ETH 在新的财库叙事下接近历史新高,而以 Stripe、Circle 为代表的传统金融势力纷纷宣布入局打造自己的 Layer1,EVM 生态近期可谓风光无两。

伴随以太坊生态的开发工具、流动性和用户网络逐渐成为行业默认,对 EVM 的兼容性已经从锦上添花变成了基础配置。正是在这样的背景下,曾以高性能订单簿链闻名的 Sei 选择了另一条路径。本文将回顾这一年中 Sei 从技术升级到生态扩张的关键节点并探讨它在多链格局重塑下的长期竞争力。

EVM 升级与基础设施对接

2024 年年中,Sei 启动了 V2 升级,正式将并行化 EVM 引入主网。在架构层面,它保留 Cosmos SDK 的底层模块化优势,同时开放与以太坊应用的无缝交互,既不割裂已有的网络共识和治理机制,又打通了与全球最大智能合约生态的桥梁。这一动作在当时的多链环境中颇为逆势——绝大多数公链在收缩研发节奏,Sei 却在性能与兼容性之间做了加法。

升级的配套举措之一是与 EVM 生态基础设施 MetaMask 建立钱包兼容合作,作为全球使用最广的钱包入口,MetaMask 的接入极大降低了用户迁移和资产管理的门槛,让原本停留在以太坊、Arbitrum 等链的用户,几乎零学习成本地进入 Sei。

紧随其后,VM 生态最头部的区块浏览器 Etherscan 正式上线 Sei,为 Sei 用户和开发者定制 Seiscan 区块浏览器。这不仅是开发者工具链完善的重要标志,也意味着链上数据透明度将与以太坊主网看齐,为调试、审计和分析提供了统一的标准接口。与其说这是被动的转向,不如说是 Sei 在多链格局重塑中的一次主动卡位——通过性能、钱包入口和数据可视化三条路径,同时拓宽了开发者覆盖面和流动性半径。

