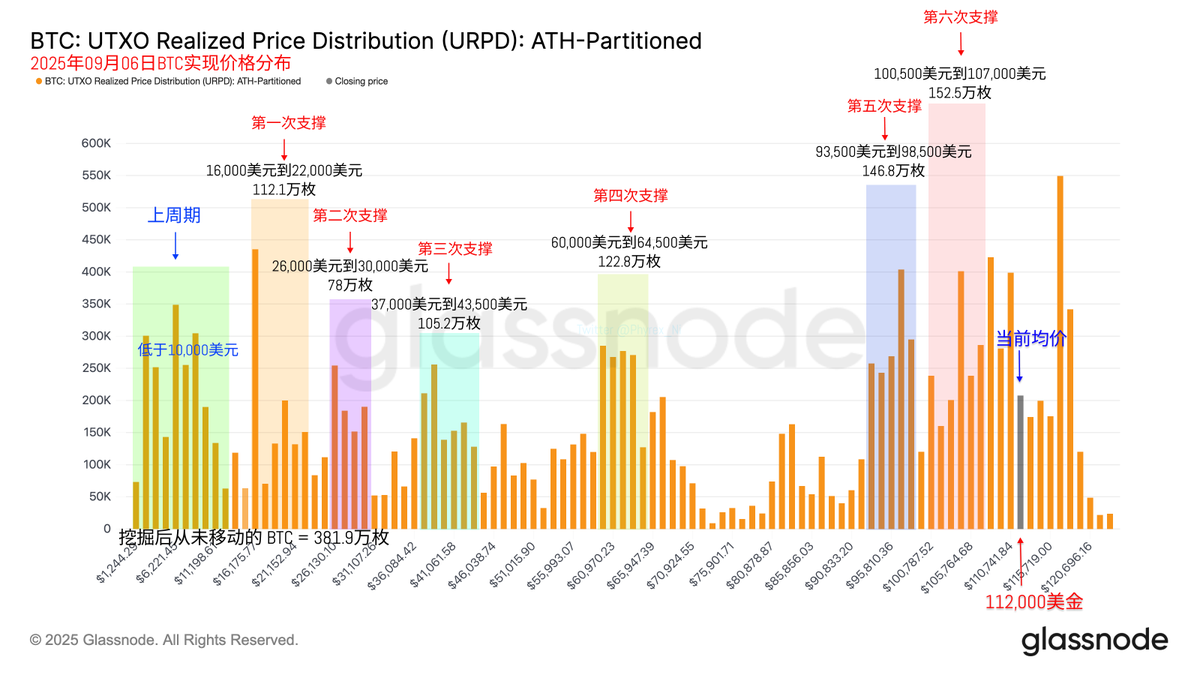

回到 Bitcoin 的数据来看,因为最近的价格一直维持小幅震荡,所以投资者都有些疲倦了,换手也在并不多,短期投资者的博弈为主,而较早期的投资者变化并不大,说明对于衰退影响更多的还是短期投资者,而长期投资者不论是成本因素还是心里因素并没有恐慌的迹象。

这周就这么混混沌沌的过去了,九月降息的概率确实很大,但市场的理解更加重要,如果市场认为目前的降息能有利于缓解经济下行的压力就会比较乐观,反之就会更加悲观,而其中最能带动情绪的应该就是川普了,毕竟现在的博弈就是川普和美联储之间的博弈。

现在来看美股闭盘后市场的情绪缓解了一些,这对于周末来说是件好事,如果市场过于激动,周末流动性狗一样低的时候波动就会更大,那就难受了,现在不要求别的,情绪别震荡太大,能好好过个周末就好。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。