近期,波场(TRON)创始人、币圈知名人物孙宇晨(Justin Sun)因其团队对WFLI(Wrapped FLi token)的地址分散操作在X平台引发热议。2025年9月5日上午7:34,孙宇晨通过X发布声明,称其团队仅进行了低金额的交易所充值测试和地址分散操作,未涉及买卖,不会对市场产生影响。然而,该声明不仅未能平息社区质疑,反而因缺乏透明度及火币(HTX)提币延迟等问题引发更大争议。本文基于孙宇晨的声明、X平台相关帖子及网络信息,梳理事件背景、声明内容、社区反应(新增质疑者观点)及潜在影响,力求客观呈现事件全貌。

事件背景

WFLI作为一种新兴加密资产,近期因其在MEXC、火币(HTX)等交易所的预售和上市计划备受关注。据网络信息,WFLI是Wrapped FLi token,旨在通过区块链技术实现资产代币化,其预售和永续合约交易吸引了大量投机者。2025年8月,WFLI在币安、Bybit、火币等交易所上线永续合约,价格从0.55美元跌至0.22美元,波动剧烈,市场情绪高涨。

孙宇晨作为波场创始人及HTX(前身为火币)的实际控制人(据彭博社,孙宇晨2022年收购火币),其操作常引发市场关注。此前,他因USDD稳定币项目(被指模仿失败的TerraUSD)及TRX市场操纵指控(SEC于2023年起诉,后于2025年2月撤销)饱受争议。WFLI事件中,孙宇晨的声明试图澄清其团队操作的性质,但社区对其透明度和火币提币延迟问题提出强烈质疑。

孙宇晨的声明内容

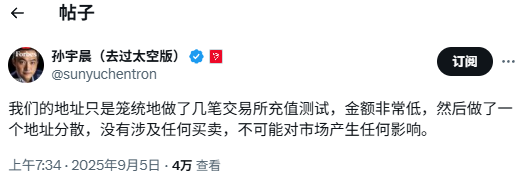

2025年9月5日上午7:34,孙宇晨在X平台发布声明,回应外界对其团队WFLI操作的猜测:

“我们的地址只是笼统地做了几笔交易所充值测试,金额非常低,然后做了一个地址分散,没有涉及任何买卖,不可能对市场产生任何影响。”

声明要点:

- 低金额充值测试:孙宇晨称其团队仅进行了小额充值测试,金额微不足道,可能是验证交易所功能或资产转移流程。

- 地址分散操作:团队将WFLI资产分散到多个地址,声称是为技术测试或安全管理,未涉及买卖。

- 无市场影响:强调操作不会影响WFLI价格或流动性,试图消除市场对其“操纵”价格的疑虑。

此外,孙宇晨在其他X帖子中对WFLI表达乐观态度,称其可能取代币安的FDUSD稳定币地位(@Michael_Liu93引述)。他还曾警告XCN项目存在市场操纵风险,呼吁交易所加强监控(2025年1月24日,ChainCatcher),间接表明对市场公平性的关注。

X平台社区反应

孙宇晨的声明在X平台引发激烈讨论,社区观点两极分化,支持者与质疑者针锋相对。以下是基于X帖子及用户提供信息整理的反应,新增质疑者观点:

支持者观点

- 技术操作合理:部分用户认为充值测试和地址分散是新币上市的常规操作。@Michael_Liu93表示:“WFLI后续博弈空间不小,最低垂果实是取代FDUSD地位。”他认为孙宇晨的参与可能为WFLI带来流动性支持,吸引更多交易所关注。

- IDO潜力:@butaidongjiaoyi分析WFLI第二轮IDO(首次代币发行)价格为0.05美元,初期解锁20%,总市值250亿,投资者可能快速回本,暗示孙宇晨的操作是为项目预热,符合市场逻辑。

质疑者观点

- 透明度不足:@Vida_BWE质疑声明缺乏具体数据支持:“你自己敢把初始持币地址公开吗?低金额测试到底是多少?没数据谁信?”他指出,WFLI价格0.42美元(对应420亿美元FDV)远超ENA(110亿美元FDV),公募属性难以吸引机构拉盘,怀疑孙宇晨隐瞒操作规模。

- 提币延迟问题:@CryptoWatcher88抱怨火币提币效率:“我火币提的WFLI半个小时了怎么不到账?交易所这么大,系统却这么慢,声明里也不解释提币问题,是不是故意拖延?”这一观点在X平台被广泛转发,反映用户对火币运营的不满。

- 操纵嫌疑:@0xcryptowizard分析WFLI赛道,承认其兼具中英文社区优势,但质疑价格过高,社区活跃度不如Solana/Base的Meme币。他表示:“地址分散听起来像洗币,孙宇晨敢不敢公开链上交易记录?不公开就是心虚。”这一观点呼应了社区对透明度的普遍关切。

