原文作者:Rui

原文编译:Saoirse,Foresight News

Hyperliquid 已点燃永续合约去中心化交易所(Perp DEX)的狂热阶段,占据了中心化交易所(CEX)8.62% 的流量。但我们必须正视该领域存在的一些隐性问题,并构建一套框架,确保向去中心化方向的转型真正不可逆。

TL;DR

- 流动性假象:成交量高≠流动性好。买卖价差、滑点和吃单手续费会导致价格影响与执行损耗,但相关指标可能因激励机制而被人为抬高。

- 隐性成本:订单簿模式需大量做市商补贴,自动做市商(AMM)的流动性提供者(LP)则难以规模化,二者均面临经济层面的挑战。

- 黑箱清算:需优先保障系统安全而非用户便利性,因此需要未平仓合约(OI)风险控制、多来源清算机制及可验证证明,但盘前交易场景下风险尤为突出。

- 交易排序牺牲:在优先服务散户还是高频交易(HFT)之间存在权衡,这本质是公平性与效率的选择。

- 低效保证金:需搭建动态高效的保证金体系,融入生息抵押品、借贷整合及对冲识别功能,以匹配中心化交易所的效率。

流动性假象

尽管交易量是常规衡量指标,但当代币激励人为催生虚假交易时,这一指标会产生误导性。即便交易量数据相同,散户交易也比「投机性交易」更具价值,因其更稳定、可持续。

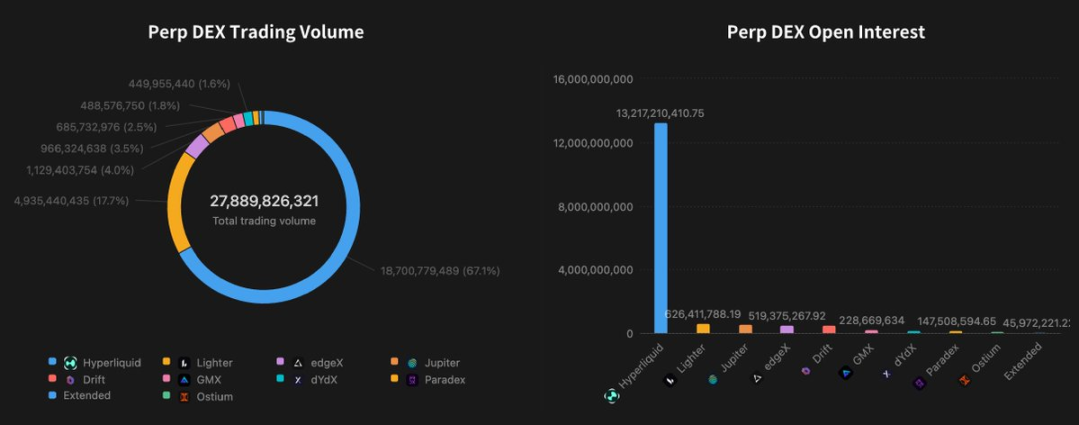

Perp DEX 交易量与未平仓合约

未平仓合约与交易量的比值(OI-to-Volume)可反映真实交易活跃度。无 API 的中心化交易所通常呈现 1:2 或 1:3 的比值。Hyperliquid 的小时费率与取消订单优先级机制使其比值达到 1:1 的较高水平,而其他尚未发行代币的去中心化交易所,因代币激励促使虚假交易以抬高交易量,通常比值更低。此外,手续费收入对平台可持续性至关重要,既能提供激励,也能直接构成安全缓冲。

流动性是衡量平台可用性的终极标准。窄幅买卖价差可降低进出市成本,低滑点能确保大额订单定价稳定,充足的市场深度则可防范交易过程中的价格波动。从对比数据来看,Hyperliquid 在处理 2000 万美元以上大额持仓时表现突出;而 edgeX 对散户交易者更友好,在 1 个基点(bps)内流动性最深、多数交易规模下滑点最低且价差最窄。

