财报亮点:

· DDC 实现全面盈利,录得历史最高的毛利率与净利润

· 启动比特币财库战略,截至 2025 年 8 月 31 日累计持有 1,008 枚 BTC,对应 1,798% 的 BTC 收益率

DDC Enterprise Limited(纳斯达克代码:DDC,下称“DDC”或“公司”),这是一家以亚洲消费者为核心、处于企业级比特币收购与财库管理前沿的公司,今日其公布了截至 2025 年 6 月 30 日的六个月未经审计财务业绩。

管理层评论

“2025 年上半年对 DDC 来说是具有转折意义的半年。”DDC 创始人、董事长兼首席执行官 Norma Chu 表示,“DDC 最初是一家以内容驱动的亚洲美食平台,如今已成长为一组深受喜爱的即食消费品牌组合。在 2025 年前六个月,DDC 实现了盈利,并录得创纪录的 33.4% 毛利率和 520 万美元净利润。我们的核心经营业务处于历史最强状态,并预计在下半年继续保持增长势头。”

Norma Chu 继续表示:“此外,我们坚定地进入了比特币财库战略领域。今年 5 月底,我们完成了首次 BTC 购买,并制定了负责任的结构化积累计划。从那时起,我们快速扩张,与顶级机构投资者完成了规模高达 5.28 亿美元的历史性融资,并完成了九次 BTC 购入。截至 8 月底,我们的财库持仓已达到 1,008 枚 BTC,自首次购买以来的 BTC 收益率达到 1,798%。”

Chu 最后强调:“DDC 在比特币财库上的竞争优势,得益于我们能够深入触达中国庞大而尚未被充分开发的投资者群体,以及强劲盈利的核心业务,这为我们进入资本市场提供了坚实保障。这一基础让我们能够持续积累比特币并不断投入增长。我们的目标非常明确:引领这一新兴赛道,在 2025 年底前持有 1 万枚 BTC,并在三年内跻身全球前三大财库公司之列。”

