In the midst of strategizing, we decide victories from thousands of miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

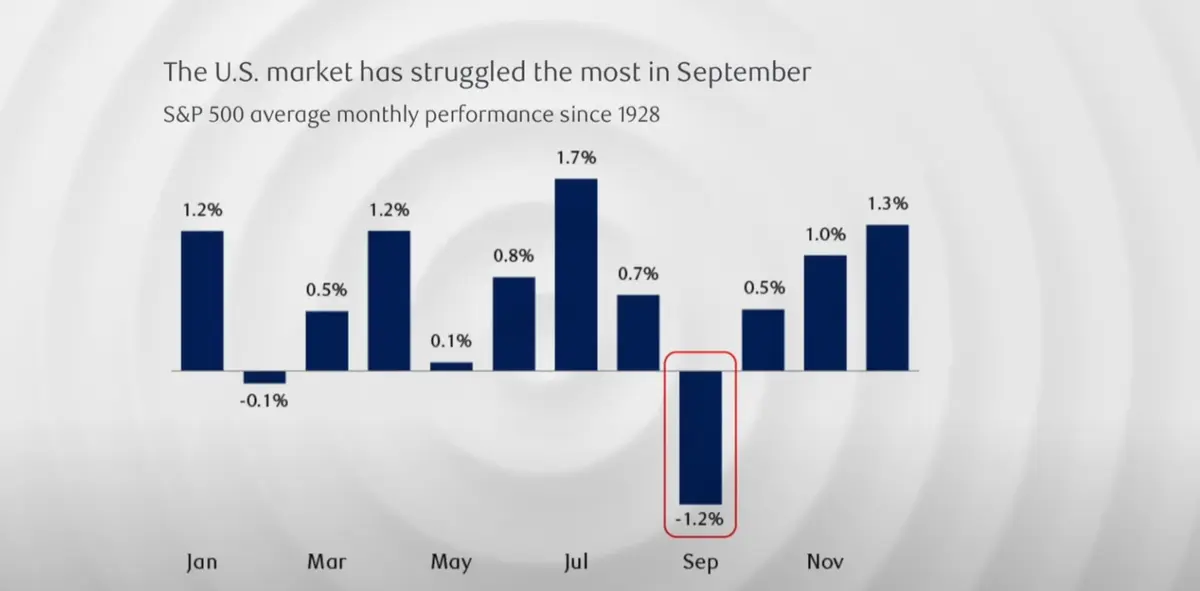

Yesterday, I received some private messages from fans asking for my views on the Federal Reserve's interest rate cuts in September and my judgment on the overall market direction for September. In fact, since the end of August, I have already started planning my trading strategy for the entire period from September to December. The reason is simple: starting in September, the volatility of the indices will definitely be larger, which means there will be significant market movements. We not only need to observe the situation in the cryptocurrency market but also look at the entire financial market. Historically, since 1928, almost all financial markets have had September as the month with the lowest average returns, with an average return of negative 1.2%. This applies to U.S. stocks, UK stocks, Hong Kong stocks, and the cryptocurrency market as well. Therefore, this phenomenon is commonly referred to as the "September Curse."

Why does this phenomenon occur? Today, let's discuss the issue of the "September Curse," which can be attributed to three main reasons.

The first reason is that major institutions on Wall Street typically have a vacation period from June to August. When September arrives, they just start to get back to work, and the first thing these institutions and investment banks do is to focus on adjusting their investment portfolios. Additionally, historical statistics show that the probability of a decline in September is relatively high, so many choose to stay out of the market to avoid the adjustment period.

The second reason is that many fund companies have their financial year ending in September. Therefore, they would want to sell off poorly performing assets before September to adjust their holdings and make their financial statements look better.

The third reason is that the U.S. government's financial year ends in September. September is also a very important meeting point for the Federal Reserve. The Federal Reserve's meeting in September will determine what monetary policy adjustments will be made in the coming months and the expectations for next year's fiscal and monetary policies. At such a time, there is a lot of policy uncertainty. As investors, this uncertainty leads to caution and a reduction in buying activity, which in turn causes the indices to decline due to insufficient buying pressure.

How should ordinary investors like us navigate this September period?

I believe that we do not need to deliberately avoid the "September Curse." There is no need to intentionally avoid market declines. Although historically, the overall financial market has a low return rate in September, it does not mean that every September will see a decline. The most important thing is that if we deliberately avoid declines, we might miss out on potential increases. Missing out on an increase can be a huge cost for everyone. In the cryptocurrency market, which is known for high returns, on average, there are only one or two days each month with significant volatility. The volatility of those one or two days can equal the combined volatility of the remaining 28 days. As a trend trader, as long as the overall directional judgment is correct, it is clearly not worthwhile to miss out on significant increases just to avoid minor pullbacks. Is it possible that the two days with the largest volatility could be down days? Of course, it is possible. However, as long-term traders, waiting for significant market movements—whether they are large declines or large increases—is what we anticipate. We should all have a pre-prepared plan, which is why contract trading is so important in this market. If the market experiences a significant decline, we can also use contract trading to short, thus achieving profits and hedging our spot positions.

Let’s take the two declines in July 2024 and early September 2024 as examples. For instance, if you held 50 Ethereum in spot before this and entered a declining cycle, the price could drop from a high of 3300 to a low of 2100. Not only would you lose confidence in your holdings, but you would also incur a loss of nearly $60,000 due to this decline. If you then experience another decline cycle, your confidence in your holdings might be completely destroyed. However, if you know how to use contracts as a trading tool, during a significant market decline, you can choose to short using contracts, which not only helps you avoid the loss of your principal but also allows you to use the $60,000 earned from hedging after the decline to buy more Ethereum in spot, thus increasing your holdings without additional capital investment while waiting for the index to stabilize and rise. As long as there is a safety margin and the index's volatility is large enough, whether it is upward or downward, we can profit from it. This is why we need a trading plan.

If you are feeling lost—unable to understand technical analysis, unsure how to read charts, not knowing when to enter the market, unable to set stop losses, not understanding take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits, or missing out on market movements—these are common issues for retail investors. I can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words, and finding the right direction is better than repeatedly facing defeats. Instead of frequent trading, it is better to strike precisely, making each trade more valuable.

Success in investing depends not only on choosing good assets but also on when to buy and sell. Preserving capital and making good asset allocations are essential for steady progress in the ocean of investments. Life is like a long river flowing into the sea; what determines victory or defeat is never just the gains and losses of a single battle or moment, but rather a well-thought-out strategy followed by action, knowing when to stop and when to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article represents personal opinions and does not constitute any trading advice. The cryptocurrency market carries risks; please invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。