- 历史信任问题:@BlockchainSkeptic提到孙宇晨过往争议:“USDD、TRX都搞过资金混淆(commingling funds),SEC都起诉过,现在WFLI又来这套?公开初始地址和交易哈希,不然谁敢投?”他引用Protos报道(),指出孙宇晨控制的USDD储备地址(TZ1SsapyhKNWaVLca6P2qgVzkHTdk6nkXa)同时出现在HTX储备中,质疑其资金管理透明度。

市场情绪与动态

- 价格波动:WFLI合约上线后价格从0.55美元跌至0.22美元,反映投机情绪高涨。火币于8月27日上线WFLI/USDT永续合约,提供1-5倍杠杆和1万美元奖池(Bitget),但提币延迟问题加剧用户不满。

- 社区分化:WFLI被视为“大众车”(散户主导),机构参与度低。@Domingo_gou表示:“WFLI短期抛压风险大,孙宇晨的声明更像危机公关,难掩操作不透明的嫌疑。”

事件潜在影响

孙宇晨的WFLI声明及其在X平台的发酵对市场和社区产生了多重影响:

- 市场信任与透明度:

- 孙宇晨的声明试图消除操纵疑虑,但未公开初始持币地址、测试金额或链上交易记录,难以平息质疑。新增的社区呼声(如“你自己敢把初始持币地址公开吗?”)凸显透明度问题。加密市场对透明度敏感,类似TerraUSD崩盘(Forbes,2022)的教训让投资者对孙宇晨的操作保持警惕。

- 火币提币延迟问题(“WFLI半个小时不到账”)进一步削弱用户信任,可能导致散户流失,影响WFLI流动性。

- WFLI价格与流动性:

- WFLI的高估值(0.42美元对应420亿美元FDV)被社区质疑,价格波动风险高。火币、MEXC等交易所的预售和杠杆交易吸引投机者,但提币延迟可能加剧抛压。

- 孙宇晨的乐观言论(如取代FDUSD)短期或提振信心,但长期需更多机构支持以稳定价格。

- 孙宇晨的行业影响力:

- 孙宇晨作为币圈KOL,其言论对市场情绪影响显著。然而,过往争议(如USDD资金混淆、SEC诉讼)使其公信力受损。此次WFLI事件可能进一步放大对其信任的讨论。

- 他与James Wynn的X Space讨论(涉及高杠杆风险,Blockchain.news)表明其试图通过公开对话修复形象,但质疑者认为这可能是转移注意力。

- 监管与合规关注:

- 孙宇晨曾向SEC和DOJ举报XCN操纵行为(ChainCatcher,2025),显示其对合规的关注。但WFLI操作的不透明性可能引发监管机构注意,尤其在香港对虚拟资产监管趋严的背景下(参考香港RWA政策)。

- 火币的提币延迟问题可能触发用户投诉,增加平台合规压力。

从第一性原理看,WFLI事件反映了新币上市的典型挑战:项目方需通过测试和推广吸引关注,但任何操作都可能被放大为“操纵”嫌疑。孙宇晨的声明因缺乏链上数据支持,难以消除社区疑虑,尤其在以下方面:

- 透明度:公开初始持币地址、测试金额及交易哈希是重建信任的关键。社区质疑“你敢把初始持币地址公开吗?”直指问题核心。

- 交易所运营:火币提币延迟(“半个小时不到账”)反映平台系统效率问题,可能与高交易量或技术瓶颈有关,需尽快优化。

- 市场定位:WFLI需平衡散户与机构参与,增强社区活跃度以对抗Meme币竞争(如Solana/Base生态)。

未来,WFLI的发展取决于:

- 透明度提升:孙宇晨需公开链上数据,回应社区对初始地址和交易记录的质疑。

- 交易所支持:火币需解决提币延迟问题,优化用户体验;更多交易所(如币安、Bybit)上线WFLI可提升流动性。

- 监管合规:香港的稳定币和RWA政策()为WFLI提供合规机会,但二级市场开放需时间,孙宇晨需确保操作符合监管要求。

- 社区建设:WFLI的中英文社区是优势,但需通过空投、治理等机制提升活跃度,避免“大众车”抛压。

结论

孙宇晨关于WFLI地址分散的声明试图澄清操作性质,但因未公开初始持币地址、测试金额及链上记录,引发社区强烈质疑。新增的质疑声音(如“你敢把初始持币地址公开吗?”“火币提WFLI半个小时不到账”)凸显透明度和交易所效率问题。WFLI作为新兴代币,面临价格波动、流动性不足和信任危机,孙宇晨的行业影响力使其言论备受关注,但也需更透明的操作以回应社区关切。投资者应关注链上数据(可通过CoinGecko、Dune Analytics验证)、交易所公告及监管动态,警惕高杠杆交易风险。WFLI的未来表现需更多机构支持和社区建设,值得持续观察。

免责声明:本文基于X平台帖子、用户提供信息及网络资料整理,仅供参考,不构成投资建议。加密市场波动性高,投资需谨慎,建议查阅官方公告和链上数据以获取准确信息。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。