订单簿比较

隐性成本

流动性是典型的「冷启动难题」:交易者不愿进入订单稀少的平台,做市商也会回避流动性不足的平台。

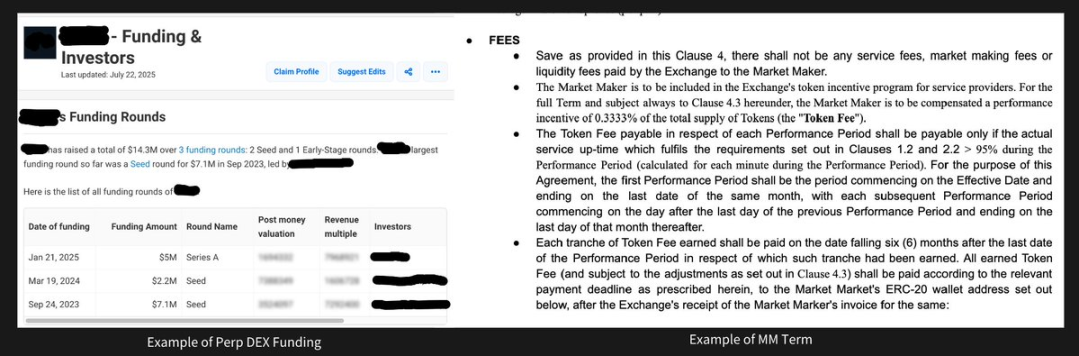

订单簿模式资本效率更高,但需要大量前期资金投入做市。做市商的要求往往较为苛刻:以某永续合约团队为例,即便收取 0.035% 的手续费,在向做市商支付 0.01%、返还用户 0.01% 后,实际仅留存 0.015%。若该团队每月运营成本为 50 万美元,那么每日吃单交易量需至少达到 1.111 亿美元才能实现盈亏平衡。这一简单计算也解释了为何多数新入局者会失败。

Perp DEX 资金和做市商条款示例

自动做市商(AMM)模式通过流动性提供者(LP)池降低了资本门槛,且能借助激励机制实现「冷启动」(GMX 和 Ostium 便是典型案例)。但该模式「庄家优势」过大,无法支撑大额交易。而 Hyperliquid 通过从 LP 池模式转向订单簿模式,探索出了一条更可持续的发展路径。

黑箱清算

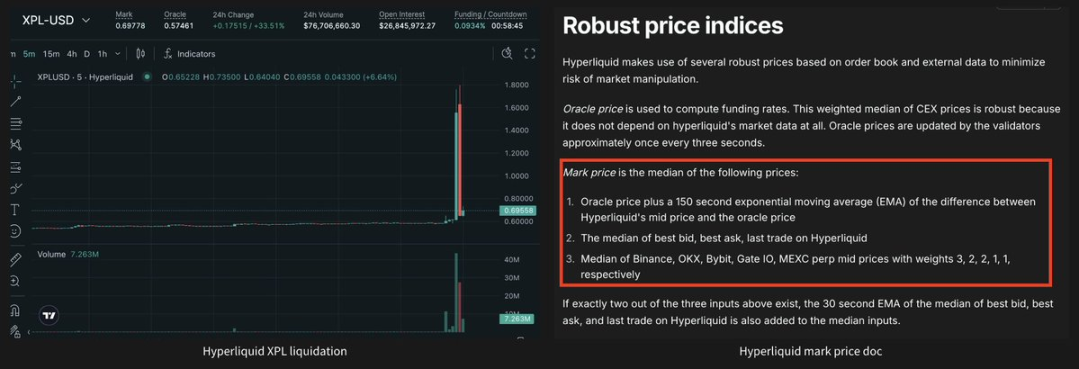

单一内部清算来源易受操纵。以 2025 年 8 月 26 日 Hyperliquid 的 XPL 事件为例:某大户在几分钟内将 XPL 价格从 0.6 美元推高至 1.8 美元,而其他平台价格保持稳定(中心化交易所盘前交易设有熔断机制,可限制异常价格波动),最终导致 85% 的空头头寸被清算,损失达 2500 万美元。尽管多数情况下,多来源标记定价更优(可提高操纵成本),且 Hyperliquid 已对多数资产采用该机制,但当平台追求「先发优势」却缺乏可靠外部定价来源时,盘前交易场景会面临独特挑战。

