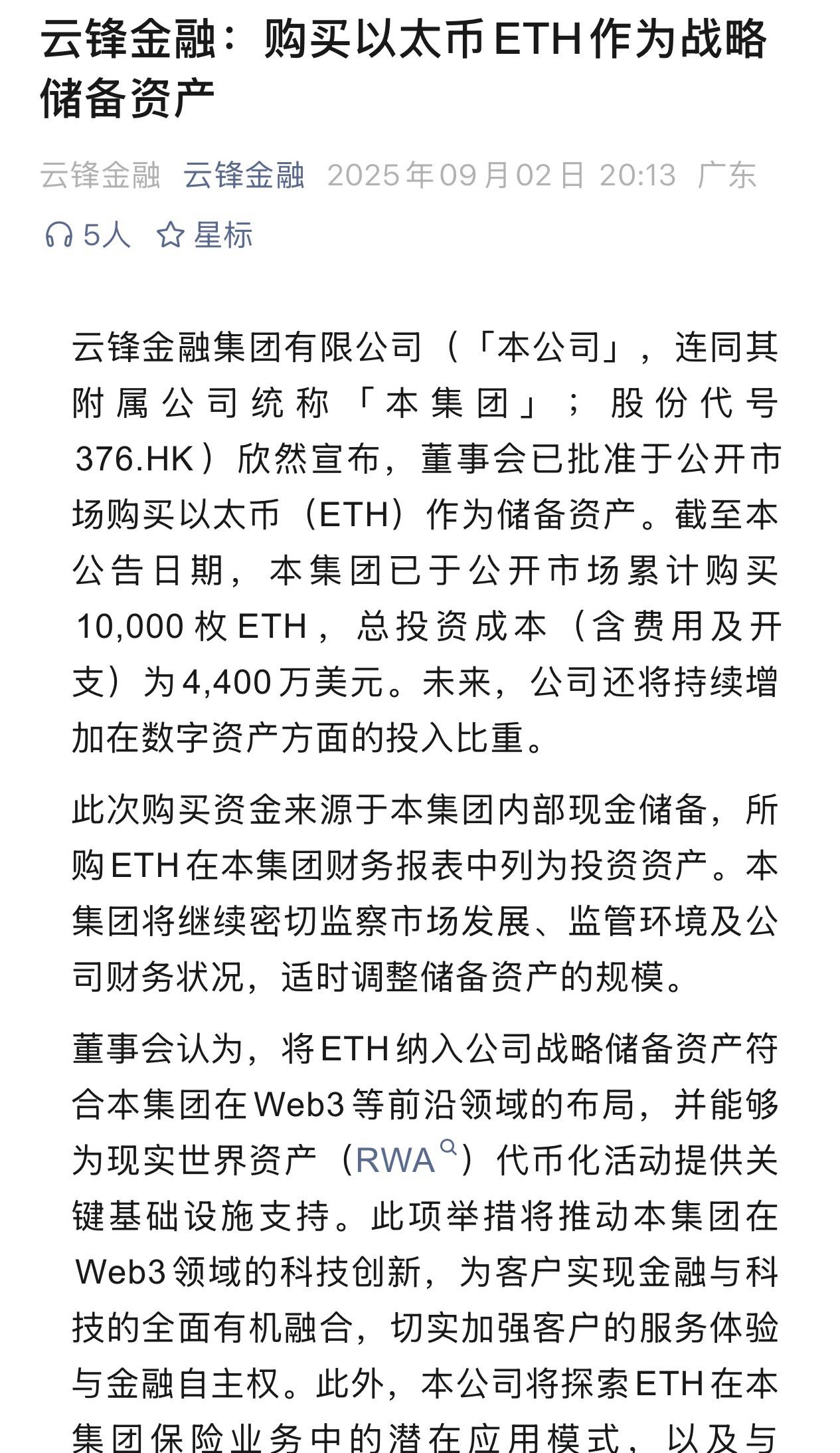

马云间接持股的云锋金融(0376.HK)于2日宣布已累计购买1万枚以太币(ETH),总投资成本达4400万美元。这一举动不仅引发股价日内涨幅近10%,更被视为阿里巴巴创始人马云在Web3领域的最新布局。不同于以往的低调,云锋金融的公告直指ETH作为储备资产的战略意义,旨在优化资产结构并减少对传统货币依赖。作为一家由马云间接持股的金融集团,此举迅速在全球加密社区和传统金融圈引发连锁反应,凸显机构投资者对数字资产的加速拥抱。