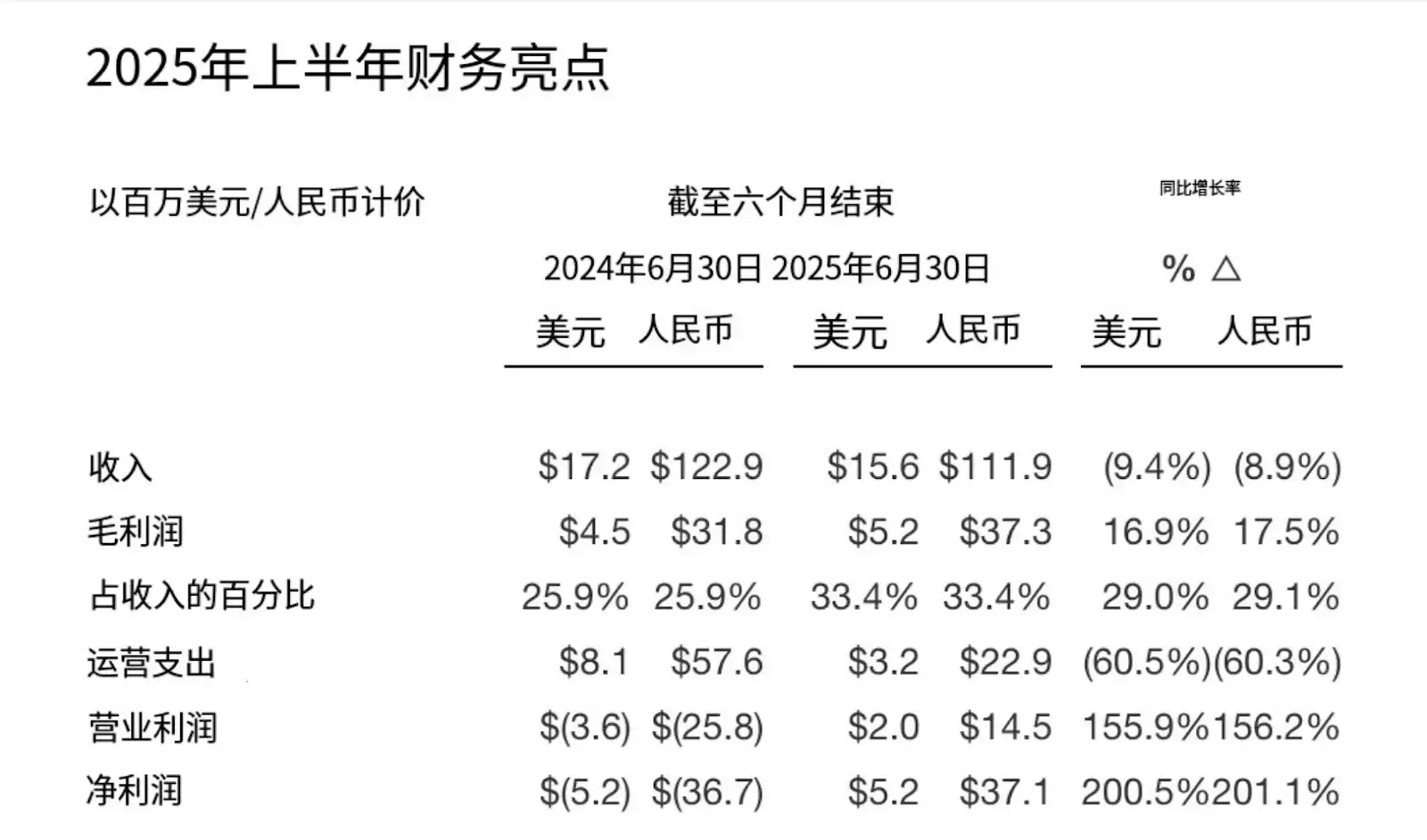

2025 年上半年财务摘要

除特别说明外,以下所有数据均与 2024 年上半年对比:

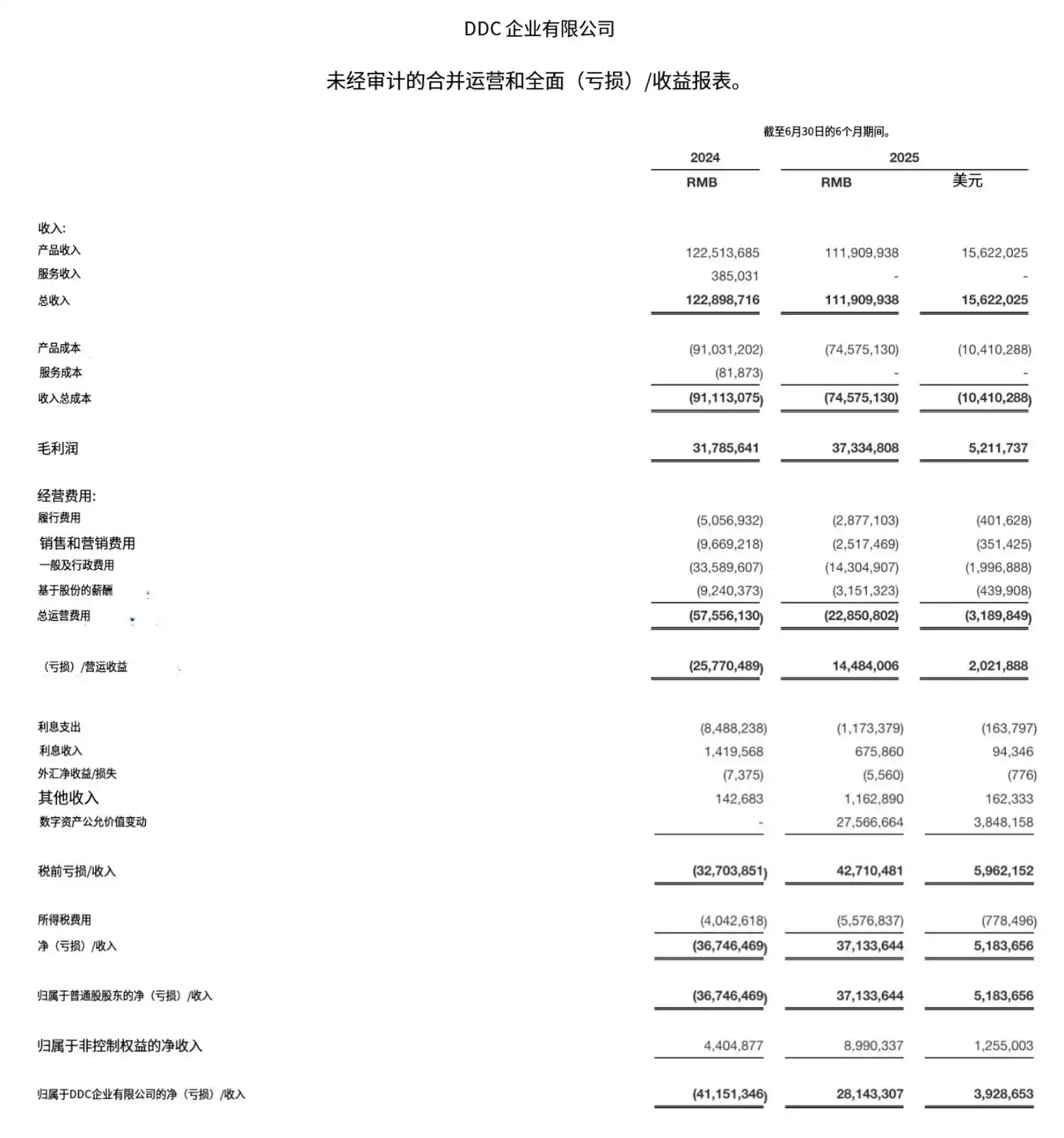

总收入为 1,560 万美元,同比下降 9.4%,主要因公司战略性退出亏损的美国业务。中国本土业务收入同比增长 7.5%,主要受中国销售量上升带动。

毛利为 520 万美元,同比提升 16.9%,得益于严格的供应链优化以及中国市场通缩带来的原材料成本下降。

营业支出为 320 万美元,同比下降 60.5%,主要由于退出美国亏损业务及在整体业务中实施严格的成本管控。

净利润为 520 万美元,而去年同期为净亏损 520 万美元。净利改善受前述因素及 380 万美元数字资产公允价值未实现收益共同推动。

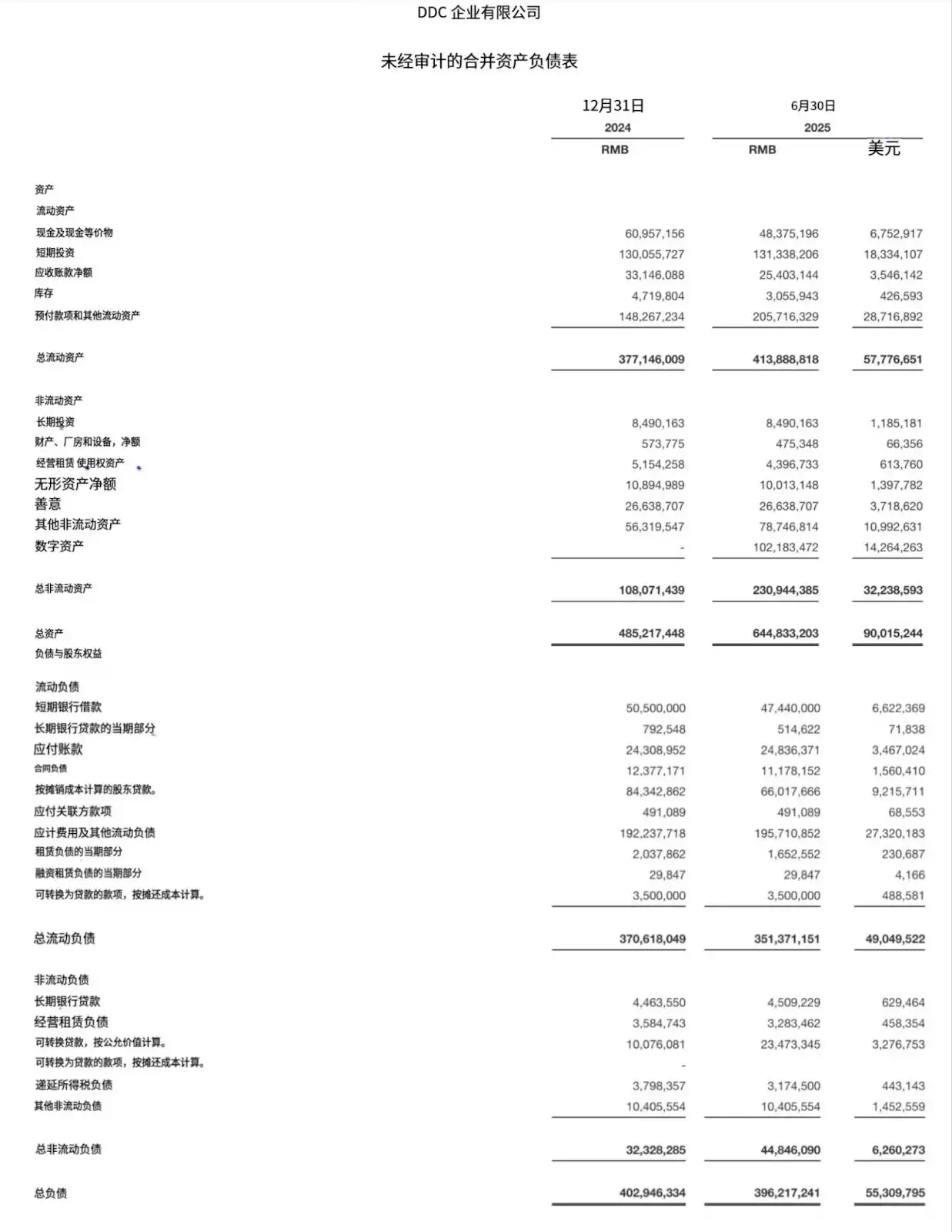

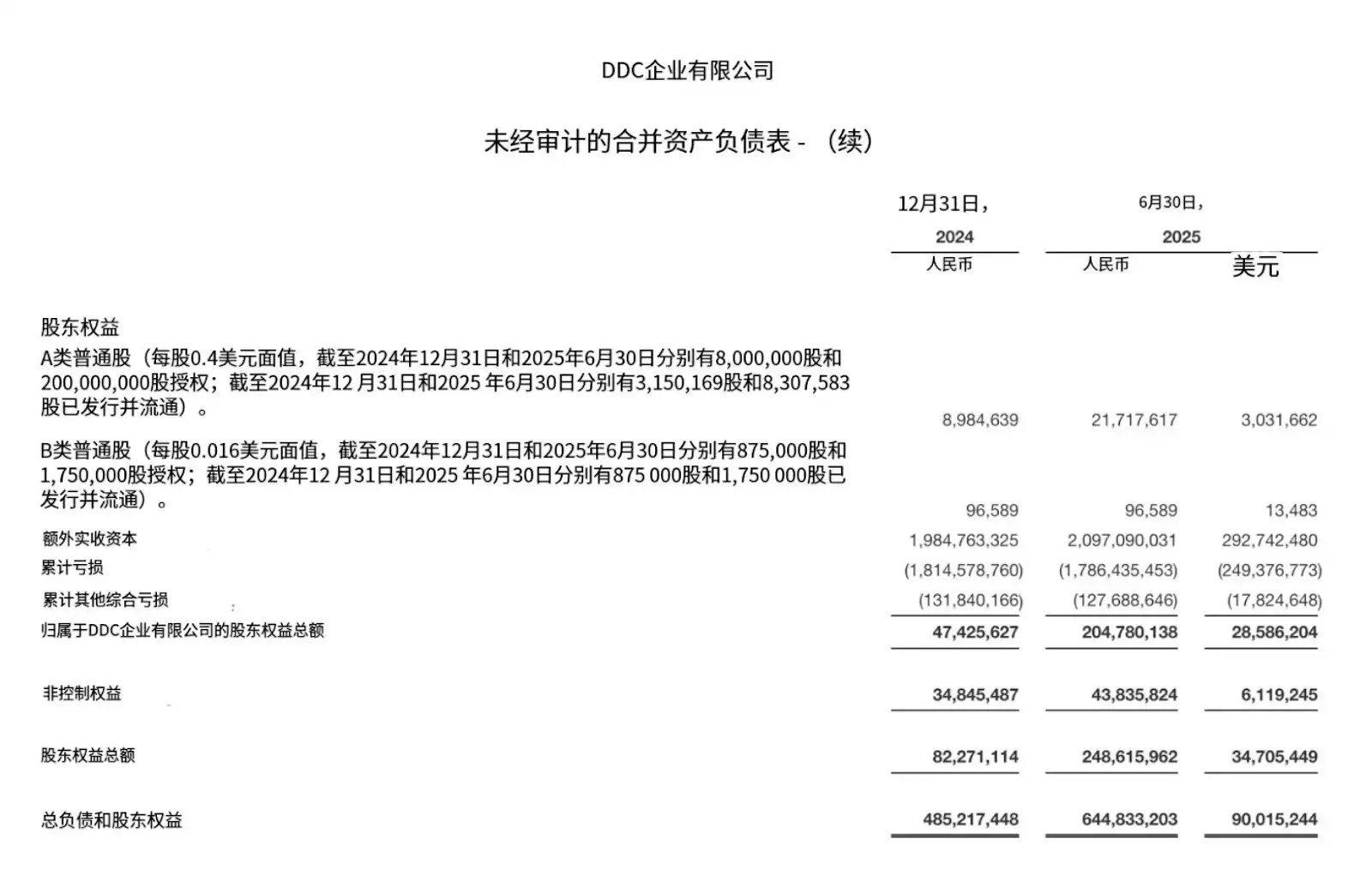

截至 2025 年 6 月 30 日,现金及现金等价物与短期投资总额为 2,510 万美元。

2025 年上半年比特币业务摘要

BTC 收益率指标(KPI): 2025 年上半年实现 367% 的 BTC 收益率,自首次购入以来累计达到 1,798%(截至 2025 年 8 月 31 日)。

数字资产: 截至 2025 年 6 月 30 日,公司持有约 138 枚 BTC。在截至 2025 年 6 月 30 日的六个月内,公司录得数字资产公允价值未实现收益 380 万美元。

2025 年上半年资本市场摘要

为比特币财库战略完成总额 5.28 亿美元的战略融资:

获得 2,600 万美元战略性 PIPE 投资,来自顶级比特币及数字资产投资者,并包含未偿债务的转换,以进一步强化资产负债表。

与 Anson Funds 签署可转换债券,首期发行 2,500 万美元(后续可再提款额度高达 2.75 亿美元)。

获得 Anson Funds 额外 200 万美元的私募投资,以及 2 亿美元的股权信用额度。

向美国证券交易委员会(SEC)提交了 5 亿美元的 F-3 表格通用注册声明。

截至 2025 年 9 月 4 日,DDC 已动用其 5.28 亿美元战略融资中的 5,300 万美元用于购买比特币。与 Anson Funds 的 2.75 亿美元可转债额度和 2 亿美元股权信用额度仍未动用。此外,截至同日,公司尚未使用 5 亿美元的通用注册额度。

财报电话会议

DDC 将于今日美国东部时间上午 8:00 举行财报电话会议。本次会议将解读截至 2025 年 6 月 30 日的半年业绩,并就公司近期战略发展提供业务更新。

日期:2025 年 9 月 4 日

时间:美国东部时间上午 8:00

参会链接:

直播网络研讨会:链接

电话参会注册:链接

希望通过电话参会的人员需使用上述电话参会注册链接进行注册。完成注册后,参会者将收到包含拨入号码、会议代码及个人 PIN 的邮件。为确保会议准时开始,公司建议参会者提前约 5 分钟接入。

关于 DDC Enterprise Limited(纽约证券交易所代码:DDC)