Hyperliquid 的 XPL 事件与价格指数

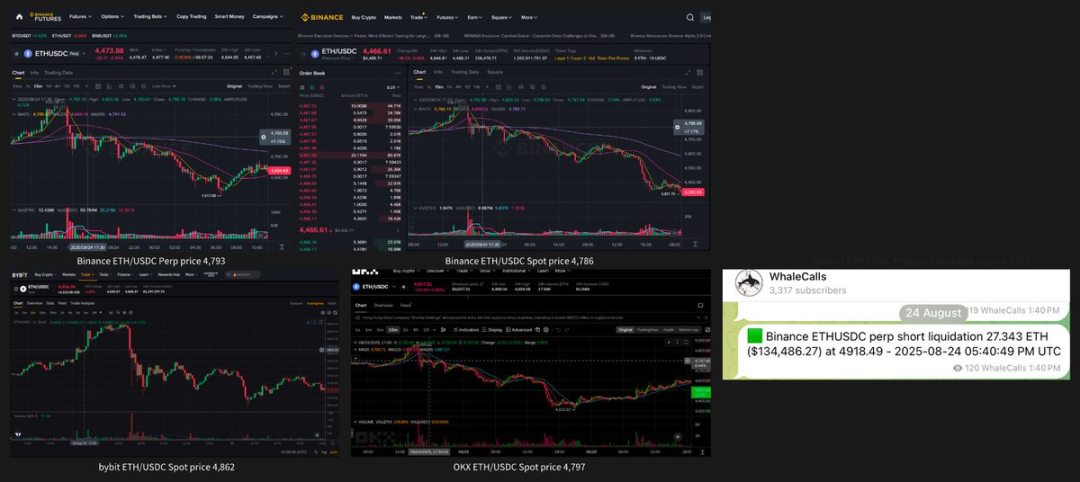

清算过程缺乏透明度与可验证性。币安声称采用「三个来源的中位数」定价,但在 2025 年 8 月 25 日,ETH/USDC 清算价格为 4918 美元,而当时可见的定价区间为 4786-4862 美元,结果难以解释。由于缺乏时间戳,中心化交易所的清算既不可预测,也无法验证。Hyperliquid 虽通过将节点预言机价格上链实现了部分改进,但内部匹配引擎与中心化交易所 API 这两个环节仍未经过验证。

币安强平示例

自由市场存在局限性。Hyperliquid 初期采用对交易者友好的模式,允许交易者自由开仓,且清算通过订单簿执行时仍保留维持保证金。但在「JELLY 事件」中,该平台被迫关闭市场,并按对自身有利的价格进行结算,开创了令人担忧的先例。尽管后续新增了孤立自动减仓(ADL)与动态未平仓合约(OI)上限机制,但 XPL 事件仍暴露了类似漏洞。

本质上,构建既公平又稳健的清算机制是一项极具挑战性的任务。Hyperliquid 在追求开放性与效率方面迈出了大胆一步,但这种「自由度」也可能滋生漏洞 —— 协同操纵者或可借此获得相对于小交易者的优势。增设波动率上限或许是更理想的改进方向。