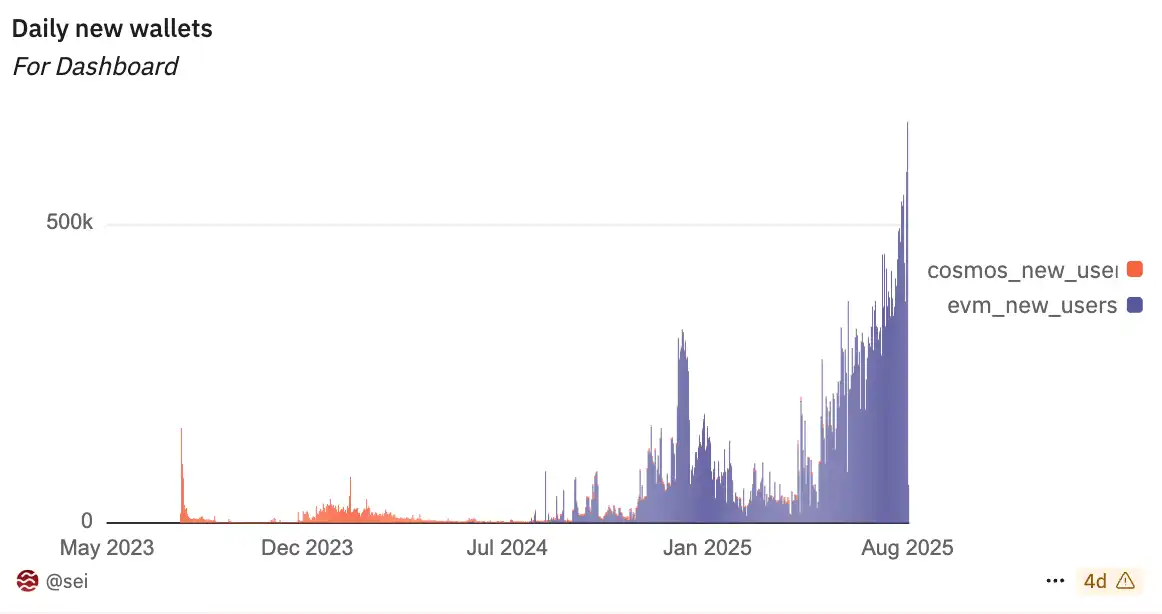

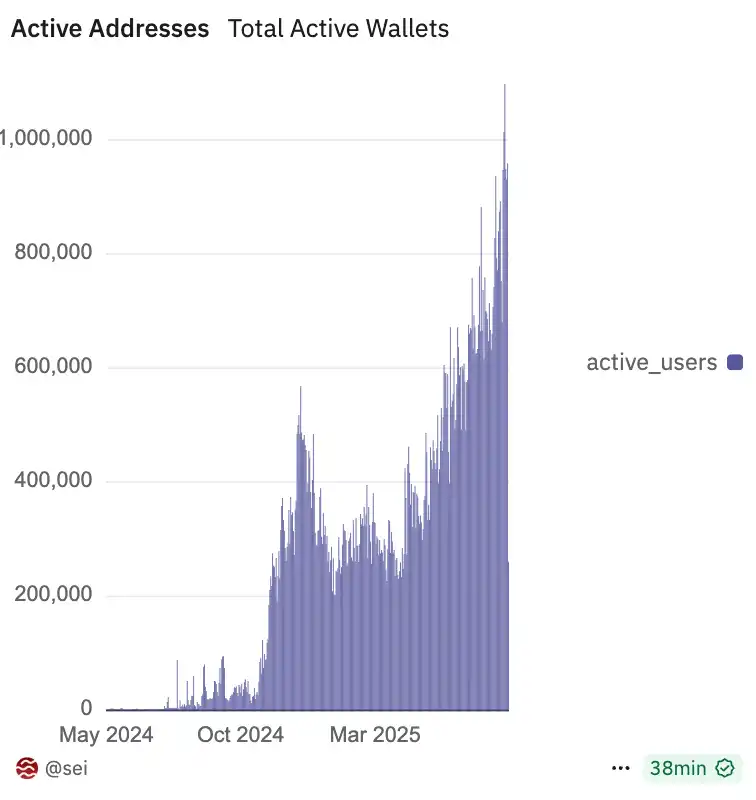

自 Sei V2 上线以来,Sei 生态迎来了爆发式增长,日活用户从 1,300 飙升至近 90 万,日交易量从 5.7 万笔增长到 165 万笔,TVL 从 1 亿美元攀升至近期峰值 6.87 亿美元。对于一个曾深扎在 Cosmos 世界、却主动向更大生态开放的公链而言,这不仅是一次增长曲线的重塑,更是一次战略叙事的翻篇。

缘何升级?

目前,Sei 曾经同时支持 EVM 与 CosmWasm 两套执行环境,试图以「双轨并行」的方式兼顾不同开发者群体的需求。这种策略在早期提供了灵活性,也让 Sei 成为少数能在 EVM 与基于 WasmVM 的应用之间实现原生互操作的网络。

然而,伴随网络规模扩大与生态结构的变化,这一架构的代价逐渐显现。用户必须同时管理两套地址,基础设施提供方需要为跨环境交互编写定制逻辑,而代码层面则承担了跨兼容性的长期维护负担。Sei Labs 联合创始人 Jay Jog 坦言,这样的复杂性不仅拖慢了迭代速度,也在无形中稀释了性能优势。

自 Sei v2 引入并行化 EVM 以来,EVM 的使用量在网络活动中迅速占据主导地位。Dune Analytics 的链上数据显示,新用户和新部署的应用大多选择了 EVM 环境,而 CosmWasm 在交易量和开发热度上的占比持续下滑。

对于习惯 Solidity 与以太坊工具链的开发者来说,EVM 不仅是熟悉的编程接口,更承载着成熟的调试工具、庞大的开源组件库以及跨链可移植性——这些都是 CosmWasm 短期内难以替代的优势。

从开发者心理到生态网络效应,EVM 形成了难以撼动的黏性。在这样的背景下,继续维持双架构不仅失去了原本的战略意义,还消耗了宝贵的研发与维护资源。

于是,SIP-3 提案登场,这份由 Sei Labs 推出的提案,直截了当地指向一个单一目标——让 Sei 转向 EVM-only 架构,全面弃用 CosmWasm 合约与原生 Cosmos 交易。

计划分阶段推进,先是在 EVM 端建立指针机制,让现有的 Cosmos 与 CosmWasm 资产能够被访问,然后冻结新的 CosmWasm 部署与入站 IBC 资产流入,最后停用旧合约的执行与非 EVM 地址的交易支持。

Sei 地址并不会彻底消失,它们仍将在验证者身份、质押与治理等协议内部环节中发挥作用,这些功能将通过 EVM 预编译(precompiles)实现,确保链上治理的延续性。

主动突围,Sei 如何切入 EVM?