DDC Enterprise Limited(NYSE: DDC)正引领企业比特币财库的革命,同时保持其作为全球领先亚洲美食平台的根基。公司已将比特币战略性地定位为核心储备资产,并积极执行一项大胆且不断加速的积累战略。在持续拓展旗下餐饮品牌组合的同时,DDC 也成为了率先将比特币纳入财务架构的上市公司先锋。

关于前瞻性声明的提示

本公告中的部分陈述属于前瞻性声明。投资者可通过以下词语或短语识别此类前瞻性声明:“可能”、“将”、“预期”、“预计”、“目标”、“估计”、“打算”、“计划”、“相信”、“很可能”、“潜在”、“继续”或其他类似表述。前瞻性声明的示例包括涉及公司业务前景、比特币积累计划,以及公司在上述融资交易下的目标与未来活动的相关表述,包括交易完成、交割条件满足及募集资金用途等。

此类陈述存在不确定性和风险,包括但不限于公司在 Form 20-F、6-K 及其他向美国证券交易委员会提交的报告中“风险因素”及“管理层财务状况与经营成果讨论与分析”部分所披露的风险。此外,公司将在 Form 6-K 中提交上述交易相关的正式文件副本,投资者可在 www.sec.gov 查询。

前瞻性声明本身就包含超出公司可预测或控制范围的风险、不确定性及其他因素。尽管公司认为这些前瞻性声明所表达的预期是合理的,但无法保证其最终会实现。公司提醒投资者,实际结果可能与预期存在重大差异,并鼓励投资者查阅公司在 SEC 提交的其他文件,以了解可能影响未来业绩的其他因素。

除法律要求外,公司没有义务就未来事件或环境变化公开更新或修订任何前瞻性声明。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。