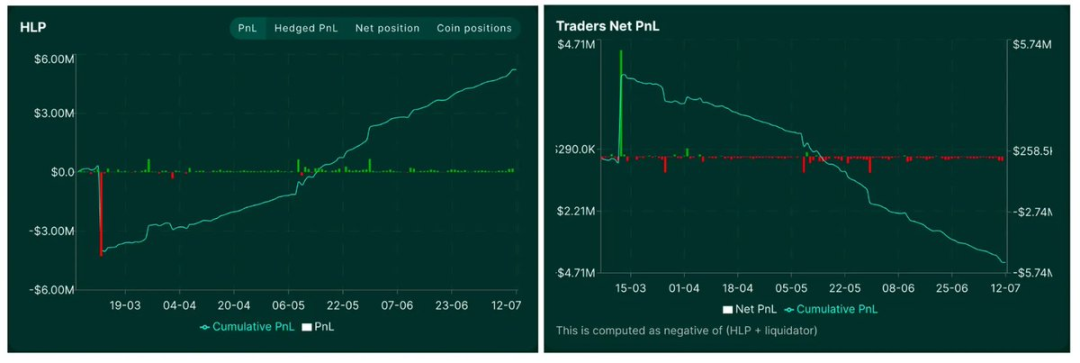

HLP 资金池仍然是盈利的,因为交易者在亏损。

交易排序牺牲

交易排序的核心权衡在于「公平性 / 可及性」与「效率 / 交易量」之间。Hyperliquid 选择优先保障公平性,通过设置「速度缓冲」(3 个区块的内存池缓冲 + 取消订单优先级),保护散户交易者与小型做市商免受复杂高频交易(HFT)的「收割」。这一机制营造了更具包容性的交易环境,让经验较少的参与者也能提供窄幅价差,无需担心逆向选择风险。但这种保护的代价是,平台整体流动性与交易量增长受限(相较于币安)—— 因为它阻碍了做市商之间自然的「优胜劣汰」竞争,而这种竞争恰恰是推动真实价格发现的关键。正如 Enzo 所提出的,「杠铃策略」或许能同时满足散户与高频交易这两类极端用户的需求。

低效保证金

中心化交易所的保证金灵活性更高,因为在用户提现前,这些保证金仅为显示数字,无需实际占用资金。去中心化交易所则面临更大挑战,无法简单通过降低保证金要求来提升灵活性。除常规交叉保证金体系外,可通过以下策略优化:

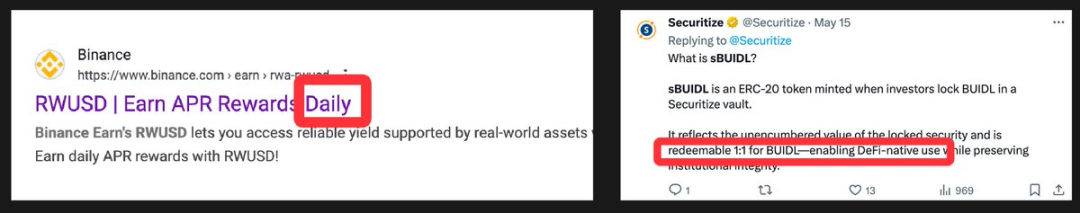

- 生息头寸:短期国债风险最低,但存在取舍。贝莱德的 BUIDL 产品需实名认证(KYC),而其他限制较宽松的同类产品则缺乏流动性。链上月度收益重置机制会带来操作复杂性,而币安推出的日年化收益产品 RWUSD 则体现了中心化交易所的优势。生息稳定币虽有潜力,但通常缺乏足够流动性支撑永续合约交易。

- 通过借贷分离抵押品与保证金:将原生资产作为抵押品借入 USDC 充当保证金,可提升灵活性。例如,用 1 枚 BTC 作为抵押品,借入 USDC 用于交易保证金。Drift 的模式允许根据贷款价值比(LTV),将 SOL 等资产作为抵押品,所有交易均以 USDC 结算。但借贷与永续合约的风险体系存在显著差异:借贷场景中,清算失败会产生坏账(因无自动减仓机制);此外,愿意为保险注资的参与者极少,导致坏账最终由贷方承担。中心化交易所可设置风险限额,并以利润覆盖偶尔的损失,但 DeFi 领域难以实现这一点,因为多数清算收益归清算者所有,协议本身缺乏风险缓冲资金。

- 保证金体系中的对冲识别:智能保证金体系应能识别「自然对冲」头寸,以降低保证金要求。例如,当用 USDE 作为抵押品,同时做空以太坊(ETH)时,这两个头寸呈负相关(ETH 抵押品 + ETH 空头),意味着只有当永续合约脱钩幅度超过 90% 时,才可能产生坏账。

结论

显然,未来的 Perp DEX 需具备资本高效的保证金体系、有竞争力的价差、极低的滑点,以及经过策略性部署的激励机制,才能构建可持续的发展路径。

但该领域仍存在关键权衡,最终取决于协议的市场理念:平台如何处理无限制的未平仓合约、如何接纳大型交易者、如何平衡散户与高频交易的执行偏好、如何协调交易者保护与系统安全 —— 这些细微差异将极大影响平台的用户群体与使用场景。

「去中心化」在该领域常被误解,多数 Perp DEX 只是将中心化风险从「托管环节」转移到了更隐蔽的「执行」与「清算」环节。优质的协议应从核心价值出发进行设计,并始终维护稳健的市场完整性。目前,借助 LayerZero 与 Monad 等先进基础设施,新的设计方案不断涌现,预示着新一代 Perp DEX 即将到来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。