升级措施的核心,在于技术执行与生态迁移的双重管理。Sei 团队明确将这一过程拆分为可控的阶段,以降低对现有生态的冲击。技术上,乐观并行化(Optimistic Parallelization)依旧是 Sei 的性能核心,它允许交易同时运行,仅在发现冲突时才回退到顺序执行模式。

Twin Turbo 共识机制则将区块终局时间压缩至约 360 毫秒,比以太坊快了数千倍,这为高频交互的 DeFi、游戏与订单簿应用提供了坚实的性能保障,意味着用户几乎感受不到延迟;SeiDB 的分层存储结构继续支撑高效的状态访问与历史数据查询。

在基础设施适配方面,MetaMask 已经成为 Sei 的重要用户入口,而 Etherscan 则补齐了链上数据浏览与开发者调试的短板。

这两项与跨链桥、数据索引、多签账户等设施的并行建设,使 Sei 能够在短时间内具备媲美甚至超越以太坊主网的开发体验。对于 CosmWasm 开发者,官方将提供迁移指南和技术支持,确保应用能够平滑过渡到 EVM 兼容形态。资产持有者则可以通过跨链桥或兑换将原生 Cosmos 资产转移至 EVM 钱包,减少流动性损耗。

Sei 的 EVM-only 时代,速度与兼容性的赌注

数据的变化验证了这场转型的成效。自 V2 升级以来,Sei 的日活钱包数从 1,300 增至近 90 万,日交易量从 5.7 万笔飙升至 165 万笔,TVL 从 1 亿美元攀升至 6.87 亿美元的峰值。

这种增长不仅反映在链上数据上,也逐渐传导到传统金融体系之中。2025 年 5 月,Canary Capital 提交了 Staked SEI ETF 的 S-1 文件,意味着 Sei 有望成为为数不多能被纳入合规资产组合的区块链之一。而设立于美国的 Sei Development Foundation,则在治理上保证了开发方向、政策对接与合规推进的稳健性。

8 月初,据 @EmberCN 监测,Sei 网络的每日活跃用户数在 8 月 2 日首次超过了 Solana 网络。Sei 近期上线原生 USDC、引入 Ondo 及 Backpack,大量的采用让 Sei 的日活数量在最近 3 个月里翻了一倍——从 38 万到现在的 75.2 万。此外,仅 10 天时间,原生 USDC 在 Sei 上的发行数量就来到了 1.08 亿美元,超过了 zkSync、Algorand、Polkadot 等链。

相关阅读:《当稳定币第一股碰上高性能 Layer1,Sei 为何脱颖而出?》

如此一来,Sei 有望成为一个真正面向传统资本市场的链上平台。在稳定币、RWA、DePIN 等下一代链上资产不断浮现的背景下,Sei 的「高吞吐 + 可监管 + 易接入」特性为其争取到了生态演化的主动权。

顺应了 EVM 生态在开发者群体中的统治性地位,也利用了 Sei 在并行执行与低延迟共识上的技术积累,试图在性能与生态之间找到新的平衡点。最终,这场升级的成败,不仅取决于技术实施的平稳与否,更取决于生态迁移的配合度——能否让现有用户与应用在最小摩擦中完成切换,并在新的 EVM-only 架构下继续扩张。

从更宏观的视角看,Sei 的转型映射出整个行业的一个趋势,在多链并存的格局下,EVM 依然是开发者心目中的默认标准。无论是出于技术熟悉度、工具链成熟度,还是生态网络效应,EVM 的吸引力都让许多新兴链选择主动兼容。而 Sei 在此基础上的创新,则是试图用更快的性能、更低的延迟,去填补以太坊及其 L2 在高频应用场景中的短板。对于希望在 Web3 世界中找到速度与兼容性最佳结合点的开发者和资本来说,这可能正是他们期待的答案。

随着 Giga 架构的规划逐步推进,Sei 希望将性能再提升一个量级,并在金融、AI、游戏和社交等高频场景中持续扩展应用边界。在多链格局的重新洗牌中,速度、流动性与生态广度或将决定一条公链的未来。

Sei 的选择,是把自己放在行业最具竞争的中心地带——那里机会巨大,但留给失败者的容错空间极小。它的下一道增长曲线,取决于能否在 EVM 世界的红海中,不只是生存,而是成为驱动下一波应用浪潮的重要基础设施。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。