集团在公告中明确表示,此次购买资金来源于内部现金储备,所购ETH将被列为投资资产。公司董事会认为,将ETH纳入战略储备符合集团在Web3、现实世界资产(RWA)代币化等前沿领域的布局。这并非孤立事件:自8月以来,云锋金融动作频频,包括发布中期业绩、获得Web3相关牌照、推进碳基建与RWA项目,以及与公链战略合作。进入9月,公告节奏进一步加快,直至本次ETH购入,显示出集团向加密金融转型的决心。

据公开数据,马云通过云锋基金间接持有云锋金融约11.15%的股份。在上海云锋新创股权投资中心中,马云持股40%,虽无投票权,但其影响力不容忽视。云锋基金由马云与虞锋于2010年创立,主要聚焦科技、金融和消费领域。云锋金融的前身可追溯至1982年成立的万胜国际证券,2015年被云锋基金以39亿港元注资控股,转型为拥有证券、保险、资管等多牌照的金融科技平台。此次ETH购入被解读为马云从支付宝时代向区块链领域的延伸,早前在2025年2月的一次企业家座谈会上,马云曾提出“技术包裹化”概念,即将算法嵌入实体场景,而以太坊作为智能合约核心,正是这一理念的金融基础设施。

公告发布后,云锋金融股价日内涨幅一度逼近10%。加密社区中,这一消息被戏称为“马云入列E卫兵”,云锋金融公告中提及,将探索ETH在保险业务中的应用,以及与Web3适应的创新场景。除ETH外,公司计划纳入比特币(BTC)、索拉纳(SOL)等主流数字资产。这与全球机构进场潮相呼应:例如,贝莱德ETHA ETF单日吸金10亿美元,渣打银行预测ETH年底价达7500美元。 RWA赛道被视为万亿级机会,云锋金融强调ETH可为RWA代币化提供基础设施支持。RWA指将房地产、债券等现实资产上链,实现代币化流通,提高流动性与效率。马云的布局被视为抢占这一赛道的前瞻之举,尤其在ETH Pectra升级即将引爆机构质押潮的背景下。

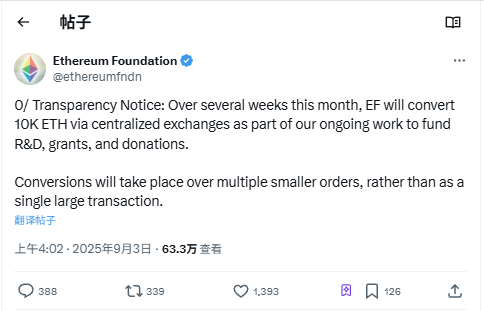

巧合的是,以太坊基金会在公告次日披露将出售1万枚ETH,用于研发与捐赠。这笔交易于9月3日凌晨完成,价值约4270万美元,基金会官推随即澄清用途。目前,基金会持仓仍达23.16万枚ETH,在公开实体中排名第四。从专业视角看,云锋金融的举措优化了资产负债表。传统金融依赖美元等法币,易受通胀与地缘风险影响;ETH作为“数字石油”,提供3-5%质押收益,碾压美债。 集团持有万通保险,此举或探索ETH在保险中的应用,如智能合约自动化赔付,提升效率。更宏观地,此事件标志区块链去中心化时代的加速。云锋金融坚信Web3变革将推动金融创新与可持续发展。

本文章仅供信息分享,不构成对任何人的任何投资建议。

加入我们的社区讨论该事件

官方电报(Telegram)社群:t.me/aicoincn

聊天室:致富群

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。